Professional Documents

Culture Documents

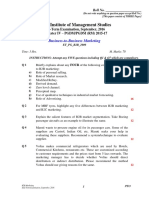

Fin4210 Question

Fin4210 Question

Uploaded by

bebetteronezxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin4210 Question

Fin4210 Question

Uploaded by

bebetteronezxCopyright:

Available Formats

The book value of a company’s assets usually does not equal the

market value of those assets. What are some reasons for this

difference?

The difference between the book value and market value of a company's assets is a fundamental

concept in corporate finance. Several reasons contribute to this disparity:

1. **Historical Cost Accounting**: Book value is based on historical cost accounting principles, where

assets are initially recorded at their purchase price and are gradually depreciated or amortized over

time. This accounting method does not account for changes in the asset's market value over time.

2. **Market Conditions**: Market value reflects the current market conditions and investor

sentiment. Asset prices can fluctuate due to changes in supply and demand, economic conditions,

interest rates, and other market factors. Book value, on the other hand, does not capture these

fluctuations.

3. **Asset Appreciation**: In some cases, assets may appreciate in value over time due to factors

such as technological advancements or increased demand for specific assets. Book value typically

does not account for these appreciations.

4. **Depreciation and Amortization**: As mentioned earlier, book value includes depreciation and

amortization, which reduce the recorded value of assets over time. This can result in a lower book

value compared to the current market value.

5. **Intangible Assets**: Intangible assets, such as intellectual property, brand value, and goodwill,

are often not accurately reflected in the book value. These assets can have significant market value

but may be recorded at a nominal amount on the balance sheet.

6. **Liabilities**: The difference between book value and market value is not limited to assets; it can

also be influenced by liabilities. If a company has undisclosed or contingent liabilities, it can impact

the market's perception of the company's overall value.

7. **Market Sentiment**: Investor sentiment and market dynamics can significantly affect a

company's stock price and, by extension, the market value of its assets. Factors like news, rumors, and

public perception can drive fluctuations in market value.

8. **Competitive Advantages**: A company with unique competitive advantages or a dominant

market position may have assets that are worth more to potential acquirers than their recorded book

value suggests.

9. **Earnings Potential**: Market value often considers a company's future earnings potential, while

book value is based on historical costs. A company with strong growth prospects may command a

higher market value.

In summary, the difference between book value and market value is primarily due to accounting

principles, market dynamics, and the inherent complexities of valuing assets in a dynamic and ever-

changing economic environment. Understanding this difference is crucial for investors, analysts, and

financial professionals when evaluating a company's financial health and potential investment

opportunities.

You might also like

- Salon Daily Sales ReportDocument1 pageSalon Daily Sales ReportShelley Maeve VergaraNo ratings yet

- Adjusted NAV Method of Company ValuationDocument5 pagesAdjusted NAV Method of Company ValuationOladeleIfeoluwaOlayodeNo ratings yet

- FIN350 - Solutions Slides 12Document3 pagesFIN350 - Solutions Slides 12David NguyenNo ratings yet

- RuruDocument18 pagesRuruShreyash PatilNo ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementSameer ShaikhNo ratings yet

- StocksDocument10 pagesStockszeyaNo ratings yet

- DocumentDocument10 pagesDocument121422672168 MBA INo ratings yet

- Functions of PR-WPS OfficeDocument7 pagesFunctions of PR-WPS Officerakeshprasadkargallu2001No ratings yet

- Basics of InvestingDocument2 pagesBasics of InvestingName NoNo ratings yet

- Financial Accounting: Advantages and Disadvantages of Accounting Measurement (Document4 pagesFinancial Accounting: Advantages and Disadvantages of Accounting Measurement (Mhmood Al-saadNo ratings yet

- Becoming An Investor Involves A Combination of EducationDocument11 pagesBecoming An Investor Involves A Combination of EducationzeyaNo ratings yet

- FM TheoryDocument42 pagesFM TheoryMeenakshi PradeepNo ratings yet

- 53 03Document1 page53 03Numaer SiddiqueNo ratings yet

- Inverstment Management Model ExamDocument10 pagesInverstment Management Model ExamNarendran SrinivasanNo ratings yet

- Chapter 7 Common Stock Analysis and ValuationDocument5 pagesChapter 7 Common Stock Analysis and ValuationbibekNo ratings yet

- Portfolio Investment ProcessDocument6 pagesPortfolio Investment ProcessmayurroyalssNo ratings yet

- GOVDocument4 pagesGOVSwelyn Angelee Mendoza BalelinNo ratings yet

- The Portfolio Investment ProcessDocument5 pagesThe Portfolio Investment ProcessApoorva MurdiyaNo ratings yet

- 4Document1 page4Vansh RajputNo ratings yet

- Functions of Stock ExchangeDocument2 pagesFunctions of Stock ExchangeGokulKarwaNo ratings yet

- Steps of Portfolio Management Process /steps of Portfolio ManagementDocument8 pagesSteps of Portfolio Management Process /steps of Portfolio ManagementRuchi KapoorNo ratings yet

- Equity Research TerminologiesDocument19 pagesEquity Research Terminologiesaryait099No ratings yet

- Part BDocument8 pagesPart BSaumya SinghNo ratings yet

- GP - Password@sameer20240223182614Document8 pagesGP - Password@sameer20240223182614mohdsameerali143No ratings yet

- Chapter Five Security Analysis and ValuationDocument66 pagesChapter Five Security Analysis and ValuationKume MezgebuNo ratings yet

- 222Document2 pages222myfeedboxNo ratings yet

- Is Your Stock Worth Its Market PriceDocument14 pagesIs Your Stock Worth Its Market PriceHuicai MaiNo ratings yet

- Balance Sheet: Nhóm 8 - Hoàngth Dimqunh Ị Ễ Ỳ - Nguynngcdip Ễ Ọ Ệ - Phmth Thuan Ạ Ị - Phmminhanhth Ạ ƯDocument11 pagesBalance Sheet: Nhóm 8 - Hoàngth Dimqunh Ị Ễ Ỳ - Nguynngcdip Ễ Ọ Ệ - Phmth Thuan Ạ Ị - Phmminhanhth Ạ ƯDiệp NguyễnNo ratings yet

- Imbalances Created Because of Structured Products in India Equity MarketsDocument8 pagesImbalances Created Because of Structured Products in India Equity MarketsManmohan BhartiaNo ratings yet

- Unit - 3 Public Issue Management Investment BankingDocument27 pagesUnit - 3 Public Issue Management Investment Bankinghansikagupta2611No ratings yet

- Upload SapmDocument20 pagesUpload SapmQurath ul ainNo ratings yet

- Investment IdeasDocument3 pagesInvestment IdeasJohn DoeNo ratings yet

- SAPM All ChaptersDocument74 pagesSAPM All Chapters9832155922No ratings yet

- Concept of Depositary Receipt: Advantages of The Depository SystemDocument10 pagesConcept of Depositary Receipt: Advantages of The Depository Systemvivek_sahu38No ratings yet

- Debate InformationDocument5 pagesDebate InformationTresha Mae ReblezaNo ratings yet

- Investment and Portfolio ManagementDocument16 pagesInvestment and Portfolio ManagementmudeyNo ratings yet

- Ia New NotesDocument20 pagesIa New Notesudaya kumarNo ratings yet

- 98 Sapm-01Document7 pages98 Sapm-01KetakiNo ratings yet

- Stock ExchangeDocument4 pagesStock ExchangedadavedanhNo ratings yet

- Securities Analysis & Portfolio Management IntroDocument50 pagesSecurities Analysis & Portfolio Management IntrogirishNo ratings yet

- Economics 2Document2 pagesEconomics 2tadiwakajongweNo ratings yet

- AssingmentDocument27 pagesAssingmentsonuponnada952722No ratings yet

- Portfolio ManagementDocument42 pagesPortfolio ManagementPrudhvinadh KopparapuNo ratings yet

- Portfolio Investment: Debt Listed SharesDocument5 pagesPortfolio Investment: Debt Listed SharesstellaebbieNo ratings yet

- Shashwat 217085Document5 pagesShashwat 217085Pooja GyawaliNo ratings yet

- Global Cost and Availability of Capital: QuestionsDocument5 pagesGlobal Cost and Availability of Capital: QuestionsCtnuralisyaNo ratings yet

- Lecture ThreeDocument9 pagesLecture ThreeDenzel OrwenyoNo ratings yet

- Answers MS 44Document16 pagesAnswers MS 44SHRIYA TEWARINo ratings yet

- Aprojectreportontechnicalanalysisatsharekhan 120809060800 Phpapp02Document109 pagesAprojectreportontechnicalanalysisatsharekhan 120809060800 Phpapp02touffiqNo ratings yet

- Cost of CapitalDocument22 pagesCost of CapitalBonas TowoNo ratings yet

- Risk. FX. NPLDocument20 pagesRisk. FX. NPLantor075No ratings yet

- Chapter 2Document10 pagesChapter 2Lasborn DubeNo ratings yet

- Interview PrepDocument12 pagesInterview Prepsahiltambe113No ratings yet

- Chapter 6Document24 pagesChapter 6sdfklmjsdlklskfjd100% (2)

- Class Notes - Fix Asset AccountingDocument2 pagesClass Notes - Fix Asset AccountinglaolagnesiaNo ratings yet

- A Study On Technical Analysis At: Industry Overview Company ProfileDocument109 pagesA Study On Technical Analysis At: Industry Overview Company ProfilePrathamesh TaywadeNo ratings yet

- Assignment of B.S (Ashish Tiwari)Document3 pagesAssignment of B.S (Ashish Tiwari)Shashwat ShuklaNo ratings yet

- Quiz 1 ExprecsionDocument2 pagesQuiz 1 ExprecsionJelsey Joe ElizagaNo ratings yet

- Answer 210Document6 pagesAnswer 210Hazel F.No ratings yet

- Interpreting Financial StatementsDocument16 pagesInterpreting Financial Statementsmucio.t.mattosNo ratings yet

- Buying A Car: Andrew GilmanDocument15 pagesBuying A Car: Andrew GilmanAndrew GilmanNo ratings yet

- Chapter 6 Cost of CapitalDocument18 pagesChapter 6 Cost of CapitalmedrekNo ratings yet

- 7 Market EquilibriumDocument4 pages7 Market EquilibriumAdeeba iqbalNo ratings yet

- Objective Computer Awareness by ArihantDocument6 pagesObjective Computer Awareness by ArihantDavid dhakadNo ratings yet

- Weekly Report Operation IMDocument3 pagesWeekly Report Operation IMgisellNo ratings yet

- Assignment Topic 2 - EquilibriumDocument5 pagesAssignment Topic 2 - EquilibriumChi NguyễnNo ratings yet

- Maize & Blue Fund - Economist Group - Sector Pitch - Underweight EnergyDocument19 pagesMaize & Blue Fund - Economist Group - Sector Pitch - Underweight EnergyNaufal SanaullahNo ratings yet

- Curled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionDocument13 pagesCurled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionSiddhant AhujaNo ratings yet

- Marketing ProjectDocument45 pagesMarketing ProjectAditi Mahale100% (1)

- Questions National Income Accounting With KeyDocument6 pagesQuestions National Income Accounting With Keyaditi shuklaNo ratings yet

- EVA Approach: Calculation of Economic Value Added (EVA)Document4 pagesEVA Approach: Calculation of Economic Value Added (EVA)Lakshmi BaiNo ratings yet

- US CMA - PART - I PPT 2 Cash, Accounts Receivables and InventoryDocument62 pagesUS CMA - PART - I PPT 2 Cash, Accounts Receivables and Inventorymohammed100% (1)

- Target CostDocument5 pagesTarget CostWarda RizviNo ratings yet

- Chapter 4 Multiple ChoicesDocument11 pagesChapter 4 Multiple ChoicesAurcus JumskieNo ratings yet

- Helium 10 The Ultimate Product Research GuideDocument18 pagesHelium 10 The Ultimate Product Research GuideNazim AltafNo ratings yet

- General Function of CreditDocument28 pagesGeneral Function of CreditJAM CLNo ratings yet

- 02.monster Pet Evolution Chapter 51 - Chapter 100Document308 pages02.monster Pet Evolution Chapter 51 - Chapter 100Abdul Muqeet RehanNo ratings yet

- Thinking Like An EconomistDocument85 pagesThinking Like An Economistgronigan100% (1)

- Topic 1 - Slutzky Equation For HoursDocument5 pagesTopic 1 - Slutzky Equation For HoursDarling SweetieNo ratings yet

- MCQ-301SM pdf-1Document44 pagesMCQ-301SM pdf-1Aayushi ShahiNo ratings yet

- Chapter 4 BDocument58 pagesChapter 4 Bvaman kambleNo ratings yet

- Exponential Growth Decay Extra Practice W - AnswersDocument3 pagesExponential Growth Decay Extra Practice W - AnswersEdal SantosNo ratings yet

- Jagan Institute of Management Studies: Business-to-Business MarketingDocument3 pagesJagan Institute of Management Studies: Business-to-Business MarketingVardhan SinghNo ratings yet

- Evaluating Financial Performance: Chapter TwoDocument41 pagesEvaluating Financial Performance: Chapter TwoSanad Rousan100% (1)

- Ipl Auction Background Guide-1Document8 pagesIpl Auction Background Guide-1Saransh BhardwajNo ratings yet

- Lesson 2: Fundamental and Technical Analysis For Investing in StockDocument13 pagesLesson 2: Fundamental and Technical Analysis For Investing in StockNica BastiNo ratings yet

- Chap 5 IAS 36 Impairment of AssetsDocument37 pagesChap 5 IAS 36 Impairment of Assetsjanay martinNo ratings yet

- 4638.270 Dräger X-Am Pumpe - enDocument5 pages4638.270 Dräger X-Am Pumpe - encristian escobarNo ratings yet