Professional Documents

Culture Documents

FOREIGN INVESTMENT APPRAISAL Afm

Uploaded by

Akshita raj SinhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FOREIGN INVESTMENT APPRAISAL Afm

Uploaded by

Akshita raj SinhaCopyright:

Available Formats

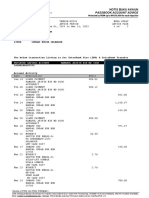

MOUNT CARMEL COLLEGE I.S.D.C.

FOREIGN INVESTMENT APPRAISAL

QUESTION 1

L. B. Inc. is considering a new plant in the Netherlands. The plant will cost 26 Million Guilders.

Incremental cash flows are expected to be 3 Million Guilders per year for the first 3 years, 4 Million

Guilders the next three, 5 Million Guilders in year 7 through 9, and 6 Million Guilders in years 10

through 19, after which the project will terminate with no residual value. The present exchange

rate is 1.90 Guilders per dollar. The required rate of return on repatriated $ is 16%. a) If the

exchange rate stays at 1.90, what is the project net present value ? b) If the guilder appreciates

to 1.84 for years 1 – 3 to 1.78 for years 4 – 6 to 1.72 years 7.9 and to 1.65 for years 10 - 19, what

happens to the present value?

QUESTION 2

OJ Ltd. is a supplier of leather goods to retailers in the UK and other Western European countries.

The company is considering entering into a joint venture with a manufacturer in South America.

The two companies will each own 50% of the limited liability company JV(SA) and will share profits

equally. £4,50,000 of the initial capital is being provided by OJ Ltd. and the equivalent in South

American dollars (SA$) is being provided by the foreign partner. The managers of the joint venture

expect the following net operating cash flows which are in nominal terms:

For tax reasons JV (SV) the company to be formed specifically for the joint venture will be

registered in South America. Ignore taxation in your calculations.

Requirements :

Assume you are the financial advisor retained by OJ Limited to advise on the proposed joint

venture. Calculate the NPV of the project under the two assumptions explained below. Use a

discount rate of 18% for both assumptions.

Assumption 1: The South America country has exchange controls which prohibits the payment

of dividends above 50% of the annual cash flows for the first three years of the project. The

accumulated balance can be repatriated at the end of the third year.

Assumption 2: The Government of the South American country is considering removing

exchange controls and restriction on repatriation of profits. If this happens all cash flows will be

distributed as dividend to the partner companies at the end of each year.

QUESTION 3

You have been engaged to evaluate an investment project overseas in a country called East

Africa, which is a politically stable country. The project involves an initial cost of East African dollar

2.5 crores (EA $) and it is expected to earn post tax cash flows as follows :

already given post tax cashflows

A.F.M. 1 C.A. Prabodh Nayak

[C.A., M.B.A.,C.F.A., P.G.D.T.F.M., C.M.A. (US), C.P.A.]

MOUNT CARMEL COLLEGE I.S.D.C.

Further, the following information is available :

a) Current spot rate is EA $ 2 per ₹ 1.

b) Risk free rate of interest in East Africa is 7% and in India 9%.

c) Required return from the project is 16%. You may make suitable (generally acceptable)

assumptions in order to evaluate the project.

QUESTION 4

Butler Company a UK company is considering undertaking a new project in Australia. The project

would require immediate capital expenditure of A$ 10million plus A$ 5m of working capital which

would be recovered at the end of the project’s four-year life. The net cash flows expected to be

generated from the project are A$ 13m before tax. Straight – line depreciation over the life of the

project are allowable expense against company tax in Australia, which is charged at the rate of

50% payable each year without delay. The project will have zero scrap value. Butler Company

will not have to pay any UK tax on the project due to a double – taxation avoidance agreement.

The A$/UKP spot rate is 2.0 and UKP is expected to appreciate against the A$ by 10% per year.

A similar risk, UK – based project would be expected to generate a minimum return of 20% after

tax. 1 uk pound = 2 A$ second unit is always 1

QUESTION 5

Sun Ltd is planning to import an equipment from Japan at a cost of 3,400 lakh Yen. The company

may avail loans at 18% p.a. with quarterly rests with which it can import the equipment. The

company has also an offer from Osaka branch of an India based bank extending credit of 180

days at 2% p.a. against opening of an irrevocable letter of credit.

Additional Information

Present exchange rate ₹100 = 340 Yen

180-day's Forward Rate ₹100 = 345 Yen

Commission charges for letter of credit at 2% per 12 months

Advise the company whether the offer from the foreign branch should be accepted.

quarterly rest - int will be calculated every once in 3 months ( int on int, compound way )

A.F.M. 2 C.A. Prabodh Nayak

[C.A., M.B.A.,C.F.A., P.G.D.T.F.M., C.M.A. (US), C.P.A.]

You might also like

- Acca FM PT 2 (091020)Document7 pagesAcca FM PT 2 (091020)Sukhdeep KaurNo ratings yet

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- Revision Question 2023.11.21Document5 pagesRevision Question 2023.11.21rbaambaNo ratings yet

- Theory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™Document6 pagesTheory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™jezNo ratings yet

- Cases - Problems Module 4 - 2011Document3 pagesCases - Problems Module 4 - 2011Uday KumarNo ratings yet

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniNo ratings yet

- Forex Extra QuestionsDocument9 pagesForex Extra QuestionsJuhi vohraNo ratings yet

- Engineering Economy Problem1Document11 pagesEngineering Economy Problem1frankRACENo ratings yet

- F9) QuestionsDocument15 pagesF9) Questionspavishne0% (1)

- FINA3020 Assignment4 2324Document2 pagesFINA3020 Assignment4 2324younes.louafiiizNo ratings yet

- 2009T2 Fins1613 FinalExamDocument24 pages2009T2 Fins1613 FinalExamchoiyokbaoNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Financial Management: Friday 9 September 2016Document15 pagesFinancial Management: Friday 9 September 2016Cynthia ohanusiNo ratings yet

- Chapter 18 - International Capital BudgetingDocument91 pagesChapter 18 - International Capital BudgetingAhmed El KhateebNo ratings yet

- IFM FinalDocument3 pagesIFM FinalRana FaisalNo ratings yet

- Lahore School of Economics: Final Semester Exam May 2021Document6 pagesLahore School of Economics: Final Semester Exam May 2021Muhammad Ahmad AzizNo ratings yet

- Fin3n Cap Budgeting Quiz 1Document1 pageFin3n Cap Budgeting Quiz 1Kirsten Marie EximNo ratings yet

- f9 Mock-ExamDocument15 pagesf9 Mock-ExamSarad KharelNo ratings yet

- FIN 400 Midterm Review QuestionDocument4 pagesFIN 400 Midterm Review Questionlinh trangNo ratings yet

- Investment Appraisal-Fm AccaDocument11 pagesInvestment Appraisal-Fm AccaCorrinaNo ratings yet

- Chapter-14: Multinational Capital BudgetingDocument41 pagesChapter-14: Multinational Capital BudgetingShakib Ahammed ChowdhuryNo ratings yet

- Cash and Marketable Securities Seatworks PDFDocument3 pagesCash and Marketable Securities Seatworks PDFGirl Lang AkoNo ratings yet

- Assignment#2Document3 pagesAssignment#2Wuhao KoNo ratings yet

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- International Finance Assignment Apple CorporationDocument3 pagesInternational Finance Assignment Apple Corporationasim27911No ratings yet

- HandoutDocument14 pagesHandoutJuzer ShabbirNo ratings yet

- Work Sheet On Chapter OneDocument3 pagesWork Sheet On Chapter Onerobel popNo ratings yet

- FM212 2018 PaperDocument5 pagesFM212 2018 PaperSam HanNo ratings yet

- PS01 MainDocument12 pagesPS01 MainSumanth KolliNo ratings yet

- Financial Management Practice Questions... 2021Document33 pagesFinancial Management Practice Questions... 2021obed nkansahNo ratings yet

- Due by Nov 6, 2014 3pm in The TA Room Faculty Block I Please Hand It Over To ArunDocument1 pageDue by Nov 6, 2014 3pm in The TA Room Faculty Block I Please Hand It Over To ArunRahul MoreNo ratings yet

- QUIZDocument5 pagesQUIZNastya MedlyarskayaNo ratings yet

- Year CF To Equity Int (1-t) CF To Firm: Variant 1 A-MDocument5 pagesYear CF To Equity Int (1-t) CF To Firm: Variant 1 A-MNastya MedlyarskayaNo ratings yet

- 2006 FinalDocument30 pages2006 Finalriders29No ratings yet

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocument3 pagesFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohNo ratings yet

- Work Sheet On Chapter OneDocument3 pagesWork Sheet On Chapter Onerobel popNo ratings yet

- FFL SMU Finance For Law .Sample Exam With SolutionDocument7 pagesFFL SMU Finance For Law .Sample Exam With SolutionAaron Goh100% (1)

- FINC 302 2020 (Ready)Document7 pagesFINC 302 2020 (Ready)Nana Yaw100% (1)

- F9 Past PapersDocument32 pagesF9 Past PapersBurhan MaqsoodNo ratings yet

- Assignment 2Document3 pagesAssignment 2Mak Chee KinNo ratings yet

- Corporate Finance: Final Exam - Spring 2003Document38 pagesCorporate Finance: Final Exam - Spring 2003Omnia HassanNo ratings yet

- Problem SetsDocument69 pagesProblem SetsAnnagrazia ArgentieriNo ratings yet

- Assorted Corp Fin QuestionDocument2 pagesAssorted Corp Fin QuestionMrinmay KulkarniNo ratings yet

- Jun 2003 - Qns Mod BDocument13 pagesJun 2003 - Qns Mod BHubbak KhanNo ratings yet

- Tesfaye MBAO FM Ass 2Document1 pageTesfaye MBAO FM Ass 2eyasu tesfayeNo ratings yet

- Skkc3343 Assignment 1-2019Document2 pagesSkkc3343 Assignment 1-2019Yi Wen Yap100% (1)

- 10MGMT 3000 Tutorial 10 2019 (Final)Document2 pages10MGMT 3000 Tutorial 10 2019 (Final)SahanNo ratings yet

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmNo ratings yet

- International Finance W2013Document20 pagesInternational Finance W2013Bahrom Maksudov0% (1)

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementSanna KazmiNo ratings yet

- Fin 311 - Ica3 F15Document4 pagesFin 311 - Ica3 F15Tommy MurphyNo ratings yet

- Problem Sets 15 - 401 08Document72 pagesProblem Sets 15 - 401 08Muhammad GhazzianNo ratings yet

- AFM (NEW) Fall. 2013Document3 pagesAFM (NEW) Fall. 2013Muhammad KhanNo ratings yet

- Advanced Financial Management: Thursday 10 June 2010Document10 pagesAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesFrom EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Tangibe and Non Tangible AssetsDocument1 pageTangibe and Non Tangible AssetsAkshita raj SinhaNo ratings yet

- Economics Unit 4Document7 pagesEconomics Unit 4Akshita raj SinhaNo ratings yet

- MONOPOLYDocument4 pagesMONOPOLYAkshita raj SinhaNo ratings yet

- Taxation - Unit 3Document4 pagesTaxation - Unit 3Akshita raj SinhaNo ratings yet

- BPSMDocument1 pageBPSMAkshita raj SinhaNo ratings yet

- Anubhav Major ReadyDocument23 pagesAnubhav Major Readyriya sharmaNo ratings yet

- Fac22a2 SuppDocument11 pagesFac22a2 Suppsacey20.hbNo ratings yet

- Sales ManualDocument27 pagesSales ManualDella GbedemahNo ratings yet

- Eggriculture Foods LTD Annual Report 2023Document105 pagesEggriculture Foods LTD Annual Report 2023suonodimusicaNo ratings yet

- Ed Unit - 4 NotesDocument11 pagesEd Unit - 4 NotesAnkit RoyNo ratings yet

- ACCT3563 Revision Workshop Slides + QuestionsDocument9 pagesACCT3563 Revision Workshop Slides + QuestionsstephanieNo ratings yet

- Have Mncs Become Stateless, or Is Global Corporation A Myth?Document2 pagesHave Mncs Become Stateless, or Is Global Corporation A Myth?Trd CatNo ratings yet

- Annex 18 SWIFT ManualDocument478 pagesAnnex 18 SWIFT ManualswiftcenterNo ratings yet

- SM02 She-1Document3 pagesSM02 She-1Arieza MontañoNo ratings yet

- RHB Islamic Bank BerhadDocument2 pagesRHB Islamic Bank BerhadVape Hut KlangNo ratings yet

- CATALYZE MS4G Learning Brief - 1Document7 pagesCATALYZE MS4G Learning Brief - 1Estiphanos GetNo ratings yet

- 30 Most Important Questions Business Studies SPCCDocument9 pages30 Most Important Questions Business Studies SPCCRonakNo ratings yet

- Ed13 FirmsDocument2 pagesEd13 Firmsmithila debnathNo ratings yet

- Capital Budgeting MethodsDocument32 pagesCapital Budgeting MethodsDarth VaderNo ratings yet

- MBA 4th Sem 2022-2023 Time TableDocument1 pageMBA 4th Sem 2022-2023 Time TableAnjali SharmaNo ratings yet

- Investments An Introduction 12th Edition Mayo Solutions ManualDocument17 pagesInvestments An Introduction 12th Edition Mayo Solutions Manualtrinhhubert9wim100% (28)

- Document 3Document2 pagesDocument 3garrettloehrNo ratings yet

- Original PDF Advanced Accounting 12th Edition by Fischer PDFDocument41 pagesOriginal PDF Advanced Accounting 12th Edition by Fischer PDFbarbara.sastre874100% (36)

- University of Mumbai: A Project Report OnDocument71 pagesUniversity of Mumbai: A Project Report Onpramod. gutalNo ratings yet

- CEO Overconfidence and Financial CrisesDocument16 pagesCEO Overconfidence and Financial CrisesFab ManNo ratings yet

- 116929-Article Text-324490-1-10-20150514Document11 pages116929-Article Text-324490-1-10-20150514Nofiu Moshood OlaideNo ratings yet

- BL Chap 30Document6 pagesBL Chap 30Thanh Truc TruongNo ratings yet

- CURRENT Affairs MAY-2023Document38 pagesCURRENT Affairs MAY-2023nareshnalika56No ratings yet

- Business Finance Lecture 1Document19 pagesBusiness Finance Lecture 1arabella joy gabitoNo ratings yet

- SWOT Analysis Slide Template: StrengthsDocument12 pagesSWOT Analysis Slide Template: StrengthsAndrrey SzNo ratings yet

- Chapter 3Document11 pagesChapter 3Yến LinhNo ratings yet

- MS 612Document3 pagesMS 612RajveerNo ratings yet

- Rochefort & Associés - General Overview - March 2021 - AcropolisDocument10 pagesRochefort & Associés - General Overview - March 2021 - AcropolisHangyu LvNo ratings yet

- Marketing ReserchDocument26 pagesMarketing ReserchKEDARNATH GAJEWARNo ratings yet

- Chapter 5 - Search For Business Oppurtunity, Ideation, Innovation, and CreativityDocument26 pagesChapter 5 - Search For Business Oppurtunity, Ideation, Innovation, and CreativityJem MalinaoNo ratings yet