Professional Documents

Culture Documents

Bir Tin

Bir Tin

Uploaded by

Bhel Baks0 ratings0% found this document useful (0 votes)

247 views2 pagesOriginal Title

BIR-TIN

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

247 views2 pagesBir Tin

Bir Tin

Uploaded by

Bhel BaksCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

FS acuerdee = ven

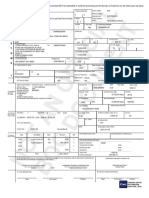

IR FORM

2303

REVISED: APRIL 2019

OCN: 080R¢70220000002018

Date OCN Generated: March 10, 2022

TIN & BRANCH CODE. | NAME OF TAXPAYER — TINISSUANCE DATE

430-744-019-00001. | "VALENZUELA, ARDEN EARL SIDO. March 10, 2022

REGISTERING OFFICE f= Emeantomos: <== == =~ [x | Branch = =

REGISTERED ADDRESS:

DOOR E 2iF ESPERANZA.BLDG. A.C. CORTES AVE... BABAO-ESTANCIA 6014 MANDAUE CITY CEBU

PHILIPPINES

f T ES

} ‘TAX TYPES FORM FILING. FILING FILING DUE DATE

| TYPES | STARTDATE | FREQUENCY

1

|=-danuary 1; [> ‘On or before the last day of

REGISTRATIONFEE | 0605 pact «ANNUALLY re

+ { ‘On or before the 10th day of the |

SA er eeal s0RiBe=| sa Met G MONTHLY ‘month following the month in

eer coe = which withholding was made.

Notlater than the last day of the

WITHHOLDING Tax. March 10, month following the close of the

EXPANDED/OTHERS | cate 2022 eee quarter during which withholding

zs = __was made.

‘On or before March 1 ofthe year

} Tollowing the célendar year in

WITHHOLDING TAX- | Jenuary 1, Which the income payments

EXPANDED/OTHERS. {GRE 2023 ANAL EY: | subject to expanded withholding

1 : taxes ot exeinpt from withnolding

| a 1 tax were paid of accrued.

[TAXPAYER TYPEIS_| PROFESSIONAL - LICENSED (PRO, IEP)

fess aces exes et ve e

JUSINESS INFORMATION DETAILS Bsepaees pane = =

ae 2 | GaTEGORY_[ REGISTRATION DATE 7

TRADE NAME 1 _| VALENZUELA CUSTOMS BROKERAGE SERVICES ‘March 10, 2022

(Psic) 52292-CUSTOMS BROKERAGE (SHIP-

AND AIRCRAFT) ae Prien vm |

Line of Business | 52202 - CUSTOMS BROKERAGE (GHIP ee eae ‘

AND AIRCRAFT) = = f

REMINDERS:

4, An annual registration tee shall be paid upon reaisiration and 8Véry year thereafter on or before the last Gay

‘of January, using BIR Form No. 0605.

2. Filing ‘of required tax returnis to conform with the above tex types, whether with or without business

‘operation, to avoid penalties

3. For new business registrants, application for registration of manual Books of Accounts (B//As) shall be before

the deadline for fling of the initial quarterly income tax return or anviual income lax return whichever comes

‘earlier, from the date of registration. Registration of new sel of manual BIAS shall be before its use.

4. Immediately inform the district office in case of transfer/cessation of business and other changes. in

registration information by fling BIR Form No, 1805,

For Self-Employed Indivietuals (SEI) whose gross sales andlor receipts and other non-operating income:

‘Goes not exceed P3,000,000 ana who opted to aval of the 8% Income tax rate, the tax type Percentage Tax

Page 1 of 2

a J wt) "a

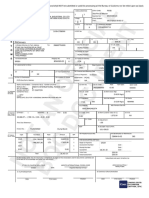

BIR FORM

2303 seri aa

=MANDAUE CITY.

:

ae

REVISED: APRIL 2019 KAWANIHAR NG RI

REVENUE DISTRICY OF

OCN: 08uR629220000002018

Date OCN Generated: March 10, 2022

TIN & BRANCH CODE. NAME OF TAXPAYER TINISSUANCE DATE.

430-744-019-00001 “VALENZUELA, ARDEN EARL SIDQ. March 10,2022

REGISTERING OFFICE. | | Heat.Offica x | Branch

REGISTERED ADDRESS

DOOR E 2/F ESPERANZA BLDG. A.C. CORTES AV!

IBABAO-ESTANCIA 6014 MANDAUE CITY CEBU

PHILIPPINES

(PT) shall hot be reflected in the Certificate of Registration (COR). However, at the start of each taxable

year, such SEI shall be automatically subjected to graduated income tax rates and required to file quarterly

i Percentage tax retumn (BIR Form No, 25510) and option to replace the GOR to reflect “PT, unless qualified

and opted to avall of the 8% Income tax rate annual

Thereby certify that the above named person is registered as indicated

aboye, under the provision of the National Intemal Revenue Code, es

| amended,

TRINIDAD A. VILLAMIL,

REVENUE DISTRICT OFFICER

(Signature over Printed Name)

TED CONSPICUOUSLY IN THE PLAGE OF BUSINESS.

‘R00 Ne. 80-Mandove

Page 2 of 2

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (347)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- P07B 202310 Flight ScheduleDocument109 pagesP07B 202310 Flight ScheduleBhel BaksNo ratings yet

- CusdecFinalSAD 2R9A2300187Document5 pagesCusdecFinalSAD 2R9A2300187Bhel BaksNo ratings yet

- CusdecPreSAD 2R9A2300187Document4 pagesCusdecPreSAD 2R9A2300187Bhel BaksNo ratings yet

- CusdecFinalSAD DGQA2300721Document5 pagesCusdecFinalSAD DGQA2300721Bhel BaksNo ratings yet

- CusdecPreSAD DGQA2300719Document4 pagesCusdecPreSAD DGQA2300719Bhel BaksNo ratings yet