Professional Documents

Culture Documents

Wq2 Topics 2902 To 2904

Wq2 Topics 2902 To 2904

Uploaded by

johnlloydcarrillo1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wq2 Topics 2902 To 2904

Wq2 Topics 2902 To 2904

Uploaded by

johnlloydcarrillo1Copyright:

Available Formats

REY OCAMPO ONLINE!

FINANCIAL ACCOUNTING AND REPORTING

WEEKLY QUIZ NO. 2 – TOPICS 2902 TO 2904 OCTOBER 2020 CPALE

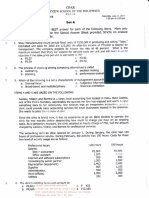

MULTIPLE CHOICE Dec. 02 Sold 300 bicycles for P1,200 each.

03 Five bicycles were returned by a customer.

1. Which of the following items should be included in a They had originally cost P820 each and were

company's inventory at the statement of financial sold for P1,200 each.

position date? 09 Purchased 55 bicycles at P910 each.

A. Goods in transit which were purchased f.o.b. 13 Purchased 76 bicycles at P960 each.

destination. 15 Sold 86 bicycles for P1,350 each.

B. Goods received from another company for sale on 16 Returned one damaged bicycles to the

consignment. supplier. This bicycle had been purchased on

C. Goods sold to a customer which are being held for 9 December.

the customer to call for at his or her convenience. 22 Sold 60 bicycles for P1,250 each.

D. None of these. 26 Purchased 72 bicycles at P980 each.

29 Two bicycles, sold on 22 December, were

2. Which of the following would not be included in the returned by a customer. The bicycles were

cost of work in process inventory? badly damaged so it was decided to write

A. Cost of electricity to operate factory equipment them off. They had originally cost P910 each.

B. Maintenance costs of factory equipment

C. Depreciation on office equipment in the sales 5. The cost of goods sold for the month of December

manager's office using moving average method is (Round unit costs to

D. Depreciation on factory equipment the nearest peso)

A. P367,230 C. P366,320

3. The cost of inventories of items that are not ordinarily B. P365,410 D. P372,725

interchangeable shall be assigned by using

A. Specific identification of their individual costs 6. The cost of goods sold for the month of December

B. First-in, first-out (FIFO) using FIFO method is

C. Weighted average cost formula A. P367,230 C. P366,320

D. Any of these B. P365,410 D. P372,725

4. Which of the following is incorrect regarding the 7. How should sales staff commission be dealt with when

implications of COVID-19 in accounting for valuing inventories at the lower of cost and net

inventories? realizable value (NRV), according to PAS2 Inventories?

A. It might be necessary to write-down inventories to A. Ignored

net realizable value. B. Added to cost

B. Reduced production might affect the extent to C. Deducted in arriving at NRV

which overheads can be included in the cost of D. Deducted from cost

inventory.

C. Entities should assess the significance of any 8. The net realizable value of the quantity of inventory

write-downs and whether they require disclosure held to satisfy firm sales or service contracts is based

in accordance with PAS 2. on the

D. Capitalization of borrowing costs on inventories A. Contract price.

that are manufactured in large quantities on a B. General selling prices.

repetitive basis may need to be suspended. C. Quoted prices in an active market for identical

assets.

D. Quoted prices in an active market for similar

Use the following information for the next two questions. assets.

Orang Dampuan Co. wholesales bicycles. It uses the

9. According to the net method, which of the following

perpetual inventory system. The company's reporting

items should be included in the cost of inventory?

date is December 31. At December 1, inventory on hand

Freight costs Purchase discounts not taken

consisted of 350 bicycles at P820 each and 43 bicycles at

A. Yes No

P850 each. During the month of December, the following

B. Yes Yes

inventory transactions took place (all purchase and sales

C. No Yes

transactions are on credit):

D. No No

Page 1 of 4 facebook.com/reyocampo.ol.3 WQ2

REY OCAMPO ONLINE

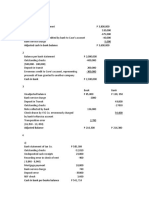

10. On November 20, 2020, Hylos Corporation entered SITUATIONAL

into a non-cancellable contract to purchase P100,000

of inventory on January 15, 2021. The value of the Information relevant to five different companies follows.

inventory on December 31, 2020, Hylos’ year end,

was P90,000. What amount should be reported on • The following figures relate to Myra Corp.’s inventory

the statement of financial position at December 31 held at 31 March 2020:

related to this purchase commitment? Product A Product B

A. P10,000 estimated liability on purchase Units held 2,000 5,000

commitment Cost per unit P14 P16

B. P100,000 accounts payable Selling price P17 P20

C. P90,000 purchase commitment liability

D. P90,000 inventory Modifications costing P5 per unit would need to be

made to product A to achieve the selling price of P17.

11. Which of the following is an agricultural activity?

A. Ocean fishing • On June 30, 2020, a flash flood damaged the

B. Deforestation warehouse and factory of Entity P, completely

C. Fish farming destroying the work in process inventory. There was

D. All of the above no damage to either the raw materials or finished

goods inventories. A physical inventory taken after

12. Which of the following is not a biological asset? the flood revealed the following valuations:

A. Sheep Finished Goods P112,000

B. Trees in a timber plantation Work-in-process 0

C. Dairy cattle Raw Materials 52,000

D. Sugar

The inventory on January 1, 2020, consisted of the

13. Which statement is incorrect regarding PFRS 13? following.

A. It defines fair value. Finished Goods P120,000

B. It sets out in a single PFRS a framework for Work-in-process 115,000

measuring fair value. Raw Materials 42,500

C. It requires disclosures about fair value P277,500

measurements.

D. It identifies the items that should be measured at A review of the books and records disclosed that the

fair value. gross profit margin historically approximated 34% of

sales. The sales for the first 6 months of 2020 were

14. Entity A had a plantation forest that is likely to be P428,000. Raw materials purchases were P96,000.

harvested and sold in 30 years. The income should be Direct labor costs for this period were P130,000, and

accounted for in the following way: manufacturing overhead has historically been applied

A. No income should be reported until first harvest at 60% of direct labor.

and sale in 30 years.

B. Income should be measured annually and • The records of Cloy Corp. report the following data for

reported using a fair value approach that the month of January:

recognizes and measures biological growth. Beginning inventory at cost P 440,000

C. The eventual sale proceeds should be estimated Beginning inventory at sales price 800,000

and matched to the profit and loss account over Purchases at cost 4,500,000

the 30-year period. Initial markup on purchases 2,900,000

D. The plantation forest should be valued every 5 Purchase returns at cost 240,000

years and the increase in value should be shown Purchase returns at sales price 350,000

in the statement of profit or loss. Freight on purchases 100,000

Additional mark up 250,000

15. Costs to sell include Mark up cancellations 100,000

A. Finance costs. Mark down 600,000

B. Income taxes. Mark down cancellations 100,000

C. Transport and other costs necessary to get assets Sales 5,300,000

to a market. Sales allowances 300,000

D. Transfer taxes and duties. Sales returns 400,000

Employee discounts 200,000

Theft and other losses 100,000

Page 2 of 4 facebook.com/reyocampo.ol.3 WQ2

REY OCAMPO ONLINE

• The following pertains to an Organic Corp.’s biological

assets:

Fair value based on unobservable inputs

for the asset P4,900

Quoted price in an active market for

similar asset 5,400

Quoted price in an active market for

identical asset 5,300

Selling price in a binding contract to sell 5,600

Estimated commissions to brokers and

dealers 500

Estimated transport and other costs

necessary to get asset to the market 300

• The following pertains to the biological assets owned

by ABC Farms, Inc.:

Carrying amount at January 1 P459,570

Purchases 26,250

Gain arising from changes in fair value

less costs to sell attributable to

physical changes 15,350

Gain arising from changes in fair value

less costs to sell attributable to

price changes 24,580

Sales 100,700

16. What is the value of Myra Corp.’s inventory held at 31

March 2020 in accordance with PAS 2 Inventories?

A. P104,000 C. P114,000

B. P108,000 D. P124,000

17. Compute the value of Entity P’s work in process

inventory lost on June 30, 2020.

A. P135,020 C. P271,980

B. P119,020 D. P 92,220

18. Using the average retail inventory method, Cloy

Corp.’s ending inventory at cost is

A. P1,024,000 C. P1,536,000

B. P1,472,000 D. P1,664,000

19. Organic Corp.’s biological assets should be valued at

A. P4,800 C. P4,500

B. P4,600 D. P4,400

20. The carrying amount of ABC Farms, Inc.’s biological

assets on December 31 is

A. P425,050 C. P525,750

B. P499,500 D. P451,300

J - end - J

Page 3 of 4 facebook.com/reyocampo.ol.3 WQ2

REY OCAMPO ONLINE

ANSWER KEY:

1. D

2. C

3. A

4. D

5. D

6. A

7. C

8. A

9. A

10. A

11. C

12. D

13. D

14. B

15. D

16. A

17. A

18. B

19. C

20. A

Page 4 of 4 facebook.com/reyocampo.ol.3 WQ2

You might also like

- Case 43 - Flinder Valves and Controls IncDocument9 pagesCase 43 - Flinder Valves and Controls IncDeby Yolanda20% (10)

- Event Planning Business Plan ExampleDocument22 pagesEvent Planning Business Plan Examplemoinahmed990% (1)

- Midland Case CalculationsDocument24 pagesMidland Case CalculationsSharry_xxx60% (5)

- Manual - Intro To Financial Analytics by Kaizen Analytic LLP (Free Webinar) PDFDocument40 pagesManual - Intro To Financial Analytics by Kaizen Analytic LLP (Free Webinar) PDFBabar Ali100% (1)

- Recording Transactions in A Financial Transaction WorksheetDocument1 pageRecording Transactions in A Financial Transaction WorksheetKizaru50% (2)

- Cash and Cash Equivalents - Problem 1-20Document9 pagesCash and Cash Equivalents - Problem 1-20Eunice PolicarpioNo ratings yet

- This Study Resource Was: B. Cost of Designing Products For Specific CustomersDocument6 pagesThis Study Resource Was: B. Cost of Designing Products For Specific CustomersSha RaNo ratings yet

- Corumbrillo Far q1q2Document7 pagesCorumbrillo Far q1q2Leane MarcoletaNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- 1Document2 pages1Your MaterialsNo ratings yet

- Cpa P1Document27 pagesCpa P1Chrisia67% (3)

- Prob Basic AcctDocument3 pagesProb Basic AcctSamuel Ferolino50% (2)

- Answer Key - Chapter 5 - 2020 EditionDocument37 pagesAnswer Key - Chapter 5 - 2020 EditionDaniel DialinoNo ratings yet

- Pizza Delivery Business PlanDocument36 pagesPizza Delivery Business PlanAustin CareloNo ratings yet

- Far FeDocument9 pagesFar FeMark Domingo Mendoza100% (1)

- MTDrill 2Document17 pagesMTDrill 2Cedric Legaspi TagalaNo ratings yet

- CasDocument29 pagesCasJunneth Pearl Homoc0% (1)

- P 1Document8 pagesP 1Ken Mosende TakizawaNo ratings yet

- Financial Accounting Review Problem 1Document16 pagesFinancial Accounting Review Problem 1YukiNo ratings yet

- Chapter 1 Introduction To Cost AccountingDocument9 pagesChapter 1 Introduction To Cost AccountingSteffany RoqueNo ratings yet

- Problem 2Document3 pagesProblem 2Mitch MinglanaNo ratings yet

- TRAPO, Inc. Estimates Its Bad Debt Losses by Aging Its Accounts Receivable. The Aging Schedule ofDocument2 pagesTRAPO, Inc. Estimates Its Bad Debt Losses by Aging Its Accounts Receivable. The Aging Schedule ofAlvinDumanggasNo ratings yet

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsPamela Mae PlatonNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- Chapter 7Document18 pagesChapter 7kathleenNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- 4 InventoriesDocument5 pages4 InventoriesandreamrieNo ratings yet

- A. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDocument13 pagesA. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDanielle Nicole MarquezNo ratings yet

- Q06A Audit of Non Cash AssetsDocument7 pagesQ06A Audit of Non Cash AssetsChristine Jane ParroNo ratings yet

- P1-PB. Sample Preboard Exam PDFDocument12 pagesP1-PB. Sample Preboard Exam PDFAj VesquiraNo ratings yet

- PartnershipDocument6 pagesPartnershipMARJORIE BAMBALANNo ratings yet

- Problems Audit of InvestmentsDocument15 pagesProblems Audit of InvestmentsKm de Leon75% (4)

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Chapter 8 OkDocument37 pagesChapter 8 OkMa. Alexandra Teddy Buen0% (1)

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- 1617 2ndS 1ste EVPeñaDocument9 pages1617 2ndS 1ste EVPeñaShania BuenaventuraNo ratings yet

- PDF ReceivablesDocument6 pagesPDF ReceivablesJanine SarzaNo ratings yet

- $RMJJZ4MDocument5 pages$RMJJZ4MAdam CuencaNo ratings yet

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Document4 pagesSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTONo ratings yet

- Exam Integ ExamDocument10 pagesExam Integ ExamRisalyn BiongNo ratings yet

- FAR.0727 - Cash and Cash EquivalentsDocument7 pagesFAR.0727 - Cash and Cash EquivalentsDenise Abbygale Ganzon100% (1)

- AC - IntAcctg1 Quiz 03 With AnswersDocument3 pagesAC - IntAcctg1 Quiz 03 With AnswersSherri BonquinNo ratings yet

- P3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Document8 pagesP3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Maria LopezNo ratings yet

- FAR-1stPB Exam - 5.21Document9 pagesFAR-1stPB Exam - 5.21NananananaNo ratings yet

- Answer KEY PPEDocument6 pagesAnswer KEY PPExjammerNo ratings yet

- Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation MethodsDocument4 pagesJimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation MethodsAngel Kaye Nacionales JimenezNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Drill#1Document5 pagesDrill#1Leslie BustanteNo ratings yet

- ACC-122 Inventory QuizDocument2 pagesACC-122 Inventory QuizPea Del Monte Añana100% (1)

- Cost AccountingDocument6 pagesCost AccountingValierry VelascoNo ratings yet

- Far TheoriesDocument6 pagesFar TheoriesallijahNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Eto SagoDocument2 pagesEto SagoaleckNo ratings yet

- Chapter 1 The Context of Systems Analysis and Design MethodsDocument5 pagesChapter 1 The Context of Systems Analysis and Design MethodsAlta SophiaNo ratings yet

- This Study Resource Was: FAR EasyDocument9 pagesThis Study Resource Was: FAR EasyPM HauglgolNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Notes in ReceivablesDocument9 pagesNotes in ReceivablesAnj HwanNo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Far - Team PRTC 1stpb May 2023Document8 pagesFar - Team PRTC 1stpb May 2023Alexander IgotNo ratings yet

- Of Alabang: ISO 9001:2015 CERTIFIEDDocument8 pagesOf Alabang: ISO 9001:2015 CERTIFIEDNita Costillas De MattaNo ratings yet

- 1 - CPAR - Audit of Inventory - Theo×ProbDocument5 pages1 - CPAR - Audit of Inventory - Theo×ProbMargaux CornetaNo ratings yet

- F FAR PBFPBOCT19.pdf 93604515Document16 pagesF FAR PBFPBOCT19.pdf 93604515Athena AthenaNo ratings yet

- Accounting: Wilma G. OstanDocument11 pagesAccounting: Wilma G. OstanHelpo BadoyNo ratings yet

- UnleveredDocument7 pagesUnleveredMohammadOmarFaruqNo ratings yet

- Chap 010Document50 pagesChap 010mas azizNo ratings yet

- AUD B41 Final Pre-Board Exam (Questions - Answers)Document13 pagesAUD B41 Final Pre-Board Exam (Questions - Answers)Joanna MalubayNo ratings yet

- Capital Expenditure Formula Excel TemplateDocument3 pagesCapital Expenditure Formula Excel TemplateKSXNo ratings yet

- Partnerships-1Document20 pagesPartnerships-1samuelNo ratings yet

- DCF-Model - TemplateDocument5 pagesDCF-Model - TemplatebysqqqdxNo ratings yet

- LangfieldSmith7e PPT Ch13Document33 pagesLangfieldSmith7e PPT Ch13Bành Đức HảiNo ratings yet

- Theories: Far Eastern University - Manila Quiz No. 1Document6 pagesTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNo ratings yet

- Maybank AR2022 Financial StatementsDocument272 pagesMaybank AR2022 Financial Statementsvikalp.singh.sengarNo ratings yet

- DepreciationDocument11 pagesDepreciationShiela Marie BautistaNo ratings yet

- Ayala Corporation SEC17Q June 2019 PDFDocument78 pagesAyala Corporation SEC17Q June 2019 PDFKeziah YpilNo ratings yet

- Study Material Accountancy 2023-24 - 2Document129 pagesStudy Material Accountancy 2023-24 - 2amrita100% (1)

- 5 - Capital Investment Appraisal (Part-1)Document29 pages5 - Capital Investment Appraisal (Part-1)Fahim HussainNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- Jardine Matheson Holdings LTD Jardine Strategic HoldingsDocument16 pagesJardine Matheson Holdings LTD Jardine Strategic Holdingsvb7ueNo ratings yet

- Chapter 7-Cash Flow Valuation BasicsDocument11 pagesChapter 7-Cash Flow Valuation Basics1954032027cucNo ratings yet

- What Is A Variable Cost?Document4 pagesWhat Is A Variable Cost?Niño Rey LopezNo ratings yet

- Voltamp Transformers: Initiating CoverageDocument12 pagesVoltamp Transformers: Initiating CoverageDarwish MammiNo ratings yet

- Exercice RBDocument61 pagesExercice RBGagAnasNo ratings yet

- File 22 Estimating EV To EBITDA Multiple With Cross HoldingDocument5 pagesFile 22 Estimating EV To EBITDA Multiple With Cross HoldingSagar KansalNo ratings yet

- Quiz Discontinued OperationDocument2 pagesQuiz Discontinued OperationRose0% (1)

- Final Account: With AdjustmentDocument49 pagesFinal Account: With AdjustmentPandit Niraj Dilip Sharma100% (1)

- Treatment of Normal Loss and Abnormal LossDocument3 pagesTreatment of Normal Loss and Abnormal LossBrijesh TrivediNo ratings yet