Professional Documents

Culture Documents

University of The Punjab

Uploaded by

Manam Sohail0 ratings0% found this document useful (0 votes)

3 views3 pagesOriginal Title

PM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesUniversity of The Punjab

Uploaded by

Manam SohailCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

UNIVERSITY OF THE PUNJAB

Submitted to: Sir Asim Tanvir

Submitted by: Rutaba Afzaal

Roll # F20BB011

Subject: Project Management

Project Proposal:

Project Name: Real Estate Fund Financial Projection Review

Summary:

I propose taking on the task of thoroughly reviewing and refining the 5-year financial projection model

for the new development real estate fund. This is a crucial step to make sure that the financial

predictions for the fund truly reflect how different real estate properties and projects are expected to

perform.

My approach involves carefully examining income, expenses, capital expenditures, debt service, and

cash flow projections. Additionally, I'll conduct sensitivity and scenario analyses to understand how the

model responds to different market situations. This way, I can ensure that the model is well-prepared for

changing conditions.

Objectives:

• Review and validate the 5-year financial projection model to identify and rectify any errors,

inconsistencies, or inaccuracies. Ensure all assumptions and inputs are reasonable, accurate, and in

accordance with industry standards.

• Perform extensive sensitivity and scenario analysis to assess the impact of different variables and

assumptions on key metrics (e.g., net operating income, internal rate of return, net present value,

equity multiple). Establish a robust understanding of potential variations in performance under

different market conditions.

• Develop a framework for dynamically adjusting the model based on changes in market conditions,

business objectives, or feedback from senior management and external stakeholders. Ensure the

model remains agile and responsive to evolving circumstances.

• Develop a framework for dynamically adjusting the model based on changes in market conditions,

business objectives, or feedback from senior management and external stakeholders.

• Encourage cooperation between several departments (acquisitions, development, asset management,

accounting) to ensure that model data and outputs are aligned and consistent.

Deliverables:

• Comprehensive review report describing the financial forecast model's flaws, contradictions, and

errors.

• Results of sensitivity and scenario analysis revealing possible changes in important performance

measures.

• Framework for dynamic model adaption with precise instructions for modifying assumptions in

response to shifting conditions.

• Detailed studies and presentations that highlight the most important conclusions, threats, and

opportunities for top management and outside stakeholders.

• Report on market research and benchmarking that identifies possible real estate possibilities and

provides evidence to support model assumptions.

Timeline:

The estimated timeline for completing this project is approximately 8 to 10 weeks.

Budget:

The budget and cost will be the specified one.

I am excited to work on this project and help make the real estate fund a success!

Sincerely,

Name: Rutaba Afzaal

Email: f20bb011@ibitpu.edu.pk

You might also like

- Project ProposalDocument3 pagesProject ProposalManam SohailNo ratings yet

- Corporate Finance Assignment 6Document4 pagesCorporate Finance Assignment 6amitchellpeartNo ratings yet

- Project Review and Administrative AspectsDocument22 pagesProject Review and Administrative Aspectsamit861595% (19)

- Final Exam Doc Cel SaberonDocument4 pagesFinal Exam Doc Cel SaberonAnonymous iScW9lNo ratings yet

- Kunooz ProfileDocument12 pagesKunooz ProfileIbrahim DaasNo ratings yet

- SNVM Unit 3Document21 pagesSNVM Unit 3Megha PatelNo ratings yet

- Feasibility StudyDocument4 pagesFeasibility StudyJohn M MachariaNo ratings yet

- Corporate Finance ProjectDocument31 pagesCorporate Finance ProjectKrishnendu SahaNo ratings yet

- Business Chapter 789Document69 pagesBusiness Chapter 789Emebet BediluNo ratings yet

- Hallmarks of A Good Financial Model PDFDocument4 pagesHallmarks of A Good Financial Model PDFwaheedanjumNo ratings yet

- F&A-EA To CEO - Renewable-FADocument1 pageF&A-EA To CEO - Renewable-FAIndranil ChoudhuryNo ratings yet

- Overview of Financial ModelingDocument25 pagesOverview of Financial Modelingalanoud100% (2)

- Financial Forecasting and Planning SynopsisDocument17 pagesFinancial Forecasting and Planning Synopsismudigonda snehaNo ratings yet

- Alternative CF Final Assessment (Individual Report) Sep 20-Jan 21Document12 pagesAlternative CF Final Assessment (Individual Report) Sep 20-Jan 21Usman HussainNo ratings yet

- Project Feasibility MethodsDocument6 pagesProject Feasibility MethodsLuo ZhongNo ratings yet

- Building Refurbishment - How Commercial Building Owners Increase Their Real Estate Value: Special Case Studies of Singapore Marina Bay Area and Orchard RoadFrom EverandBuilding Refurbishment - How Commercial Building Owners Increase Their Real Estate Value: Special Case Studies of Singapore Marina Bay Area and Orchard RoadNo ratings yet

- Project AppraisalDocument19 pagesProject AppraisalSagar Parab100% (2)

- Financial Modeling and ForecastingDocument59 pagesFinancial Modeling and ForecastingYamini Divya KavetiNo ratings yet

- Finance Director Strategic Operations in Atlanta GA Resume Julie PowellDocument2 pagesFinance Director Strategic Operations in Atlanta GA Resume Julie PowellJulie PowellNo ratings yet

- Project MGT Mod 3Document16 pagesProject MGT Mod 3rahulking219No ratings yet

- What Is A Feasibility StudyDocument4 pagesWhat Is A Feasibility StudyKim Ramallosa RelosNo ratings yet

- FM2Document3 pagesFM2Ronove GamingNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingShweta SaxenaNo ratings yet

- Ba05 Group 4 - BSMT 1B PDFDocument31 pagesBa05 Group 4 - BSMT 1B PDFMark David100% (1)

- Commercial Banking System and Role of RBIDocument9 pagesCommercial Banking System and Role of RBIRishi exportsNo ratings yet

- Corporate ReportingDocument27 pagesCorporate ReportingPankaj MahantaNo ratings yet

- Lesson 1-FeasibDocument4 pagesLesson 1-FeasibManielyn TulaylayNo ratings yet

- Industry To Be Covered:: PROJECT TITLE: Study of Equity Portfolio Management ServicesDocument2 pagesIndustry To Be Covered:: PROJECT TITLE: Study of Equity Portfolio Management ServicesOm PrakashNo ratings yet

- SynopsisDocument2 pagesSynopsisomdhakadNo ratings yet

- Research Methodology: Analyzing Investment DecisionsDocument8 pagesResearch Methodology: Analyzing Investment DecisionsEkaur KaurNo ratings yet

- Why Understanding Financial StatementsDocument11 pagesWhy Understanding Financial StatementsnaimNo ratings yet

- 2 Part Financial AnalysisDocument20 pages2 Part Financial AnalysisAbebe TilahunNo ratings yet

- Project ApraissalDocument19 pagesProject ApraissalPremchandra GuptaNo ratings yet

- PM Definition, Phases & CharacteristicsDocument3 pagesPM Definition, Phases & CharacteristicsKalathiya ChintanNo ratings yet

- A Study On Capital Budgetting With Reference To Bescal Steel IndustriesDocument69 pagesA Study On Capital Budgetting With Reference To Bescal Steel IndustriesAman Agarwal100% (1)

- Project Finance (Smart Task 3)Document13 pagesProject Finance (Smart Task 3)Aseem Vashist100% (1)

- Digital Assignment 3: Feasibility StudyDocument8 pagesDigital Assignment 3: Feasibility Studysayantan ghoshNo ratings yet

- PM Assignment 1 SolvedDocument7 pagesPM Assignment 1 SolvedRahul GoswamiNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Financial Projections and Key Metrics for MBLDocument6 pagesFinancial Projections and Key Metrics for MBLGohar AfshanNo ratings yet

- Capital Budgeting-1Document46 pagesCapital Budgeting-1sagarharbandhupalNo ratings yet

- Sourav Sasmal ProjectDocument10 pagesSourav Sasmal ProjectSourav SasmalNo ratings yet

- Chapter III Feasibility PlanDocument50 pagesChapter III Feasibility Planrathnakotari100% (1)

- The Project Feasibility StudyDocument17 pagesThe Project Feasibility StudyJoshua Fabay Abad100% (2)

- A Project Proposal: Submitted by Sowmya R Roll No: 0905MBA1391 Register NoDocument4 pagesA Project Proposal: Submitted by Sowmya R Roll No: 0905MBA1391 Register Nosowmyaaa87No ratings yet

- KBL ProjectDocument63 pagesKBL ProjectSunil Darak100% (1)

- Business Plan Checklist: Plan your way to business successFrom EverandBusiness Plan Checklist: Plan your way to business successRating: 5 out of 5 stars5/5 (1)

- Smart Task 2 SubmissionDocument5 pagesSmart Task 2 SubmissionPrateek JoshiNo ratings yet

- Post Audit of Investment Projects ReviewDocument9 pagesPost Audit of Investment Projects ReviewJoyleen PatricioNo ratings yet

- The Feasibility StudyDocument41 pagesThe Feasibility StudyAnkit AnandNo ratings yet

- Capital Budgeting: Meaning Process Project AppraisalDocument15 pagesCapital Budgeting: Meaning Process Project Appraisalhanu11No ratings yet

- MODULE 1 Lesson 2 and 3Document22 pagesMODULE 1 Lesson 2 and 3Annabeth BrionNo ratings yet

- Project Management HomeworkDocument2 pagesProject Management HomeworkSagar PhullNo ratings yet

- Job DescriptionDocument1 pageJob DescriptionMazen KishtbanNo ratings yet

- Project Review Amp Administrative AspectsDocument7 pagesProject Review Amp Administrative AspectsSatyam SenNo ratings yet

- Investment Cavablar 2021 IIDocument42 pagesInvestment Cavablar 2021 IImahammadabbasli03No ratings yet

- Administrative Skills: Budgets in A Business Environment: ITLA 023Document22 pagesAdministrative Skills: Budgets in A Business Environment: ITLA 023TAN XIEW LINGNo ratings yet

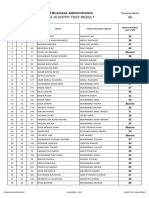

- Entry Test Result MPhil 2014 PDFDocument11 pagesEntry Test Result MPhil 2014 PDFHafizAhmadNo ratings yet

- 06 Plastic Model KitsDocument1 page06 Plastic Model KitsLeonidas MianoNo ratings yet

- Comments PRAG FinalDocument13 pagesComments PRAG FinalcristiancaluianNo ratings yet

- Plan & Elevation of Dog-Legged StaircaseDocument1 pagePlan & Elevation of Dog-Legged Staircasesagnik bhattacharjeeNo ratings yet

- Updated Scar Management Practical Guidelines Non-IDocument10 pagesUpdated Scar Management Practical Guidelines Non-IChilo PrimaNo ratings yet

- Psychrometrics Drying Problems SEODocument5 pagesPsychrometrics Drying Problems SEOStephanie Torrecampo Delima100% (2)

- Arduino ProjectsDocument584 pagesArduino ProjectsJoão Francisco83% (12)

- Cameron VBR-II (Variable Bore Ram) PackerDocument2 pagesCameron VBR-II (Variable Bore Ram) Packerjuan olarteNo ratings yet

- Internship Report On: "Training and Development of Bengal Group of Industries."Document47 pagesInternship Report On: "Training and Development of Bengal Group of Industries."Lucy NguyenNo ratings yet

- Lorenzo Tan National High School 2018-2019 Federated Parent Teacher Association Officers and Board of DirectorsDocument4 pagesLorenzo Tan National High School 2018-2019 Federated Parent Teacher Association Officers and Board of DirectorsWilliam Vincent SoriaNo ratings yet

- Facilitate Training Session Powerpoint PresentationDocument16 pagesFacilitate Training Session Powerpoint Presentationscribdhie100% (2)

- Develop Your Leadership SkillsDocument22 pagesDevelop Your Leadership Skillsektasharma123No ratings yet

- RCT Methodology ChecklistDocument6 pagesRCT Methodology ChecklistSyahidatul Kautsar NajibNo ratings yet

- Common IntentionDocument5 pagesCommon IntentionNandha KumaranNo ratings yet

- Design For Six Sigma Za PrevodDocument21 pagesDesign For Six Sigma Za PrevodSrdjan TomicNo ratings yet

- Title Page - Super King Air C90CGTi FusionDocument2 pagesTitle Page - Super King Air C90CGTi Fusionsergio0% (1)

- Project Feasibility Study For The Establishment of Footwear and Other AccessoriesDocument12 pagesProject Feasibility Study For The Establishment of Footwear and Other Accessoriesregata4No ratings yet

- Design of Grounding System For GIS Indoor SubstationDocument4 pagesDesign of Grounding System For GIS Indoor Substationzerferuz67% (3)

- Sjzl20061019-ZXC10 BSCB (V8.16) Hardware ManualDocument69 pagesSjzl20061019-ZXC10 BSCB (V8.16) Hardware ManualAhmadArwani88No ratings yet

- The Influence of Culture Subculture On Consumer BehaviorDocument55 pagesThe Influence of Culture Subculture On Consumer Behaviorvijendra chanda100% (12)

- 1081 Camid Vs Op DigestDocument2 pages1081 Camid Vs Op DigestLennart Reyes67% (3)

- Indian Railway Bridge Design ProcessDocument18 pagesIndian Railway Bridge Design ProcessCivil Engineer100% (1)

- Meritor 210 220 230 240 2SpeedSingleAxlesDocument27 pagesMeritor 210 220 230 240 2SpeedSingleAxlesYhojan DiazNo ratings yet

- Best Frequency Strategies - How Often To Post On Social Media PDFDocument24 pagesBest Frequency Strategies - How Often To Post On Social Media PDFLiet CanasNo ratings yet

- Juno Gi BrochureDocument2 pagesJuno Gi BrochureJerry VagilidadNo ratings yet

- Bomani Barton vs. Kyu An and City of Austin For Alleged Excessive Use of ForceDocument16 pagesBomani Barton vs. Kyu An and City of Austin For Alleged Excessive Use of ForceAnonymous Pb39klJNo ratings yet

- Capital Harness XC LaunchDocument36 pagesCapital Harness XC LaunchnizarfebNo ratings yet

- Indian Standard: Specification For Reels and Drums For Bare ConductorsDocument13 pagesIndian Standard: Specification For Reels and Drums For Bare ConductorsUppala Krishna ChaitanyaNo ratings yet