Professional Documents

Culture Documents

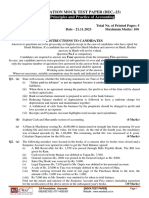

CA Foundation Accounts CHP 6A Test Series Question Paper

CA Foundation Accounts CHP 6A Test Series Question Paper

Uploaded by

oneunique.1unqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Foundation Accounts CHP 6A Test Series Question Paper

CA Foundation Accounts CHP 6A Test Series Question Paper

Uploaded by

oneunique.1unqCopyright:

Available Formats

Download Certified Copies fromwww.castudynotes.

com

CA Foundation Accounts Test Series

Chapter 6 Accounting for Special Transaction

1. Anand of Bangalore consigned to Raj of Pune, goods to be sold at invoice price which represents

125% of cost. Raj is entitled to a commission of 10% on sales at invoice price and 25% of any excess

realized over invoice price. The expenses on freight and insurance incurred by Anand were Rs 12,000.

The account sales received by Anand shows that Raj has effected sales amounting to Rs 1,20,000 in

respect of 75% of the consignment. His selling expenses to be reimbursed were Rs 9,600 10% of

consignment goods of the value of Rs 15,000 were destroyed in fire at the Pune godown and the

insurance company paid Rs 12,000 net of salvage. Raj remitted the balance in favour of Anand.

You are required to prepare Consignment Account and ·the account of Raj in the books of Anand

m

along with the necessary calculations.

co

2. A firm sends good on "Sale or Return basis. Customers have the choice of returning the goods within a

month. During May 2018, the following are the details of goods sent:

s.

te

Date (May) 2 8 12 18 20 27

o

Customers P B Q D E R

yn

Value (Rs) 17,000 22,000 25,000 5,500 2,000 28,000

d

Within the stipulated time, P and Q returned the goods and B, D and E signified that they have accepted

tu

the goods.

as

Show in the books of the firm, the Sale or Return Account and Customer Q for Sale or Return Account

.c

as on 15th June 2019.

w

3. Prepare Journal entries for the following transactions in K. Katrak’s books.

w

(i) Katrak’s acceptance to Basu for Rs 2,500 discharged by a cash payment of Rs 1,000 and a new bill

w

for the balance plus Rs 50 for interest.

(ii) G. Gupta’s acceptance for Rs 4,000 which was endorsed by Katrak to M. Mehta was dishonoured.

Mehta paid Rs 20 noting charges. Bill withdrawn against cheque.

(iii) D. Dalal retires a bill for Rs 2,000 drawn on him by Katrak for Rs 10 discount.

(iv) Katrak’s acceptance to Patel for Rs 5,000 discharged by Patel Mody’s acceptance to Katrak for a

similar amount.

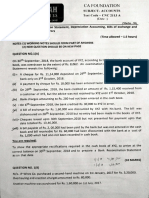

4. Mehnaaz accepted the following bills drawn by Shehnaaz.

On 8th March, 2018 Rs 4,000 for 4 months.

Download CA Foundation Subject-wise notes fromwww.castudynotes.com

Download Certified Copies fromwww.castudynotes.com

On 16th March, 2018 Rs 5,000 for 3 months.

On 7th April, 2018 Rs 6,000 for 5 months

On 17th May, 2018 Rs 5,000 for 3 months.

He wants to pay all the bills on a single day. Find out this date. Interest is charged @ 18% p.a. and

Mehnaaz wants to save Rs 157 by way of interest. Calculate the date on which he has to effect the

payment to save interest of Rs 157.

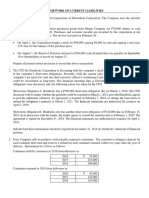

5. Ramesh has a Current Account with Partnership firm. He had a debit balance of Rs 85,000 as on 01-

07-2018. He has further deposited the following amounts:

Date Amount (Rs)

14-07-2018 1,23,000

m

18-08-2018 21,000

co

He withdrew the following amounts:

s.

te

Date Amount (Rs)

o

29-07-2018 92,000

yn

09-09-2018 11,500

d

Show Ramesh's A/c in the books of the firm. Interest is to be calculated at 10% on debit balance and 8%

tu

on credit balance. You are required to prepare current account as on 30th September, 2018 by means

as

of product of balances method.

.c

w

w

w

Download CA Foundation Subject-wise notes fromwww.castudynotes.com

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- MTP May19 QDocument4 pagesMTP May19 Qomkar sawantNo ratings yet

- Test Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingDocument4 pagesTest Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingabhimanyuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Accountancy Xi Online Exam (2) - 274Document6 pagesAccountancy Xi Online Exam (2) - 274Swami NarangNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of AccountingUmang AgrawalNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- Accounting Class-Xi Assignment 1 Chapter: 3 Theory Base of Accounting Application Based QuestionsDocument4 pagesAccounting Class-Xi Assignment 1 Chapter: 3 Theory Base of Accounting Application Based QuestionsAparna SinghalNo ratings yet

- Cnu 2112 Accounts Paper 1 - Question Paper.Document3 pagesCnu 2112 Accounts Paper 1 - Question Paper.Yash VyasNo ratings yet

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Document2 pagesAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNo ratings yet

- QP Half Yearly Accounts XiiDocument8 pagesQP Half Yearly Accounts XiiVazahat HusainNo ratings yet

- Test Aldine FinalDocument3 pagesTest Aldine FinalAkshay TulshyanNo ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- Petiton Under Rule 6 of Insolvency and Bankruptcy CodeDocument18 pagesPetiton Under Rule 6 of Insolvency and Bankruptcy CodeBHAVYANSHI DARIYA100% (1)

- CA Foundation AccountDocument7 pagesCA Foundation Accountrishab kumarNo ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Practice Sheet CH - Fundamentals (IOC & IOD)Document3 pagesPractice Sheet CH - Fundamentals (IOC & IOD)vaibhavbananiNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- K - J.K. Shah: TOPICS: Bank ReconclatlonDocument3 pagesK - J.K. Shah: TOPICS: Bank ReconclatlonJpNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Time: 55 Mins. Accountancy-Xi MM: 25Document2 pagesTime: 55 Mins. Accountancy-Xi MM: 25Sudhanshu guptaNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Unit Test 2 AccountsDocument3 pagesUnit Test 2 Accountssagar bavalekarNo ratings yet

- Accounts Test Paper From JeegyasaDocument6 pagesAccounts Test Paper From JeegyasaAnushka KunduNo ratings yet

- MB 104 Basics of Accounting and FinanceDocument3 pagesMB 104 Basics of Accounting and FinancerajeshpatnaikNo ratings yet

- FA (2010) MidtermDocument16 pagesFA (2010) MidtermRishi BiggheNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- Accountancy Sample Paper Final ImportantDocument18 pagesAccountancy Sample Paper Final ImportantChitra Vasu100% (1)

- 11th Accountancy Practice PaperDocument5 pages11th Accountancy Practice PaperPrachi RustagiNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- ImportantQuestions2Ch FundamentalsDocument4 pagesImportantQuestions2Ch Fundamentalslocaboyaj07No ratings yet

- J.K Shah Full Course Practice Question PaperDocument7 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- Receivables ExercisesDocument5 pagesReceivables ExercisesChrystelle Gail LiNo ratings yet

- 1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFDocument10 pages1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFBest ThingsNo ratings yet

- Blossom Senior Secondary School 1Document8 pagesBlossom Senior Secondary School 1raviNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- 12th BK Prelim Quesiton Paper March 2021Document8 pages12th BK Prelim Quesiton Paper March 2021Harendra PrajapatiNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- KVS Mumbai XI ACC SQP & SMS SET-II (Annual Exam) (22-23)Document23 pagesKVS Mumbai XI ACC SQP & SMS SET-II (Annual Exam) (22-23)ishitaNo ratings yet

- Sample Q P Set2 AccDocument9 pagesSample Q P Set2 AccJohn JoshyNo ratings yet

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- Acctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Document5 pagesAcctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Jaya RamirezNo ratings yet

- CA Foundation Accounts CHP 6A Test Series Model AnswerDocument6 pagesCA Foundation Accounts CHP 6A Test Series Model Answeroneunique.1unqNo ratings yet

- Accounts Chapter-Wise Test 4 (Question Paper)Document3 pagesAccounts Chapter-Wise Test 4 (Question Paper)Shweta BhadauriaNo ratings yet

- Karnataka I PUC Accountancy 2019 Model Question Paper 1Document7 pagesKarnataka I PUC Accountancy 2019 Model Question Paper 1Lokesh Rao100% (1)

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- BCK CHAP 5-1 FoundationDocument14 pagesBCK CHAP 5-1 Foundationoneunique.1unqNo ratings yet

- Indicators of The Economics Ca FoundationDocument22 pagesIndicators of The Economics Ca Foundationoneunique.1unqNo ratings yet

- GCP Services - IndiaDocument19 pagesGCP Services - Indiaoneunique.1unqNo ratings yet

- DRHP Dated September 14, 2022 - 20221221114612Document435 pagesDRHP Dated September 14, 2022 - 20221221114612oneunique.1unqNo ratings yet

- BCK Chapter 2 Handwritten NDocument8 pagesBCK Chapter 2 Handwritten Noneunique.1unqNo ratings yet

- IDIOMSDocument14 pagesIDIOMSoneunique.1unqNo ratings yet