Professional Documents

Culture Documents

Company Law CH 4 5 6

Company Law CH 4 5 6

Uploaded by

Lakshay Yadav Gurgaon, Haryana0%(1)0% found this document useful (1 vote)

157 views2 pagesOriginal Title

Company Law Ch 4 5 6

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0%(1)0% found this document useful (1 vote)

157 views2 pagesCompany Law CH 4 5 6

Company Law CH 4 5 6

Uploaded by

Lakshay Yadav Gurgaon, HaryanaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

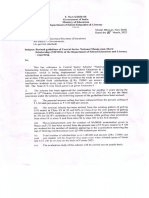

Trisha Data Security Limited was incorporated just a year ago with a paid- up

share capital of & 200 crore. Within such a small period of about year in

operation, it has earned sizeable profits and has topped the charts for its high

employee-friendly environment. The company wants to issue sweat equity to

its employees. A close friend of the CEO of the company has tald him that the

company cannot issue sweat equity shares as minimum 2 years have not

elapsed since the time company commenced its business. The CEO of the

company has approached you to advise about the essential conditions to be

fulfilled before the issue of sweat equity shares especially since their company

is just about a year old.

Shankar Portland Cement Limited is engaged in the manufacture of different

types of cements and has got a good brand value. Over the years, it has built a

good reputation and its Balance Sheet as at March 31, 2020 showed the

following position:

1. Authorized Share Capital (25,00,000 equity shares of % 10/- each)

% 2,50,00,000

2. Issued, subscribed and paid-up Share Capital (10,00,000 equity shares of

% 10/- each, fully paid-up) ® 1,00,00,000

2 Free Reserves @ 3,00,00,000

The Board of Directors are proposing to declare a bonus issue of 1 share for

every 2 shares held by the existing shareholders. The Board wants to know the

conditions and the manner of issuing bonus shares under the provisions of the

Companies Act, 2013.

Answer the following citing relevant provisions:

(a) Prayas Electricals Limited having paid-up capital of € 1 crore availed a

term loan of 7 10,00,000 from Beta Bank Limited to purchase electrical

items. Mr. Sambhav, one of the directors of the company, is of the

opinion that it shall be considered as ‘deposit’. Is his contention correct?

(b) Eklavya Publishing Company Limited facing acute cash crunch wants to

utilise a portion of ‘Deposit Repayment Reserve Account’ to pay off its

short-term creditors who are pressing hard for repayment of

¥ 20,00,000, Is it justified to use funds lying in ‘Deposit Repayment

Reserve Account’ in this manner?

(Sanjiv is a shareholder in Utsah Textiles Private Limited holding 10,000

shares of * 10 each. His wife Sneha and his three sons Aayush, Pranav

and Himanshu are also shareholders in the company holding 1,000

shares each. In response to the invitation from the company inviting

deposits from its members, Sanjiv wants to deposit Rs. 1,00,000 for 36

months jointly with his wife and three sons. Whether Utsah Textiles

Private Limited can accede to the request of Sanjiv and accept deposit

jointly in five names since all the depositors are shareholders of the

company.

Ranjit acquired a property from PQR Limited which was mortgaged to

Pyramid Bank. He settled the dues to Pyramid Bank in full and the same was

registered with the sub-registrar who noted that the mortgage had been

settled. But neither the company nor Pyramid Bank filed particulars of

satisfaction of charge with the jurisdictional Registrar of Companies. Can

Ranjit approach the Registrar and seek any relief in this regard? Discuss this

matter in the light of provisions of the Companies Act, 2013.

Renuka Soaps and Detergents Limited realised on 2nd May, 2022 that

particulars of charge created an 10th March, 2022 in favour of a Sankalp

Commercial Bank Limited were not registered with the Registrar of

Companies. What procedure should the company follow to get the charge

registered? Would the procedure be different if the company realised its

mistake of not registering the charge on 7th June, 2022 instead of 2nd May,

2022? Explain with reference to the relevant provisions of the Companies Act,

2013.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AssignmentDocument4 pagesAssignmentLakshay Yadav Gurgaon, HaryanaNo ratings yet

- NMMSSGuidelinesDocument9 pagesNMMSSGuidelinesLakshay Yadav Gurgaon, HaryanaNo ratings yet

- GE Indian Economy IDocument3 pagesGE Indian Economy ILakshay Yadav Gurgaon, HaryanaNo ratings yet

- Block 1Document92 pagesBlock 1Lakshay Yadav Gurgaon, HaryanaNo ratings yet