Professional Documents

Culture Documents

Assignment 1

Assignment 1

Uploaded by

Bryll AñAbezaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Assignment 1

Uploaded by

Bryll AñAbezaCopyright:

Available Formats

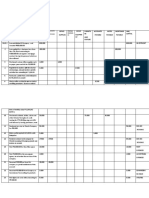

ASSIGNMENT:

On September 1, 2023, Superman started Superman Laundry Service with P300,000 as an initial investment. The

following other transactions for the month are:

2 Purchased chairs and tables for cash, P7,000.

3 Purchased laundry supplies on account from Batman Supply Inc., P5,000.

4 Purchased washing machines and dryers from Spiderman Equipment Corp., P150,000, paying P50,000 and

the balance on account.

16 Revenues earned for the first half of the month, P30,000, were P20,000 on cash basis and the rest on account.

17 Paid P10,000 to Spiderman Equipment Corp. for the equipment purchased on account on Sept. 4.

18 Superman, the owner, withdrew cash from the business worth P10,000 for personal use.

23 Received P8,000 from revenues earned on account from the first half of the month.

28 Revenues earned on cash basis for the second half of the month, P40,000.

29 Paid accounts to Batman Supply Inc. P3,000.

30 Paid electricity and water bills for the month, P8,000.

30 Paid Salaries to employees, P15,000.

Required:

1. Prepare journal entry for the transactions above.

2. Prepare T-Accounts.

3. Prepare Trial Balance.

Chart of Accounts

ASSETS LIABILITIES

Cash Accounts Payable

Accounts Receivable

Laundry Supplies OWNER’S EQUITY

Furniture and Fixtures Superman, Capital

Laundry Equipment Superman, Drawing

EXPENSES INCOME

Utilities Expense Laundry Service Revenue

Salaries Expense

You might also like

- 2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsDocument25 pages2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsMoon Binn100% (2)

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Step 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleDocument16 pagesStep 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleSteffane Mae Sasutil100% (1)

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Activity BookkeepingDocument10 pagesActivity BookkeepingAquisha MicuboNo ratings yet

- ABM - 111 - Final ExaminationDocument2 pagesABM - 111 - Final ExaminationTimothy JamesNo ratings yet

- DRILL 4 Journalizing T Account Trial BalanceDocument2 pagesDRILL 4 Journalizing T Account Trial Balancetrexy jeane sumapigNo ratings yet

- ACCCOB1 - (Module 1)Document36 pagesACCCOB1 - (Module 1)Andrei AngNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document6 pagesFundamentals of Accountancy, Business and Management 1John Francis JabinesNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Acctg Project-2Document3 pagesAcctg Project-2Jania Lopez Amiuq CampilananNo ratings yet

- Bookpng Irene Borra Bus. Trans Practical ExercisesDocument1 pageBookpng Irene Borra Bus. Trans Practical ExercisessbcluincNo ratings yet

- In June of 20XXDocument3 pagesIn June of 20XXBonita VBNo ratings yet

- Abmss 4Document3 pagesAbmss 4Archie EspiloyNo ratings yet

- Activity For October 10 2022Document2 pagesActivity For October 10 2022Glo Ri NeNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- BUSINESS PLAN - EntrepDocument7 pagesBUSINESS PLAN - EntrepimchangkyunNo ratings yet

- Chapter 4 - Accounting FundamentalsDocument19 pagesChapter 4 - Accounting Fundamentalsclariza100% (1)

- Sample ExcelDocument9 pagesSample Excelhmmmmn75% (4)

- Fabm 2 Lesson 3Document4 pagesFabm 2 Lesson 3ABM1205 Lancanan Ma. SheilaNo ratings yet

- Quiz 1 Acctg. MTDocument1 pageQuiz 1 Acctg. MTIsabela RiegoNo ratings yet

- Accounting Cycle: Journal EntriesDocument5 pagesAccounting Cycle: Journal EntriesNeha PandeyNo ratings yet

- Modul Tugas 1 Praktikum Pengantar Akuntansi PDFDocument2 pagesModul Tugas 1 Praktikum Pengantar Akuntansi PDFMnur SyabaniNo ratings yet

- Mr. Addams' EditingDocument15 pagesMr. Addams' EditingKim KoalaNo ratings yet

- Tabular AnalysisDocument5 pagesTabular AnalysisjamesmakarioslabruscaNo ratings yet

- Quiz JournalizingDocument24 pagesQuiz JournalizingSharlene AberosNo ratings yet

- Chapter 6 JournalizingDocument2 pagesChapter 6 JournalizingMari Carreon TulioNo ratings yet

- Exercises and Problem Debit 2-A May 2 CashDocument16 pagesExercises and Problem Debit 2-A May 2 CashRenz MoralesNo ratings yet

- Activity #1 Journalizing and Posting To T Accounts (1) 1Document1 pageActivity #1 Journalizing and Posting To T Accounts (1) 1Kil ZoldyckNo ratings yet

- Complete Accounting Cycle Service EntityDocument2 pagesComplete Accounting Cycle Service EntityChristine PalaganasNo ratings yet

- Seatwork Acctg 1Document8 pagesSeatwork Acctg 1Lara Lewis AchillesNo ratings yet

- Acc 102 Drill No. 1 Answer Key 3Document17 pagesAcc 102 Drill No. 1 Answer Key 3Hanan MacalbeNo ratings yet

- The AccountDocument12 pagesThe AccountRose PinedaNo ratings yet

- Year Particulars PR Debit CreditDocument3 pagesYear Particulars PR Debit CreditJohn Lloyd SuizoNo ratings yet

- Accounting TermDocument8 pagesAccounting TermErick Danilo Salguero EscalanteNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Accountingtemplates1 Prob 7Document20 pagesAccountingtemplates1 Prob 7Mc Clent CervantesNo ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- Perpetual Inventory Method: Accounting Practice SetDocument8 pagesPerpetual Inventory Method: Accounting Practice SetZyn Marie OccenoNo ratings yet

- Orca Share Media1569244186322Document8 pagesOrca Share Media1569244186322Zyn Marie OccenoNo ratings yet

- WAC Chief HongDocument24 pagesWAC Chief HongJasmine ActaNo ratings yet

- Sample Problems - Recording and Adjusting EntriesDocument6 pagesSample Problems - Recording and Adjusting EntrieskapitanadaveNo ratings yet

- Assignment No. 1 (Financial Transactions) Answer KeyDocument9 pagesAssignment No. 1 (Financial Transactions) Answer KeyHeasylyn tadeoNo ratings yet

- Chapter 2 - The Recording Process Practice SolutionsDocument13 pagesChapter 2 - The Recording Process Practice SolutionsNguyễn Minh ĐứcNo ratings yet

- PROB 2.3 Date Account Titles and Explanation P.R. Debit CreditDocument15 pagesPROB 2.3 Date Account Titles and Explanation P.R. Debit CreditMinh PhươngNo ratings yet

- Recording Business Transactio NSDocument13 pagesRecording Business Transactio NSAnonymousNo ratings yet

- Journal EntriesDocument6 pagesJournal EntriesJermaine M. SantoyoNo ratings yet

- Accounting Cycle ProblemDocument2 pagesAccounting Cycle ProblemAyeshaNo ratings yet

- Activity 2 3Document2 pagesActivity 2 3MA. FRITZIE DE ASISNo ratings yet

- Activity 1-Journalizing - Magayones - BSMA 1-9Document12 pagesActivity 1-Journalizing - Magayones - BSMA 1-9Alejandro Francisco Jr.No ratings yet

- Basic Accounting Equation Readings - 1095409783Document11 pagesBasic Accounting Equation Readings - 1095409783GwenNo ratings yet

- Journalizing Kvvnvsit1-2 Prob6&7Document12 pagesJournalizing Kvvnvsit1-2 Prob6&7devora aveNo ratings yet

- FAR111 AssignDocument1 pageFAR111 Assignnaldima06No ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- Siniligan Lee-Roy C. BSHM Ii E Assessment #3Document3 pagesSiniligan Lee-Roy C. BSHM Ii E Assessment #3Princess AlontoNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- KVVNBSIT1-2 RecordingbusinesstransactionsDocument6 pagesKVVNBSIT1-2 Recordingbusinesstransactionsdevora aveNo ratings yet

- Adjusting Entries Company A ExercisesDocument19 pagesAdjusting Entries Company A ExercisesRodolfo CorpuzNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Tourism PromotionsDocument9 pagesTourism PromotionsBryll AñAbezaNo ratings yet

- Dance ArtsDocument4 pagesDance ArtsBryll AñAbezaNo ratings yet

- ZephaniahDocument7 pagesZephaniahBryll AñAbezaNo ratings yet

- Musical ArtsDocument6 pagesMusical ArtsBryll AñAbezaNo ratings yet

- Geography and Tourism in North AmericaDocument46 pagesGeography and Tourism in North AmericaBryll AñAbezaNo ratings yet