Professional Documents

Culture Documents

Private Car Schedule / Jadual Kereta Persendirian Auto 365 Comprehensive Premier

Uploaded by

6vygxm654zOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Private Car Schedule / Jadual Kereta Persendirian Auto 365 Comprehensive Premier

Uploaded by

6vygxm654zCopyright:

Available Formats

RTD Code:08

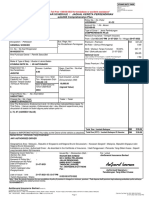

PRIVATE CAR SCHEDULE / JADUAL KERETA PERSENDIRIAN

auto 365 Comprehensive Premier

The Insured / Pemegang Polisi Policy No. / No. Polisi

BVB0179527 01-C1

YAP MIN HAO

Account No. / No . Akaun

B1-01-03 G59800-00

NUSAVILLA, JALAN JATI 11 Type of Cover / Jenis Perlindungan

TAMAN NUSA BESTARI JAYA COMPREHENSIVE PREMIER

SKUDAI Period of Insurance / Tempoh Insurans

81300 JOHOR BAHRU From / Dari 00:00:01 AM 27-11-2022 To / Hingga 26-11-2023

Bus. Regn. No / Premium / Premium RM 1,194.05

Occupation / Pekerjaan No Pendaftaran Perniagaan

ASSISTANT MANAGER - 1,194.05

NCD / Diskaun Tanpa Tuntutan 55.00% 656.73

Wef / Berkuatkuasa dari 27-11-2022

I.C. No. / No.Kad Pengenalan 537.32

910527016061 Optional Cover T

Gross Premium / Premium Kasar 537.32

Hire Purchase Owner / Pemilik Sewa Beli Rebate / Rebat 10% 53.73

PUBLIC BANK BERHAD 483.59

Make & Type of Body / Buatan & Jenis Badan Service Tax / Cukai Perkhidmatan 6.0 % 29.02

HONDA CITY S / 4D SEDAN Stamp Duty / Duti Setem 10.00

Registration No. / Excess / Lebihan Regn. Card No. / No.Kad

No.Pendaftaran Pendaftaran

0.00

JRE2729 -

Carrying or Seating Tonnage / C.C./ Watt Sum Insured / Jumlah

Capacity Incl. Driver / Tan / Keupayaan Enjin Diinsuranskan (RM)

Muatan Tempat Duduk 1497.00 CC

Termasuk Pemandu 30,240.00

Year of Manufacture /

5 Tahun Diperbuat (Agreed Value)

2015

Engine /Motor No. / No . Enjin / Motor

L15Z16684980

Chassis No. / No. Casis Trailer / Treler

PMHGM6660GD105001 -

Named Driver / Pemandu Yang Dinamakan

ANY AUTHORISED DRIVER

NG MIN MIN|910929015600

Note : Compulsory excess will be applied for named driver under 21 years old /

Provisional (P) or Learner (L) driver’s licence / unnamed driver. / Ekses wajib

akan dikenakan untuk pemandu yang dinamakan di bawah umur 21 tahun /

pemegang lesen memandu Percubaan (P) atau Pelajar (L) / Pemandu yang

tidak dinamakan.

Subject to IMPORTANT NOTICE: Your duty as the Owner of the vehicle as attached. Total Due / Jumlah Berbayar RM 522.61

Geographical Area : Malaysia , Republic of Singapore and Negara Brunei Darussalam. / Kawasan Geografi : Malaysia, Republik Singapura dan

Negara Brunei Darussalam.

Limitations as to Use / Authorised Driver : As described in the Certificate of Insurance. / Had Penggunaan / Pemandu Yang Diberi Kuasa : Seperti

yang tercatat dalam Sijil Insurans.

Replacing Cover Note No./ - Issued By / Dikeluarkan Oleh : For / untuk

Gantian No. Nota AMGENERAL INSURANCE BERHAD AmGeneral Insurance Berhad

Perlindungan MENARA SHELL,

Renewal of Policy No./ W3589730 NO. 211, JALAN TUN

Pembaharuan No.Polisi SAMBANTHAN

Date of Proposal or 01-11-2022 Tel : 03-22683333

Declaration / Fax : 03-21713030

Tarikh Cadangan atau

Pengisytiharan Authorised Signature /

Date of Issue / Time 01-11-2022 05:53:19 PM Tandatangan Yang Diberi Kuasa

Tarikh Dikeluarkan / Waktu

Note: / Nota: No refund of premium for any cancellation of policy if premium is charged on minimum premium / Tiada bayaran balik premium bagi sebarang pembatalan polisi sekiranya premium

yang dikenakan adalah premium minima.

Page 1 01-11-2022 05:53:58 PM

05BVL1PM911153-1

Policy Document No./ UW-PW-S009(E)(MT)

No.Dokumen Polisi: REV: B

C.I. Code / M.X.1

Kod Sijil Insurans:

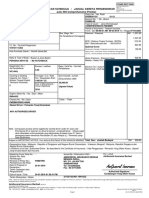

CERTIFICATE OF INSURANCE / SIJIL INSURANS

AKTA PENGANGKUTAN JALAN RAYA 1987 (MALAYSIA)

ORIGINAL COPY / PERATURAN KENDERAAN BERMOTOR (RISIKO KEATAS PIHAK KETIGA) 1959 (MALAYSIA)

AKTA KENDERAAN BERMOTOR (RISIKO KEATAS PIHAK KETIGA DAN PAMPASAN) (KAP 189) REPUBLIK SINGAPURA RTD Code :08

SALINAN ASAL PERATURAN KENDERAAN BERMOTOR (RISIKO KEATAS PIHAK KETIGA DAN PAMPASAN 1960 (REPUBLIK SINGAPURA)

AKTA INSURANS KENDERAAN BERMOTOR (RISIKO KEATAS PIHAK KETIGA) (KAP 90) NEGARA BRUNEI DARUSSALAM

Certificate No. / No. Sijil

BVB0179527 01-C1 Excess : RM 0.00 Sum Insured : RM 30,240.00 (Agreed Value)

1. Index Mark and Registration Number of Vehicle / Tanda Indeks dan No. Pendaftaran Kenderaan

JRE2729 NCD : 55.00% Wef : 27-11-2022

2. Name of Insured / Nama Pemegang Polisi

YAP MIN HAO

3. Period of Insurance / Tarikh Insurans

From / Dari 00:00:01 AM 27-11-2022 To / Hingga 26-11-2023

4. Persons or Classes of Persons entitled to drive / Orang atau kelas orang yang layak memandu:*

a) The Insured.

b) Any other person who is driving on the Insured's order or with his/her permission.

a) Pemegang Polisi.

b) Sesiapa yang memandu atas arahan Pemegang Polisi atau dengan kebenarannya.

Provided that the person driving is permitted in accordance with the licensing or other laws or regulations to drive the Motor Vehicle or has been so permitted and is not

disqualified by order of a Court of Law or by reason of any enactment or regulation in that behalf from driving the Motor Vehicle. / Dengan syarat orang yang dibenarkan

memandu itu menurut perlesenan atau undang-undang atau peraturan lain bagi memandu kenderaan bermotor dan telah dibenarkan dan tidak hilang kelayakan atas perintah

Mahkamah Undang-undang atau atas sebab mana-mana enakmen atau peraturan berkenaan pemanduan kenderaan bermotor.

5. Limitations as to use / Had Penggunaan*

Use only for social, domestic and pleasure purposes and for the insured`s business. The policy does not cover :-

Use for hire or reward, racing, pace-making, reliability trial, speed-testing the carriage of goods other than samples in connection with any trade

or business.

Digunakan hanya untuk tujuan sosial, domestik dan persiaran dan untuk perniagaan Pemegang Polisi.

Polisi ini tidak melindungi kegunaan untuk sewaan atau ganjaran, perlumbaan, mengkadar kelajuan, ujian kebolehpercayaan, ujian kelajuan,

membawa barangan selain daripada sampel yang berkaitan dengan apa-apa pekerjaan atau perniagaan.

* Limitations rendered inoperative by Section 95 of the Road Transport Act 1987 (Malaysia) or Section 8 of the Motor Vehicles (Third Party Risks and Compensation) Act (Cap

189) Republic of Singapore or Section 7 of the Motor Vehicles Insurance (Third Party Risks) Act (Cap 90) Negara Brunei Darussalam are not included under this heading. /

* Had yang ditakwilkan tidak berkuatkuasa oleh Seksyen 95 Akta Pengangkutan Jalanraya (Malaysia),1987 atau Seksyen 8 Akta Kenderaan Bermotor (Risiko Keatas Pihak

Ketiga Dan Pampasan) (Kap 189) Republik Singapura dan Seksyen 7 Akta Insurans Kenderaan Bermotor (Risiko Keatas Pihak Ketiga) (Kap 90) Negara Brunei Darussalam

tidak termasuk dibawah tajuk ini.

I/WE HEREBY CERTIFY that the policy to which this certificate relates is issued in accordance with the provisions of Part IV of the Road Transport Act,

1987 (Malaysia), Motor Vehicles (Third Party Risks and Compensation) Act (Cap 189) Republic of Singapore and the Motor Vehicles Insurance (Third Party

Risks) Act (Cap 90) Negara Brunei Darussalam. / SAYA / KAMI DENGAN INI MENGESAHKAN bahawa polisi yang melaluinya sijil ini dikeluarkan adalah

selaras dengan peruntukan Bahagian IV Akta Pengangkutan Jalan, 1987 (Malaysia), Akta Kenderaan Bermotor (Risiko Keatas Pihak Ketiga dan

Pampasan) (Kap 189) Republik Singapura dan Akta Insurans Kenderaan Bermotor (Risiko Keatas Pihak Ketiga) (Kap 90) Negara Brunei Darussalam.

IMPORTANT NOTICE: Your duty as the Owner of the vehicle. Failure to comply to the below may result your

claim to be declined.

(1) The insured will have to take all reasonable care to secure the vehicle from loss or damage.

(2) Report to the police for all incidents. For road accident, you have to report to the police within 24 hours. for / untuk AmGeneral Insurance Berhad

(3) Notify us in writing within 7 days after the incident and complete the claim form in full and return it to us (Incorporated in Malaysia / Ditubuhkan di Malaysia)

with the related documents within 21 days from your notification's date. Approved Insurers / Penanggung Insurans Yang Dibenarkan

(4) You must obtain our consent in writing before you repair your vehicle or incur any expenses.

(5) For private car own damage claim - In the event of claim, repairs must be conducted by our

approved repairer.

(6) When incident happen, you need to collect these details :

(a) all drivers e.g full name, residential address and contact number

(b) all vehicles e.g. make and model, registration number, and insurance details

(c) date, time and location of the incident

(d) description of the incident and

(e) report to us immediately

(f) report to us for any claims made by another person against you and send us the notices and Authorised Signature /Tandatangan Yang Diberi Kuasa

letters within 14 days from the receipt of the documents.

(7) Do not negotiate or settle any claims made against you, unless you have our consent in writing.

(8) We will have full discretion in the conduct, defence and/or settlement of any claim.

Agent Code / Kod Ejen: G59800-00

N.B. (i) We have the right to cancel this policy by giving you 14 days’ notice in writing by

registered post to your last known address in our records.

(ii) Betterment – In the event your vehicle age is 5 years and above, this policy is subject to rate of betterment.

(iii) You need to read this policy carefully, and if any error or incorrect description is found herein, or

if the cover is not in accordance with your wishes, you should inform us immediately and return this policy to us for alteration.

Important Notice / Kenyataan Penting :

* For environmental conservation, we have adopted paper less printing concept. Please log on to our website to view the Bahasa Malaysia language policy wordings, terms and conditions and exclusion.

For further enquires, please contact your insurance intermediary or our Customer Contact Centre. /Untuk pemeliharaan alam sekitar, kami telah mengaplikasikan konsep tanpa percetakan. Sila layari laman

web kami untuk rujukan da / atau mencetak kandungan polisi, terma-terma, syarat-syarat dan pengecualian dalam Bahasa Melayu. Untuk pertanyaan lanjut, sila hubungi ejen insurans anda atau Pusat

Khidmat Pelanggan kami.

* You are advised to read and understand the summary of this product as contained in the Product Disclosure Sheet on our website. /Anda dinasihati supaya membaca dan memahami ringkasan produk ini

seperti yang tertera di dalam Lampiran Pemberitahuan Produk yang boleh didapati dilaman web kami.

0917

Page 2 01-11-2022 05:53:58 PM

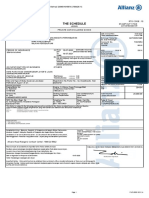

Invoice

Invois

Invoice No. : SST-11-22-11118039 Date : 01-11-2022

No. Invois Tarikh

Name : YAP MIN HAO

Nama

Address : B1-01-03

Alamat NUSAVILLA, JALAN JATI 11

TAMAN NUSA BESTARI JAYA

SKUDAI

81300 - JOHOR BAHRU

Agent Name : AMGENERAL INSURANCE BERHAD Account No. : G59800-00

Nama Ejen No. Akaun

Policy/Endorsement No. : W3589730 Cover Note No. : BVB0179527

No. Polisi/Endorsemen No. Nota

Class of Policy : PRIVATE CAR EX GOODS

Jenis Insurans

Period of Insurance : From 27-11-2022 To 26-11-2023

Tempoh Insurans

No. / No Description / Deskripsi Total / Jumlah (RM)

1 Gross Premium / Premium Kasar 537.32

2 Rebate / Rebat 10% 53.73

3 Service Tax / Cukai Perkhidmatan 6% 29.02

4 Stamp Duty / Duti Setem 10.00

5 Total Payable (OTC) / Jumlah Berbayar Di Kaunter 522.60

6 Total Payable / Jumlah Berbayar 522.61

AmGeneral Insurance Berhad

This is computer generated. No signature is required.

Ini adalah cetakan komputer . Tandatangan tidak diperlukan.

Page 3 01-11-2022 05:53:58 PM

INSURED NAME : YAP MIN HAO

VEHICLE NO : JRE2729

COVER NOTE NO : BVB0179527

PRIVACY CLAUSE

1.0 PRIVACY CLAUSE

1.1 You confirm that you have read, understood and agree to be bound by the Privacy Notice of AmGeneral Insurance

which is available at our website and the clauses herein, as may relate to the processing of your personal

information. For the avoidance of doubt, you agree that the said Privacy Notice shall be deemed to be incorporated

by reference into this policy.

1.2 In the event you provide personal and/or financial information relating to third parties, including information relating

to your next-of-kin and dependents, for the purpose of operating the Insurance Policy with AmGeneral or otherwise

subscribing to AmGeneral's products and services, you:

a. confirm that you have obtained their consent or are otherwise entitled to provide the information to

AmGeneral and for AmGeneral to use it in accordance with this Insurance Policy;

b. agree to ensure that the personal and financial information of the said third parties is accurate and

update AmGeneral in writing in the event of any change to the said personal and financial information;

and

c. agree to AmGeneral's right to terminate the Insurance Policy should such consent be withdrawn by any

of the said third parties

1.3 Even after you have provided AmGeneral with any information, you have the option to withdraw the consent given

earlier. In such instances, AmGeneral will have the right to not provide or discontinue the provision of the Insurance

Policy that is/are linked with such information.

1.4 You agree that the Company and its related companies may contact you about products and services and offers,

which the Company and its related companies believe may be of interest to you, through various channels of

communication.

1.5 In the event you do not wish to consent to use your personal data to receive marketing of products and services by

the Company and its related companies, you may contact AmGeneral as per below details or you may contact

AmGeneral's nearest branch to you:

Customer Service Executive, Customer Contact Centre

Telephone No E-Mail

AmAssurance 1 800 88 6333 customer@amassurance.com.my

Kurnia Insurans 1 800 88 3833 customer@kurnia.com

1.6 AmGeneral reserves the right to amend this Section from time to time at AmGeneral's sole discretion by providing

notice to you.

VEHICLE INSURED VALUE

1.0 IF YOUR POLICY IS AN 'AGREED VALUE' POLICY

1.1 Your vehicle is insured based on an agreed value.

1.2 In the event of total loss or theft, the maximum amount that we will pay is up to the sum insured as shown in the

schedule.

2.0 IF YOUR POLICY IS A 'MARKET VALUE' POLICY

2.1 Your vehicle is insured based on market value.

2.2 In the event of loss or theft, the maximum amount that we will pay is up to the market value of the vehicle which will

be determined at the time of loss or the sum insured as shown in the schedule; whichever is lesser.

2.3 It is important to insure your vehicle with the appropriate market value. Below are the effects of over-insurance and

under-insurance when an incident happens and giving rise to a claim:

a. Over-insurance : When a claim arises, the maximum amount that we will pay you is up to the market

value of your vehicle even if your vehicle's sum insured is higher than the market

value.

b. Under-insurance : When claim arises, we will only bear part of the loss in proportion to the difference

between the market value and the sum insured. The balance has to be borne by you

if the under-insured amount is more than 10% of the market value.

Page 4 01-11-2022 05:53:58 PM

You might also like

- Diesel Engines For Vehicles D2066 D2676Document6 pagesDiesel Engines For Vehicles D2066 D2676Branislava Savic63% (16)

- TB 60 Repair Parts PDFDocument282 pagesTB 60 Repair Parts PDFvatasa100% (2)

- MEMORANDUM OF AGREEMENT DraftsDocument3 pagesMEMORANDUM OF AGREEMENT DraftsRichard Colunga80% (5)

- InsuranceDocument5 pagesInsuranceTamoghna RokadeNo ratings yet

- JHQ3750 Ins PDFDocument34 pagesJHQ3750 Ins PDFAlice ZakariaNo ratings yet

- Retail Branding and Store Loyalty - Analysis in The Context of Reciprocity, Store Accessibility, and Retail Formats (PDFDrive)Document197 pagesRetail Branding and Store Loyalty - Analysis in The Context of Reciprocity, Store Accessibility, and Retail Formats (PDFDrive)Refu Se ShitNo ratings yet

- Printpdf 60 PDFDocument5 pagesPrintpdf 60 PDFMohd Halim HussinNo ratings yet

- Pacific & Orient Insurance Co BHD: Premium Polisi (RM)Document2 pagesPacific & Orient Insurance Co BHD: Premium Polisi (RM)Mohamad HamidNo ratings yet

- Method Statement FINALDocument61 pagesMethod Statement FINALshareyhou67% (3)

- Present Tenses ExercisesDocument4 pagesPresent Tenses Exercisesmonkeynotes100% (1)

- API RP 7C-11F Installation, Maintenance and Operation of Internal Combustion Engines.Document3 pagesAPI RP 7C-11F Installation, Maintenance and Operation of Internal Combustion Engines.Rashid Ghani100% (1)

- Car InsuranceDocument5 pagesCar InsuranceAditya kumarNo ratings yet

- 15C26792 / Reliance Money Solutions PVT LTD: Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument2 pages15C26792 / Reliance Money Solutions PVT LTD: Reliance Private Car Vehicle Certificate Cum Policy Scheduleswami rNo ratings yet

- OB and Attendance PolicyDocument2 pagesOB and Attendance PolicyAshna MeiNo ratings yet

- OkDocument1 pageOkAkash SinghNo ratings yet

- Private Car Schedule / Jadual Kereta Persendirian Auto365 Comprehensive PlusDocument1 pagePrivate Car Schedule / Jadual Kereta Persendirian Auto365 Comprehensive Plusyati ahmadNo ratings yet

- AIG Malaysia CovernoteDocument2 pagesAIG Malaysia CovernoteKelly ObrienNo ratings yet

- Policy Wkk4562Document7 pagesPolicy Wkk4562surya namahaNo ratings yet

- Private Car Schedule / Jadual Kereta Persendirian Auto 365 Comprehensive PremierDocument12 pagesPrivate Car Schedule / Jadual Kereta Persendirian Auto 365 Comprehensive Premiernavindon6No ratings yet

- JRF 4597Document4 pagesJRF 4597feigu6598No ratings yet

- Motorcycle Schedule / Jadual Motosikal: 04JVG3PM910448-1Document6 pagesMotorcycle Schedule / Jadual Motosikal: 04JVG3PM910448-1Gambar GambarNo ratings yet

- BVB0032939 PDFDocument6 pagesBVB0032939 PDFMuhammadAmirrulAriffinHeffnyNo ratings yet

- ''Please Call KAA Toll Free 1-800-88-3833 For Breakdown or Accident Assistance'' Private Car Schedule / Jadual Kereta PersendirianDocument3 pages''Please Call KAA Toll Free 1-800-88-3833 For Breakdown or Accident Assistance'' Private Car Schedule / Jadual Kereta PersendirianMuthu JoeNo ratings yet

- BVB0033270 PDFDocument6 pagesBVB0033270 PDFMohd Fakhrul Nizam HusainNo ratings yet

- Mh-12-Em-1754 (Alto)Document4 pagesMh-12-Em-1754 (Alto)Sujit JadhavNo ratings yet

- Setem Hasil Dibayar Jadual Kereta Persendirian: Stamp Duty PaidDocument10 pagesSetem Hasil Dibayar Jadual Kereta Persendirian: Stamp Duty Paidfezanj0% (1)

- Cover NoteDocument2 pagesCover Notecalvin tekNo ratings yet

- Tata Aig InsuranceDocument6 pagesTata Aig Insurancerajbrar98No ratings yet

- Policy Schedule AgentDocument5 pagesPolicy Schedule Agentantaressquadron90No ratings yet

- Motor Vehicle Policy Schedule / Jadual Polisi Kenderaan BermotorDocument5 pagesMotor Vehicle Policy Schedule / Jadual Polisi Kenderaan BermotorQhazry Bin SulNo ratings yet

- CNandReceiptWaterMarkNew 1548329375557Document6 pagesCNandReceiptWaterMarkNew 1548329375557Zaihanadiah ZainalabidinNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6200120953-00 - Hanun SreedharDocument4 pagesTata AIG Motor Policy Schedule - 3184 - 6200120953-00 - Hanun SreedharHANUNNo ratings yet

- Endorsement Confirmation Slip 6e29095Document5 pagesEndorsement Confirmation Slip 6e29095Nor IlaNo ratings yet

- Pacific & Orient Insurance Co. Berhad: Motorcycle Policy Schedule / Jadual PolisiDocument5 pagesPacific & Orient Insurance Co. Berhad: Motorcycle Policy Schedule / Jadual PolisiAfiq Nur IrfanNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6200113882-00 - Stake SecureDocument4 pagesTata AIG Motor Policy Schedule - 3184 - 6200113882-00 - Stake SecureHANUNNo ratings yet

- CNandReceiptWaterMarkNew 1594952474128Document3 pagesCNandReceiptWaterMarkNew 1594952474128Jack SinichiNo ratings yet

- CreateDS PDF - AspxDocument1 pageCreateDS PDF - AspxDEEPAKARYA2008No ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6200447582-00Document2 pagesTata AIG Motor Policy Schedule - 3184 - 6200447582-00Chetan SharmaNo ratings yet

- MP001395718AGER4 CertificateDocument1 pageMP001395718AGER4 CertificateRadziman RahmanNo ratings yet

- VHD9301 Insurance Quotation (Axa)Document2 pagesVHD9301 Insurance Quotation (Axa)Carson NgNo ratings yet

- Certificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Document1 pageCertificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Md RashidNo ratings yet

- Agent Agent License Code: AIG3142D : Name: Agent Contact No.: 9413101976Document2 pagesAgent Agent License Code: AIG3142D : Name: Agent Contact No.: 9413101976श्री बालाजी मोबाइल रिपेयरिंग एंड ट्रेनिंग सेंटरNo ratings yet

- Cover Note: Stamp Duty PaidDocument2 pagesCover Note: Stamp Duty PaidAmmar IsmailNo ratings yet

- Reliance Private Car Policy-Stand-alone Own DamageDocument11 pagesReliance Private Car Policy-Stand-alone Own DamageGurjar Desi 2No ratings yet

- Ma 227332Document11 pagesMa 227332Siew Ngoh TongNo ratings yet

- Cover Note 85232ce PDFDocument7 pagesCover Note 85232ce PDFzamri sarikinNo ratings yet

- PolicyDocument6 pagesPolicyMohit PandeyNo ratings yet

- Details of Participant - Maklumat Terperinci Peserta: E-JadualDocument4 pagesDetails of Participant - Maklumat Terperinci Peserta: E-JadualSyahmina ZakiNo ratings yet

- Cover Note 5b08f45Document3 pagesCover Note 5b08f45Pizo SuhailaNo ratings yet

- Cover NoteDocument4 pagesCover NoteShafiqNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6201016246-00Document5 pagesTata AIG Motor Policy Schedule - 3184 - 6201016246-00Naman JainNo ratings yet

- Bancan Gba00157 00547277 10 VPP V3677048 00001 T405 03SCHL Post 1Document3 pagesBancan Gba00157 00547277 10 VPP V3677048 00001 T405 03SCHL Post 1Taufik Hameed SultanNo ratings yet

- Cover Note 7d5de45 PDFDocument8 pagesCover Note 7d5de45 PDFFardiana EdrinaNo ratings yet

- Policy Schedule Cum Cer Ficate of Insurance: Premium Computation TableDocument2 pagesPolicy Schedule Cum Cer Ficate of Insurance: Premium Computation Tableriyaz ahmadNo ratings yet

- Insurance HERO 2023Document5 pagesInsurance HERO 2023752.nithinrajNo ratings yet

- Reliance Private Car Policy-Stand-alone Own DamageDocument11 pagesReliance Private Car Policy-Stand-alone Own DamageSomveer SheoranNo ratings yet

- Pibg SK SG Puyu Kejohanan Memanah Terbuka SK MergongDocument5 pagesPibg SK SG Puyu Kejohanan Memanah Terbuka SK MergongFairuz YusofNo ratings yet

- Certificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Document1 pageCertificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134DipNo ratings yet

- State Code: 6, Haryana: Customer Care Toll Free Number: 1800 345 0330 Email:customer - Support@nic - Co.inDocument3 pagesState Code: 6, Haryana: Customer Care Toll Free Number: 1800 345 0330 Email:customer - Support@nic - Co.inconsultingseo27No ratings yet

- Wa0006.Document1 pageWa0006.Gamer JiNo ratings yet

- Schedule / Jadual MX1: Page 1 of 2Document2 pagesSchedule / Jadual MX1: Page 1 of 2Ahmad ZubirNo ratings yet

- Anil Sir Scooty InsuranceDocument1 pageAnil Sir Scooty InsuranceDipNo ratings yet

- Cover Note: Stamp Duty PaidDocument2 pagesCover Note: Stamp Duty PaidSaharinaNo ratings yet

- CNandReceiptWaterMarkNew 1678780407148Document3 pagesCNandReceiptWaterMarkNew 1678780407148khairulshamsudin05No ratings yet

- Policy DocumentDocument6 pagesPolicy DocumentAbhishaik ReddyNo ratings yet

- ActivaDocument1 pageActivaFaraz KhanNo ratings yet

- Car Policy 2020 PDFDocument5 pagesCar Policy 2020 PDFSusheel Kumar TiwariNo ratings yet

- Guidelines For Doing Business in Grenada & OECSDocument14 pagesGuidelines For Doing Business in Grenada & OECSCharcoals Caribbean GrillNo ratings yet

- Traffic Survey, Analysis, and ForecastDocument91 pagesTraffic Survey, Analysis, and Forecastsanthosh rajNo ratings yet

- FINAL VERSION On Assessment Tool For CDCs LCs Sept. 23 2015Document45 pagesFINAL VERSION On Assessment Tool For CDCs LCs Sept. 23 2015Edmar Cielo SarmientoNo ratings yet

- Revenue Memorandum Circular No. 55-2016: For ExampleDocument2 pagesRevenue Memorandum Circular No. 55-2016: For ExampleFedsNo ratings yet

- Tax Havens IMF PDFDocument59 pagesTax Havens IMF PDFClassic PhyXNo ratings yet

- Sharat Babu Digumarti Vs State, Govt. of NCT of Delhi (Bazee - Com Case, Appeal) - Information Technology ActDocument17 pagesSharat Babu Digumarti Vs State, Govt. of NCT of Delhi (Bazee - Com Case, Appeal) - Information Technology ActRavish Rana100% (1)

- Pepsico SDM ProjectDocument6 pagesPepsico SDM ProjectJemini GanatraNo ratings yet

- Capgemini - 2012-06-13 - 2012 Analyst Day - 3 - Michelin - A Better Way ForwardDocument12 pagesCapgemini - 2012-06-13 - 2012 Analyst Day - 3 - Michelin - A Better Way ForwardAvanish VermaNo ratings yet

- Flight Data Recorder Rule ChangeDocument7 pagesFlight Data Recorder Rule ChangeIgnacio ZupaNo ratings yet

- DBM Uv W ChartDocument2 pagesDBM Uv W ChartEddie FastNo ratings yet

- Fertilisation and PregnancyDocument24 pagesFertilisation and PregnancyLopak TikeNo ratings yet

- DL Manual - Com Vs Controller Gs Driver p100 Operating ManualDocument124 pagesDL Manual - Com Vs Controller Gs Driver p100 Operating ManualThiago Teixeira PiresNo ratings yet

- 2010 Information ExchangeDocument15 pages2010 Information ExchangeAnastasia RotareanuNo ratings yet

- OBOE GougerDocument2 pagesOBOE GougerCarlos GaldámezNo ratings yet

- Acceptable Use Policy 08 19 13 Tia HadleyDocument2 pagesAcceptable Use Policy 08 19 13 Tia Hadleyapi-238178689No ratings yet

- The One With The ThumbDocument4 pagesThe One With The Thumbnoelia20_09No ratings yet

- ABBindustrialdrives Modules en RevBDocument2 pagesABBindustrialdrives Modules en RevBMaitry ShahNo ratings yet

- PRESENTACIÒN EN POWER POINT Futuro SimpleDocument5 pagesPRESENTACIÒN EN POWER POINT Futuro SimpleDiego BenítezNo ratings yet

- Ethical Hacking IdDocument24 pagesEthical Hacking IdSilvester Dian Handy PermanaNo ratings yet

- Forensic IR-UV-ALS Directional Reflected Photography Light Source Lab Equipment OR-GZP1000Document3 pagesForensic IR-UV-ALS Directional Reflected Photography Light Source Lab Equipment OR-GZP1000Zhou JoyceNo ratings yet

- Auditing Principles and Practices-IDocument8 pagesAuditing Principles and Practices-IMoti BekeleNo ratings yet

- Chemical & Ionic Equilibrium Question PaperDocument7 pagesChemical & Ionic Equilibrium Question PapermisostudyNo ratings yet