Professional Documents

Culture Documents

Financial Literacy and Behavioral Biases Among Tra

Uploaded by

chisa meiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Literacy and Behavioral Biases Among Tra

Uploaded by

chisa meiCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/329447025

Financial Literacy and Behavioral Biases among Traditional Age College

Students

Article in Accounting and Finance Research · December 2018

DOI: 10.5430/afr.v8n1p30

CITATIONS READS

4 456

4 authors, including:

Ohaness Paskelian

University of Houston - Downtown

3 PUBLICATIONS 8 CITATIONS

SEE PROFILE

All content following this page was uploaded by Ohaness Paskelian on 24 September 2019.

The user has requested enhancement of the downloaded file.

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Financial Literacy and Behavioral Biases

among Traditional Age College Students

Ohaness Paskelian1, Kevin Jones1, Stephen Bell2 & Robert Kao2

1

Marilyn Davies College of Business, University of Houston-Downtown, Houston, TX 77002, USA

2

School of Business, Park University, Parkville, MO 64152, USA

Correspondence: Ohaness Paskelian, Marilyn Davies College of Business, University of Houston-Downtown, 320 N

Main St, Suite 442B, Houston, TX 77002, USA. Tel: 1-713-221-8204. E-mail: paskeliano@uhd.edu.

Received: November 16, 2018 Accepted: December 4, 2018 Online Published: December 5, 2018

doi:10.5430/afr.v8n1p30 URL: https://doi.org/10.5430/afr.v8n1p30

Abstract

In this paper, we examine several financial literacy issues facing college students. We identify college student

perceptions about personal finances, assess student financial literacy knowledge, and evaluate student awareness

concerning savings and retirement positions.

We find that basic financial literacy is not the only factor in making sound financial decisions. Our results show the

majority of the college students surveyed are financially literate and have the ability to make informed decisions

about their personal finances in the short-run. While our respondents appear confident in making short-run financial

decisions, their behavior tends to suggest that their confidence is somewhat misguided. In addition, a large number of

the students surveyed feel they do not have the requisite knowledge to make wise retirement planning choices.

Further, several respondents report a distrust of retirement plans offered by private companies, which may lead to

suboptimal retirement savings.

Keywords: financial literacy, behavioral biases, retirement savings, college students

1. Introduction

Financial literacy allows one to understand the basics of budgeting, saving and investing. This knowledge is

particularly important to college students since sound financial planning at the beginning of one’s career is crucial

for long-term financial well-being and retirement.

There has been a tremendous amount of academic and policy oriented research conducted during the past 10 years

investigating the connection between financial literacy and savings, personal debt levels and savings for retirement

among households and individuals (Lusardi and Mitchell 2007a, and Van Rooij et al. 2011). The majority of

research does not find strong relationships between financial education and financial behavior. Several hypotheses

have been put forward to explain this puzzling finding. One widely cited reason is the ineffectiveness of current

financial literacy education. Volpe, Chen, and Liu (2006) note financial behavior is difficult to change. Therefore,

they assert that stronger education programs are needed to promote financial literacy. The current environment of

simple interventions or financial literacy short courses may not be relevant, interesting or adequate to provide

necessary financial literacy skills. In addition, they note that finding knowledgeable and engaging teachers may not

be easy.

The recent proliferation of financial markets has introduced a multitude of new financial instruments and services to

the economy which in turn has led a wide range of academics, politicians, and industry group advocates to express

concern that low levels of financial literacy may be harmful to investors (Lusardi and Mitchell, 2007b). Those

concerns led Congress to include a financial literacy component to the No Child Left Behind Act of 2001.

Several researchers have attributed low personal savings and high personal debt levels to financial illiteracy (Kinzie,

2007 and Lusardi and Mitchell, 2006, 2007a). According to Mason and Wilson (2000), financial literacy is defined

as the individual’s ability to obtain, process, and comprehend the relevant information necessary to make financial

decisions with an understanding of its potential consequences. On the other hand, financial illiteracy is defined as the

Published by Sciedu Press 30 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

absence of a solid knowledge base related to financial markets and financial assets, and the inability to evaluate or

make effective financial decisions.

Financial literacy is especially important to recent university graduates. University students usually accumulate a

substantial amount of debt to complete their education and incur the responsibility of repaying their loans after their

graduation. According to the Financial Literacy & Education Commission (2006), 50% of education costs on average

are related to student loans, consumer loans and credit cards.

In this paper, we investigate several financial literacy issues facing college students. We conduct an original survey

in two universities, for privacy concerns we will call them University 1 and University 2. The survey identifies

college student perceptions concerning personal finance positions, assesses student financial literacy knowledge, and

measures college student knowledge concerning basic financial concepts.

This paper provides new perspectives about the impact of financial literacy on savings and retirement problems that

is not fully researched in the existing literature. In this paper, we explore the socioeconomic factors that may

influence the different types of savings decisions among college level students. We find that financial literacy is not

the sole determinant when it comes to explaining improper or inadequate long-term savings and retirement decisions.

Our results show that the majority of the college students actually have the basic financial and economic knowledge

to make sound decisions about their current personal finances. However, we also find that a large number of the

college students feel they lack the information needed to make wise retirement decisions. Surprisingly, over a third

of the respondents indicate a lack of trust in retirement accounts offered by private companies which can in turn stifle

retirement savings.

The remainder of the paper is organized as follows: Section 2 provides a literature review of previous studies

related to financial literacy, savings and retirement issues. Section 3 covers the empirical hypotheses tested in the

paper. Section 4 elaborates on the data and the methodology used in the paper. Section 5 reports the results. Finally,

section 6 concludes the paper.

2. Literature Review

Volpe, Chen and Liu (2006) provide an overview of the studies conducted in the 1990s by private firms to assess

financial literacy among adults. The primary criticism levelled against these privately-sponsored studies is their

alignment with the corporate interests of the surveying party. Volpe et al. noted that while there have been studies

conducted among high school and college students to assess their financial literacy, these studies tend to be limited in

scope and performed in only a few institutions.

Jump$tart, a non-profit organization which focuses on improving financial literacy among youths, conducted the most

prominent study of financial literacy among high school students to date. Jump$tart administered the same exam to

high school seniors between 1997 and 2006. The exam included questions on money management, savings, investment,

credit and income as a means of assessing financial literacy. The results are far from stellar. Jump$tart reported an

average score of 57 percent in 1997 (with 60 percent being a passing score), with scores decreasing significantly in

subsequent years (2000-2006).

Chen and Volpe (1998) conducted similar financial literacy tests for college students in 13 public and private

universities. The authors report an average financial knowledge score of only 53 percent. The authors find that

business majors generally scored higher than other majors. In addition, students scored highest on questions where

they had some experience such as auto insurance, apartment leases, and scored lowest on questions where they had

the least experience such as taxes, life insurance and investments. Chen and Volpe (1998) concluded that financial

experience could increase financial literacy.

Savings and retirement decisions by individuals require knowledge of both Social Security and employer-sponsored

pensions as well as a deep understanding of core financial principles such as the time value of money. Bernheim

(1988) studied the Social Security Retirement History Survey (RHS) and found that many adults do not know

important features of their Social Security entitlements and pensions. He reported that adults do not know their

expected Social Security benefit estimates and often predict inaccurate benefits or do not know the benefits at all.

Mitchell (1988) explored the issue of company pensions plans and found that many workers lack basic knowledge of

the characteristics of the pension plan. She utilized the Survey of Consumer Finances (SCF) and found that only half

of employees who were required to contribute to their pensions did so. In addition, more than one-third of employees

did not know about early retirement features and other characteristics of their pension plan.

Published by Sciedu Press 31 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Gustman and Steinmeier (2005) using the 1992 Health and Retirement Survey (HRS), report that the majority of

those surveyed do not know their Social Security or pension entitlements. Only 27 percent of respondents gave

estimates within 25 percent of their actual Social Security entitlements. Respondents who gave the most accurate

estimates tended to be highly educated, high income, white males. However, the most troubling finding of this

survey was that the majority of respondents still have trouble performing the basic calculations necessary to plan for

retirement.

Lusardi and Mitchell (2006, 2007a) studied the 2004 HRS survey and find a lack of basic financial knowledge

among the respondents. Their findings confirm the lack of understanding of basic time value concepts and

compounding among the respondents. Lusardi and Mitchell (2007b) confirmed their findings by studying the Rand

American Life Panel (ALP) survey. The respondents were educated and high-earning middle-aged adults, however

over a quarter of respondents did not possess basic finance knowledge and skills.

Lusardi, Mitchell, and Curto (2009a) find that financial knowledge and understanding of basic time value of money

concepts is lacking among young adults, which hinders their ability to make rational decisions regarding asset

allocation. Lusardi, Mitchell, and Curto (2009b), using data from the 2008 Health and Retirement Study, find older

Americans are also lacking in financial knowledge. They reported that the majority of respondents over 55 do not

have basic understanding of stocks, bonds, risk, diversification, portfolios, inflation and investment fees. The authors

argue that these findings have significant implications for public policy.

Lusardi and Mitchell (2006, 2007b) reported other forms of financial illiteracy. The authors note that the concept of

inflation is not well understood among many Americans, and therefore, they make mistakes when it comes to

accounting for inflation in their future retirement savings. In addition, the authors report a lack of understanding of

the concepts of risk and diversification which affect investment decisions. Bucks and Pence (2006) study the Survey

of Consumer Finances to distributions in three lender-reported datasets and find that many individuals who hold

adjustable rate mortgages (ARMs) exhibit shocking ignorance of their mortgage terms. They note that ARM

borrowers do not have complete understanding of their mortgage characteristics and typically underestimate their

risks and potential liabilities. Agarwal et al. (2009) find similar results using data from a mandatory loan counselling

program for high-risk mortgage applicants in Chicago. They find that a large majority of ARM applicants did not

know that their interest rate was not fixed for the life of the mortgage.

In summary, there is overwhelming evidence in the financial literature suggesting that many consumers are not

financially literate. In addition, those studies also assert that financial literacy is an important factor in the retirement

planning and saving process. However, the previous studies do not specifically assess the financial literacy levels of

college level students. This paper fills the gap in the financial literacy literature by surveying college level students

who by definition are getting a relatively higher level of education. The paper tries to explore whether gaining

college level education results in a higher level of financial literacy which in turn will provide for better savings,

investing and retirement related decisions.

3. Hypotheses Development

Danes and Hira (1987) explore financial literacy knowledge among college students and find that students know about

credit cards and their costs, in particular compounding interest charges. In addition, students distinguish between the

different types of insurance and know the importance of carrying insurance. However, the authors find that students

show little to no knowledge regarding the different types and characteristics of loans and do not place high importance

on record keeping processes.

In addition, Volpe, Chen and Pavlicko (1996) studied financial literacy knowledge among college students, and find

that it is related to gender, academic discipline and experience. They conclude that overall, college students possess an

inadequate level of personal investment knowledge. In a more comprehensive study, Chen and Volpe, (1998) find

similarly inadequate financial literacy knowledge among college students in general. However, in their study, business

majors perform much better than non-business majors on financial literacy-related questions.

Based on the above literature, we hypothesize the following:

H1: College level students and in particular business majors including finance and accounting majors, will have

adequate financial literacy knowledge.

Chen and Volpe, (1998); Danes and Hira, (1987); Volpe, Chen and Povlicko, (1996) find that gender, employment

status, ethnicity, family income and college major may affect the financial literacy levels of business majors. Hilgert

and Hogarth (2003) and Mandell (2004) report that parents have a strong influence on their children’s financial literacy

knowledge. Analyzing national surveys conducted in 1997, 2000, 2002 and 2004, Mandell (2004) and Hilgert and

Published by Sciedu Press 32 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Hogarth (2003) find that high schoolers obtain their financial knowledge from their parents or through personal

experience. Both researchers conclude that in order to transmit effective financial knowledge, parents need to be

financially literate in the first place.

Based on the above literature, we hypothesize the following:

H2: College level students and in particular business majors including finance and accounting majors, gain their

financial literacy primarily from their parents or personal experience.

Finally, previous studies explore the relationship between financial literacy and planning/saving for retirement. Two

major findings are provided by this strand of literature. First, financial literacy has direct and positive impact on

retirement planning. Individuals with relatively greater financial literacy plan more for retirement, and reach higher

net worth upon retirement. Second, causality runs from financial literacy to retirement planning to wealth

accumulation.

Lusardi and Mitchell (2006, 2007a) studied the 2004 Health and Retirement Survey report that concluded the majority

of those surveyed do not correctly know their Social Security or other pension entitlements. The authors also report

lack of understanding among respondents on the basics of compounding and interest rates. Further, Lusardi, Mitchell,

and Curto (2009b), using data from the 2008 Health and Retirement Study, report that older Americans lack basic

financial aptitude. The authors report that their findings suggest that the majority of Americans do not have

“rudimentary understanding of stock and bond prices, risk diversification, portfolio choice, and investment fees.” The

authors argue that these findings have significant implications for public policy.

Based on the above literature, we hypothesize the following:

H3: College level students and in particular business majors including finance and accounting majors, will have

adequate knowledge of planning for savings and retirement.

4. Methodology

We modelled a five-page survey instrument (see Appendix A) that is used to survey financial literacy knowledge and

perceptions of college students at University 1 and University 2. The survey instrument is developed using Lusardi

and Mitchell (2009a and b) and Mandell (2004) surveys as examples. The survey consists of three parts. Part one

contains questions related to student demographic background, education and family information. The second part

contains five questions devised to assess the financial literacy level of the respondents. The third part, which has

three subcategories, contains questions related to the perception of students about their financial situation, influences

on their financial literacy and the perception of students about retirement savings. This part of the survey asks the

respondents to indicate the level of importance of each factor in their answer. We used a six-point, equal-interval

importance scale where, -2 = Strongly Disagree, -1 = Disagree, 0 = No Opinion, 1 = Agree and 2 = Strongly Agree.

We opted to include a “Not Available” option because some of the questions asked in the survey instrument may not

have been applicable to the sample of the students who responded to this survey. The first subcategory related to

the personal financial situation of students consists of 15 questions. We deliberately included questions similar in

meaning but opposite in construction to further assess whether the students are really answering correctly or are they

merely mechanically choosing their answers. The second subcategory consists of 8 questions related to influences on

student financial literacy. The third subcategory consisted of 14 questions related to perceptions about retirement

savings. The purpose of the three subsets is to test the three hypotheses that we put forward in this research. Finally,

we provided the students with the option to add any additional information if they wished to do so. The authors

received approval from their respective institutions in order to administer the survey among the students. No

identifying information was recorded or asked in the survey. The survey was completely anonymous.

Published by Sciedu Press 33 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

5. Results

5.1 Participant Characteristics

Table 1. The table presents descriptive statistics of the respondents.

Number of Percentage

Respondents

Location

Houston 247 57%

Kansas City 184 43%

Gender

Male 218 51%

Female 213 49%

Age Group

18-21 142 33%

22-29 176 41%

30-39 63 15%

40-49 32 7%

Above 50 18 4%

Marital Status

Married 96 22%

Single 175 41%

Separated/Divorced 82 19%

Living with a partner 71 16%

Widowed 7 2%

Ethnicity

White 93 22%

Hispanic or Latino 134 31%

Black or African American 114 26%

Native American or Indian 14 3%

Asian/Pacific Islander 65 15%

Other 11 3%

Classification

Freshman 38 9%

Sophomore 69 16%

Junior 132 31%

Senior 168 39%

Other 24 6%

Major

Accounting 85 20%

Finance 97 23%

CIS/EIS 24 6%

Management 63 15%

Published by Sciedu Press 34 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Marketing 17 4%

General Business 57 13%

Insurance Management 4 1%

Undecided/No Major 45 10%

Other 39 9%

Employment Status

Employed full-time 85 20%

Employed part-time 155 36%

Small Business owner or self-employed 17 4%

Unemployed looking for a job 59 14%

Unemployed full-time student 115 27%

Income Level

Below $9,999 147 34%

$10,000-$19,999 112 26%

$20,000 - $29,999 57 13%

$30,000 - $39,999 54 13%

$40,000 or more 61 14%

Father’s Schooling level

Less than high school 109 25%

High school or equivalent 148 34%

Associate/community college degree 57 13%

Bachelor’s degree 57 13%

Masters or above 60 14%

Mother’s schooling level

Less than high school 87 20%

High school or equivalent 194 45%

Associate/community college degree 68 16%

Bachelor’s degree 58 13%

Masters or above 24 6%

Debt Level

$0 91 21%

$1-$4,999 129 30%

$5,000-$9,999 55 13%

$10,000-$19,999 57 13%

$20,000-$39,999 67 16%

$40,000 or more 24 6%

Don't know 8 2%

The sample size consists of 431 responses from students enrolled at University 1 and University 2 during 2014. The

responding student locational distribution is 57% in Houston and 43% in Kansas City. The demographic composition

is 51% males and 49% females. The respondents are predominantly young. Forty one percent of the respondents are

in the 22-29 year age bracket and thirty-three percent are in the 18-21 year age bracket. The other significant age

Published by Sciedu Press 35 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

group is the 30-39 year age bracket (15%). The respondents are mostly single (41%). 22% are married and 16%

living with a partner. 19% are separated or divorced. The ethnic composition of the respondents is widely varied;

31% of the respondents are Hispanic or Latinos, 26% are Black or African American, 22% are white and 15% Asian

or Pacific Islander.

The two largest groups of the respondents are juniors and seniors (31% and 39% respectively) followed by

sophomores (16%), freshman (9%) and other (6%). As for the majors of the respondents, the two largest groups are

finance majors and accounting majors with 23% and 20% of the respondents, respectively. Management is the third

most popular major in the sample and represents 15% of the respondents. Management is followed by General

Business majors which accounts for 13% of the sample, and undecided/no major is in fifth place at 10%.

The employment status of the respondents is as diverse as their background and major field of study. Unemployed

full-time students represent 27% of the respondents, while 14% of respondents indicate they are unemployed and

looking for a job. Part-time employed students represent 36% of the respondents, and full-time employed students

are only 20%. Based on these numbers, 77% of the respondents are unemployed or part-time employed. As for the

respondents’ income level, 34% report income below $10,000, 26% report income between $10,000 and $20,000,

and 13% have an annual income between $20,000 and $30,000.

The survey asked respondents about their parents’ education level. Regarding the father’s education level, 25% of

the respondents report less than high school level, 34% report high school or equivalent level and 13% report

community college level of education. Similar results are found in regards to the mother’s education level. 20% of

the respondents report less than high school level education, 45% report high school or equivalent level and 16%

report community college level of education. Overall, the results about family education show that the majority of

the respondents come from families where the highest education attained is below the college level.

With regard to indebtedness levels, 21% of the respondents report no debt, while 30% of the respondents report less

than $5,000 of total debt. Thirteen percent of the respondents state their debt level is between $5,000 and $10,000.

Only 6% of the respondents reported debt levels above $40,000. These results seem reasonable given the age and

income level of the majority of the sample.

Published by Sciedu Press 36 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

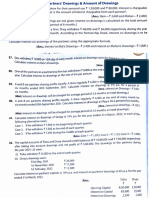

5.2 Financial Knowledge Survey

Table 2. Financial Literacy Background Information

Number of Percentage

Respondents

Financial Knowledge Source

At home from my parents 104 24%

Learning on my own over time 192 45%

School coursework 47 11%

From friends and relatives 69 16%

Other 19 4%

Safest place to save $5000

At home 41 10%

In a savings account at a bank 351 81%

Investing in the stock market 12 3%

Investing in the bond market 27 6%

Gross pay deductions

Social Security and Medicare contributions 50 12%

Federal Income tax, property tax, Medicare 38 9%

and Social Security

Federal Income tax, Social Security and 312 72%

Medicare contributions

Federal Income tax, sales tax, and Social 31 7%

Security contributions

Credit history/record rights

Credit record checked once a year for free 375 87%

Cannot view credit record unless provided by 28 6%

bank

Credit record are property of U.S. government 15 3%

Accessible only if turned down for credit 13 3%

based on the report

TVM Calculation

You 220 51%

Your friend 79 18%

You and your friend would have the same 123 29%

amount

Cannot be determined 9 2%

We utilize five specific questions in the survey to analyze the level and origin of respondent financial knowledge.

Forty-five percent of the respondents report they gained their financial knowledge on their own over time, 24%

indicate they gained their financial knowledge at home from their parents, 16% state they gained their financial

knowledge from friends and relatives, and surprisingly only 11% report they gained their financial knowledge from

school coursework. The results are surprising because the vast majority of the respondents are college level students

majoring in a Business discipline, therefore, they should have received at least some type of education in financial

matters.

Published by Sciedu Press 37 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

The majority of respondents in our sample were able to correctly answer the four questions related to financial

literacy and the understanding of common financial knowledge. The results are not surprising given the fact that the

respondents are college level students majoring in Business.

Eighty-one percent of the respondents correctly state that the safest place to save $5000 is in a savings account at a

bank. 72% of the respondents correctly identify the 3 deductions out of the gross pay, which are Federal income tax,

Social security tax and Medicare contributions. Eighty-seven percent of the respondents correctly answer the

question related to the right to receive a free credit report once a year. Finally, only 51% of the respondents were able

to correctly answer the question related to the time value of money and compound interest.

5.3 Respondents Perceptions about their Personal Financial Situation

Table 3. The results represent the survey responses of 431 students from 2 different universities. The t-statistic

represents the t-value when testing the mean to 0.

Not Strongly Strongly Std.

Disagree Neutral Agree Mean t-stat

Available Disagree Agree Dev

Panel A: Perceptions

about personal financial

situation

1. I feel in control of my 0 8 15 21 254 133 1.13 1.68 6.521

financial situation ***

0% 1.86% 3.48% 4.87% 58.93% 30.86%

2. I feel capable of using 0 5 11 24 234 157 1.22 1.09 4.638

my future income to ***

achieve my financial goals

0% 1.16% 2.55% 5.57% 54.29% 36.43%

3. My finances are a 2 57 105 54 107 106 0.23 0.61 14.25

significant source of worry 2***

or hassle to me

0.46% 13.23% 24.36% 12.53% 24.83% 24.59%

4. I am certain about where 0 14 37 41 215 124 0.93 0.669 18.63

my money is spent 9***

0% 3.25% 8.58% 9.51% 49.88% 28.77%

5. I feel credit cards are 0 178 155 24 43 31 -0.94 1.398 5.643

safe and risk free ***

0% 41.30% 35.96% 5.57% 9.98% 7.19%

6. I feel putting money 1 12 27 18 116 257 1.34 0.933 8.890

each month for savings or ***

investments is important

0.23% 2.78% 6.26% 4.18% 26.91% 59.63%

7. I feel capable of 0 11 42 44 214 120 0.91 0.669 -18.6

handling my financial 39***

future (i.e. buying

insurance or investments)

0% 2.55% 9.74% 10.21% 49.65% 27.84%

8. I compare my receipts of 4 48 126 72 119 62 0.05 1.398 5.643

purchases to my monthly ***

statements

0.93% 11.14% 29.23% 16.71% 27.61% 14.39%

9. I use credit cards to 4 172 128 32 71 24 -0.82 0.869 9.185

make purchases that I can’t ***

afford

Published by Sciedu Press 38 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

0.93% 39.91% 29.70% 7.42% 16.47% 5.57%

10. I miss important life 0 89 114 61 127 40 -0.19 0.513 7.190

events to work extra hours ***

to pay bills and other

expenses

0% 20.65% 26.45% 14.15% 29.47% 9.28%

11. I received cash 3 215 95 41 36 41 -0.95 1.012 5.379

advances from my credit ***

card in the past 12 months

0.7% 49.88% 22.04% 9.51% 8.35% 9.51%

12. I contribute to a savings 0 53 86 34 127 131 0.45 0.687 7.279

account regularly ***

0% 12.3% 19.95% 7.89% 29.47% 30.39%

13. I missed one or more 2 260 86 24 34 25 -1.21 0.579 9.514

credit payments in the past ***

12 months

0.46% 60.32% 19.95% 5.57% 7.89% 5.80%

14. I keep adequate records 0 17 88 41 187 98 0.61 1.213 11.36

of my finances 0***

0% 3.94% 20.42% 9.51% 43.39% 22.74%

15. I always pay more than 2 152 78 38 85 76 -0.34 0.752 6.485

the minimum amount on 0***

my credit card

0.46% 35.27% 18.10% 8.82% 19.72% 17.63%

Panel B: Influences on

Financial Literacy

1. My parents taught me 0 45 64 55 175 92 0.48 1.142 11.59

about money management 4***

and savings

0% 10.44% 14.85% 12.76% 40.60% 21.35%

2. I read to increase my 0 36 65 50 168 112 0.59 1.2 2.169

financial knowledge *

0% 8.35% 15.08% 11.60% 38.98% 25.99%

3. I gained most of my 0 97 179 54 71 30 -0.56 0.869 8.179

knowledge about finances ***

in high school

0% 22.51% 41.53% 12.53% 16.47% 6.96%

4. I follow my parents as 2 51 152 67 114 45 -0.12 0.979 -3.23

far as savings and 8**

investments are concerned

0.46% 11.83% 35.27% 15.55% 26.45% 10.44%

5. I attended a class or 0 105 172 52 83 19 -061 0.798 -6.38

seminar provided by a 8***

financial planning firm

0% 24.36% 39.91% 12.06% 19.26% 4.41%

6. I attended a financial 1 122 185 63 46 14 -.83 0.633 -12.2

Published by Sciedu Press 39 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

literacy seminar organized 49***

by non-profit organization

0.23% 28.31% 42.92% 14.62% 10.67% 3.25%

7. I can get any information 0 13 53 68 239 58 0.64 0.583 11.28

I want related to finances 7***

from the Internet

0% 3.02% 12.30% 15.78% 55.45% 13.46%

8. I follow my instincts 3 24 52 51 224 77 0.64 0.841 13.35

when it comes to money 8***

and finances

0.7% 5.57% 12.06% 11.83% 51.97% 17.87%

Panel C: Perceptions

about retirement savings

1. I save enough for 0 96 184 78 48 25 -0.65 0.741 5.259

retirement ***

0% 22.27% 42.69% 18.10% 11.14% 5.80%

2. Social Security will 0 196 125 47 54 9 -1.03 0.924 -11.9

provide me with an 21***

adequate amount of

retirement income

0% 45.48% 29.00% 10.90% 12.53% 2.09%

3. The retirement benefits 3 98 141 129 48 12 -0.62 0.754 -8.49

provided by my employer 1***

are adequate

0.70% 22.74% 32.71% 29.93% 11.14% 2.78%

4. I plan to work part-time 0 48 91 98 167 27 0.08 0.975 -1.13

after I retire 3

0% 11.14% 21.11% 22.74% 38.75% 6.26%

5. I save enough in a 0 98 186 106 40 1 -0.79 1.208 3.404

private retirement account **

such as IRA to meet my

retirement goals

0% 22.74% 23.43% 16.71% 27.15% 10.21%

6. I do not save for 2 95 101 72 117 44 -0.20 1.093 2.775

retirement *

0.46% 22.04% 23.43% 16.71% 27.15% 10.21%

7. I feel confident about the 0 184 121 65 44 17 -0.95 0.87 4.282

future of Social Security ***

and Medicare

0% 42.69% 28.07% 15.08% 10.21% 3.94%

8. I save enough regularly 4 74 135 54 125 39 -0.19 1.085 5.757

to meet my financial goals ***

0.93% 17.17% 31.32% 12.53% 29% 9.05%

9. I will live with my 2 163 137 47 60 22 -0.83 1.29 -1.32

children when I retire 9

0.46% 37.82% 31.79% 10.90% 13.92% 5.10%

10. I understand the 0 47 118 81 149 36 0.02 1.136 0.059

different retirement plans

Published by Sciedu Press 40 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

available to me

0% 10.9% 27.38% 18.79% 34.57% 8.35%

11. I feel that I need more 3 18 49 51 186 124 0.81 1.201 -1.62

information/education 8

related to retirement

0.7% 4.18% 11.37% 11.83% 43.16% 28.77%

12. I do not trust private 0 26 74 178 117 36 0.15 0.801 3.628

companies providing **

retirement accounts

0% 6.03% 17.17% 41.30% 27.15% 8.35%

13. I think the government 2 30 62 66 179 92 0.56 1.081 8.271

should provide citizens ***

with more retirement

choices other than Social

Security

0.46% 6.96% 14.39% 15.31% 41.53% 21.35%

14. I think having 1 89 136 96 75 34 -0.39 0.914 6.317

insurance coverage is ***

adequate retirement

coverage

0.23% 20.65% 31.55% 22.27% 17.40% 7.89%

*** is significant at 1% level, ** is significant at 5% level, * is significant at 10% level

The first subcategory of the survey is related to respondent perceptions about their personal financial situation. The

majority of the respondents tend to have a positive attitude toward their own personal financial situation and seem to

be in control of their finances. The vast majority of the respondents (89.79%) affirm that they are in control of their

financial situation. Similarly, almost all of the respondents feel capable of using their future income to achieve their

financial goals (90.72%). Only about half of the respondents (49.42%) consider that their finances are significant

sources of worry. In addition, 78.65% of the respondents are certain where their money is spent. 78.65% of the

respondents feel that credit cards are not safe nor risk free. Also, 86.54% of the respondents feel that it is important

to save monthly either in a savings or investment account. 77.49% of the respondents feel capable of handling their

financial future, i.e., buying insurance or investments. 69.61% of the respondents affirm that they do not use credit

cards to make purchases they cannot afford.

The general level of optimism that respondents exhibit in regard to controlling their finances and their financial

situation is not always reflected by their behavior. Surprisingly, only 42% of the respondents compare the receipts of

their purchases to their monthly statements, which is at odds with the notion that most respondents are aware where

their money was spent. 38.75% of the respondents state they have missed important life events in order to work extra

time to pay their bills. 71.92% of the respondents did not receive cash advances from their credit cards in the past

12 months. As far as saving, 59.86% of the respondents confirmed that they contributed to a savings account

regularly and 80.27% of the respondents did not miss one or more credit payments in the past 12 months. Finally,

66.13% of the respondents feel that they keep adequate records of their finances. Only 37.35% of the respondents

pay more than the minimum amount on their credit card.

5.4 Influences on Respondent Financial Literacy

The second subcategory of the survey questions is related to the sources of influence on financial literacy of the

respondents. 61.95% of the respondents indicate they were influenced by their parents who taught them about money

management and savings. Surprisingly, 47.10% of respondents do not follow the actions of their parents as far as

savings and investments are concerned. Only 23.43% of respondents answered affirmatively that they gained most of

their financial literacy at high school. 68.91% of respondents affirmed that they can get any information related to

finances from the Internet. Finally, 69.84% admitted that they follow their instincts when it comes to money and

finances.

Published by Sciedu Press 41 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

64.97% of the respondents admit the need to increase their financial knowledge. Only 37.59% of respondents state

they have attended a class or seminar provided by a financial planning firm or non-profit organization.

5.5 Respondent Perceptions about Retirement Savings

The third subcategory of the survey relates to retirement savings and respondent perceptions about their personal

retirement situation. The majority of the respondents (64.96%) admit that they do not save enough for retirement.

This particular finding seems to be logical given the fact that the respondents are college level students. Only 16.94%

of the respondents do save for retirement. Furthermore, 74.48% of the respondents do not have a positive outlook in

regards to Social Security, asserting that it will not provide them with adequate income during retirement. In addition,

55.45% of the respondents feel that the retirement benefits provided by their employer are inadequate. 32.25% of the

respondents do not plan to work part-time after they retire, while 45.01% do plan to work part-time after they retire.

65.90% of the respondents do not save enough in a private retirement account such as IRA to meet their retirement

goals and only 9.51% of the respondents have such savings.

To the question “I do not save for retirement”, 45.47% of the respondents gave a negative response which suggests

that they do save for retirement. However, 37.36% of the respondents provide a positive answer which shows that

they do not save for retirement. 70.76% of the respondents did not feel confident about the future of Medicare and

Social Security. Only 38.05% of the respondents assert that they save regularly to meet their financial goals. This

particular result contradicts the positive perceptions about respondent financial situation in panel A of table 3. On the

other hand, 69.61% of the respondents do not plan to live with their children when they retire. Only 42.92% of the

respondents have an understanding of the different retirement plans available to them and 71.93% of the respondents

feel they need more information/education related to retirement. In addition, 35.50% of the respondents do not trust

private companies providing retirement accounts, while 41.30% felt neutral about them. 62.88% of the respondents

think that the government should provide more retirement choices than Social Security. Finally, only 25.29% of the

respondents agree that having insurance coverage is adequate retirement coverage, while 52.20% disagree.

6. Analysis of Results

The survey results from the college student respondents on their perceptions concerning their personal financial

situation showed that the majority of them tend to have positive attitudes toward their current financial situation and

seem to be in control of their finances. However, the optimistic responses regarding the ability to control their

current financial situation are not always supported by their behavior.

The second subcategory of survey questions is related to the sources of influence on financial literacy of the

respondents. Most of the respondents indicate that their personal financial behaviors are influenced by their parents,

siblings or relatives. In addition, they rely on getting financial information from online sources. Most of them

admitted that they follow their instincts when it comes to money and finance decisions. The above-referenced

responses strongly suggest that universities need to assume the role of teaching adequate personal financial

management to students.

The third subcategory of the survey relates to retirement savings and respondent perceptions about their personal

retirement situation. The majority of the respondents disclose that they do not save enough money for retirement. In

part, this response can be explained by the fact that the respondents are college students. The respondents feel they

need more information or education related to retirement and think that the government should provide more

retirement options than just Social Security. The respondents need to learn about the characteristics of employer

401(k) plans, choose what to invest in, and decide how much and where to invest. Most of the respondents feel that

they need more information or education related to retirement.

7. Conclusions

Financial literacy and behavioral biases often reflect contradictions among many of our traditional college age

students. Financial literacy includes understanding how to balance a personal budget, manage credit cards, control

debt payments, and ensure adequate retirement funds. We find that the majority of our respondents have the basic

tools necessary to make sound short-term financial decisions. However, their financial literacy does not always

translate into sound financial behavior.

The lack of knowledge about retirement planning and saving among college students is also concerning. This issue

is exacerbated by the fact that most of the students surveyed tend to rely on instincts when making financial

decisions. This would suggest that even with additional formal retirement education classes, many would choose to

rely on instinct rather than planning and analysis to make one of the largest investment decisions of their lifetime.

Published by Sciedu Press 42 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Even among college students, we observe the need to develop programs that can do more than impart the necessary

knowledge to make sound short and long run financial decisions. For financial education programs to be effective,

they must provide knowledge and affect behavior. Further research on this topic should be geared toward

determining best practices aimed at altering financial behavior. A college setting lends itself to an experimental

research design that could help determine which tactics are most useful in getting students to make sound short and

long run financial decisions.

References

Agarwal, S., Amromin, G., Ben-David, I., Chomsisengphet, S. & Evanoff, D.D. (2009). Do Financial Counseling

Mandates Improve Mortgage Choice Performance? Evidence from a Legislative Experiment. Fisher College of

Business Working Paper 2008-03-019.

Bernheim, B. D. (1988). Social Security Benefits: An Empirical Study of Expectations and Realizations, in Rita

Ricardo-Campbell and Edward P. Lazear (eds.), Issues in Contemporary Retirement, Stanford, CA: Hoover

Institution Press. Stanford, pp. 312-345.

Bucks, B. & Pence K. (2006). Do Homeowners Know Their House Value and Mortgage Terms? FEDS Working

Paper No. 2006-03. Washington, D.C.: Board of Governors of the Federal Reserve System.

Chen, H. & Volpe, R. P. (1998). An analysis of personal financial literacy among college student. Financial Services

Review, 7, 107-128. https://doi.org/10.1016/S1057-0810(99)80006-7

Danes, S. M. & Hira, T. K. (1987). Money management knowledge of college students. The Journal of Student

Financial Aid, 17(1), 4-16.

Financial Literacy & Education Commission (2006). Taking ownership of the future: The national strategy for

financial literacy. Washington D.C., Author.

Gustman, A. L. & Steinmeier T. L. (2005). Imperfect Knowledge of Social Security and Pensions. Industrial

Relations, 44(2), 373-397. https://doi.org/10.1111/j.0019-8676.2005.00389.x

Hilgert, M. A. & Hogarth, J. M. (2003). Household financial management: The connection between knowledge and

behavior. Federal Reserve Bulletin, July, 309- 322.

Kinzie, S. (2007). Money on the line during these classes: Colleges teach financial basics. Washington Post.

Retrieved May 1, 2007 from

http://www.washingtonpost.com/wpdyn/content/article/2007/03/29/AR2007032902361.html.

Lusardi, A. & Mitchell O.S. (2006). Financial Literacy and Planning: Implications for Retirement Wellbeing.”

Pension Research Council Working Paper No. 1.

Lusardi, A. & Mitchell O.S. (2007a). Baby Boomer Retirement Security: The Roles of Planning, Financial Literacy,

and Housing Wealth. Journal of Monetary Economics, 54, 205-224.

https://doi.org/10.1016/j.jmoneco.2006.12.001

Lusardi, A. & Mitchell O.S. (2007b). Financial Literacy and Retirement Planning: New Evidence From the Rand

American Life Panel. Michigan Retirement Research Center WP 2007-157.

Lusardi, A., Mitchell O.S. & Curto V. (2009a). Financial Literacy Among the Young: Evidence and Implications for

Consumer Policy. Pension Research Council Working Paper No. 2009-09. Philadelphia, PA: The Pension

Research Council.

Lusardi, A., Mitchell O.S. & Curto V. (2009b). Financial Literacy and Financial Sophistication Among Older

Americans. NBER Working Paper No. 15469, November.

Mandell, L. (2004). Financial Literacy: Are we improving? Results of the 2004 nationalJump$tart Coalition survey.

Washington, DC: Jump$tart Coalition.

Mitchell, O. S. (1988). Worker Knowledge of Pension Provisions. Journal of Labor Economics, 6, 21-39.

https://doi.org/10.1086/298173

Mason, C. L. J. & Wilson, R. M. S. (2000). Conceptualizing Financial Literacy. Business School Research Series.

Paper 2000: 7. UK: Loughborough University.

Volpe, R. P., Chen, H. & Liu, S. (2006). An Analysis of the Importance of Personal Finance Topics and the Level of

Knowledge Possessed by Working Adults.” Financial Services Review, 15, 81-96.

Published by Sciedu Press 43 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Volpe, R. P., Chen H. & Pavlicko, J. J. (1996). Personal investment literacy among college students: a survey.

Financial Practice and Education, 6(2), 86-94.

Van Rooij, M., Lusardi, A. & Alessie, R. (2011), Financial Literacy and Stock Market Participation. Journal of

Financial Economics, 101 (2), 449-472. https://doi.org/10.1016/j.jfineco.2011.03.006

APPENDIX A: Financial Literacy Survey

Demographics of the respondents

1 - What is your gender?

a) Male

b) Female

2 - What is your age group?

a) 18-21

b) 22-29

c) 30-39

d) 40-49

e) Above 50

3-What is your marital status?

a) Married

b) Single

c) Separated/Divorced

d) Living with a partner

e) Widowed

4-What is your ethnicity?

a) White

b) Hispanic or Latino

c) Black or African American

d) Native American or American Indian

e) Asian / Pacific Islander

f) Other

5-What’s your academic standing?

a) Freshman

b) Sophomore

c) Junior

d) Senior

e) Other

6 – What is your major?

a) Accounting

b) Finance

c) CIS/EIS

d) Management

e) Marketing

Published by Sciedu Press 44 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

f) General Business

g) Insurance Management

h) Undecided/No Major

i) Other

7 – What is your employment status?

a) Employed full-time

b) Employed part-time

c) Small business owner, or self-employed

d) Unemployed looking for a job

e) Unemployed full time student

8-Which best describes your income last year (not including student loans)?

a) Below $9,999

b) $10,000-$19,999

c) $20,000-$29,999

d) $30,000-$39,999

e) $40,000 or more

9-What’s the highest level of schooling your father completed

a) Less than high school

b) High school or equivalent

c) Associate/community college degree

d) Bachelor's degree

e) Masters or above

10-What’s the highest level of schooling your mother completed

a) Less than high school

b) High school or equivalent

c) Associate/community college degree

d) Bachelor's degree

e) Masters or above

11-How much do you estimate you owe on all debts including credit cards, student loans and other debts? (Do not

include mortgage)

a) $0

b) $1 – 4999

c) $5000-$9999

d) $10,000 - $19,999

e) $20,000 - $39,999

f) $40,000 or more

g) Don't know

12-What is your GPA?

a) Below 1

b) 1.01-2.0

c) 2.01-3.0

d) 3.01-4.0

Published by Sciedu Press 45 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Financial Literacy Background Information

1-Where did you gain most of your knowledge about managing money?

a) At home from my parents.

b) Learning on my own over time.

c) School coursework.

d) From friends and relatives.

e) Other Please specify:

2- Suppose you saved $5000 for your college expenses. Which of the following is the safest place for storing your

money?

a) At home.

b) In a savings account at a bank.

c) Investing in the stock market.

d) Investing in the bond market.

3-Your take-home pay from your job is less than the total amount you earn. Which of the following best describes

what is taken out of your total pay?

a) Social Security and Medicare contributions.

b) Federal income tax, property tax, Medicare and Social Security contributions.

c) Federal income tax, Social Security and Medicare contributions.

d) Federal income tax, sales tax, and Social Security contributions.

4-Which of the following statements best describes your credit history/record related rights and issues?

a) Your credit record can be checked once a year for free.

b) You cannot view your credit record unless provided to you by a financial institution/bank.

c) All credit records are the property of the U.S. government and access is only available to law enforcement

agencies and financial institutions.

d) You can only access your records only if you are turned down for credit based on a credit report.

5-You and your best friend are the same age. At age 25, you began saving $2,000 a year in a retirement account that

earns a 7% return (compounded annually) while your friend saved nothing. At age 50, your friend realized he needed

money for retirement and started saving $4,000 per year in an account that provided the same return as yours while

you kept saving $2,000. Who will have the most money in their account by age 75?

a) You.

b) Your friend.

c) You and your friend would have the same amount.

d) Cannot be determined.

Published by Sciedu Press 46 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

Perceptions about Financial Knowledge and Attitudes

Directions: Circle the number corresponding to your level of agreement or disagreement with each statement.

Level of Agreement

Strongly No Strongly Circle One

Disagre Disagree Opinion Agree Agree Level of Agreement

-2 -1 0 +1 +2 Disagree Agree

A. Perceptions about personal financial situation

1. I feel in control of my financial situation. -2 -1 0 +1 +2

2. I feel capable of using my future income to achieve my financial goals. -2 -1 0 +1 +2

3. My finances are a significant source of worry or hassle to me. -2 -1 0 +1 +2

4. I am certain about where my money is spent. -2 -1 0 +1 +2

5. I feel credit cards are safe and risk free. -2 -1 0 +1 +2

6. I feel putting away money each month for savings or investments is important. -2 -1 0 +1 +2

7. I feel capable of handling my financial future (i.e. buying insurance or investments).-2 -1 0 +1 +2

8. I compare my receipts of purchases to my monthly statements. -2 -1 0 +1 +2

9. I use credit cards to make purchases that I can't afford. -2 -1 0 +1 +2

10. I miss important life events to work extra hours to pay bills and other expenses. -2 -1 0 +1 +2

11. I received cash advances from my credit card in the past 12 months. -2 -1 0 +1 +2

12. I contribute to a savings account regularly. -2 -1 0 +1 +2

13. I missed one or more credit card payments in the past 12 months. -2 -1 0 +1 +2

14. I keep adequate records of my finances -2 -1 0 +1 +2

15. I always pay more than the minimum amount on my credit card. -2 -1 0 +1 +2

B. Influences on Financial Literacy

1. My parents taught me about money management and savings. -2 -1 0 +1 +2

2. I read to increase my financial knowledge. -2 -1 0 +1 +2

3. I gained most of my knowledge about finances in high school. -2 -1 0 +1 +2

4. I follow my parents as far as savings and investments are concerned. -2 -1 0 +1 +2

5. I attended a class or seminar provided by a financial planning firm. -2 -1 0 +1 +2

6. I attended a financial literacy seminar organized by non-profit organization. -2 -1 0 +1 +2

7. I can get any information I want related to finances from the Internet. -2 -1 0 +1 +2

8. I follow my instincts when it comes to money and finances. -2 -1 0 +1 +2

Retirement Related Questions

A. Perceptions about Retirement Savings

1. I save enough for retirement. -2 -1 0 +1 +2

2. Social Security will provide me with an adequate amount of retirement income. -2 -1 0 +1 +2

3. The retirement benefits provided by my employer are adequate. -2 -1 0 +1 +2

4. I plan to work part-time after I retire. -2 -1 0 +1 +2

5. I save enough in a private retirement account such as IRA to meet my retirement goals -2 -1 0 +1 +2

6. I do not save for retirement. -2 -1 0 +1 +2

Published by Sciedu Press 47 ISSN 1927-5986 E-ISSN 1927-5994

http://afr.sciedupress.com Accounting and Finance Research Vol. 8, No. 1; 2019

7. I feel confident about the future of Social Security and Medicare. -2 -1 0 +1 +2

8. I save enough regularly to meet my financial goals -2 -1 0 +1 +2

9. I will live with my children when I retire. -2 -1 0 +1 +2

10. I understand the different retirement plans available to me. -2 -1 0 +1 +2

11. I feel that I need more information/education related to retirement. -2 -1 0 +1 +2

12. I do not trust private companies providing retirement accounts. -2 -1 0 +1 +2

13. I think the government should provide citizens with more retirement choices other than Social Security.

-2 -1 0 +1 +2

14. I think having life insurance coverage is adequate retirement coverage. -2 -1 0 +1 +2

Is there any additional comments or concerns you want to address or add to your answers that illustrates better your

savings for retirement?

Published by Sciedu Press 48 ISSN 1927-5986 E-ISSN 1927-5994

View publication stats

You might also like

- Public No More: A New Path to Excellence for America’s Public UniversitiesFrom EverandPublic No More: A New Path to Excellence for America’s Public UniversitiesNo ratings yet

- Effectsofattitudeandbackground IJMDocument16 pagesEffectsofattitudeandbackground IJMkringNo ratings yet

- Is University Worth It? Essential Information about Employment Outcomes for GraduatesFrom EverandIs University Worth It? Essential Information about Employment Outcomes for GraduatesNo ratings yet

- Vol 7 Num2 107Document23 pagesVol 7 Num2 107ceszBigHit BabiesssNo ratings yet

- Contributing Factorsof Students Financial Literacyina State UniversityinDocument10 pagesContributing Factorsof Students Financial Literacyina State UniversityinSnitchNo ratings yet

- Financial Literacy Among Undergraduate Students Empirical Evidence From GhanaDocument17 pagesFinancial Literacy Among Undergraduate Students Empirical Evidence From GhanaVichy PattiasinaNo ratings yet

- Financial Literacy A Psychologist's Perspective OnDocument6 pagesFinancial Literacy A Psychologist's Perspective OnEva ShaNo ratings yet

- Financial Literacy in Senior High SchoolDocument30 pagesFinancial Literacy in Senior High Schoolpeter vander100% (7)

- Financial Literacy Among University StudentsDocument6 pagesFinancial Literacy Among University StudentsMehedi HasanNo ratings yet

- Paper 104Document13 pagesPaper 104Ryza Bernadette MuzonesNo ratings yet

- THESISSDocument42 pagesTHESISSPatrick De GuzmanNo ratings yet

- SSRN Id2191606Document54 pagesSSRN Id2191606ebdscholarship2023No ratings yet

- Journal of The Japanese and International Economies: Tetsuya Kawamura, Tomoharu Mori, Taizo Motonishi, Kazuhito OgawaDocument19 pagesJournal of The Japanese and International Economies: Tetsuya Kawamura, Tomoharu Mori, Taizo Motonishi, Kazuhito OgawaNguyễn Việt TùngNo ratings yet

- Phillips2022 Phillips2022Document15 pagesPhillips2022 Phillips2022irfandi buamonabotNo ratings yet

- Innovasion Vol 5 Issue 2-6-13Document8 pagesInnovasion Vol 5 Issue 2-6-13Princess MarielleNo ratings yet

- Financial Capability Literacy Behavior and DistresDocument21 pagesFinancial Capability Literacy Behavior and DistresMariene Thea DimaunahanNo ratings yet

- Determinantspaper PDFDocument8 pagesDeterminantspaper PDFMayann SaleNo ratings yet

- College Students and Financial LiteracyDocument8 pagesCollege Students and Financial LiteracyRandy AninditoNo ratings yet

- EBM Chapter 2Document6 pagesEBM Chapter 2GenieNo ratings yet

- Financial Literacy Among The YoungDocument23 pagesFinancial Literacy Among The YoungJulio César SilvaNo ratings yet

- Medrano PRDocument10 pagesMedrano PRRhealynMarananNo ratings yet

- Education Sciences: Managing Personal Finance Literacy in The United States: A Case StudyDocument11 pagesEducation Sciences: Managing Personal Finance Literacy in The United States: A Case StudyYuslia Nandha Anasta SariNo ratings yet

- Personal Finance Knowledge Level Among Senior High School Students in Cape Coast Metropolis of GhanaDocument6 pagesPersonal Finance Knowledge Level Among Senior High School Students in Cape Coast Metropolis of GhanainventionjournalsNo ratings yet

- An Analysis of Personal Financial Literacy Among College StudentsDocument22 pagesAn Analysis of Personal Financial Literacy Among College StudentsMade WillyNo ratings yet

- Allgood 2015Document23 pagesAllgood 2015Laud Shawn Agyekum DonkorNo ratings yet

- Financial Stress and Hardship Among Young AdultsDocument29 pagesFinancial Stress and Hardship Among Young AdultsKristina XuNo ratings yet

- Kokiii ResearchcDocument41 pagesKokiii ResearchckrissanglimbagoNo ratings yet

- Financial LiteracyDocument10 pagesFinancial LiteracyBehroozNo ratings yet

- Presentation DefenseDocument28 pagesPresentation DefenseynotusakiNo ratings yet

- The Impact of Financial Literacy On Budgeting Management Among Abm StudentsDocument12 pagesThe Impact of Financial Literacy On Budgeting Management Among Abm StudentsDatu Abdullah Sangki MpsNo ratings yet

- SSRN Id923448Document21 pagesSSRN Id923448Kersten BarnedoNo ratings yet

- FINANCIAL LITERACY IMPACT ON STUDENTSDocument27 pagesFINANCIAL LITERACY IMPACT ON STUDENTSJohn kinder Basilio100% (1)

- Financial Literacy, Financial Education and Downstream Financial BehaviorsDocument103 pagesFinancial Literacy, Financial Education and Downstream Financial Behaviorsfabianmauricio482No ratings yet

- An Analysis of Personal Financial Lit Among College StudentsDocument22 pagesAn Analysis of Personal Financial Lit Among College StudentsRamanarayana BharadwajNo ratings yet

- Course: Business Research MethodsDocument9 pagesCourse: Business Research MethodsBhuvnesh KumawatNo ratings yet

- BRM ReportDocument31 pagesBRM ReporthannNo ratings yet

- Ej1323284 PDFDocument14 pagesEj1323284 PDFmia guinooNo ratings yet

- 1.Management-Financial Literacy of Himachal Pradesh-Karan GuptaDocument14 pages1.Management-Financial Literacy of Himachal Pradesh-Karan GuptaImpact JournalsNo ratings yet

- Global RRL of AbesnteeismDocument4 pagesGlobal RRL of AbesnteeismelijahjosephhmesadaNo ratings yet

- Financial Literacy Impacts Likelihood of Over-IndebtednessDocument32 pagesFinancial Literacy Impacts Likelihood of Over-IndebtednessLucia ENo ratings yet

- Annamaria Lusardi - Financial Literacy - An Essential Tool For Informed Consumer ChoiceDocument30 pagesAnnamaria Lusardi - Financial Literacy - An Essential Tool For Informed Consumer ChoiceEsteban MuñozNo ratings yet

- Financialliteracy ManuscriptDocument29 pagesFinancialliteracy ManuscriptArvin RescatorNo ratings yet

- 23-Article Text-23-1-10-20170315Document12 pages23-Article Text-23-1-10-20170315Marlon CaldaNo ratings yet

- Chapter 1 Research IVYDocument22 pagesChapter 1 Research IVYPrincess IvyNo ratings yet

- In Partial Fulfillment of The Requirements in Practical Research 2Document27 pagesIn Partial Fulfillment of The Requirements in Practical Research 2John kinder BasilioNo ratings yet

- IJIRK-8.08.02.SeniorHighSchoolLeanersFinancialLiteracyandNumeracyACorrelationalStudypdfDocument14 pagesIJIRK-8.08.02.SeniorHighSchoolLeanersFinancialLiteracyandNumeracyACorrelationalStudypdfeuginemagturocaststudentNo ratings yet

- Financial LiteracyDocument43 pagesFinancial LiteracyCoke HampaihNo ratings yet

- 2017 An Analysis of The Factors Affecting The Spending and Saving Habits of College Students Samantha Villanueva Skidmore CollegeDocument25 pages2017 An Analysis of The Factors Affecting The Spending and Saving Habits of College Students Samantha Villanueva Skidmore Collegespongebob squarepantsNo ratings yet

- RRL AgeDocument5 pagesRRL AgeJan AbigailNo ratings yet

- Chapter IDocument30 pagesChapter INow OnwooNo ratings yet

- Financial LiteracyDocument16 pagesFinancial LiteracyQuang100% (1)

- Read and Writing RRLDocument11 pagesRead and Writing RRLArturo TJ PacificadorNo ratings yet

- Effect of Financial ProblemDocument18 pagesEffect of Financial ProblemMacahia Jomar73% (26)

- Chapter - Ii Review of LiteratureDocument49 pagesChapter - Ii Review of Literaturepooja shandilyaNo ratings yet

- Nonchalant sDocument16 pagesNonchalant sPinky Dela Cruz AballeNo ratings yet

- Making The Dough and Knowing How To Spend It - Students UnderstanDocument36 pagesMaking The Dough and Knowing How To Spend It - Students UnderstanThu HươngNo ratings yet

- Journal of Advanced Computing and Communication Technologies (ISSNDocument5 pagesJournal of Advanced Computing and Communication Technologies (ISSNzoe regina castroNo ratings yet

- Review of Related LiteratureDocument2 pagesReview of Related LiteraturePrincess Regidor100% (1)

- The Impact of Financial Literacy Education On SubsDocument11 pagesThe Impact of Financial Literacy Education On SubsSVPSNo ratings yet

- Journal of Consumer Affairs - 2023 - Phung - The Role of Learning Motivation On Financial Knowledge Among VietnameseDocument35 pagesJournal of Consumer Affairs - 2023 - Phung - The Role of Learning Motivation On Financial Knowledge Among Vietnamesebayu prayogaNo ratings yet

- ATM Claim FormDocument1 pageATM Claim FormJm VenkiNo ratings yet

- Unit 2 Branch AccountsDocument37 pagesUnit 2 Branch Accountsuday20051110No ratings yet

- FINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsDocument11 pagesFINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsAmie Jane MirandaNo ratings yet

- Case Capital BudgetingDocument10 pagesCase Capital Budgetingvinagoya100% (1)

- FM II Assignment 6 W22Document1 pageFM II Assignment 6 W22Farah ImamiNo ratings yet

- Golden Gate Colleges Senior High School Department: The Problem and Its BackgroundDocument49 pagesGolden Gate Colleges Senior High School Department: The Problem and Its BackgroundKimberly BanuelosNo ratings yet

- ListDocument8 pagesListLuis RodríguezNo ratings yet

- Compilation of Material Findings On 2013 AFS of Financing CompaniesDocument5 pagesCompilation of Material Findings On 2013 AFS of Financing CompaniesJuan FrivaldoNo ratings yet

- MATHINVS - Simple Annuities 3.6Document7 pagesMATHINVS - Simple Annuities 3.6Kathryn SantosNo ratings yet

- Risks in Foreign ExchangeDocument19 pagesRisks in Foreign ExchangeDivya BhadriNo ratings yet

- Interest On Drawings PDFDocument5 pagesInterest On Drawings PDFNaitik ChawlaNo ratings yet

- Project Financing and Verticalization in Infrastructure Project Evaluation. A Case Study of AbengoaDocument25 pagesProject Financing and Verticalization in Infrastructure Project Evaluation. A Case Study of AbengoaVivian Nwanze AdamolekunNo ratings yet

- Commercial Private Equity Now Provides Transaction Evaluation Within 24 Hours So Their Clients Can Close The Deal Within DaysDocument4 pagesCommercial Private Equity Now Provides Transaction Evaluation Within 24 Hours So Their Clients Can Close The Deal Within DaysPR.comNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- Pro Forma Balance Sheet Template: Company NameDocument5 pagesPro Forma Balance Sheet Template: Company NamePhương ĐinhNo ratings yet

- Inflation Is The Decline of Purchasing Power of A Given Currency Over TimeDocument2 pagesInflation Is The Decline of Purchasing Power of A Given Currency Over TimeMidz SantayanaNo ratings yet

- TOP 6 MONEY MARKET INSTRUMENTSDocument6 pagesTOP 6 MONEY MARKET INSTRUMENTSNur ShahiraNo ratings yet

- 1MCL FormIEPF 2 2013 2014 2020Document319 pages1MCL FormIEPF 2 2013 2014 2020Harsha ReddyNo ratings yet

- Financial System - Introduction ExplainedDocument31 pagesFinancial System - Introduction ExplainedVaidyanathan RavichandranNo ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- BoeingDocument10 pagesBoeingSwathiNo ratings yet

- Monetary Policy - Objectives, Tools, and Types of Monetary PoliciesDocument3 pagesMonetary Policy - Objectives, Tools, and Types of Monetary PoliciesVincentNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisHema LathaNo ratings yet

- PPT7-Elimination of Unrealized Gains and Losses On Intercompany Sales of Plant and PropertyDocument50 pagesPPT7-Elimination of Unrealized Gains and Losses On Intercompany Sales of Plant and PropertyRifdah SaphiraNo ratings yet

- Sensitivity AnalysisDocument5 pagesSensitivity AnalysisMohsin QayyumNo ratings yet

- ARC-FAR May 2022 Batch - 1st PreboardDocument11 pagesARC-FAR May 2022 Batch - 1st PreboardjoyhhazelNo ratings yet

- Amortization and Sinking FundDocument27 pagesAmortization and Sinking FundKelvin BarceLonNo ratings yet

- The Will to Go Beyond: Faysal Bank's 2010 Annual ReportDocument541 pagesThe Will to Go Beyond: Faysal Bank's 2010 Annual ReportAnnie DollNo ratings yet

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (86)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 4.5 out of 5 stars4.5/5 (23)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (796)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (708)

- Think BIG and Kick Ass in Business and LifeFrom EverandThink BIG and Kick Ass in Business and LifeRating: 4.5 out of 5 stars4.5/5 (236)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayFrom EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayRating: 5 out of 5 stars5/5 (42)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- The Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellFrom EverandThe Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellRating: 5 out of 5 stars5/5 (6)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)