0% found this document useful (0 votes)

167 views12 pagesUnderstanding Dividend Policy Models

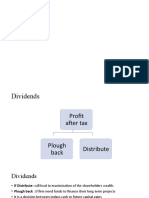

This document discusses various models and theories related to dividend policy. It begins by outlining two options for utilizing profits: retaining earnings to reinvest in the business or distributing dividends to shareholders.

Several dividend models and theories are then described, including the traditional approach linking dividends and stock prices, Walter's model examining the relationship between internal rate of return and cost of capital, and Gordon's dividend equalization model. Miller and Modigliani's hypothesis of the irrelevance of dividend policy under certain assumptions is also discussed.

Finally, the document notes that a company's dividend policy must balance shareholder desires for dividends with business needs to reinvest profits, and that factors like shareholder expectations, earnings growth

Uploaded by

Akshita raj SinhaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

167 views12 pagesUnderstanding Dividend Policy Models

This document discusses various models and theories related to dividend policy. It begins by outlining two options for utilizing profits: retaining earnings to reinvest in the business or distributing dividends to shareholders.

Several dividend models and theories are then described, including the traditional approach linking dividends and stock prices, Walter's model examining the relationship between internal rate of return and cost of capital, and Gordon's dividend equalization model. Miller and Modigliani's hypothesis of the irrelevance of dividend policy under certain assumptions is also discussed.

Finally, the document notes that a company's dividend policy must balance shareholder desires for dividends with business needs to reinvest profits, and that factors like shareholder expectations, earnings growth

Uploaded by

Akshita raj SinhaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd