Professional Documents

Culture Documents

DateExtension Summer 2021 09-09-2021

Uploaded by

Grishma Bhindora0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

4539222_DateExtension Summer 2021 09-09-2021

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesDateExtension Summer 2021 09-09-2021

Uploaded by

Grishma BhindoraCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

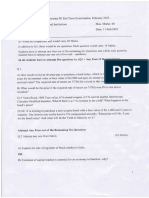

Seat No.: ________ Enrolment No.

___________

GUJARAT TECHNOLOGICAL UNIVERSITY

MBA – SEMESTER 3 – EXAMINATION – SUMMER 2021

Subject Code: 4539222 Date:09/09/2021

Subject Name: Financial Derivatives (FD)

Time: 02.30 PM TO 05.30 PM Total Marks: 70

Instructions:

1. Attempt all questions.

2. Make suitable assumptions wherever necessary.

3. Figures to the right indicate full marks.

Q.1 Explain the following terms : 14

a Spread

b Combinations

c Risk free security

d Options

e Swaps

f Forward

g Derivatives

Q.2 A Differentiate between Forward Contracts and Futures Contracts. 7

B Explain the concepts of upside risks and downside risks. 7

OR

B Write short-note on Greeks in Options. 7

Q.3 A R Co. has a market price of Rs.990. The volatility on the share is 0.34, the risk free interest 7

rate is 6%. What would be the price of the call with a strike price of Rs.980, if the expiry

date were 22 days ahead? Assumption is that there has not been any dividend

announcement

B Write the difference between Futures contract and options contract. 7

OR

Q.3 A A 10 month forward contract on a stock with a price of Rs.50. We assume that the risk free 7

rate of interest (continuously compounded) is 8 % p.a. for all maturities. We also assume

the dividends of Rs.0.75 per share are expected after 3 months, 6 months and 9 months.

What is the price of forward today?

B Write the difference between Spot/cash market and Derivative market. 7

Q.4 A Write a note on the types of orders. 7

B Write a note on Cost-of-Carry Model. 7

OR

Q.4 A Write a note on the participants in the Derivatives market. 7

B Share X is currently available at Rs.100. The risk free rate of interest is 8% p.a. 7

compounded continuously. What should be the ideal contract price of one month futures

contract?

Q.5 Assume that an importer in India is importing goods from Australia for AUD 500000 and 14

that this payment will have to be made one month later. The current exchange rate is AUD

1 = INR 25. The exchange rate after one month is not known, and the importer would like

to know the amount in Indian rupees they need to pay when the payment of AUD 5,00,000

is due one month hence. They decide to enter a forward contract to buy AUD in one month.

Suppose that the interest rate in India and Australia is 12% and 6% respectively.

1. What would be the forward rate?

2. If the actual forward rate is AUD 1 = INR 24.95, what is the arbitrage profit?

OR

Q.5 On 1st September, Ashok Leyland shares are selling at Rs.40.35. Ashok Leyland futures 14

have a contract size of 9,550. The September futures expiring on September 28th are priced

at Rs.41.25 and the October futures expiring on October 26 are priced at Rs.41.54. The

initial margin requirement is 5 % of the contract value. On September 28, the shares are

selling at Rs.41.83.

1. If you buy one September contract, what is the value of the contract?

2. How much money do you need to post as the margin?

3. What would be the amount of cash settlement for a September contract?

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Chapter 1 - Solution PDFDocument6 pagesChapter 1 - Solution PDFEllaine100% (8)

- ICAEW - Accounting 2020 - Chap 4Document78 pagesICAEW - Accounting 2020 - Chap 4TRIEN DINH TIENNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityCA Kiran KhatriNo ratings yet

- Summer 2019 (06-05-2019)Document2 pagesSummer 2019 (06-05-2019)Grishma BhindoraNo ratings yet

- 2840202Document4 pages2840202lathigara jayNo ratings yet

- Old Paper 2597121Document2 pagesOld Paper 2597121IlyasNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversitysuchipatelNo ratings yet

- GTU MBA Semester IV Risk Management Exam QuestionsDocument3 pagesGTU MBA Semester IV Risk Management Exam QuestionsPILLO PATELNo ratings yet

- Summer 2021 19-08-2021Document2 pagesSummer 2021 19-08-2021Grishma BhindoraNo ratings yet

- Winter 2021 23-02-2022Document2 pagesWinter 2021 23-02-2022Grishma BhindoraNo ratings yet

- 4203 (Previous Year Questions)Document7 pages4203 (Previous Year Questions)Tanjid MahadyNo ratings yet

- 2019 ZaDocument5 pages2019 ZaChandani FernandoNo ratings yet

- TYBMS SEM5 CDM NOV18ccDocument3 pagesTYBMS SEM5 CDM NOV18ccteyim37538No ratings yet

- Portfolio Management and Invesrment AnalysisDocument3 pagesPortfolio Management and Invesrment AnalysisGyan PokhrelNo ratings yet

- (WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 4Document6 pages(WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 4Sachin BarthwalNo ratings yet

- Financial Derivatives in Diff ProspectDocument7 pagesFinancial Derivatives in Diff ProspectNishantNo ratings yet

- Question Paper: Bms College of EngineeringDocument2 pagesQuestion Paper: Bms College of EngineeringShivaNo ratings yet

- Mba 3 Sem Security Analysis and Portfolio Management 2830203 Summer 2019Document3 pagesMba 3 Sem Security Analysis and Portfolio Management 2830203 Summer 2019It's AnimeboyNo ratings yet

- IFDocument2 pagesIFAshok ShahNo ratings yet

- Mba 4 Sem Risk Management 840203 Summer 2014Document2 pagesMba 4 Sem Risk Management 840203 Summer 2014Hansa PrajapatiNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversitySaR aSNo ratings yet

- End Semester Exams June 2020 Investment Portfolio AnalysisDocument5 pagesEnd Semester Exams June 2020 Investment Portfolio AnalysisRaissa KoffiNo ratings yet

- FIN 425 Global Financial Risk Management - Sample Exam IDocument3 pagesFIN 425 Global Financial Risk Management - Sample Exam IIbrahim KhatatbehNo ratings yet

- Test 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTDocument6 pagesTest 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTprakhar rawatNo ratings yet

- 03 Task Performance 1Document2 pages03 Task Performance 1Janne AclanNo ratings yet

- FRM QuestionsDocument126 pagesFRM QuestionsanaraNo ratings yet

- Mba Summer 2022Document2 pagesMba Summer 2022Prince KotadiyaNo ratings yet

- Test 1 Maf653 Oct2017 QnADocument7 pagesTest 1 Maf653 Oct2017 QnAFakhrul Haziq Md FarisNo ratings yet

- End Term QuestionDocument3 pagesEnd Term QuestionArjun MahatNo ratings yet

- Chapter 2Document2 pagesChapter 211.15. Hoàng Nguyễn Thanh HươngNo ratings yet

- ProblemsDocument6 pagesProblemsPradeep BulleNo ratings yet

- SESSION 4 Practice ExerciseDocument2 pagesSESSION 4 Practice Exercisevaibhav chaurasiaNo ratings yet

- FD Sem 3Document2 pagesFD Sem 3AAKIB HAMDANINo ratings yet

- Chapter 2 - AFM - UEH - F2023 - ExercicesDocument3 pagesChapter 2 - AFM - UEH - F2023 - Exercicestoantran.31211025392No ratings yet

- Assignment 5 2020Document5 pagesAssignment 5 2020林昀妤No ratings yet

- V1 - 20140410 FRM-2 - Questions PDFDocument30 pagesV1 - 20140410 FRM-2 - Questions PDFIon VasileNo ratings yet

- Forwards and FuturesDocument5 pagesForwards and FuturesChirag LaxmanNo ratings yet

- GTU MBA Semester IV Banking and Insurance Exam QuestionsDocument1 pageGTU MBA Semester IV Banking and Insurance Exam QuestionsHansa PrajapatiNo ratings yet

- Institute of Rural Management AnandDocument2 pagesInstitute of Rural Management AnandDharampreet SinghNo ratings yet

- GTU-MBA-4549221-SUMMER-2023Document2 pagesGTU-MBA-4549221-SUMMER-2023suvagiyaamisha16No ratings yet

- Derivatives Code515ADocument3 pagesDerivatives Code515AparoothiNo ratings yet

- MAF653 TEST 1 NOV 2022 QuestionDocument11 pagesMAF653 TEST 1 NOV 2022 QuestionAyunieazahaNo ratings yet

- Exam MFE/3F Questions Chapter 2 - Comparing OptionsDocument11 pagesExam MFE/3F Questions Chapter 2 - Comparing OptionsEduardo AcevesNo ratings yet

- FRM Practice QuestionsDocument4 pagesFRM Practice Questionsshubendu ghoshNo ratings yet

- BBMF2023 PRINCIPLE OF INVESTMENT INTRODUCTIONDocument9 pagesBBMF2023 PRINCIPLE OF INVESTMENT INTRODUCTIONKÃLÅÏ SMÎLĒYNo ratings yet

- Financial Derivatives - Prof. Vandana BhamaDocument3 pagesFinancial Derivatives - Prof. Vandana BhamakaranNo ratings yet

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocument3 pagesCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksGyan PokhrelNo ratings yet

- AL Financial Management Nov Dec 2016Document4 pagesAL Financial Management Nov Dec 2016hyp siinNo ratings yet

- Investments Exercise 12Document4 pagesInvestments Exercise 12Vilhelm CarlssonNo ratings yet

- Project A Project B Project C Project D Expected NPV (RS.) 60,000 80,000 70,000 90,000 Standard Deviation (RS.) 4,000 10,000 12,000 14,000Document11 pagesProject A Project B Project C Project D Expected NPV (RS.) 60,000 80,000 70,000 90,000 Standard Deviation (RS.) 4,000 10,000 12,000 14,000Hari BabuNo ratings yet

- 1 RiskManagement QpaperDocument2 pages1 RiskManagement QpaperBhavish VohraNo ratings yet

- MFIN6003 AssignmentsDocument4 pagesMFIN6003 AssignmentscccNo ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- Ca Final SFM Test Paper QuestionDocument8 pagesCa Final SFM Test Paper Question1620tanyaNo ratings yet

- Financial Markets & Institutions Feb.23Document2 pagesFinancial Markets & Institutions Feb.23pratik9365No ratings yet

- Workbook - Investment Management - Module 4: Particulars Bond A Bond BDocument2 pagesWorkbook - Investment Management - Module 4: Particulars Bond A Bond BManjunath RameshNo ratings yet

- ACFI813 May 2023 Exam FinalDocument5 pagesACFI813 May 2023 Exam FinalEmin SalmanovNo ratings yet

- De So 3Document2 pagesDe So 3Nguyễn PhươngNo ratings yet

- Uestions: Bond ValuationDocument8 pagesUestions: Bond Valuationसम्राट सुबेदीNo ratings yet

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- Competitive Advantage in Investing: Building Winning Professional PortfoliosFrom EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityGrishma BhindoraNo ratings yet

- Dec 2013 2810007Document4 pagesDec 2013 2810007Grishma BhindoraNo ratings yet

- 09-05-2019 (Summer 2019)Document3 pages09-05-2019 (Summer 2019)Grishma BhindoraNo ratings yet

- Physical and Inorganic ChemistryDocument2 pagesPhysical and Inorganic Chemistryvashu patelNo ratings yet

- IMP Ques All SubjectsDocument14 pagesIMP Ques All SubjectsGrishma BhindoraNo ratings yet

- Physical and Inorganic ChemistryDocument2 pagesPhysical and Inorganic Chemistryvashu patelNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityGrishma BhindoraNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityGrishma BhindoraNo ratings yet

- 31-12-2018 (Winter 2018)Document2 pages31-12-2018 (Winter 2018)Grishma BhindoraNo ratings yet

- Winter 2021 2840003Document3 pagesWinter 2021 2840003Grishma BhindoraNo ratings yet

- Analyzing Hospital Data and Improving Decision MakingDocument3 pagesAnalyzing Hospital Data and Improving Decision MakingGrishma BhindoraNo ratings yet

- Winter 2017 2840003Document4 pagesWinter 2017 2840003Grishma BhindoraNo ratings yet

- Winter 2020 3549201Document2 pagesWinter 2020 3549201Grishma BhindoraNo ratings yet

- Winter 2020 2840003Document2 pagesWinter 2020 2840003Grishma BhindoraNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityGrishma BhindoraNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityGrishma BhindoraNo ratings yet

- Memorandum FormatsDocument5 pagesMemorandum FormatsprabhanshiNo ratings yet

- Effective CommunicationDocument2 pagesEffective CommunicationGrishma BhindoraNo ratings yet

- DCS Module 4Document26 pagesDCS Module 4Grishma BhindoraNo ratings yet

- Case Study 1Document6 pagesCase Study 1Grishma BhindoraNo ratings yet

- Gujarat Technological University: Mba - Semester 04 - Examination - Summer 2017Document4 pagesGujarat Technological University: Mba - Semester 04 - Examination - Summer 2017Grishma BhindoraNo ratings yet

- VVV Sample Analytical ReportvvvDocument9 pagesVVV Sample Analytical ReportvvvGrishma BhindoraNo ratings yet

- Choosing Communication FormDocument1 pageChoosing Communication FormGrishma BhindoraNo ratings yet

- DCS Module 3Document45 pagesDCS Module 3Grishma BhindoraNo ratings yet

- Stock Shares Price ($) Market Value of AssetsDocument34 pagesStock Shares Price ($) Market Value of AssetsRADHIKA BANSALNo ratings yet

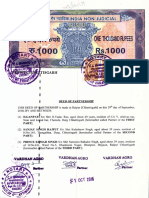

- Coins of India, Pakistan, Nepal & Bhutan: From Ancient Times To The PresentDocument10 pagesCoins of India, Pakistan, Nepal & Bhutan: From Ancient Times To The Presentraja000ramNo ratings yet

- ICICIdirect DividendYieldStocks May2011Document2 pagesICICIdirect DividendYieldStocks May2011maitre6669No ratings yet

- Chapter 005 PMDocument5 pagesChapter 005 PMHayelom Tadesse GebreNo ratings yet

- Chapter 6 Applications of Macroeconomics Theory As A Basis For Understanding The Key Economic Variables Affecting The BusinessDocument52 pagesChapter 6 Applications of Macroeconomics Theory As A Basis For Understanding The Key Economic Variables Affecting The Businessaladdin oidacraNo ratings yet

- Agro Company Loan Approval DocumentDocument5 pagesAgro Company Loan Approval DocumentgtyhNo ratings yet

- Dealroom Embedded Finance v2Document32 pagesDealroom Embedded Finance v2Sushma KazaNo ratings yet

- Financial InclusionDocument425 pagesFinancial InclusionNishad ThakurNo ratings yet

- Cambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtDocument4 pagesCambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtShannen LyeNo ratings yet

- Garfield (1) VAT Tax QuestionDocument2 pagesGarfield (1) VAT Tax QuestionSerena JainarainNo ratings yet

- What Is A Financial System How Does An International Financial System WorkDocument6 pagesWhat Is A Financial System How Does An International Financial System WorkSamar MalikNo ratings yet

- Questions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectDocument6 pagesQuestions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectddNo ratings yet

- Karnataka Bank 5326520315Document101 pagesKarnataka Bank 5326520315eepNo ratings yet

- MHBAN00448330000412942 NewDocument7 pagesMHBAN00448330000412942 NewRajan DeepNo ratings yet

- Report On Marvel's Restructuring Dilemma: Financial ManagementDocument19 pagesReport On Marvel's Restructuring Dilemma: Financial Managementebi ayatNo ratings yet

- Module 4 ECON AnnuityDocument11 pagesModule 4 ECON AnnuityMIKE ARTHUR DAVIDNo ratings yet

- RBI Circular On EPBG April 6 2015Document4 pagesRBI Circular On EPBG April 6 2015Sachin JainNo ratings yet

- Export MarketingDocument10 pagesExport MarketingPradeepNo ratings yet

- Example of Muet WritingDocument6 pagesExample of Muet WritingZulhelmie ZakiNo ratings yet

- Full Download Ebook Ebook PDF Macroeconomics Australia in The Global Environment 2nd Edition PDFDocument42 pagesFull Download Ebook Ebook PDF Macroeconomics Australia in The Global Environment 2nd Edition PDFshiela.martinez137100% (47)

- NOTES On CAPITAL BUDGETING PVFV Table - Irr Only For Constant Cash FlowsDocument3 pagesNOTES On CAPITAL BUDGETING PVFV Table - Irr Only For Constant Cash FlowsHussien NizaNo ratings yet

- Commercial Transactions and Finance ExplainedDocument5 pagesCommercial Transactions and Finance ExplainedKaran UpadhyayNo ratings yet

- Islamic Banking Vs Conventional BankingDocument17 pagesIslamic Banking Vs Conventional BankingFarrukh Ahmed Qureshi100% (19)

- Conversation With BankerDocument6 pagesConversation With BankerMatthew EcclesNo ratings yet

- Bank GK Raw FileDocument7 pagesBank GK Raw FileThomas HarveyNo ratings yet

- HSBC AccountsDocument8 pagesHSBC Accountssilvernitrate1953No ratings yet

- JSE, FSC, investment goals, risk analysisDocument5 pagesJSE, FSC, investment goals, risk analysisCeila FerronNo ratings yet

- Deed of PartnershipDocument8 pagesDeed of PartnershipDilip AgrawalNo ratings yet