Professional Documents

Culture Documents

Week 2 C31FF TUTORIAL QUESTIONS - 1414040219

Uploaded by

Bilal AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 2 C31FF TUTORIAL QUESTIONS - 1414040219

Uploaded by

Bilal AliCopyright:

Available Formats

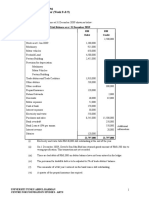

Week 2: C31FF TUTORIAL QUESTIONS

Question 1: (Income statement)

From the following trial balance of B Lane after his first year’s trading, you are required to draw

up an income statement for the year ended 30 June 20X8. A balance sheet is not

required.

Trial Balance as at 30 June 20X8

Dr Cr

£ £

Sales 265,900

Purchases 154,870

Rent 4,200

Lighting and heating expenses 530

Salaries and wages 51,400

Insurance 2,100

Buildings 85,000

Fixtures 1,100

Debtors 31,300

Sundry expenses 412

Creditors 15,910

Cash at bank 14,590

Drawings 30,000

Vans 16,400

Motor running expenses 4,110

Capital 114,202

396,012 396,012

Stock at 30 June 20X8 was £16,280

Question 2: (statement of financial position)

The following is a list of the assets and claims of Aglowsun Engineering as at 30 June last year:

£000

Trade payables 86

Motor vehicles 38

Long-term borrowing (Loan from Industrial Finance Company) 260

Equipment and tools 207

Short-term borrowings 116

Inventories 153

Property 320

Trade receivables 185

Required:

a) Prepare the statement of financial position of the business as at 30 June last year from the

information provided, using the standard layout. (Hint: There is a missing item that needs to be

deduced and inserted.)

b) Discuss the significant features revealed by this financial statement.

Question 3: (statement of financial position)

G. Hope started in business on 1 July 20X0, with £40,000 capital in cash. During the first year, he kept

very few records of his transactions.

The assets and liabilities of the business at 30 June 20X1 were:

£

Freehold premises 76,000

Mortgage on the premises 50,000

Stock 24,000

Debtors 2,800

Cash and bank balances 5,400

Creditors 7,600

During the year, Hope withdrew £9,000 cash for his personal use but he also paid £6,000 received from

the sale of his private car into the business bank account.

Required:

From the above information, prepare a the statement of financial position (balance sheet) showing the

financial position of the business at 30 June 20X1 and indicating the net profit for the year.

You might also like

- O Level Accounts Important QuestionsDocument55 pagesO Level Accounts Important QuestionsibrahoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ACC2002L Financial Management Question PackDocument67 pagesACC2002L Financial Management Question PackAhamed NabeelNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- 1819 IB124 Summer Exam PaperDocument6 pages1819 IB124 Summer Exam PaperHarry TaylorNo ratings yet

- Lecture 6 - Practice Questions-1Document4 pagesLecture 6 - Practice Questions-1donkhalif13No ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- 4 Tangible Fixed Assets: DR CR 000 000Document7 pages4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNo ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- Fa Topic 17-23Document34 pagesFa Topic 17-23MehakpreetNo ratings yet

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocument28 pagesICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Daa 101 Introduction To Accounting Ii - RispahDocument4 pagesDaa 101 Introduction To Accounting Ii - RispahSpencerNo ratings yet

- ICAEW QB2024 Accounting Scenario DangKhoa (1)Document21 pagesICAEW QB2024 Accounting Scenario DangKhoa (1)minhphuc0177No ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- f2 Financial Accounting August 2015Document18 pagesf2 Financial Accounting August 2015Saddam HusseinNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Total Mark: 32.5Document5 pagesTotal Mark: 32.5phithuhang2909No ratings yet

- Jimmy Lim - Perbaikan UAS ICAEWDocument9 pagesJimmy Lim - Perbaikan UAS ICAEWJimmy LimNo ratings yet

- Group assignment on FSDocument4 pagesGroup assignment on FSHuyền TrangNo ratings yet

- Accounting Mock Exam 3Document3 pagesAccounting Mock Exam 3Hâ HiiNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- F&A Level II (Paper B)Document6 pagesF&A Level II (Paper B)almmohamed294No ratings yet

- Worked Example Chap12Document8 pagesWorked Example Chap12Giang Thái HươngNo ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- ASSIGNMENTDocument3 pagesASSIGNMENTDoreen OngNo ratings yet

- Review Questions Volume 1 - Chapter 28Document2 pagesReview Questions Volume 1 - Chapter 28YelenochkaNo ratings yet

- Tutorial 7 QADocument4 pagesTutorial 7 QAJin HueyNo ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Accounting: The Institute of Chartered Accountants in England and WalesDocument26 pagesAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhNo ratings yet

- AccountingDocument19 pagesAccountinggigigiNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Bản inDocument23 pagesBản inTrang VũNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- FS Withadj QuesDocument7 pagesFS Withadj QuesHimank SaklechaNo ratings yet

- Bài tập buổi 12Document7 pagesBài tập buổi 12Huế ThùyNo ratings yet

- 1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 EpsDocument3 pages1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 Epsarmaan ryanNo ratings yet

- CL9BD LTD., Company Financial StatementsDocument2 pagesCL9BD LTD., Company Financial Statementsrumelrashid_seuNo ratings yet

- Final exam financial accountingDocument9 pagesFinal exam financial accountingHazim BadrinNo ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- National Officers Academy December Mock Exams Accountancy Paper 1Document5 pagesNational Officers Academy December Mock Exams Accountancy Paper 1faraz hassanNo ratings yet

- Sole Traders QuestionsDocument5 pagesSole Traders QuestionsJawad Hasan0% (1)

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- Accounting 621Document2 pagesAccounting 621Sarah Precious NkoanaNo ratings yet

- 1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftDocument2 pages1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftpalashndcNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- Financial Accounting F3 Assignment - Preparation of Financial StatementsDocument3 pagesFinancial Accounting F3 Assignment - Preparation of Financial StatementsRakesh RoshanNo ratings yet

- Incomplete RecordsDocument27 pagesIncomplete RecordsSteven Raintung0% (1)

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- Calculating financial statements for a recreation clubDocument6 pagesCalculating financial statements for a recreation clubchin leaNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Chapter 11 Financial Accounting With Adjustment: Question 1 FuguangDocument15 pagesChapter 11 Financial Accounting With Adjustment: Question 1 FuguangClaudia WongNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- CAT 2 Urgent DBM EveningDocument3 pagesCAT 2 Urgent DBM EveningCollins WandatiNo ratings yet

- Sampling DistributionDocument13 pagesSampling DistributionBilal AliNo ratings yet

- EdinburghWaverley 04 Sept 2023 230828 131530Document2 pagesEdinburghWaverley 04 Sept 2023 230828 131530Bilal AliNo ratings yet

- Bilal Ali 17i-0707 Section A1 (Assignemnt)Document116 pagesBilal Ali 17i-0707 Section A1 (Assignemnt)Bilal AliNo ratings yet

- Scholarships and BursariesDocument1 pageScholarships and BursariesBilal AliNo ratings yet