Professional Documents

Culture Documents

3rd Stimulus

Uploaded by

Alex SpeerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3rd Stimulus

Uploaded by

Alex SpeerCopyright:

Available Formats

Third Stimulus (Economic Impact Payment) information from

www.IRS.gov/coronavirus/third-economic-impact-payment

Eligibility

Most eligible people didn't need to take additional action to get a third payment.

Generally, someone was eligible for the full amount of the third Economic Impact Payment if they:

are a U.S. citizen or U.S. resident alien (and their spouse if filing a joint return), and

are not a dependent of another taxpayer, and

had adjusted gross income (AGI) that is not more than:

o $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

o $112,500 if filing as head of household or

o $75,000 for any other filing status

Payments were phased out – or reduced – above those AGI amounts. This means people did not receive a payment if their AGI was at

least:

$160,000 if married and filing a joint return or if filing as a qualifying widow or widower

$120,000 if filing as head of household

$80,000 for any other filing status

Amount of Third Economic Impact Payment

The third Economic Impact Payment amount was:

$1,400 for an eligible individual with a valid Social Security number ($2,800 for married couples filing a joint return if both

spouses have a valid Social Security number or if one spouse has a valid Social Security number and one spouse was an

active member of the U.S. Armed Forces at any time during the taxable year)

$1,400 for each qualifying dependent with a valid Social Security number or Adoption Taxpayer Identification Number

issued by the IRS

Getting Your Payment

Most eligible individuals received their third Economic Impact Payment automatically and didn't need to take additional action. The

IRS used available information to determine your eligibility and issue the third payment to people who:

filed a 2020 tax return

filed a 2019 tax return if the 2020 tax return had not been submitted or processed yet

did not file a 2020 or 2019 tax return but registered for the first Economic Impact Payment with the Non-Filers tool in 2020

registered through the 2021 Child Tax Credit Non-filer Sign-up Tool

are federal benefit recipients who do not usually file a tax return.

If you determine that you were eligible to receive the third economic impact payment because you met the above requirements, but

you did not receive payment because it was lost, stolen, destroyed, or not received for another reason, you should request a payment

trace so the IRS can determine if your payment was cashed. If it was not, the IRS will credit your account for the payment, but they

cannot reissue payments. This will allow you to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

Do not request a payment trace to determine if you were eligible for a payment or to confirm the amount of

payment you should have received.

You might also like

- Coronavirus Economic Impact Payment FAQ 4.14.20 1Document2 pagesCoronavirus Economic Impact Payment FAQ 4.14.20 1Indiana Family to FamilyNo ratings yet

- How Did The Income Tax Start?: Irs - GovDocument6 pagesHow Did The Income Tax Start?: Irs - GovApurva BhargavaNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationJude Thomas SmithNo ratings yet

- EA LectureNotesDocument84 pagesEA LectureNotesKim Nguyen100% (1)

- Form W-10 Dependent Care Provider IdentificationDocument1 pageForm W-10 Dependent Care Provider IdentificationFlorence Smith SlusarskiNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyNo ratings yet

- Advanced Certification - Study Guide (For Tax Season 2017)Document7 pagesAdvanced Certification - Study Guide (For Tax Season 2017)Center for Economic Progress100% (4)

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- LPA120 Fees Exemptions RemissionsDocument4 pagesLPA120 Fees Exemptions RemissionssriharshamysuruNo ratings yet

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationapi-259574251No ratings yet

- California DE-4Document4 pagesCalifornia DE-4Tuğrul SarıkayaNo ratings yet

- IRS Notice 1444-DDocument2 pagesIRS Notice 1444-DCourier JournalNo ratings yet

- IL-1040 InstructionsDocument16 pagesIL-1040 InstructionsRushmoreNo ratings yet

- 2020.4 Coronavirus Stimulus Package F.A.Q. - Checks, Unemployment, Layoffs and More - The New York TimesDocument12 pages2020.4 Coronavirus Stimulus Package F.A.Q. - Checks, Unemployment, Layoffs and More - The New York TimesgioanelaNo ratings yet

- Claiming DependentsDocument9 pagesClaiming DependentschloeiskingNo ratings yet

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocument6 pages2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassNo ratings yet

- Basic Certification - Study Guide (For Tax Season 2017)Document6 pagesBasic Certification - Study Guide (For Tax Season 2017)Center for Economic ProgressNo ratings yet

- 1701 Guide Nov 2011Document1 page1701 Guide Nov 2011Cy YolipseNo ratings yet

- Request For Student's or Borrower's Taxpayer Identification Number and CertificationDocument2 pagesRequest For Student's or Borrower's Taxpayer Identification Number and Certificationcse08115No ratings yet

- Regulation 1: Individual TaxationDocument14 pagesRegulation 1: Individual TaxationFaten AlraiiNo ratings yet

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- F1040ez 2008Document2 pagesF1040ez 2008jonathandeauxNo ratings yet

- Income Tax Act - 1961: Penalties For Non-Payments of TaxesDocument3 pagesIncome Tax Act - 1961: Penalties For Non-Payments of TaxesTejas GujjarNo ratings yet

- Government Form 1310Document3 pagesGovernment Form 1310EmilyNo ratings yet

- File SE Tax for Self-Employment IncomeDocument5 pagesFile SE Tax for Self-Employment Income5sfsfdNo ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- Form IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsDocument2 pagesForm IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsMorning32No ratings yet

- IRS Form W-9Document4 pagesIRS Form W-9Gary S. Wolfe100% (1)

- Request W-9 Tax Form IdentificationDocument4 pagesRequest W-9 Tax Form IdentificationLogan BairdNo ratings yet

- W-9 FormDocument2 pagesW-9 FormTrish HitNo ratings yet

- Dwnload Full Pearsons Federal Taxation 2018 Individuals 31st Edition Rupert Solutions Manual PDFDocument36 pagesDwnload Full Pearsons Federal Taxation 2018 Individuals 31st Edition Rupert Solutions Manual PDFhone.kyanize.gnjijj100% (12)

- LG FFDocument1 pageLG FFfeem743No ratings yet

- The IRSs Dirty Dozen Tax ScamsDocument4 pagesThe IRSs Dirty Dozen Tax ScamsChelsea BorbonNo ratings yet

- Arpdf RRDocument9 pagesArpdf RRsidewalksurfer505No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationChristiney Spencer100% (1)

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- Form IL-W-4: Employee's and Other Payee's Illinois Withholding Allowance Certificate and InstructionsDocument2 pagesForm IL-W-4: Employee's and Other Payee's Illinois Withholding Allowance Certificate and InstructionsBetty WeissNo ratings yet

- W9Document4 pagesW9James-heatha GowersNo ratings yet

- Pearsons Federal Taxation 2018 Individuals 31st Edition Rupert Solutions ManualDocument25 pagesPearsons Federal Taxation 2018 Individuals 31st Edition Rupert Solutions ManualMarkHalldxaj100% (47)

- F1040es 2018Document18 pagesF1040es 2018diversified1No ratings yet

- State of MI W4PDocument2 pagesState of MI W4PAJL0% (1)

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- IRS FAQ On The Recovery Rebate CreditDocument32 pagesIRS FAQ On The Recovery Rebate CreditCurtis Heyen100% (1)

- Prentice Halls Federal Taxation 2013 Individuals 26th Edition Pope Solutions ManualDocument25 pagesPrentice Halls Federal Taxation 2013 Individuals 26th Edition Pope Solutions ManualJamesBatesypcmi100% (51)

- Resolve Tax Disputes & Get HelpDocument5 pagesResolve Tax Disputes & Get HelpgodardsfanNo ratings yet

- Prentice Halls Federal Taxation 2016 Comprehensive 29th Edition Pope Solutions ManualDocument20 pagesPrentice Halls Federal Taxation 2016 Comprehensive 29th Edition Pope Solutions Manualjuliaspenceryu3eo100% (13)

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationjntecnologiaNo ratings yet

- Instructions For Schedule 3 (Form 1040A)Document4 pagesInstructions For Schedule 3 (Form 1040A)IRSNo ratings yet

- Dwnload Full Prentice Halls Federal Taxation 2015 Individuals 28th Edition Pope Solutions Manual PDFDocument36 pagesDwnload Full Prentice Halls Federal Taxation 2015 Individuals 28th Edition Pope Solutions Manual PDFrenewerelamping1psm100% (11)

- Full Download Prentice Halls Federal Taxation 2015 Individuals 28th Edition Pope Solutions ManualDocument11 pagesFull Download Prentice Halls Federal Taxation 2015 Individuals 28th Edition Pope Solutions Manualasaberloulia0100% (22)

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Nonresident AlienagmnqDocument6 pagesNonresident AlienagmnqSchroederGormsen7No ratings yet

- f1040 PDFDocument2 pagesf1040 PDFClient FirstNo ratings yet

- Beast MorpherDocument1 pageBeast MorpherAlex SpeerNo ratings yet

- Spectral HeritorDocument3 pagesSpectral HeritorAlex SpeerNo ratings yet

- Max Fleischer's Fleischer Studios Falls from GraceDocument6 pagesMax Fleischer's Fleischer Studios Falls from GraceAlex SpeerNo ratings yet

- BAED-BFIN2121 Business Finance: Home BAED-BFIN2121-2122S Week 7: Sources of Funds I Learning Activity 002Document7 pagesBAED-BFIN2121 Business Finance: Home BAED-BFIN2121-2122S Week 7: Sources of Funds I Learning Activity 002Luisa RadaNo ratings yet

- Horgren CH 03Document29 pagesHorgren CH 03Nuke Sekuntum HariyaniNo ratings yet

- Medina Guce Galindes Salanga 2018 Barangay Governance PDFDocument16 pagesMedina Guce Galindes Salanga 2018 Barangay Governance PDFPaulojoy BuenaobraNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument59 pagesChapter 4 - Completing The Accounting CycleTâm Lê Hồ HồngNo ratings yet

- CH 17Document23 pagesCH 17SaAl-ismailNo ratings yet

- IBF301 Ch008 2020Document45 pagesIBF301 Ch008 2020Giang PhanNo ratings yet

- Annual Report: Ekuiti Nasional BerhadDocument131 pagesAnnual Report: Ekuiti Nasional BerhadFiruz Abd RahimNo ratings yet

- Nama Akun Ud Wirastri TinaDocument1 pageNama Akun Ud Wirastri Tinadwianantaputri258No ratings yet

- Tax Incentives Impact SME PerformanceDocument12 pagesTax Incentives Impact SME PerformanceJoe LagalaNo ratings yet

- PLM Business School Credit Management Module on Credit DecisionsDocument29 pagesPLM Business School Credit Management Module on Credit DecisionsHarlene BulaongNo ratings yet

- Chang Et Al 2016 Journal of Financial and Quantitative AnalysisDocument54 pagesChang Et Al 2016 Journal of Financial and Quantitative AnalysisLaila AbdallahNo ratings yet

- Endowment Fund Scholarship FormDocument2 pagesEndowment Fund Scholarship FormPäťhäň ŘājāNo ratings yet

- Beechy 7e Tif Ch09Document20 pagesBeechy 7e Tif Ch09mashta04No ratings yet

- Working Capital Management in HCL Infosystems Limited DeepakDocument74 pagesWorking Capital Management in HCL Infosystems Limited DeepakDeepak BhatiaNo ratings yet

- 1 9th Social Sura Guide 2019 2020 Sample Materials Tamil MediumDocument101 pages1 9th Social Sura Guide 2019 2020 Sample Materials Tamil Mediumn.ananthapadmanabhanNo ratings yet

- OFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisDocument34 pagesOFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisThanhdat VoNo ratings yet

- Compare Financial Ratios of 3 Top BanksDocument89 pagesCompare Financial Ratios of 3 Top BanksSami ZamaNo ratings yet

- ECON 358 Assignment 1 (version B) AnalysisDocument6 pagesECON 358 Assignment 1 (version B) AnalysishannahNo ratings yet

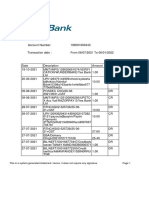

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument5 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signaturegaming boyNo ratings yet

- Umali Vs CADocument2 pagesUmali Vs CAMekiNo ratings yet

- Accounting Cycle & Financial Statements ExplainedDocument3 pagesAccounting Cycle & Financial Statements ExplainedMohiuddin GaalibNo ratings yet

- Financial Analysis Tools and Techniques GuideDocument22 pagesFinancial Analysis Tools and Techniques GuideCamille G.No ratings yet

- Money Collocations: Match The Collocation With The Correct DefinitionDocument3 pagesMoney Collocations: Match The Collocation With The Correct DefinitionMamadou KaNo ratings yet

- GW Law Faculty Analyzes Holder in Due Course DoctrineDocument41 pagesGW Law Faculty Analyzes Holder in Due Course DoctrineRussel SirotNo ratings yet

- Form details for loan applicationDocument12 pagesForm details for loan applicationmanammadhuNo ratings yet

- Candlestick Patterns PDF Free Guide DownloadDocument11 pagesCandlestick Patterns PDF Free Guide DownloadGreg Mavhunga88% (8)

- Account Statement From 1 Nov 2020 To 9 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Nov 2020 To 9 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancevinod reddyNo ratings yet

- Cash ManagementDocument3 pagesCash ManagementPoorna Chandra GaralapatiNo ratings yet

- Financial Management HomeworkDocument33 pagesFinancial Management HomeworkShielaNo ratings yet

- Choosing Between Entrepreneurship and EmploymentDocument9 pagesChoosing Between Entrepreneurship and EmploymentMa Melissa Nacario SanPedroNo ratings yet