Professional Documents

Culture Documents

FP&A Cheat Sheetv2

FP&A Cheat Sheetv2

Uploaded by

Rajkumar RajamanikamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FP&A Cheat Sheetv2

FP&A Cheat Sheetv2

Uploaded by

Rajkumar RajamanikamCopyright:

Available Formats

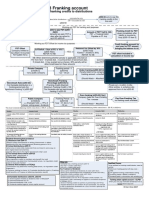

FP&A CHEAT SHEET By Asif Masani

5 TYPES OF FINANCIAL What is FP&A? TOP 12 MANAGEMENT

PROJECTIONS Planning & Budgeting: FP&A teams work

Forecasting and Modelling: Creating, updating, and REPORTS

maintaining financial models & detailed forecasts in a

with different departments to prepare spreadsheet a budgeting tool.

1.BUDGET budgets. Once they collect all the

1. MONTH END REPORTING:

information they work on

Blueprint for company to do business in the next FY Latest month actuals compared against Budget & forecast

consolidatinginto one overall company with variance analysis, commentary & recommendations.

2. ANNUAL OPERATING PLAN (A.O.P) budget.

2.QUARTERLY BUSINESS REVIEWS (QBR)

Broader than budget + practical outline of the company's

targets and key activities. Top management examines progress metrics, identifies

adjustments based on previous quarters' performance.

3. FORECAST OR OUTLOOK 3. OPERATING BUDGET (PLAN) DECK

Latest estimates of a company's future financial outcomes.

Prepared in advance of a reporting period as a goal or plan

It shows if the company is reaching its budget or not.

that the business expects to achieve in the next financial year.

4. LONG RANGE PROJECTIONS 4. LATEST ESTIMATE/ OUTLOOK DECK

Evaluates business decisions like acquisitions, strategic plans The latest forecast is updated and compared against previous

& alternatives. Has a longer-term horizon of 2 to 7 years. Management Reporting: Preparing and Ccomments are made on what has changed from previous.

Finance Businesss Partnership: analysing internal reports for senior

5. CAPITAL INVESTMENT DECISIONS The mindset is of a Finance business management to support their decision- 5.FLASH REPORTING

making

partner (keeping a business first Periodic snapshot of key financial and operational data.

Decisions like investing in new equipment, launching a new approach)

product, lease v/s buy, produce in-house v/s outsource etc 6.RISKS & OPPORTUNITIES ASSESSMENT

"FP&A teams act as a bridge between business teams & leadership"

7 BUDGETING

In this report all the risks and opportunities are listed along

with the probability of its occurrence.

APPROACHES 7. HEADCOUNT REPORTING:

Employee data presented in many ways. Example, permanent,

fixed-term or temporary, job titles & positions etc

1.INCREMENTAL BUDGETING

8. SALES PIPELINE ANALYSIS

We pick last year’s Budget & add or subtract a percentage.W.

Revenue is forecasted on the basis the of the deal stage and

probability of conversion and is usually tracked with CRM tool

2. ZERO BASED BUDGETING

9.ADHOC REPORTING

Broader than the budget and provides a practical outline of

the company's targets and key activities. These are one-time reports that helps the senior management

to answer critical business questions immediately

3. ACTIVITY BASED BUDGETING

The budget inputs finalized basis the desired output or result.

10. BALANCED SCORECARDS

Building rapport, the ability to deal with conflicts and being

4. VALUE PROPOSITION BASED

Traditional v/s Rolling Forecast able to influence decision making.

11. KPI OR OKR REVIEWS

Ensures everything in the budget creates + delivers value.

KPI: set of quantifiable measurements used to gauge a

5. ROLLING FORECAST company's overall performance. OKR: A goal-setting framework

for defining & tracking objectives and their outcomes.

New period is added to replace the previous one as it expires.

12. INVESTOR PRESENTATIONS

6. TOPS DOWN BUDGETING

These presentations are prepared for the earnings call

Top management takes decisions without participation from

middle management

7. BOTTOMS UP BUDGETING

7 QUALITIES

Managers recommend their targets. Inputs start from

operational level and moves top. It is Participative.

MANAGEMENT REPORT

3 KEY PAIN POINTS 1.ONE PAGER REPORT

IN BUDGETING The main report has to fit on 1 page. Too many details can

divert the focus and attention.

2. DECISION FOCUSED

1.INEFFECTIVETECHNOLOGY

The results for each line item should suggest a decision or an

More than 60% companies use Excel as their budgeting action. Ideally include a recommendation /suggested action.

software. Excel is user friendly but not best tool for budgets

3.INTUITIVE TO UNDERSTAND

2. LONG CYCLE TIMES

Avg cycle time for preparing a budget is around 3 months. Design in a way soimportant information jumps right out.

Slow to detect problems & doesnt add lot of value.

4. CONSISTENT LOOK & FEEL

3. GAMING BEHAVIOUR Consistent appearance makes reports much easier to read.

The traditional budgeting process incentivies gaming instead

of “stretch behaviour” 5. SIMPLE LANGUAGE

Budget, Forecast and Rolling Forecast Examples Avoid using accounting jargons like trueups, one timers etc

TOP 10 FP&A SKILLS 6. FREQUENCY

Short enough + allow time for taking decisions between updates

1. ATTENTION TO DETAIL + BIG PICTURE 7. ACCURACY

Should tie back to the accounting system

To produce accurate reports,spot trends and inconsistencies.

At the same time be able to connect the various dots.

2.OWNERSHIP AND ACCOUNTABILITY

10 WAYS TO

Bee answerable and take ownership for what you work.

ANALYSE DATA

3. EFFECTIVE QUESTIONING SKILLS 1. DRILL UP/ DRILL DOWN

Asking right questions, at right time, listening objectively to Move into further detail from the parent to child and child to

various viewpoints, considering the information gathered, parent relationships to uncover root causes of anomalies.

4. BUSINESS ACUMEN 2. SLICE AND DICE

Understand the business model, organizational goals, Pivot the dimensions of the data on-the-fly.

objectives and strategy.

3. SEGMENTATION

5. DATA INTO INSIGHTS

Grouping data with common attributes like customer

Turning complex data into actionable insights, bringing segmentation (small business, enterprise , government)

numbers to life, making reports useful, interesting, valuable .

6. COMMUNICATION &PRESENTATION 4. DATA VISUALIZATION

Graphical representations of the data across multiple

Regularly make presentations on financial and operational

dimensions and variables.

performance to senior management.

5. DRIVER BASED RELATIONSHIPS

7. DATA STORYTELLING

COMMON FP&A TERMS 3 KEY SKILLS IN 5 INTERVIEW TIPS Dependency relationships (when one thing happens or

Instead of sharing a lot of numbers and data tables building a changes, another thing happens or changes

compelling story instead around the business performance. PRESENTATION 6. BENCHMARKING

8.COLLABORATION & TEAMWORK 1. THE TOP LINE 1. UNDERSTAND THE BUSINESS Comparing results with internal benchmarks or external

This is eaither Revenues, Cash, Bookings or Sales The business model, products and services benchmarks (those produced by peers in your industry).

Work closely with cross functional teams on various initiatives

9. LEADERSHIP 2. THE BOTTOM LINE 2. STUDY THE FINANCIAL 7. SEASONALITY

This is usually the Net Income after all expenses You can get the financials from company’s website. Comparing results adjusted for selling seasons of the

FP&A is not just numbers crunching. Emotional, intelligence,

the ability to influence and empathy are equally important. business (eg: retail in december, hospitality in summer etc)

3. YOY COMPARISIONS 3. QUESTIONNAIRE / ASSIGNMENT

8.TREND ANALYSIS

10. BUILDING RELATIONSHIPS Difference between two values of the same measure More than the final result demonstrating a logical

(e.g., revenues this year versus last year) thought process / approach is more important Showing whether results are improving or not over time and

Building rapport, the ability to deal with conflicts and being compared to related measures that may be improving or not.

able to influence decision making. 4. BUDGET V/S OUTLOOK/ FCST 4. DURING THE INTERVIEW

Budget is set at the beginning of year,outlook changes 9. PROFITABILITY ANALYSIS

Link your experience to the required job description

all the time. This compares outlook against budget Product Profitability ,Channel Profitability, Customer

using stories and examples from the past.

profitability .Segment profitability, Branch Profitability etc

5. EXPENSE V/S EXPENDITURE

5. ASK QUESTIONS

An expense occurs when an asset is used for its 10. OUTLIERS

Based on your reserach ask atleast 2-3 meaningful

economic purpose, and expenditure occurs when the

questions either during or at the end Deviations from the norm or anomalies

payment / cash flows out.

www.fpnaprofessionals.com Follow Asif Masani on

You might also like

- Information About This Workbook: Author: Website: ContactDocument51 pagesInformation About This Workbook: Author: Website: ContactRodrigo AlejoNo ratings yet

- Ultimate FP&A Resource Guide-1Document113 pagesUltimate FP&A Resource Guide-1AbdinourNo ratings yet

- Cma TemplateDocument25 pagesCma TemplateSavoir PenNo ratings yet

- 10 Skills For Your Finance Career: SwipeDocument48 pages10 Skills For Your Finance Career: SwipeJunias Folly100% (1)

- FP&A Guide 300 PagesDocument300 pagesFP&A Guide 300 PagesSergey Strebkov100% (2)

- CMA Exam Study Tips Hock-2016Document23 pagesCMA Exam Study Tips Hock-2016sheriflouis100% (2)

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- Cashflow Forecast Actual SampleDocument33 pagesCashflow Forecast Actual SampleAchanNo ratings yet

- Kruze Fin Model v8 11 SharedDocument69 pagesKruze Fin Model v8 11 SharedsergexNo ratings yet

- Exercises and Answers Chapter 5Document8 pagesExercises and Answers Chapter 5MerleNo ratings yet

- Monthly Report SBAPL v1109Document105 pagesMonthly Report SBAPL v1109Rushikesh GadreNo ratings yet

- Forbes July21Document93 pagesForbes July21Agnish GhatakNo ratings yet

- Fund Based Non Fund Based Working Capital Limits Banks Term LoansDocument48 pagesFund Based Non Fund Based Working Capital Limits Banks Term LoanscallvkNo ratings yet

- Sales Plan Presentation TemplateDocument13 pagesSales Plan Presentation TemplateTunde OsiboduNo ratings yet

- 12 Strategy Tools Every Finance Professional Should KnowDocument46 pages12 Strategy Tools Every Finance Professional Should Knowsadaf hashmiNo ratings yet

- Investment Banking ResumeDocument85 pagesInvestment Banking ResumeleekosalNo ratings yet

- Financial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetDocument3 pagesFinancial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetAarnaaNo ratings yet

- Financial Modelling in Power SectorDocument5 pagesFinancial Modelling in Power SectorngozinwaneriNo ratings yet

- FP&A Interview Q TechnicalDocument17 pagesFP&A Interview Q Technicalsonu malikNo ratings yet

- Ifrs Us Gaap 2017Document515 pagesIfrs Us Gaap 2017Vladimir M. BlancourtNo ratings yet

- Chapter 6 NotesDocument23 pagesChapter 6 Notesapi-294576901No ratings yet

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- Commercial Law Fresh Perspectives 230222 182109Document542 pagesCommercial Law Fresh Perspectives 230222 182109Monde Tidimalo Lunathi MbaluNo ratings yet

- A Guide To Careers in FinanceDocument21 pagesA Guide To Careers in FinanceGav InvestmentsNo ratings yet

- GSL Module 1 1.5 To 1.9 Student SlidesDocument51 pagesGSL Module 1 1.5 To 1.9 Student Slidesalynn joyNo ratings yet

- F1 CIMA Workbook Q PDFDocument169 pagesF1 CIMA Workbook Q PDFKhadija Rampurawala100% (1)

- CENTURY 21 ACCOUNTING © Thomson/South-Western Lesson 5-1Document30 pagesCENTURY 21 ACCOUNTING © Thomson/South-Western Lesson 5-1its QA3KNo ratings yet

- Fast Standards For Financial ModelingDocument34 pagesFast Standards For Financial Modelingsonthaliarahul5561100% (1)

- Fp&a Questions v2Document11 pagesFp&a Questions v2wokif64246No ratings yet

- FAST Standard 02c July 2019Document72 pagesFAST Standard 02c July 2019DYPUSM WEC100% (2)

- AA153501 1427378053 BookDocument193 pagesAA153501 1427378053 BooklentinieNo ratings yet

- Flevy 100 Case Studies On Strategy & TransformationDocument501 pagesFlevy 100 Case Studies On Strategy & TransformationmheryantooNo ratings yet

- Matching Principle and Accrual Basis of AccountingDocument2 pagesMatching Principle and Accrual Basis of AccountingNazish KhalidNo ratings yet

- Professional Services AgreementDocument5 pagesProfessional Services AgreementNick FasciNo ratings yet

- OLD Corporation Code of The Philippines Revised Corporation Code of The Philippines RemarksDocument20 pagesOLD Corporation Code of The Philippines Revised Corporation Code of The Philippines RemarksAngela Louise SabaoanNo ratings yet

- Cima F1 Chapter 4Document20 pagesCima F1 Chapter 4MichelaRosignoli100% (1)

- FBO Management: Operating, Marketing, and Managing as a Fixed-Base OperatorFrom EverandFBO Management: Operating, Marketing, and Managing as a Fixed-Base OperatorNo ratings yet

- All About FP&A 2.0 - FP&A Professionals PDFDocument176 pagesAll About FP&A 2.0 - FP&A Professionals PDFparvez ansariNo ratings yet

- Cima E1Document5 pagesCima E1Enoch Abassey0% (1)

- Variance Analysis - 3 Crucial Questions To AskDocument14 pagesVariance Analysis - 3 Crucial Questions To AskGopal SoneeNo ratings yet

- CMA (USA) - Recorded Lectures Details V2Document15 pagesCMA (USA) - Recorded Lectures Details V2frostyfusioncreameryNo ratings yet

- New Product DevelopmentDocument12 pagesNew Product DevelopmentDiane ChakanzahNo ratings yet

- Nisha Pandey PDF 1Document71 pagesNisha Pandey PDF 1Ajay ThakurNo ratings yet

- Code of Ethics and Business ConductDocument10 pagesCode of Ethics and Business ConductSwapnil ChonkarNo ratings yet

- Guidelines For The Use of ConsultantsDocument49 pagesGuidelines For The Use of ConsultantsFariedNo ratings yet

- September 14 Gary Kadi MI SeminarDocument2 pagesSeptember 14 Gary Kadi MI SeminarHenryScheinDentalNo ratings yet

- Blue Star Limited: Investor PresentationDocument32 pagesBlue Star Limited: Investor PresentationSunny GanpuleNo ratings yet

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument27 pagesFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Special Report Property Investment StructuresDocument19 pagesSpecial Report Property Investment StructurespoolboyANo ratings yet

- Corporate Finance ReviewDocument13 pagesCorporate Finance ReviewAtul SrivastavaNo ratings yet

- Chapter 7 SolutionsDocument8 pagesChapter 7 SolutionsAustin LeeNo ratings yet

- Does FBT Apply?: Div 13 ExclusionsDocument1 pageDoes FBT Apply?: Div 13 Exclusionsoddsey0713No ratings yet

- Simulation in manufacturing systems A Clear and Concise ReferenceFrom EverandSimulation in manufacturing systems A Clear and Concise ReferenceNo ratings yet

- The Hershey Company: Financial Statement Analysis AnalysisDocument19 pagesThe Hershey Company: Financial Statement Analysis AnalysisNikhil Singh100% (1)

- 2019 Tax Advisors Update 11.14.19 PDFDocument326 pages2019 Tax Advisors Update 11.14.19 PDFD100% (1)

- 2-3 Capital AllowancesDocument1 page2-3 Capital Allowancesoddsey0713No ratings yet

- 3-3 Franking AccountDocument1 page3-3 Franking Accountoddsey0713No ratings yet

- SoDChecker Version0 4Document45 pagesSoDChecker Version0 4ravin.jugdav678No ratings yet

- Hedge Fund Accounting - Student - BNY MellonDocument8 pagesHedge Fund Accounting - Student - BNY MellonRajesh GuptaNo ratings yet

- Icaew Vs AccaDocument3 pagesIcaew Vs AccaIlyasIkbalNo ratings yet

- Accounting 3 StatementsDocument149 pagesAccounting 3 StatementsArthur M100% (1)

- FSAV3eModules 5-8Document26 pagesFSAV3eModules 5-8bobdoleNo ratings yet

- Cover Letter TicketmasterDocument1 pageCover Letter TicketmasterJohanna WongNo ratings yet

- Share ValuationDocument7 pagesShare ValuationroseNo ratings yet

- 1-8 GST - GST Payable or ITC AvalDocument2 pages1-8 GST - GST Payable or ITC Avaloddsey0713No ratings yet

- ACCO320Midterm Fall2013FNDocument14 pagesACCO320Midterm Fall2013FNzzNo ratings yet

- Calculation Policy - Multiplication & DivisionDocument54 pagesCalculation Policy - Multiplication & DivisionmheryantooNo ratings yet

- Calculation Policy - Addition & SubtractionDocument41 pagesCalculation Policy - Addition & SubtractionmheryantooNo ratings yet

- ICMSS ADRO Research ReportDocument26 pagesICMSS ADRO Research ReportmheryantooNo ratings yet

- Indonesia Financial Sector Development 4Q23Document42 pagesIndonesia Financial Sector Development 4Q23mheryantooNo ratings yet

- SEA IPO Capital MarketDocument46 pagesSEA IPO Capital MarketmheryantooNo ratings yet

- 2021.07 - Global Investment Views - ENDocument7 pages2021.07 - Global Investment Views - ENmheryantooNo ratings yet

- BSCM Key TermsDocument20 pagesBSCM Key TermsJake YuanNo ratings yet

- Fin624 Curren Solved PaperDocument8 pagesFin624 Curren Solved PaperHáłīmà TáríqNo ratings yet

- Seedrs Term-Sheet For-Entr-Guide v2Document5 pagesSeedrs Term-Sheet For-Entr-Guide v2Umair QNo ratings yet

- Frequently Asked Questions GenDocument7 pagesFrequently Asked Questions Genanon_820321208No ratings yet

- Business Studies 17Document8 pagesBusiness Studies 17bhaiyarakeshNo ratings yet

- Uplift Construction and Development CorporationDocument3 pagesUplift Construction and Development CorporationDAXEN STARNo ratings yet

- AECO and Post COVID by VIATechnikDocument14 pagesAECO and Post COVID by VIATechnikMeghdad AttarzadehNo ratings yet

- Closing and Post Closing Entries - 102823Document10 pagesClosing and Post Closing Entries - 102823Jerickho JNo ratings yet

- Cindefinido 2309 Castellano CDocument20 pagesCindefinido 2309 Castellano CnamoNo ratings yet

- Brochure IIM Calcutta Advanced Programme in Strategic Project Management 12 05 2020Document19 pagesBrochure IIM Calcutta Advanced Programme in Strategic Project Management 12 05 2020Bhavesh JhaNo ratings yet

- Argumentative EssayDocument6 pagesArgumentative EssayMannan AroraNo ratings yet

- Metric AssignmentDocument4 pagesMetric Assignmentdhiraj shettyNo ratings yet

- Update National Sales Conference - RUNDOWN 21april2021Document1 pageUpdate National Sales Conference - RUNDOWN 21april2021NasrudinNo ratings yet

- Presentation On Draft: Rajasthan State Training PolicyDocument36 pagesPresentation On Draft: Rajasthan State Training PolicyChetram MeenaNo ratings yet

- Feasibility Study Your MinimalistDocument15 pagesFeasibility Study Your MinimalistaceNo ratings yet

- (123doc) Chien Luoc Kinh Doanh ViettelDocument9 pages(123doc) Chien Luoc Kinh Doanh ViettelVõ Thị Mai HươngNo ratings yet

- 2020 Bandhan-Bank - Shareholding-Pattern PDFDocument7 pages2020 Bandhan-Bank - Shareholding-Pattern PDFVAIBHAV WADHWANo ratings yet

- Berman CH 08Document28 pagesBerman CH 08Harpreet SharmaNo ratings yet

- Convergys AssignmentDocument2 pagesConvergys Assignmentleni thNo ratings yet

- Local StudiesDocument2 pagesLocal StudiesA Boosted CatNo ratings yet

- Corporate Law - Cheat Sheet (Lecture 1) PDFDocument1 pageCorporate Law - Cheat Sheet (Lecture 1) PDFSarah CamilleriNo ratings yet