Professional Documents

Culture Documents

Public Debt Types

Uploaded by

kaadi44530 ratings0% found this document useful (0 votes)

1 views11 pagesSiddiki aj s kre kek je kel

Original Title

Public Debt types

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSiddiki aj s kre kek je kel

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views11 pagesPublic Debt Types

Uploaded by

kaadi4453Siddiki aj s kre kek je kel

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Public Debt: Overview

Debt can be simply understood as the amount owed by the

borrower to the lender. The total financial obligations of

the public sector make up a nation’s gross government

debt, also known as public debt or sovereign debt.

The financial market where investors may purchase and sell

debt instruments of different forms and attributes is generally

referred to as the “debt market.”

Government borrowing over time is mostly due to prior

shortfalls in the budget. When a government’s expenses

exceed its receipts, a deficit results. Both domestic and

foreign people may be subject to government debt.

The sum is counted against the nation’s external debt if it is

owed to citizens of another country.

Debt instruments

A debt instrument is an asset that provides the lender

(investor), a fixed income on the asset from the borrower. The

lender receives the principal back in due course along with

interest payments.

The Reserve Bank of India has allowed the following bodies

to issue debt instruments in India:

Central and State Governments

Municipal Corporations

Government agencies

Banks

NBFCs

Public Sector Units

Corporates

Types of Debt Instruments in India

The debt market in India is one of the largest in Asia and

broadly consists of government securities (G-Secs), including

central and state government securities and bonds issued by

corporations.

Debt products available include bonds, Certificates of

Deposit, Commercial Papers, Debentures, National Savings

Certificates, Government Securities, Fixed Deposits, and

more.

Government bonds:

These are issues by central or state governments.

These bonds act as a loan wherein the government

borrows money from investors at a predetermined

interest rate for a specific period.

Government bonds fall under the broad category of

government securities (G-secs) and are issued under the

supervision of the Reserve Bank of India.

The interest rate offered on the government bond, also

known as the coupon rate, can be either fixed or floating.

Debentures:

Companies issue debentures to raise funds by borrowing

money from the public.

The company thus promises to pay fixed interest to the

investors.

These debt instruments may or may not be backed by any

specific security or collateral. Hence, the investors have

to rely on the credit ratings of the issuing company as

security.

Fixed deposits:

Fixed deposits (FDs) are one of the most popular

investment products as they are versatile and flexible.

Banks, certain Non-Banking Finance Companies

(NBFCs), and even post offices issue fixed deposits.

They are popular due to their ease of investment,

liquidity (except in tax-saving FDs), and uncomplicated

nature.

Debt mutual funds:

Debt Mutual funds invest the pooled money in fixed-

income products like government securities, corporate

bonds, and some part in money market instruments.

Debt funds, also known as fixed-income funds, are

considered less volatile than equity funds as they invest

in fixed-income products. They also have a low-cost

structure.

Certificates of deposit

Certificates of Deposit (CDs), introduced in India in

1989, are short-term debt instruments.

Banks and Financial Institutions issue CDs in

dematerialized form against the funds that an investor

deposits for a specific term.

The Reserve Bank of India lays down guidelines from

time to time for their issue and operation.

All individual residents in India are eligible to buy

certificates of deposit. The minimum duration of a CD

issued by a bank is seven days and goes up to one year

Public provident fund:

The Public Provident Fund (PPF) scheme is a popular

long-term investment product. PPFs have been around

since 1968.

In this investment option, you put aside a small sum of

money regularly to create wealth in the long term.

Interest rates are fixed by the government quarterly. And

the Investment and returns are tax-exempt.

Public debt

Public debt is the total amount borrowed by the government

of a country when the government’s revenue from taxes and

other sources falls short of its spending requirements.

In India, public debt includes the total liabilities of the Union

government that have to be paid from the Consolidated Fund

of India (Article 292).

It is further classified into internal & external debt. Internal

debt is categorized into marketable and non-marketable

securities.

Marketable government securities include G-secs and T-

Bills issued through auction.

Non-marketable securities include intermediate treasury

bills issued to state governments and special securities

issued to national Small Savings Fund among others.

Sometimes, the term is also used to refer to the overall

liabilities of the central and state governments.

However, the Union government clearly distinguishes its

debt liabilities from those of the states.

It calls the overall liabilities of both the Union

government and state General Government Debt (GGD)

or Consolidated General Government Debt.

The internal debt comprises loans raised in the open market.

It also includes borrowings through treasury bills

including treasury bills issued by state governments,

commercial banks, and other investors.

It also includes non-negotiable, non-interest-bearing

rupee securities issues to international financial

institutions.

The part of a nation’s debt that is borrowed from foreign

lenders, such as commercial banks, governments, or

international financial institutions, is referred to as its external

debt.

These loans must typically be repaid in the currency used

to make the loan, plus any applicable interest.

The borrowing nation may sell and export items to the

lending nation to get the required cash.

The amount of the government’s debt is crucial since a sizable

portion of annual payments (around 25%) are made merely

to cover the interest on the previous debt. For the current

fiscal year, the government’s debt is predicted to be about

62% of GDP.

The debt-to-GDP ratio shows how probable it is that the

nation will be able to pay off its debt. Investors frequently use

the debt-to-GDP ratio to determine the capacity of the

government to finance its debt. Global economic crises have

been fueled by higher debt-to-GDP ratios.

Public debt management

Sovereign or public debt management is the process of

establishing and executing a strategy for managing the

government’s debt to raise the required amount of funding.

It aims to achieve its risk and cost objectives and to meet any

other sovereign debt management goals the government may

have set, such as developing and maintaining an efficient

market for government securities.

In 2015, the creation of a statutory body called Public Debt

Management Agency (PDMA) was envisaged in India.

As the RBI set interest rates and conducted the purchase

and sale of government bonds, it raised issues of conflict

of interest.

Till the time a PDMA comes into place, the government

created an interim arrangement that deals with the

management of public debt called the Public Debt

Management Cell.

Public Debt Management Cell

Public Debt Management Cell is an interim arrangement

before setting up an independent and statutory debt

management agency namely the Public Debt Management

Agency (PDMA).

PDMC has the following advisory functions to the

Government:

Plan borrowings of the Government, including market

borrowings, other domestic borrowings, SGBs

Manage Central Government’s liabilities including NSSF,

and contingent liabilities.

Monitor cash balances of the Government, improve cash

forecasting, and promote efficient cash management

practices.

Advise other Divisions in DEA on matters related to

External Debt involving external borrowings through MI,

Bilateral cooperation, and other possible sources, in terms

of cost, tenure, currency, hedging requirements, etc., and

monitor developments in foreign exchange markets.

Foster a liquid and efficient market for Government

securities

Develop interfaces with various stakeholders/agencies in

the regulatory/financial architecture etc. to carry out

assigned functions efficiently.

Advice on matters related to investment and capital

market operations.

Undertake research work related to new product

development, market development, risk management,

debt sustainability assessment, other debt management

functions, etc.

Develop a database system for collecting and maintaining

a comprehensive database of Government of India

liabilities on a near real-time basis and shall be

responsible for the publication of relevant information.

Carry out Preparatory work for independent PDMA.

Conclusion

An excessive level of public debt can result in higher interest

rates, which has a crowding effect on the amount of private

investment in the economy and the rate of economic

expansion as a whole.

You might also like

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Analysis of Debt Market: Security Analysis and Portfolio ManagementDocument11 pagesAnalysis of Debt Market: Security Analysis and Portfolio ManagementSonali MalhotraNo ratings yet

- Public DebtDocument10 pagesPublic DebtPule JackobNo ratings yet

- FIMMDAIDocument8 pagesFIMMDAIVikhyat NareshNo ratings yet

- Debt MarketDocument21 pagesDebt Marketmamta jainNo ratings yet

- DMMF Cia 3-1 (1720552)Document17 pagesDMMF Cia 3-1 (1720552)Prarthana MNo ratings yet

- Bond Market in IndiaDocument4 pagesBond Market in IndiaHarsh ShahNo ratings yet

- Govt. Securities Market - 1Document46 pagesGovt. Securities Market - 1Bipul Mishra100% (1)

- FIM Topic 5Document11 pagesFIM Topic 5ANTIKANo ratings yet

- Government BondsDocument7 pagesGovernment BondsLiza kesiNo ratings yet

- Financial Economics Cia 3 Capital Market Instrument: Bond MarketDocument6 pagesFinancial Economics Cia 3 Capital Market Instrument: Bond Marketrahul baidNo ratings yet

- Q. 8 Governments BondsDocument2 pagesQ. 8 Governments BondsMAHENDRA SHIVAJI DHENAKNo ratings yet

- Seminar Presentation On::-Debt Instuments: - Structure of Intrest Rates in India: - Fixed Deposits: - Bond ValuationDocument20 pagesSeminar Presentation On::-Debt Instuments: - Structure of Intrest Rates in India: - Fixed Deposits: - Bond ValuationRavindra NimbalkarNo ratings yet

- Stock Market Training - Debt MarketDocument12 pagesStock Market Training - Debt MarketShakti ShuklaNo ratings yet

- Public Finance CH 4Document2 pagesPublic Finance CH 4Anshu Ranjan MauryaNo ratings yet

- Debt MarketDocument25 pagesDebt Marketketan dontamsettiNo ratings yet

- Financial System NoteDocument5 pagesFinancial System NoteVaibhav PriyeshNo ratings yet

- Market: Venkatasai Kiran B IBS-S-8011Document12 pagesMarket: Venkatasai Kiran B IBS-S-8011Sanket AdvilkarNo ratings yet

- Bond or Debt Market IndiaDocument12 pagesBond or Debt Market IndiaNidhi ChoudhariNo ratings yet

- 10Document8 pages10Anirudh SinglaNo ratings yet

- Public Debt in BangladeshDocument37 pagesPublic Debt in BangladeshSaifulIslamNo ratings yet

- Financial Institution and MarketsDocument57 pagesFinancial Institution and MarketsTushar GaurNo ratings yet

- Debt InstrumentsDocument14 pagesDebt InstrumentsAnubhav GoelNo ratings yet

- Public Finance Unit 3&4Document15 pagesPublic Finance Unit 3&4atifah3322No ratings yet

- Debt MarketDocument11 pagesDebt MarketPsychopheticNo ratings yet

- Debt MarketDocument7 pagesDebt Marketafnjpczuffxlk mhNo ratings yet

- Market: Venkatasai Kiran B IBS-S-8011Document12 pagesMarket: Venkatasai Kiran B IBS-S-8011BV SeshikanthNo ratings yet

- Public Borrowing and Debt ManagementDocument53 pagesPublic Borrowing and Debt Managementaige mascod100% (1)

- M.Voc Sem III - Unit II MVB 304 Investment in Government SecuritiesDocument21 pagesM.Voc Sem III - Unit II MVB 304 Investment in Government SecuritiesNehaNo ratings yet

- Components of The Indian Debt MarketDocument3 pagesComponents of The Indian Debt MarketkalaswamiNo ratings yet

- Understanding Debt MarketsDocument51 pagesUnderstanding Debt MarketsSahil KhannaNo ratings yet

- Security Analysis and Portfolio Management, Bond Market in India.Document26 pagesSecurity Analysis and Portfolio Management, Bond Market in India.Gagandeep Singh BangarNo ratings yet

- Indian Debt Market DetailedDocument75 pagesIndian Debt Market DetailedShubham BansalNo ratings yet

- Debt MarketDocument18 pagesDebt MarketShreyansh JainNo ratings yet

- Money Market InstrumentsDocument8 pagesMoney Market InstrumentsTej KumarNo ratings yet

- DEFINITION of 'Savings Account': Deposit Interest RateDocument4 pagesDEFINITION of 'Savings Account': Deposit Interest Ratemuyi kunleNo ratings yet

- Corporate Bond Market in IndiaDocument33 pagesCorporate Bond Market in Indiaarpanx9No ratings yet

- Debt Market in IndiaDocument2 pagesDebt Market in Indiarisban22No ratings yet

- Non Bank Financial Institutions (Fis) :: Finance/ Capital LeaseDocument11 pagesNon Bank Financial Institutions (Fis) :: Finance/ Capital LeaseMd. Saiful IslamNo ratings yet

- Subject EconomicsDocument13 pagesSubject EconomicsAbhirup ChakrabortyNo ratings yet

- Security Analysis and Portfolio Management: UNIT-1Document51 pagesSecurity Analysis and Portfolio Management: UNIT-1Sudha PanneerselvamNo ratings yet

- 5th & 6th Sesion - Debt IssueDocument25 pages5th & 6th Sesion - Debt IssueSuvajitLaikNo ratings yet

- Market: Venkatasai Kiran B IBS-S-8011Document12 pagesMarket: Venkatasai Kiran B IBS-S-8011kadalarasaneNo ratings yet

- Fin358 Individual Assignment (Bond)Document9 pagesFin358 Individual Assignment (Bond)nur hazaniNo ratings yet

- 2nd Assignment FinanceDocument5 pages2nd Assignment Financesunnykumar.m2325No ratings yet

- Fiscal Policy?: Important Tools Used in Monetary Policy in India?Document10 pagesFiscal Policy?: Important Tools Used in Monetary Policy in India?Nafeel TMVNo ratings yet

- Money Market and InstrumentsDocument20 pagesMoney Market and InstrumentsAyush ShrimalNo ratings yet

- Debt Funding - Indian Fund Based & Indian Non-Fund BasedDocument8 pagesDebt Funding - Indian Fund Based & Indian Non-Fund BasedSrinibashNo ratings yet

- Investment in Govt Securities - CompleteDocument5 pagesInvestment in Govt Securities - CompleteAtharva SamantNo ratings yet

- Debt Market in IndiaDocument5 pagesDebt Market in IndiaBasavaraju K R100% (1)

- Debt InstrumentsDocument5 pagesDebt InstrumentsŚáńtőśh MőkáśhíNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentSonali AggarwalNo ratings yet

- Debt MarketDocument8 pagesDebt MarketAnjan BiswasNo ratings yet

- The Indian Corporate Bond MarketDocument9 pagesThe Indian Corporate Bond MarketLegisnationsNo ratings yet

- Government BondDocument28 pagesGovernment BondLotusNuruzzamanNo ratings yet

- History and Overview of Debt MarketDocument6 pagesHistory and Overview of Debt MarketPRATIK SHETTYNo ratings yet

- Debt Market SEM 6Document6 pagesDebt Market SEM 6aaradhya pankhuriNo ratings yet

- Public DebtDocument8 pagesPublic DebtRajesh Shahi100% (2)

- 08 Chapter 01Document44 pages08 Chapter 01anwari risalathNo ratings yet

- Forex NotesDocument24 pagesForex NotesPhotos Back up 2No ratings yet

- SameeraDocument1 pageSameeraTabrez AhamadNo ratings yet

- Camella Homes - Gensan - House Models by Real Estate Agent, Debbie R. GuiangDocument15 pagesCamella Homes - Gensan - House Models by Real Estate Agent, Debbie R. GuiangDebbie Delos Reyes GuiangNo ratings yet

- Individual Car Loan Agreement SampleDocument32 pagesIndividual Car Loan Agreement Sampleey019.aaNo ratings yet

- Rescue Financing in Light of The Insolvency and Bankruptcy Code, 2016: Success, Challenges and InspirationsDocument14 pagesRescue Financing in Light of The Insolvency and Bankruptcy Code, 2016: Success, Challenges and InspirationsSHIVAM BHATTACHARYANo ratings yet

- Wa0000.Document2 pagesWa0000.Ashok GNo ratings yet

- Solved April Company Has Five Salaried Employees Your Task Is To PDFDocument1 pageSolved April Company Has Five Salaried Employees Your Task Is To PDFAnbu jaromiaNo ratings yet

- Memorandum of AgreementDocument1 pageMemorandum of AgreementKristel Alyssa MarananNo ratings yet

- Baroda Home LoanDocument31 pagesBaroda Home LoanRajkot academyNo ratings yet

- Child Gain 21 IllustrationDocument2 pagesChild Gain 21 IllustrationHarish ChandNo ratings yet

- Consumer Math Chapter 3.5Document9 pagesConsumer Math Chapter 3.5William ShevchukNo ratings yet

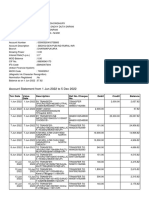

- Statement MithunDocument2 pagesStatement Mithunbiswa chakrabortyNo ratings yet

- Department of Business Administration Group Assignment On Fundamental of Accounting IDocument5 pagesDepartment of Business Administration Group Assignment On Fundamental of Accounting IMohammed HassenNo ratings yet

- Acknowledge ReceiptDocument4 pagesAcknowledge ReceiptdimenmarkNo ratings yet

- Passbookstmt 1687916025932Document4 pagesPassbookstmt 1687916025932dbreddy287No ratings yet

- Indicators of Consumer Behavior: The University of Michigan Surveys of ConsumersDocument13 pagesIndicators of Consumer Behavior: The University of Michigan Surveys of ConsumersTobias HanselNo ratings yet

- Terminal Benefit - Nilam ShahDocument24 pagesTerminal Benefit - Nilam ShahRaghava NarayanaNo ratings yet

- 1 How Much Would The Gerrards Have To Put DownDocument1 page1 How Much Would The Gerrards Have To Put Downtrilocksp SinghNo ratings yet

- Sir Eric Module 1Document10 pagesSir Eric Module 1Joshua Cedrick DicoNo ratings yet

- TDS 310317Document4 pagesTDS 310317ravibhartia1978No ratings yet

- Jan 2022Document92 pagesJan 2022Divya KarthikNo ratings yet

- Assignment - Commercial Banking System and Role of RBIDocument6 pagesAssignment - Commercial Banking System and Role of RBIShivam GoelNo ratings yet

- A Study On Financial Analysis of Punjab National BankDocument11 pagesA Study On Financial Analysis of Punjab National BankJitesh LadgeNo ratings yet

- A Clog On The Equity of RedemptDocument27 pagesA Clog On The Equity of Redemptamit dipankarNo ratings yet

- ANNUITIESDocument23 pagesANNUITIESJonalyn Bautista-CanlasNo ratings yet

- Fund Loan Form PDFDocument3 pagesFund Loan Form PDFsarge18100% (1)

- Chapter-17 Solve ClassDocument5 pagesChapter-17 Solve ClassRabina Akter JotyNo ratings yet

- AARYADocument6 pagesAARYARavindra JadhavNo ratings yet

- Course Module 5 Mathematics of InvestmentDocument22 pagesCourse Module 5 Mathematics of InvestmentAnne Maerick Jersey OteroNo ratings yet

- The Impact of Servicer Advances On Private Label RMBSDocument0 pagesThe Impact of Servicer Advances On Private Label RMBSMartin AndelmanNo ratings yet