Professional Documents

Culture Documents

BSA2 - AIS2 Quiz No. 2

BSA2 - AIS2 Quiz No. 2

Uploaded by

Melrose Eugenio Erasga0 ratings0% found this document useful (0 votes)

28 views8 pagesQuiz questions

Original Title

BSA2_AIS2 Quiz no. 2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentQuiz questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views8 pagesBSA2 - AIS2 Quiz No. 2

BSA2 - AIS2 Quiz No. 2

Uploaded by

Melrose Eugenio ErasgaQuiz questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

2

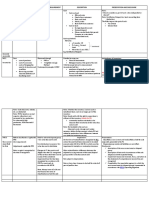

PROBLEMS

Problem 23-1 (IAA)

Erica Company had the following property acquisitions

during the current year:

1, Acquired a tract of land in exchange for 50,000 ordinary

shares with P100 par value and market price of P120 per

share on the date of acquisition.

The last property tax bill indicated assessed value of

P4,500,000 for the land.

2. Received land from a major shareholder as an inducement

to locate a plant in the city.

No payment was required but the entity paid P50,000 for

legal expenses for land transfer. The land is fairly valued

at P1,000,000.

3. Purchased for P5,500,000, including appraiser fee of

P100,000 a warehouse building and the land on which it

is located.

The land had an appraised value of P2,000,000 and original

cost of P1,400,000. The building had an appraised value

of P3,000,000 and original cost of P2,500,000.

4. Purchased an office building and the land on which it is

located for P7,500,000 cash and assumed an existing

P2,500,000 mortgage.

For realty tax purposes, the property is assessed at

| P9,600,000, 60% of which is allocated to building.

| Required:

Prepare journal entries to record the transactions for the

current year.

681

Problem 23-2 (ACP)

Credulous Company purchased equipment on January 1,

2021 under the following terms:

a. P200,000 downpayment

b. Five annual payments of P100,000, the first installment

note to be paid on December 31, 2021.

The same equipment was available at a cash price of

P580,000.

Required:

Prepare journal entries for 2021 and 2022.

Problem 23-3 (ACP)

On January 1, 2021, Enrich Company purchased a machine

under the following terms:

a. P100,000 downpayment

b. Four annual payments of P200,000, the first installment

note to be paid on December 31, 2021.

The fair value of the machine is not clearly determinable on

the date of acquisition.

The prevailing rate of interest for this type of obligation is 10%.

The present value factors at 10% for four periods are:

Present value of 1 -683

Present value of ordinary annuity of 1 3.170

Required:

Prepare journal entries for 2021 and 2022.

Problem 23-11 (IAA)

Acrophobia Company summarized the following manufacturing

and construction activities for the current year:

Finished goods Machinery

Materials 3,000,000 500,000

Direct labor 4,000,000 1,000,000

Overhead for the prior year was 75% of the direct labor cost.

Overhead in the current year related to both product

manufacture and construction activities amounted to P3,600,000.

Required:

a. Calculate the cost of the machinery, assuming that

manufacturing activities are to be charged with overhead

at the rate experienced in the prior year.

b. Calculate the cost of the machinery if manufacturing and

construction activities are to be charged with overhead at

the same rate.

687

Problem 23-12 (IAA)

During the year, Storm Company purchased a new machine. A

P300,000 down payment was made‘and three monthly

installments of P500,000. The cash price would have been

P1,550,000.

The entity paid no installation charges under the monthly

payment plan but a P50,000 installation charge would have

been incurred with a cash purchase.

What amount should be capitalized as cost of the machine?

a. 1,800,000

b. 1,500,000

ec. 1,600,000

d. 1,550,000

Problem 23-15 (AICPA Adapted)

On December 31, 2021, Bart Compan: .

. a y purchased =

jn exchange for a noninterest bearing note eeaianp eke

payments of P200,000. g)

The first payment was made on December 31, 2021 and

the others are due annually on December 31.

At date of issuance, the prevailing rate of interest for this

type of note was 11%.

PV of an ordinary annuity of 1 at 11% for 8 periods 5.146

PV of an annuity of 1 in advance at 11% for 8 periods 5.712

1. What amount should be recorded as initial cost of the

machine?

a. 1,600,000

b. 1,029,200

c. 1,400,000

d. 1,142,400

2. What amount should be recorded as discount on note

payable on December 31, 2021? ‘

a. 657,600

b. 457,600

c. 570,800

d. 0

3. What amount should be recorded as interest expense for

2022?

a. 125,664

b. 103,664

c. 118,212

d. 176,000

W

hat is the carrying amount of note payable on

December 31, 2022?

942,400

846,064

742,400

742,412

aes

689

Problem 23-19 (IAA)

Anxious Company acquired two items of machinery.

* On December 31, 2021, Anxious Company purchased a

machine in exchange for a noninterest bearing note

requiring ten payments of P500,000.

The first payment was made on December 81, 2022, and

the others are due annually on December 31.

The prevailing rate of interest for this type of note at

date of issuance was 12%. The present value of an

ordinary annuity of 1 at 12% is 5.33 for nine periods and

5.65 for ten periods.

On December 31, 2021, Anxious Compary acquired

used machinery by issuing the seller a two-year,

noninterest-bearing note for P3,000,000.

In recent borrowing, the entity has paid a 12% interest

for this type of note. The present value of 1 at 12% for 2

* periods is .80 and the present value of an ordinary annuity

of 1 at 12% for 2 periods is 1.69.

What amount should be reported as total cost of the

machinery?

a. 5,065,000

b. 5,225,000

¢c. 5,565,000

d. 8,235,000

691

Problem 23-20 (IAA)

rchased a ten-ton draw press at a cost of

us oun

cay indie terms of 5/15, n/45. Payment was made within

the discount period.

i i 000 for

- eng cost was P90,000 which inckaded P4, f

cmaaer in transit. Installation cost. totaled P240,000 which

included P80,000 for taking out a section of a wall and

rebuilding it because the press was too large for the doorway.

What amount should be capitalized as cost of the ten-ton

draw press?

a. 3,420,000

b. 3,670,000

ce. 3,750,000

d. 3,715,200

Problem 23-21 (IAA)

Holiday Company purchased a high speed industrial

centrifuge at a cost of P840,000. Shipping cost amounted to

P50,000. Foundation work to house the centrifuge cost

P80,000.

An additional water line had to be run to the equipment at

cost of P40,000. Labor and testing cost totaled P60,000.

Materials used up in testing cost P30,000.

What amount should be capitalized as cost of the equipment?

1,100,000

1,060,000

1,020,000

1,040,000

aorp

Problem 23-22 (AICPA Adapted)

At the beginning of the current year, Hallmark C

exchanged an old packaging machine, which cost 1.200.000

and was 50% depreciated, for a used machine and paid aveash

difference of P200,000.

The fair value of the old packaging machine was determined to

be P700,000.

1. What amount should be recorded as cost of the new asset

acquired?

a. 700,000

b. 900,000

c. 800,000

d. 600,000

2. What amount should be yecorded as gain on exchange?

500,000

100,000

200,000

0

aorP

Problem 23-23 (AICPA Adapted)

At the beginning of the current year, Jam Company traded

in an old machine having a carrying amount of P1,700,000

and paid a cash difference of P600,000 for a new machine

with a cash price of P2,050,000.

1. What amount should be recorded as cost of the machine

acquired in exchange?

a. 1,680,000

b. 2,050,000

c. 1,450,000

d. 1,080,000

2. What amount of loss should be recognized on the

exchange? :

a. 600,000

b. 250,000

c. 350,900

d. 0

693

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSA 2 GG QuizDocument5 pagesBSA 2 GG QuizMelrose Eugenio ErasgaNo ratings yet

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- ACCTG 22 DepartmentalDocument12 pagesACCTG 22 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- Acctg 25 DepartmentalDocument11 pagesAcctg 25 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- 05 s2 Prospectus SMC 2012Document674 pages05 s2 Prospectus SMC 2012Melrose Eugenio ErasgaNo ratings yet

- Illustrative Examples - Notes and Loans ReceivableDocument4 pagesIllustrative Examples - Notes and Loans ReceivableMelrose Eugenio ErasgaNo ratings yet

- Name of Form Bir Form Filing and Payment DescriptionDocument4 pagesName of Form Bir Form Filing and Payment DescriptionMelrose Eugenio ErasgaNo ratings yet

- Japanese LangDocument7 pagesJapanese LangMelrose Eugenio ErasgaNo ratings yet

- Summary of Measurement, Presentation and DisclosureDocument17 pagesSummary of Measurement, Presentation and DisclosureMelrose Eugenio ErasgaNo ratings yet