Professional Documents

Culture Documents

Assignment 1a NumericalsSat-Sun

Assignment 1a NumericalsSat-Sun

Uploaded by

Noman EjazOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1a NumericalsSat-Sun

Assignment 1a NumericalsSat-Sun

Uploaded by

Noman EjazCopyright:

Available Formats

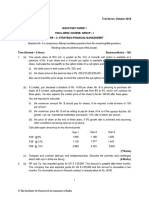

Assignment # 1

Question # 01

IU Co. is holding 2 million shares of Rs.110 each as its total Net worth. The company decided to

obtain working capital financing under Musharka mode of financing by liquidating 25% of its

shares to Ameen Islamic Bank for 5 years terms. During the period company reported Profit &

Loss results as (Rs.220,000), (310,000), Rs.455,000, Rs.850,000 & 800,000. In the fifth year the

company buyout the entire shares from the Bank Muslim at prevailing share price of the term.

Show all the calculations.

Question# 02

Syendicate/Collective Modaraba

Investment

Amount

Mudarba Capital % 8, 000,000

1 A Group 6

Rab-ul-Malls

2 B Group 14

3 C Group 8

4 D Group. 9

5 E Group 10

6 F Group 7

7 G Group 13

8 H Group 23

9 I Group 10

Administrative Costs 24

Sales 12,000,000

Required: Fill the required fillings to complete the problem.

Q#3. Mudarbah Financing from Mudassir bank to M. Ahmad is 300,000 at 60:40

with 5% cost (sales=350,000), to Osama is 450,000 at 30:70 with 7% cost

(sales=550,000) to Zeeshan is 500,000 at 50:50 with 9% cost (sales=450,000)

After collecting the profitability, Islamic bank will share it with its Rab-al-Maal at

43:57. Determine the following details:

1. Show all the calculations with proper format

2. Mudarbah Capital amount?

3. Name the type of Mudaraba executed in the question

___________________________

You might also like

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Book-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Document12 pagesBook-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Hein Linn KyawNo ratings yet

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideFrom EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo ratings yet

- Global Research: EquityDocument40 pagesGlobal Research: EquityAlex CurtoisNo ratings yet

- Summer Training Project of Textile Industry"manjinder Singh"Document89 pagesSummer Training Project of Textile Industry"manjinder Singh"manjinder1933% (3)

- BFN303 2022 2Document2 pagesBFN303 2022 2faleye olumide emmanuelNo ratings yet

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelNo ratings yet

- PM Presentation Baba GroupDocument9 pagesPM Presentation Baba GroupHuzaifa Iftikhar CHNo ratings yet

- SCMPEDocument8 pagesSCMPEkalyanNo ratings yet

- Exercise 8 (11 Jan 2023)Document2 pagesExercise 8 (11 Jan 2023)Teo ShengNo ratings yet

- Midterm Test April2021Document5 pagesMidterm Test April2021NURUL FATIN NABILA BINTI MOHD FADZIL (BG)No ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- 6TH Sem Previous Year Question PaperDocument42 pages6TH Sem Previous Year Question Paperguptaonly01No ratings yet

- Super 60 Questions CA Final AFM For MAy 24 ExamsDocument42 pagesSuper 60 Questions CA Final AFM For MAy 24 ExamsHenry HundersonNo ratings yet

- Applied Value Knowledge Opportunistic MA in Times of CrisisDocument12 pagesApplied Value Knowledge Opportunistic MA in Times of CrisisfabrlafontNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- Wa0002Document3 pagesWa0002abdfaz951No ratings yet

- SFM Q MTP 2 Final May22Document6 pagesSFM Q MTP 2 Final May22Divya AggarwalNo ratings yet

- Ca Final New - Group 1: Paper 2Document9 pagesCa Final New - Group 1: Paper 2Priyanshu TomarNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- MBM633, QB, Unit-4, 5Document4 pagesMBM633, QB, Unit-4, 5Mayank bhardwajNo ratings yet

- Lecture 56 AssignmentDocument4 pagesLecture 56 AssignmentMuneeb UllahNo ratings yet

- Principles of FinanceDocument9 pagesPrinciples of FinanceEdmond YapNo ratings yet

- AFM Case Study MbaDocument2 pagesAFM Case Study MbaN . pavanNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- AssignmentDocument5 pagesAssignmentAsmita MoonNo ratings yet

- Diwali Picks October - Fundamental DeskDocument16 pagesDiwali Picks October - Fundamental DeskSenthil KumarNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- BCOE - 143 E DoneDocument4 pagesBCOE - 143 E DoneAmit YadavNo ratings yet

- Appendix FinalDocument10 pagesAppendix FinalOmar AhmadNo ratings yet

- Goat Project NewDocument15 pagesGoat Project NewmrigendrarimalNo ratings yet

- Assignment AnswerDocument40 pagesAssignment AnswerKreatif TuisyenNo ratings yet

- Project Report On General StoreDocument10 pagesProject Report On General StoredigitaltechnolifeNo ratings yet

- FM - Sept 2021Document2 pagesFM - Sept 2021Vishnu DevNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- Paper14 PDFDocument94 pagesPaper14 PDFShilpa Arora NarangNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Taqa Co 100305Document3 pagesTaqa Co 100305Yue XiangNo ratings yet

- Statement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FDocument2 pagesStatement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FPavan BasundeNo ratings yet

- MMHE - First Major Slew of Contracts For The Year - 160615Document3 pagesMMHE - First Major Slew of Contracts For The Year - 160615Liesa TalibNo ratings yet

- (OKS) Maxwell InternationalDocument13 pages(OKS) Maxwell InternationalTung NgoNo ratings yet

- Financial Management D2Document17 pagesFinancial Management D2Chisanga ChilubaNo ratings yet

- Project Report On General StoreDocument12 pagesProject Report On General Storeimtaj320haqueNo ratings yet

- Solarvest - 1QFY24Document4 pagesSolarvest - 1QFY24gee.yeap3959No ratings yet

- KotureshwaraDocument9 pagesKotureshwaraVeerabhadreshwar Online CenterNo ratings yet

- UntitledDocument6 pagesUntitledAlok TiwariNo ratings yet

- Project Management Assignment (1) 7 SeptDocument15 pagesProject Management Assignment (1) 7 Septsan sanNo ratings yet

- Cost Accounting and FM IpcoDocument18 pagesCost Accounting and FM Ipcomayoogha1407No ratings yet

- Paper 3 Cost Accounting and Financial ManagementDocument5 pagesPaper 3 Cost Accounting and Financial Managementmt93570No ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- FM LMS Based AssessmentDocument11 pagesFM LMS Based AssessmentHassaan KhalidNo ratings yet

- Financial Management May 2019Document2 pagesFinancial Management May 2019Thomas RajuNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Rebuilding the Corporate Genome: Unlocking the Real Value of Your BusinessFrom EverandRebuilding the Corporate Genome: Unlocking the Real Value of Your BusinessNo ratings yet

- Practice Questions Summer2013Document3 pagesPractice Questions Summer2013Noman EjazNo ratings yet

- Assignment 2 Numerical Wed - Fall13Document1 pageAssignment 2 Numerical Wed - Fall13Noman EjazNo ratings yet

- Chapter 5 - Production and Cost Analysis in The Short-RunDocument21 pagesChapter 5 - Production and Cost Analysis in The Short-RunNoman EjazNo ratings yet

- Chapter 4 - Techniques For Understanding - 97Document18 pagesChapter 4 - Techniques For Understanding - 97Noman EjazNo ratings yet