Professional Documents

Culture Documents

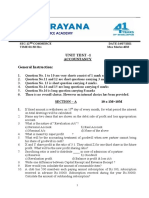

As CH # 6 Partnership Final Accounts

Uploaded by

Hamza AsadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As CH # 6 Partnership Final Accounts

Uploaded by

Hamza AsadCopyright:

Available Formats

1 AS Partnership F/A's

Chapter 6

Partnership Final Accounts

CSS-O/A Levels-Accounts Department

2 AS Partnership F/A's

1 Alec and Jean were in partnership with capitals of $90 000 and $60 000 respectively.

On 1 June 2012 Alec had a debit balance on his current account of $2900 and Jean had a

credit balance on her current account of $3100.

On 31 May 2013 Alec had a credit balance on his current account of $3000 and Jean had a

credit balance on her current account of $340.

The partnership agreement stated:

1 Interest on capital is payable at 5% per annum.

2 Interest on drawings is charged at 8% per annum.

3 Annual partnership salaries were Alec $14 000 and Jean $12 000.

4 Profits and losses are to be shared in the ratio of capital invested.

Alec withdrew $20 000 and Jean $22 000 during the year.

REQUIRED

(a) Prepare the current account of each partner for the year ended 31 May 2013. [10]

(b) Calculate the profit for the year ended 31 May 2013 before appropriation. [6]

(c) Explain the term goodwill. [4]

On 1 June 2013 Alec and Jean agreed to admit Chris as a new partner. It was agreed that

Chris would pay cash into the business for goodwill.

Goodwill was valued at $36 000.

In addition Chris also introduced a motor vehicle valued at $12 150 and inventory of $5850.

The partners agreed that profits and losses are to be shared between Alec, Jean and Chris

in the ratio of 3:2:1. No goodwill account is to be maintained on the books.

REQUIRED

(d) Prepare the capital accounts of Alec, Jean and Chris after Chris’s admission to the

partnership. [10]

[ W13 P22 Q2 ] [Total: 30]

CSS-O/A Levels-Accounts Department

3 AS Partnership F/A's

2 Tania and Sue are in partnership. The following balances have been taken from their books of

account at 31 January 2015. $

Revenue 163 400

Insurance 13 260

Wages 6 500

Rent received 10 400

Rates paid 9 500

Provision for doubtful debts 174

Office expenses 28 200

Capital

Tania 120 000

Sue 80 000

Additional information

1 On 31 January 2015, insurance prepaid amounted to $6400 and wages accrued amounted

to $8500.

2 Rent received is for the period 1 February 2014 to 28 February 2015.

3 Office expenses include $470 for use of Tania’s home telephone.

4 The provision for doubtful debts is to be maintained at 3% of trade receivables.

On 31 January 2015 the trade receivables totalled $7800.

5 Fixtures and fittings are depreciated at 10% per annum using the straight-line method.

Fixtures and fittings cost $7500.

6 Motor vehicles cost $60 000. Accumulated depreciation at 31 January 2014 was $35 000. No

vehicles were bought or sold during the year. Vehicles are depreciated at 20% using the

reducing balance method.

7 Computer equipment was valued at $5700 on 1 February 2014. A new computer costing

$1800 was purchased during the year. There were no sales of computer equipment during

the year. On 31 January 2015 the computer equipment was valued at $6200.

REQUIRED

(a) Prepare the partnership’s income statement for the year ended 31 January 2015. [10]

Additional information

On 1 February 2014 the balance on Tania’s current account was $5000 (credit).

On 31 January 2015, the balance on her current account was $71 068 (credit). She withdrew

$5000 during the year.

The partnership agreement provides for the following:

1 Partners are permitted to withdraw up to a maximum of 5% of capital invested.

2 Interest on drawings is charged at a rate of 7% on the annual drawings.

3 Interest on capital is payable at 4% per year.

4 Tania receives a salary of $1450 per month.

5 Profits and losses are shared in the ratio of capital invested.

REQUIRED

(b) Prepare Tania’s current account for the year ended 31 January 2015 to identify her share of

profit for the year. [5]

[W15 P23 Q2] [Total: 15]

CSS-O/A Levels-Accounts Department

4 AS Partnership F/A's

3 Tom and Jerry are in partnership. They do not have a formal partnership agreement.

The following information is available for the partnership for the year ended 30 November 2015:

$

Capital account balances at 30 November 2015

Tom 90 000

Jerry 54 000

Current account balances at 1 December 2014

Tom 18 000 Credit

Jerry 10 800 Debit

Drawings for the year

Tom 8 000

Jerry 2 800

Profit from operations 12 600

Loan from partner account

Tom 24 000

Tom made the loan to the partnership on 1 December 2014.

Profits had accrued evenly and drawings had been taken evenly throughout the year.

Additional information

Tom and Jerry prepared a formal partnership agreement to take effect from 1 September 2015.

The terms of the agreement were:

1 Interest on capital was to be at a rate of 8% per annum.

2 Interest on drawings was to be at a rate of 3% per annum based on the annual drawings.

3 Tom was to be paid a salary of $16 216 per annum.

4 Profits and losses were to be shared in the ratio 3 : 2 respectively.

5 Loan interest was to be paid at a rate of 4% per annum.

REQUIRED

(a) Calculate the profit before appropriation for the nine months ended 31 August 2015 and the

three months ended 30 November 2015.

[3]

(b) Prepare the appropriation account for the nine months ended 31 August 2015 and the three

months ended 30 November 2015. [6]

(c) Prepare the current accounts for Tom and Jerry for the year ended 30 November 2015. [8]

Additional information

The partnership is considering expansion and will need to purchase additional non-current assets

at a cost of $60 000.

REQUIRED

(d) State the difference between capital and revenue expenditure. [2]

(e) Identify and explain one accounting concept relating to depreciation. [3]

(f) (i) Discuss two possible sources of finance which could be us ed to fund the purchase of

the additional non-current assets. [6]

(ii) Recommend the most appropriate source of finance for the partnership. Justify your

answer. [2]

[W16 P22 Q1] [Total: 30]

CSS-O/A Levels-Accounts Department

5 AS Partnership F/A's

4 Carlos and Erika have been in partnership for several years and prepare their financial

statements to 31 July.

At 1 August 2016 the following information related to non-current assets was available.

$

Plant and machinery

Cost 65 000

Provision for depreciation 5 000

Motor vehicles

Cost 18 000

Provision for depreciation 3 600

During the year ended 31 July 2017 the following took place.

1 On 1 November 2016, the partnership purchased a new machine for $7500.

2 On 1 December 2016 a machine was sold for $6800. The machine had been purchased for

$10 000 on 1 May 2015.

3 On 1 February 2017 a new motor vehicle was purchased for $14 000.

4 The accounting policies in respect of depreciation are:

Plant and machinery is depreciated using the straight-line method at 10% per annum.

Motor vehicles are depreciated using the reducing balance method at 20% per annum.

A full year’s depreciation is charged in the year of purchase and none in the year of

disposal.

5 No adjustments have yet been made for depreciation or disposal of the machine.

The profit for the year ended 31 July 2017 before any adjustments was $37 490.

REQUIRED

(a) Calculate the revised profit before appropriation for the year ended 31 July 2017. [5]

Additional information

The terms of the partnership agreement are as follows:

1 Annual partnership salaries: Carlos $10 000 and Erika $15 000.

2 Interest on capital: 3% per annum.

3 No interest is to be paid on drawings up to $20 000. Interest at a rate of 6% is to be

charged on any drawings in excess of $20 000.

4 Profits and losses are to be shared in the ratio of the capital invested.

The following information is also available at 31 July 2017.

$

Capital account:

Carlos 84 000

Erika 28 000

Drawings:

Carlos 15 000

Erika 25 000

REQUIRED

(b) Prepare the partnership appropriation account for the year ended 31 July 2017. [4]

CSS-O/A Levels-Accounts Department

6 AS Partnership F/A's

Additional information

On 31 July 2016 the balances on the partners’ current accounts were:

$

Carlos 1 300 credit

Erika 250 debit

REQUIRED

(c) Prepare the current accounts for the year ended 31 July 2017. [5]

Additional information

The following information is also available:

31 July 2017 31 July 2016

$ $

Credit sales 385 000 327 500

Credit purchases 172 000 153 000

Inventory 6 535 10 800

Bank overdraft 16 100 1 200

Other receivables 34 126

Other payables 586 248

Trade receivables collection period 46 days 31 days

Trade payables payment period 36 days 39 days

REQUIRED

(d) Calculate the following at 31 July 2017:

(i) Trade receivables [2]

(ii) Trade payables [2]

(e) Assess the working capital position of the partnership at 31 July 2017. [4]

(f) Advise the partners of three ways in which they could improve the cash position of the

business. [3]

Additional information

Carlos and Erika are considering converting the partnership into a limited company.

REQUIRED

(g) Advise the partners whether or not they should take this course of action. Justify your

answer. [5]

[S18 P23 Q1] [Total: 30]

CSS-O/A Levels-Accounts Department

7 AS Partnership F/A's

Alac and Jean

1 (a)

Current accounts

Alec Jean Alec Jean

$ $ $ $

Balance 2 900 (1) Balance 3 100 (1)

Drawings 20 000 22 000 (1) Interest on capital 4 500 (1) 3 000 (1)

Interest on drawings 1 600 (1) 1 760 (1) Salaries 14 000 12 000 (1)

Balance c/d 3 000 340 Share of profit 9 000 (1of) 6 000 (1of)

27 500 24 100 27 500 24 100

Balance b/d 3 000 340

Marker Note:

Drawings and Salaries – 1 mark for both figures.

Share of profit must be in ratio of 3:2 for (of).

[10]

(b) Calculation of profit for the year ended 31 May 2013 before appropriation.

$

Share of profit 15 000 (1of) from (a)

Salary 26 000 (1)

Interest on capital 7 500 (1of)

48 500

LESS

Interest on drawings 3 360 (1of)

Profit for the year 45 140 (2cf/1of)

An anchor figure must be present for any marks to be awarded. [6]

(c) Goodwill is an intangible asset (1). It arises from the location (1) reputation (1) and customer

loyalty (1). It represents the value of the business in excess of (1) the book value of its net

assets (1). [4]

(d)

Capital accounts

Alec Jean Chris Alec Jean Chris

$ $ $ $ $ $

Goodwill 18 000 (1) 12 000 (1) 6 000 (1) Balance b/d 90 000 60 000

Balance c/d 93 600 62 400 48 000 Goodwill 21 600 (1) 14 400 (1)

Cash 36 000 (1)

Vehicle 12 150 (1)

Inventory 5 850 (1)

111 600 74 400 54 000 111 600 74 400 54 000

Balance b/d 93 600 62 400 48 000 (2cf/1of)

Marker Note:

Award 0 marks for Balance b/d is not brought down. [10]

[Total: 30]

CSS-O/A Levels-Accounts Department

8 AS Partnership F/A's

Tania And Sue

2 (a) Income statement for the year ended 31 January 2015

$ $

Revenue 163 400

Add rent received (10400 / 13 × 12) 9 600

173 000 (1)

LESS

Insurance (13260 – 6400) 6 860 (1)

Wages (6500 + 8500) 15 000 (1)

Rates 9 500

Provision for doubtful debts (174 to 234) 60 (1)

Office expenses (28200 – 470) 27 730 (1)

Depreciation:

Fixtures and fittings 750 (1)

Motor vehicles 5 000 (1)

Computer equipment 1 300 (1) 66 200

Profit for the year 106 800 (1of)

[10]

(b) Current account – Tania

$ $

Int on drawings 350 (1) Balance 5 000

Drawings 5 000 (1) Int on capital 4 900 (1)

Balance c/d 71 068 Salary 17 400 (1)

Profit share 49 218

76 418 76 418

Balance b/d 71 068 (1)

[5]

CSS-O/A Levels-Accounts Department

9 AS Partnership F/A's

Tom and Jerry

3 (a)

9 months 3 months

$ $

Profit from operations 9450 3150 (1 for both profits)

Less loan interest: 900 240

Profit before appropriation 8550 (1) 2910 (1)

Workings: [3]

(b)

Tom and Jerry

Appropriation Account for the year ended 30 November 2015

9 months 3 months

$ $ $

Profit before appropriation 8 550 2 910

Interest on drawings:

Tom 60

Jerry 21 81 (1)

Salary: Tom (4 054) (1)

Interest on capital:

Tom (1 800)

Jerry (1 080) (2 880) (1)

Remaining profit / loss 8 550 (3 943) (1) OF for

Split of remaining profit / loss: both

Tom 4 275 (1)OF (2 366) (1)OF

Jerry 4 275 both (1 577) both

8 550 (3 943)

[6]

(c)

Current accounts

Tom Jerry Tom Jerry

Balance b/d 10 800 Balance b/d 18 000

Interest on drawings 60 21 (1)OF Salary 4 054 (1) OF

Drawings 8 000 2 800 (1) Interest on capital 1 800 1 080 (1) OF

Loss 2 366 1 577 (1)OF Loan interest 1 140 (1) OF

Profit share 4 275 4 275 (1) OF

Balance c/d 18 843 Balance c/d 9 843

29 269 15 198 29 269 15 198

Balance b/d 9 843 Balance b/d 18 843 (1) OF

[8]

CSS-O/A Levels-Accounts Department

10 AS Partnership F/A's

(d) Capital expenditure is expenditure on non-current assets (1) with an expected life of more

than 12 months (1) Max 1

Revenue expenditure is expenditure on running costs to generate income / day-to-day

operating expenses (1) Max 1 [2]

(e) Consistency (1)

• to assist comparisons of performance between years. (1)

• using the same depreciation method each year. (1)

OR

Prudence (1)

• avoid overstating profits / net assets (1)

• charging depreciation as an expense and so not overstating profits (1)

OR

Accruals / matching (1)

• match the cost of an asset with the income generated from its use (1)

• matching wear and tear of the asset against the reduction in value (1) [3]

(f) (i) Possible options could include:

• External loan

• Partner’s loan

• Introduce new partner

• Partner introduces additional capital

• Sale of unused non-current assets

• Hire purchase

Award 1 mark for identifying source plus max 2 marks for development (max 3 marks per

source)

For example

Bank loan (1)

Has to be paid back with interest at either a fixed or variable rate (1). May require

security / collateral to cover the possibility of loan default (1).

Introduce new partner (1)

Would introduce capital which doesn’t need to be repaid (1). The partner would however

expect a share of the profits (1). [6]

(ii) 1 mark for a decision about the source of funding and max 1 mark for any justification of

the outcome. [2]

[Total: 30]

CSS-O/A Levels-Accounts Department

11 AS Partnership F/A's

4 Carlos and Erika

(a) $ $ 5

Profit for year before adjustments 37 490

Less:

Depreciation – Plant and machinery W1 6 250 (1)

– Motor vehicles W2 5 680 (1)

Loss on sale W3 1 200 (1)

13 130

Revised profit before appropriation 24 360 (2)CF(1)OF

W1: Depreciation plant and machinery

= 65 000 +7500 – 10 000 ×10% = 6250

W2: depreciation motor vehicles

= 18 000 – 3600 = (14 400 + 14 000) × 20% = 5680

W3: Loss on sale

(10 000 – 2000) = 8000 – 6800 = 1200

CSS-O/A Levels-Accounts Department

12 AS Partnership F/A's

(b) Carlos and Erika 4

Appropriation account for the year ended 31 July 2018

Revised profit for the year 24 360

Add: Interest on drawings

Carlos –

Erika 300 300 (1)

Less: Interest on capital

Carlos (2 520)

Erika (840) (3 360) (1)

Less: Salary

Carlos (10 000)

Erika (15 000) (25 000) (1)

Loss (3 700)

Share of loss Carlos (2 775) }

Erika (925) }(1)OF

(3 700)

Revised profit must be candidate’s own figure from 1(a) to be awarded OF share of loss mark.

CSS-O/A Levels-Accounts Department

13 AS Partnership F/A's

(c) Carlos and Erika 5

Current accounts

$ $ $ $

Carlos Erika Carlos Erika

Balance b/d 250 Balance b/d 1 300

Drawings 15 000 25 000 * Interest on capital 2 520 840 (1)OF

Interest on – 300 (1)OF Salaries 10 000 15 000 * (1)

drawings

Share of loss 2 775 925 (1)OF Balance c/d 3 955 10 635

17 775 26 475 17 775 26 475

Balance b/d 3 955 10 635 (1)OF

* Drawings/salaries both must be correct for 1 mark.

(d)(i) 4

( 46 × $385 000) (1) = $48 521 (1)

365

(d)(ii)

( 36 × $172 000) (1) = $16 964 (1)

365

CSS-O/A Levels-Accounts Department

14 AS Partnership F/A's

(e) Positive working capital. (1) 4

The trade receivables collection period has deteriorated from 31 days to 46 days which could increase the possibility of bad

debts. (1)

The trade payables payment period has decreased by 3 days suggesting that creditors are being paid faster than they need to

be or less credit has been extended by suppliers. (1)

Cash flow problems may result. (1)

The above may have led to the increased bank overdraft and associated bank interest. (1)

There may be less effective credit control in place/may not be carrying out adequate credit referencing checks on new

customers. (1)

Max 4 marks

(f) The partners could reduce their salaries. (1) 3

The partners could reduce their drawings. (1)

Additional capital could be introduced by the existing partners. (1)

A new partner, or partners, could be admitted to the partnership. (1)

A loan could be negotiated. (1)

The partnership could dispose of surplus/unused non-current assets. (1)

Max 3 marks

Accept other valid points

CSS-O/A Levels-Accounts Department

15 AS Partnership F/A's

(g) Remaining as a partnership 5

Disadvantages:

The partners usually have unlimited liability

Profits need to be shared with other partners

There is the possibility of disputes between the partners

Decisions made by one partner are legally binding on the others

Partnership will need to be dissolved if partner dies

1 mark per valid point

Max 2 marks

Becoming a limited company

Disadvantages:

Potential loss of control as additional shareholders invest

There will be costs associated with setting up the company

More detailed financial information

Available for public scrutiny

1 mark per valid point

Max 2 marks

1 for decision

Accept other valid points

CSS-O/A Levels-Accounts Department

You might also like

- ACCA F7 Mock Exam QuestionsDocument18 pagesACCA F7 Mock Exam QuestionsGeo Don100% (1)

- AFAR QuizDocument18 pagesAFAR QuizHans Even Dela Cruz100% (1)

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- 5 CastilloDocument5 pages5 CastilloGhie Morales100% (1)

- CHAPTER 5 - Financial AspectDocument35 pagesCHAPTER 5 - Financial AspectFídely PierréNo ratings yet

- Partnership AccountsDocument5 pagesPartnership AccountsMUSTHARI KHANNo ratings yet

- Financial Statements of A PartnershipDocument2 pagesFinancial Statements of A PartnershipMini NimNo ratings yet

- Chapter 4-Partnership AccountDocument2 pagesChapter 4-Partnership AccountmurshidalbimaanyNo ratings yet

- Partnership Changes - Past Paper QuestionsDocument4 pagesPartnership Changes - Past Paper QuestionsAli GoharNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- FA2 Revision Question 3Document8 pagesFA2 Revision Question 3miss ainaNo ratings yet

- Bad Debts and Pfbd..Document6 pagesBad Debts and Pfbd..rizwan ul hassanNo ratings yet

- Acct 470 Pre Quiz Chapter 4,5,9-12Document28 pagesAcct 470 Pre Quiz Chapter 4,5,9-12karissa.jqasm.0No ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- Afar QuizDocument18 pagesAfar QuizCpa Cheap review materialsNo ratings yet

- AFAR Quiz Master S Copy FinalDocument18 pagesAFAR Quiz Master S Copy FinalPam G.No ratings yet

- Additional Questions-5Document14 pagesAdditional Questions-5Shivam Kumar JhaNo ratings yet

- Mock Test Paper 2Document7 pagesMock Test Paper 2FarrukhsgNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- Worksheet PartnershipDocument6 pagesWorksheet PartnershipyoseNo ratings yet

- Cambridge, 2nd Ed. - PartnershipDocument3 pagesCambridge, 2nd Ed. - PartnershipShannen LyeNo ratings yet

- Zimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3Document7 pagesZimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3chauromweaNo ratings yet

- Quizzer 1Document4 pagesQuizzer 1Arvin John MasuelaNo ratings yet

- Final ExamDocument11 pagesFinal Examdar •No ratings yet

- Accounting Yr 11 Chapter 11-13 QuizDocument9 pagesAccounting Yr 11 Chapter 11-13 QuizThin Zar Tin WinNo ratings yet

- 20 Regional Mid-Year Convention - Academic League Advanced Financial Accounting and Reporting CupDocument20 pages20 Regional Mid-Year Convention - Academic League Advanced Financial Accounting and Reporting CupAshNor RandyNo ratings yet

- Partnership AccountsDocument15 pagesPartnership AccountsAbdul Sameeu MohamedNo ratings yet

- Partnership AccountsDocument15 pagesPartnership AccountsAbdul Sameeu MohamedNo ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- Class 12Document33 pagesClass 12vaibhav dangiNo ratings yet

- 9706 w19 QP 31Document13 pages9706 w19 QP 31PontuChowdhuryNo ratings yet

- Half Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIIDocument7 pagesHalf Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIImarudev nathawatNo ratings yet

- Accrual & Prepaid HW QDocument4 pagesAccrual & Prepaid HW Q小仙女哈哈哈No ratings yet

- 110 WarmupDay1Document25 pages110 WarmupDay1shiieeNo ratings yet

- 01 Accruals and Prepayments TestDocument13 pages01 Accruals and Prepayments TestThomas Kong Ying Li100% (1)

- Accruals & Prepayment-1Document3 pagesAccruals & Prepayment-1Kopanang LeokanaNo ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- AccrualsDocument4 pagesAccrualsschool of schoolNo ratings yet

- Accounts First Term Grade 12Document5 pagesAccounts First Term Grade 12NivpreeNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Past Papers - Partnership ChangesDocument10 pagesPast Papers - Partnership ChangesFarhan JehangirNo ratings yet

- Rcvbls ProblemsDocument6 pagesRcvbls ProblemsJerric CristobalNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- Additional Questions-7Document8 pagesAdditional Questions-7Ak AgarwalNo ratings yet

- Accounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1Document4 pagesAccounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1taiba sajjadNo ratings yet

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- Admission WorksheetDocument9 pagesAdmission WorksheetShristi BishtNo ratings yet

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- CAT Paper FA2Document16 pagesCAT Paper FA2Asra Javed100% (1)

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- Afar 01Document11 pagesAfar 01Raquel Villar DayaoNo ratings yet

- Level 3 Accounting Update Text 2022Document105 pagesLevel 3 Accounting Update Text 2022KhinMgLwin100% (1)

- Advanced Financial Accounting and ReportingDocument5 pagesAdvanced Financial Accounting and Reportingaccounting prob100% (1)

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & Accountancyharesh60% (5)

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- Accounting - ProblemsDocument11 pagesAccounting - ProblemsAzfar JavaidNo ratings yet

- Partnership TestDocument3 pagesPartnership Teststudy.aman902No ratings yet

- Partnership A Level ClassifiedDocument3 pagesPartnership A Level ClassifiedArShadNo ratings yet

- Partnership DigestDocument9 pagesPartnership DigestNelia Mae S. VillenaNo ratings yet

- A Strategic Management Review of Pakistan RailwaysDocument28 pagesA Strategic Management Review of Pakistan RailwaysBilal100% (3)

- BL2 LongquizDocument2 pagesBL2 LongquizJanna Mari FriasNo ratings yet

- Chapter 4 - Forms of Business OrganizationDocument24 pagesChapter 4 - Forms of Business Organizationairam cabadduNo ratings yet

- FV Entrepreneurship Qtr1 Wk2Document8 pagesFV Entrepreneurship Qtr1 Wk2MheraldyneFaith MaderaNo ratings yet

- Final Multiplex BA M3M Corner WalkDocument64 pagesFinal Multiplex BA M3M Corner WalkNidhi YadavNo ratings yet

- Polish Accounting ActDocument54 pagesPolish Accounting Actreginleifmm100% (2)

- MAN Chapter 1: Question Bank: Environmental Studies - 17601Document4 pagesMAN Chapter 1: Question Bank: Environmental Studies - 17601rohitNo ratings yet

- Acrf Partnership and Corporation DomingoDocument42 pagesAcrf Partnership and Corporation DomingoJullie AnnNo ratings yet

- TAX2601 SummaryDocument14 pagesTAX2601 SummaryGhairunisa Harris50% (2)

- Final (1) - OnYOKDocument108 pagesFinal (1) - OnYOKLuisa Datu TolentinoNo ratings yet

- Aniceto Saludo, Jr. vs. PNBDocument1 pageAniceto Saludo, Jr. vs. PNBValora France Miral AranasNo ratings yet

- How To Become Member of CciDocument20 pagesHow To Become Member of CcisalmanNo ratings yet

- Beams11 - Ppt16-Partnership Formation Cyber PDFDocument25 pagesBeams11 - Ppt16-Partnership Formation Cyber PDFCYNTHIA ARYA PRANATANo ratings yet

- CIR vs. SuterDocument5 pagesCIR vs. SuterAnonymous oDPxEkdNo ratings yet

- 1 9489496609 PDFDocument23 pages1 9489496609 PDFneelam jainNo ratings yet

- MCQsDocument48 pagesMCQsSujeetDhakalNo ratings yet

- Corporate TaxationDocument7 pagesCorporate TaxationfcnrrsNo ratings yet

- Agency and Partnership - Course OutlineDocument16 pagesAgency and Partnership - Course OutlineGideon Tangan Ines Jr.No ratings yet

- AlwarDocument94 pagesAlwarSaurabh SrivastavaNo ratings yet

- 011.FAQs English PDFDocument32 pages011.FAQs English PDFLoveNo ratings yet

- Financial Management (Payongayong, 2nd Ed) - Chapter 1Document10 pagesFinancial Management (Payongayong, 2nd Ed) - Chapter 1Auie Eugene Frae Salamera0% (1)

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- Quizzes PremidDocument80 pagesQuizzes PremidJosh Sean Kervin SevillaNo ratings yet

- Accounting For Partnership: Basic ConceptsDocument47 pagesAccounting For Partnership: Basic Concepts12B 25 Ribhav SethiNo ratings yet

- National Income and Related Aggregates (Test Questions) : Article Shared by Diptimai KarmakarDocument34 pagesNational Income and Related Aggregates (Test Questions) : Article Shared by Diptimai KarmakarRounak BasuNo ratings yet

- Accounting-for-Partnership-Corporation-AC-34 (1) - Answer KeyDocument7 pagesAccounting-for-Partnership-Corporation-AC-34 (1) - Answer KeyRhelyn Dato-onNo ratings yet

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmNo ratings yet