Professional Documents

Culture Documents

Digest Dison v. Posadas, JR

Uploaded by

Alelie MalazarteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Digest Dison v. Posadas, JR

Uploaded by

Alelie MalazarteCopyright:

Available Formats

LUIS W.

DISON, plaintiff-appellant,

vs.

JUAN POSADAS, JR., Collector of Internal Revenue, defendant-appellant.

G.R. No. L-36770

November 4, 1932

Facts:

This case arose from the case filed by plaintiff Luis Dison against defendant Collector of

Internal Revenue for the recovery of an inheritance tax in the sum of P2,808.73 which was paid

under protest. Dison alleged that the tax is illegal because he received the property, which is the

basis of the tax, from his father before his death by a deed of gift inter vivos which was duly

accepted and registered before the death of his father. On the other hand, the defendant answered

with a general denial and with a counterdemand for the sum of P1,245.56 which it was alleged is

a balance still due and unpaid on account of said tax.

On April 9, 1928, Felix Dison transferred 22 tracts of land to his son, plaintiff Luis Dison

by virtue of the Deed of Gift. However, the donor reserved for his life the usufruct of three tracts.

Said deed was acknowledged by the donor before a notary public on April 16, 1928. Luis Dison,

on April 17, 1928, formally accepted said gift by an instrument in writing which he

acknowledged before a notary public on April 20, 1928. The following day, Felix Dison died.

Plaintiff alleged that he received and holds the subject property by a consummated gift and that

Act No. 2601 being the inheritance tax statute, does not tax gifts. In addition, appellant contends

that he is not an heir of his deceased father within the meaning of Section 1540 of the

Administrative Code because his father in his lifetime had given the appellant all his property

and left no property to be inherited.

Issue:

Does section 1540 of the Administrative Code subject the plaintiff-appellant to the

payment of an inheritance tax?

Ruling:

Yes. The Court ruled that the expression in Section 1540 “any of those who, after his

death, shall prove to be his heirs,” includes those who, by our law, are given the status and rights

of heirs, regardless of the quantity of property they may receive as such heirs. That the appellant

in this case occupies the status of heir to his deceased father cannot be questioned. Construing

the conveyance here in question, under the facts presented, as an advance made by Felix Dison to

his only child, the Court held that Section 1540 to be applicable and the tax to have been

properly assessed by the Collector of Internal Revenue. Neither the title of Act No. 2601 nor

chapter 40 of the Administrative Code makes any reference to a tax on gifts. Perhaps it is enough

to say of this contention that section 1540 plainly does not tax gifts per se but only when those

gifts are made to those who shall prove to be the heirs, devisees, legatees or donees mortis

causa of the donor.

When the law says all gifts, it doubtless refers to gifts inter vivos, and not mortis causa.

Both the letter and the spirit of the law leave no room for any other interpretation. Such, clearly,

is the tenor of the language which refers to donations that took effect before the donor’s death,

and not to mortis causa donations, which can only be made with the formalities of a will, and

can only take effect after the donor's death. Any other construction would virtually change this

provision into: The law (Section 1540) presumes that such gifts have been made in anticipation

of inheritance, devise, bequest, or gift mortis causa, when the donee, after the death of the donor

proves to be his heir, devisee or donee mortis causa, for the purpose of evading the tax, and it is

to prevent this that it provides that they shall be added to the resulting amount.

You might also like

- Tax Cases 1 To 13Document23 pagesTax Cases 1 To 13Gracey Sagario Dela TorreNo ratings yet

- Another Night at Darryl's - Eb MajorDocument9 pagesAnother Night at Darryl's - Eb Majorsarahhubbard2004No ratings yet

- TAX 2 Case Digest MidtermsDocument80 pagesTAX 2 Case Digest MidtermsPaolo OlleroNo ratings yet

- Dison V PosadasDocument2 pagesDison V PosadasAlyanna ChangNo ratings yet

- Taxation CasesDocument22 pagesTaxation CasesGhadahNo ratings yet

- Domestic Violence Lease TerminationDocument2 pagesDomestic Violence Lease TerminationJeremy PageNo ratings yet

- Property Case AssignmentsDocument103 pagesProperty Case AssignmentsGoody DulayNo ratings yet

- Digested Cases Pablo Lorenzo, Vs PosadasDocument4 pagesDigested Cases Pablo Lorenzo, Vs Posadasm_ramas2001No ratings yet

- 05 - Dison vs. PosadasDocument2 pages05 - Dison vs. Posadascool_peach100% (1)

- Tax 2 Case Digest - Estate Tax & Donors TaxDocument15 pagesTax 2 Case Digest - Estate Tax & Donors TaxPaul Mariano100% (1)

- RocesvPosadas RODRIGUEZDocument1 pageRocesvPosadas RODRIGUEZPau SaulNo ratings yet

- Sample of Cancellation of Real Estate MortgageDocument1 pageSample of Cancellation of Real Estate MortgageJacques Honrales100% (1)

- Cir Vs FisherDocument2 pagesCir Vs FisherJesimiel CarlosNo ratings yet

- Ledesma Vs McLachlinDocument2 pagesLedesma Vs McLachlinChelle BelenzoNo ratings yet

- Case: Action To Recover From The Defendant, Collector of Internal Revenue, Certain Sums of Money PaidDocument6 pagesCase: Action To Recover From The Defendant, Collector of Internal Revenue, Certain Sums of Money PaidJulian DubaNo ratings yet

- Sea ShadowDocument7 pagesSea ShadowIlia BystrovNo ratings yet

- Roces v. Posadas (58 Phil 108)Document1 pageRoces v. Posadas (58 Phil 108)Julie Anne CäñoNo ratings yet

- Extrajudicial Settlement of Estate Template 2Document4 pagesExtrajudicial Settlement of Estate Template 2bro smartNo ratings yet

- Dizon Vs Posadas JRDocument1 pageDizon Vs Posadas JRArahbells100% (1)

- Tax Case DigestDocument4 pagesTax Case DigestRuby Reyes100% (1)

- Estate Taxation - Compiled DigestsDocument33 pagesEstate Taxation - Compiled Digestsmarydalem100% (1)

- Legal Forms - Chattel MortgageDocument2 pagesLegal Forms - Chattel MortgageMitz FranciscoNo ratings yet

- Donor'S Tax Compilation of Case DigestDocument8 pagesDonor'S Tax Compilation of Case DigestmarydalemNo ratings yet

- Acebedo v. Abesamis (G.R. No. 102380, January 18, 1993)Document2 pagesAcebedo v. Abesamis (G.R. No. 102380, January 18, 1993)Lorie Jean UdarbeNo ratings yet

- G.R. No. L-36770 November 4, 1932 LUIS W. DISON, Plaintiff-Appellant, JUAN POSADAS, JR., Collector of Internal Revenue, Defendant-AppellantDocument21 pagesG.R. No. L-36770 November 4, 1932 LUIS W. DISON, Plaintiff-Appellant, JUAN POSADAS, JR., Collector of Internal Revenue, Defendant-AppellantmnyngNo ratings yet

- Dison-vs.-Posadas PDFDocument5 pagesDison-vs.-Posadas PDFChristle CorpuzNo ratings yet

- Marcelino Aguas For Plaintiff-Appellant. Attorney-General Jaranilla For Defendant-AppellantDocument4 pagesMarcelino Aguas For Plaintiff-Appellant. Attorney-General Jaranilla For Defendant-AppellantNeil BorjaNo ratings yet

- Dizon Vs PosadasDocument3 pagesDizon Vs PosadasJamel torresNo ratings yet

- Marcelino Aguas For Plaintiff-Appellant. Attorney-General Jaranilla For Defendant-AppellantDocument3 pagesMarcelino Aguas For Plaintiff-Appellant. Attorney-General Jaranilla For Defendant-AppellantRomeo Boy-ag Jr.No ratings yet

- Dison v. Posadas FactsDocument1 pageDison v. Posadas FactsHenri VasquezNo ratings yet

- Tax Cases Estate TaxDocument6 pagesTax Cases Estate TaxKristine Jay Perez-CabusogNo ratings yet

- Dison v. PosadasDocument1 pageDison v. PosadasGela Bea BarriosNo ratings yet

- Donor's Tax Case DigestsDocument7 pagesDonor's Tax Case DigestsEllaine Marie MendozaNo ratings yet

- Digest Roces v. Posadas, JRDocument2 pagesDigest Roces v. Posadas, JRAlelie MalazarteNo ratings yet

- Tax DigestsDocument1 pageTax DigestsJulia San JoseNo ratings yet

- Henderson Supplee, Jr. v. Francis R. Smith, Collector of Internal Revenue For The First District of Pennsylvania, 242 F.2d 855, 1st Cir. (1957)Document7 pagesHenderson Supplee, Jr. v. Francis R. Smith, Collector of Internal Revenue For The First District of Pennsylvania, 242 F.2d 855, 1st Cir. (1957)Scribd Government DocsNo ratings yet

- Tax 2Document19 pagesTax 2Lucifer MorningstarNo ratings yet

- Tax 1st Set DigestDocument4 pagesTax 1st Set DigestDiane Dee YaneeNo ratings yet

- Plaintiffs-Appellants Vs Vs Defendant-Appellee Feria & La O, Attorney-General JaranillaDocument5 pagesPlaintiffs-Appellants Vs Vs Defendant-Appellee Feria & La O, Attorney-General Jaranillajillian margaux royNo ratings yet

- 158-Lorenzo v. Posadas, JR., 64 Phil. 353Document9 pages158-Lorenzo v. Posadas, JR., 64 Phil. 353Jopan SJNo ratings yet

- Donors Tax ModuleDocument13 pagesDonors Tax ModuleRovi Anne IgoyNo ratings yet

- Donors Tax ModuleDocument13 pagesDonors Tax ModuleRovi IgoyNo ratings yet

- Vidal-de-Roces-vs.-PosadasDocument9 pagesVidal-de-Roces-vs.-PosadasChristle CorpuzNo ratings yet

- Tax DigestsDocument4 pagesTax DigestsRianna VelezNo ratings yet

- Lorenzo Ona V CIRDocument20 pagesLorenzo Ona V CIRChatNo ratings yet

- Main Pleading - Issue 3Document2 pagesMain Pleading - Issue 3Priscilla DawnNo ratings yet

- LUTZ v. ARANETA 98 PHIL. 145 December 22, 1955 (Case Digest)Document8 pagesLUTZ v. ARANETA 98 PHIL. 145 December 22, 1955 (Case Digest)sonskiNo ratings yet

- 01 - Lorenzo V PosadasDocument21 pages01 - Lorenzo V PosadasRaymond ChengNo ratings yet

- 14 Oña v. CIR, G.R. No. L-19342, May 25, 1972Document11 pages14 Oña v. CIR, G.R. No. L-19342, May 25, 1972JenNo ratings yet

- Tax2 #1Document9 pagesTax2 #1Tey TorrenteNo ratings yet

- De Roses Vs PosadasDocument4 pagesDe Roses Vs PosadasGoodyNo ratings yet

- Tax Cases: The Revised OneDocument16 pagesTax Cases: The Revised OneDaniel Danjur DagumanNo ratings yet

- Vidal de Roces Vs PosadasDocument2 pagesVidal de Roces Vs Posadasjames lebronNo ratings yet

- G.R. No. L-43082 Lorenzo V Posadas 64 Phil 353Document7 pagesG.R. No. L-43082 Lorenzo V Posadas 64 Phil 353Shereen AlobinayNo ratings yet

- 1-Lorenzo Vs PosadasDocument9 pages1-Lorenzo Vs PosadasNimpa PichayNo ratings yet

- Posadas CaseDocument10 pagesPosadas CaseIrene QuimsonNo ratings yet

- Pablo Lorenzo and Delfin Joven For Plaintiff-Appellant. Office of The Solicitor-General Hilado For Defendant-AppellantDocument15 pagesPablo Lorenzo and Delfin Joven For Plaintiff-Appellant. Office of The Solicitor-General Hilado For Defendant-AppellantattycpajfccNo ratings yet

- Vidal de Roces Vs PosadasDocument3 pagesVidal de Roces Vs PosadasAnonymous oO1cYvNo ratings yet

- Donor and Estate TaxDocument4 pagesDonor and Estate TaxAnneNo ratings yet

- GOVERNMENT-vs.-PAMINTUANDocument2 pagesGOVERNMENT-vs.-PAMINTUANChristle CorpuzNo ratings yet

- Rosenthal v. Commissioner of Internal Revenue, 205 F.2d 505, 2d Cir. (1953)Document10 pagesRosenthal v. Commissioner of Internal Revenue, 205 F.2d 505, 2d Cir. (1953)Scribd Government DocsNo ratings yet

- Falk v. Commissioner of Internal Revenue, 189 F.2d 806, 3rd Cir. (1951)Document7 pagesFalk v. Commissioner of Internal Revenue, 189 F.2d 806, 3rd Cir. (1951)Scribd Government DocsNo ratings yet

- Angeles Vs CIRDocument4 pagesAngeles Vs CIRGoodyNo ratings yet

- Post Capitulation Trinidad (1797–1947): Aspects of the Laws, the Judicial System, and the GovernmentFrom EverandPost Capitulation Trinidad (1797–1947): Aspects of the Laws, the Judicial System, and the GovernmentNo ratings yet

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet

- LOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSFrom EverandLOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSNo ratings yet

- Rent Agreement-Mayur Vihar J Ph-3 - 81A POCKET 6 MAYUR VIHAR PHASE - 3Document6 pagesRent Agreement-Mayur Vihar J Ph-3 - 81A POCKET 6 MAYUR VIHAR PHASE - 3Satveer kashyapNo ratings yet

- Application For Development Permission PDFDocument2 pagesApplication For Development Permission PDFKOKORANo ratings yet

- Possession: 1) MeaningDocument6 pagesPossession: 1) MeaningHyder KhanNo ratings yet

- Third World Quarterly Jun 2000 21, 3 Research LibraryDocument24 pagesThird World Quarterly Jun 2000 21, 3 Research LibraryFlorinNo ratings yet

- 1535 1549Document25 pages1535 1549PhilipBrentMorales-MartirezCariagaNo ratings yet

- Republic Act No. 4726Document8 pagesRepublic Act No. 4726Remer JalbunaNo ratings yet

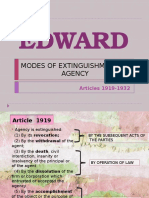

- Extinguishment of AgencyDocument75 pagesExtinguishment of AgencyNol Danics67% (3)

- CEA - Sample Exam QuestionsDocument7 pagesCEA - Sample Exam QuestionsADRES CUSTCARENo ratings yet

- STD-771-117 Principles For A60 Pipe Penetrations Below M.deckDocument1 pageSTD-771-117 Principles For A60 Pipe Penetrations Below M.deckAurinho92No ratings yet

- Shumus al-anwar wa-kunuz al-asrar, Ibn al-Ḥajj al-Kabir, Muḥammad pdf - كتاب شمس الأنوار وكنوز الأسرار لابن الحاج الكبير التلسمانيDocument213 pagesShumus al-anwar wa-kunuz al-asrar, Ibn al-Ḥajj al-Kabir, Muḥammad pdf - كتاب شمس الأنوار وكنوز الأسرار لابن الحاج الكبير التلسمانيwajd.ishqairNo ratings yet

- 2048 0203 0622 PDFDocument3 pages2048 0203 0622 PDFPARAMESHA ANo ratings yet

- J.& R.Mac (Machine Tools) Limited: Annual Accounts Provided by Level Business ForDocument7 pagesJ.& R.Mac (Machine Tools) Limited: Annual Accounts Provided by Level Business ForLevel BusinessNo ratings yet

- Deed of Exchange Draft DeedDocument4 pagesDeed of Exchange Draft DeedReubenPhilip50% (4)

- Application FormDocument1 pageApplication FormjvenatorNo ratings yet

- Encumbrances of TCT No. 043-2013007816)Document2 pagesEncumbrances of TCT No. 043-2013007816)Reya ErychNo ratings yet

- Batavia Tax AssesmentsDocument285 pagesBatavia Tax AssesmentscherylwaityNo ratings yet

- Gmada DocumentDocument6 pagesGmada DocumentVikram SinghNo ratings yet

- MCIAA Vs Heirs of Gavina Ijordan, Et AlDocument2 pagesMCIAA Vs Heirs of Gavina Ijordan, Et AlStephanie ArtagameNo ratings yet

- Fraudulent TransferDocument3 pagesFraudulent Transfergot itNo ratings yet

- Usa Sale DeedDocument8 pagesUsa Sale DeedSantosh DasNo ratings yet

- PressRelease November 2017Document9 pagesPressRelease November 2017Jeff Morris100% (1)

- Property Nelson Spring 05Document101 pagesProperty Nelson Spring 05Thomas JeffersonNo ratings yet