Professional Documents

Culture Documents

Tax-Calculator Residents YA23

Uploaded by

Krishna Kumar0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

Tax-calculator Residents YA23 (1) (1)

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageTax-Calculator Residents YA23

Uploaded by

Krishna KumarCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

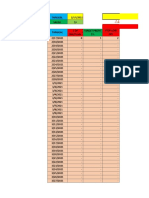

Income Tax Calculator for Tax Resident Individuals

YEAR OF ASSESSMENT 2023 (For the year ended 31 Dec 2022)

What to do: Enter amount in the gray boxes, where applicable.

Tips: For more information, move your mouse over the field or click on the field name.

INCOME

Employment Income S$ .00

Less: Employment Expenses S$ .00

NET EMPLOYMENT INCOME S$ 0 .00

Trade, Business, Profession or Vocation S$ .00

Add: OTHER INCOME

Dividends S$ .00

Interest S$ .00

Rent from Property S$ .00

Royalty, Charge, Estate/Trust Income S$ .00

Gains or Profits of an Income Nature S$ .00

TOTAL INCOME S$ 0 .00

Less: Approved Donations S$ .00

ASSESSABLE INCOME 0 .00

Less: PERSONAL RELIEFS

Earned Income Relief S$ .00

Spouse/Handicapped Spouse Relief S$ .00

Qualifying/Handicapped Child Relief S$ .00

Working Mother's Child Relief S$ .00

Parent/Handicapped Parent Relief S$ .00

Grandparent Caregiver Relief S$ .00

Handicapped Brother/Sister Relief S$ .00

CPF/Provident Fund Relief S$ .00

Life Insurance Relief S$ .00

Course Fees Relief S$ .00

Foreign Domestic Worker Levy Relief S$ .00

CPF Cash Top-up Relief (Self, Dependant and Medisave account) S$ .00

Supplementary Retirement Scheme (SRS) Relief S$ .00

NSman(Self/Wife/Parent) Relief S$ .00

Total Personal Reliefs (capped at $80,000) S$ 0 .00

CHARGEABLE INCOME S$ 0 .00

Tax Payable on Chargeable Income S$ 0.00

Less: Parenthood Tax Rebate S$

NET TAX PAYABLE S$ 0.00

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PTS - CBLMDocument7 pagesPTS - CBLMDeex Agueron83% (6)

- Oracle Financials Cloud Intro For CFOs and System IntegratorsDocument76 pagesOracle Financials Cloud Intro For CFOs and System IntegratorsMiguel Felicio100% (1)

- Sami Abusaad Trend Analysis PDF EbookDocument18 pagesSami Abusaad Trend Analysis PDF EbookWuU2345100% (1)

- Hoja de Resumen Liquidacion de ObraDocument2 pagesHoja de Resumen Liquidacion de ObraLucero Inocente PerezNo ratings yet

- Emtagas - 2012 - 2013Document38 pagesEmtagas - 2012 - 2013BC GonzaloNo ratings yet

- Sesion 1 - PPT Formulacion y Evaluacion de Proyectos de InversionDocument70 pagesSesion 1 - PPT Formulacion y Evaluacion de Proyectos de InversionMiryhan Tineo Ramon100% (1)

- ApostilaMatemática Versão 2016 1 AlunosDocument139 pagesApostilaMatemática Versão 2016 1 AlunosJosé Cataldi CataldiNo ratings yet

- Lucy H Koh Financial Disclosure Report For Koh, Lucy HDocument12 pagesLucy H Koh Financial Disclosure Report For Koh, Lucy HJudicial Watch, Inc.No ratings yet

- Bloquera Miguel GonzalesDocument53 pagesBloquera Miguel Gonzalescesarfula50% (2)

- Retailing MangementDocument56 pagesRetailing MangementSubbaRaoNo ratings yet

- Business Plan BriquettesDocument32 pagesBusiness Plan BriquettesAnonymous B35kDvZ86% (7)

- Graded Exam #1Document14 pagesGraded Exam #1RamsyNo ratings yet

- Takaful Islamic InsuranceDocument8 pagesTakaful Islamic InsuranceSaif ul NazirNo ratings yet

- Primary MarketDocument23 pagesPrimary Marketmansi888100% (1)

- Política Exterior MexicanaDocument5 pagesPolítica Exterior MexicanaNereyda Flores100% (2)

- Target Trading HarianDocument21 pagesTarget Trading HarianNavz BlackNo ratings yet

- Tesis-Tipos de PuntadasDocument115 pagesTesis-Tipos de PuntadasJose Edwin100% (2)

- CuestionarioDocument8 pagesCuestionarioÊstêfy VânessâNo ratings yet

- Unlocking Private Finance To Support CCS InvestmentsDocument31 pagesUnlocking Private Finance To Support CCS InvestmentsBamrung SungnoenNo ratings yet

- Metodologia Plan Maestro Parque Naciones Unidas-1Document2 pagesMetodologia Plan Maestro Parque Naciones Unidas-1Rony Guardado CifuentesNo ratings yet

- Investment Property: By:-Yohannes Negatu (Acca, DipifrDocument31 pagesInvestment Property: By:-Yohannes Negatu (Acca, DipifrEshetie Mekonene AmareNo ratings yet

- Strategy Implementation Anne Mulcahy 1Document61 pagesStrategy Implementation Anne Mulcahy 1Apurva Kiran Nahata100% (1)

- Manual Contable para Instituciones FinancierasDocument232 pagesManual Contable para Instituciones Financieraseqo20006434No ratings yet

- Role of Sbi & HDFC in Business FinanceDocument47 pagesRole of Sbi & HDFC in Business Financepurusottam_asianpacificNo ratings yet

- Hoja de VidaDocument16 pagesHoja de VidaastribcaroNo ratings yet

- Macroentorno Coca ColaDocument6 pagesMacroentorno Coca Colaalberto pachecoNo ratings yet

- O/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Document8 pagesO/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Muhammad ImranNo ratings yet

- Jugnoo: Expansion or Consolidation: Sushmita Biswal Waraich Ajay ChaturvediDocument11 pagesJugnoo: Expansion or Consolidation: Sushmita Biswal Waraich Ajay ChaturvediValeria FloresNo ratings yet

- FIS SunGard Announcement Deck - FINALDocument19 pagesFIS SunGard Announcement Deck - FINALjamesashworthNo ratings yet

- Vietnam Remains Firm On Controversial Airport ProjectDocument3 pagesVietnam Remains Firm On Controversial Airport ProjectQuan ThànhNo ratings yet