Professional Documents

Culture Documents

Financial Statement Analysis

Financial Statement Analysis

Uploaded by

Kamal AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis

Financial Statement Analysis

Uploaded by

Kamal AhmedCopyright:

Available Formats

1.

Comparative statement of proposed distribution of asset

STAKEHOLDERS Land AMOUNT Asset VALUE Loan AMOUNT Loan/asset ratio BOOK VALUE BOOK VALUE/ASSET loss in 2020 loss/liability ratio

Noman 222 1800 3351 1.862 1,362 75.67% 57.86 0.017

Zaber 264 2031 3205 1.578 653 32.15% 148.33 0.046

zubair 219 1377 2610 1.895 408 29.63% 50.19 0.019

Talha 243 1884 1218 0.646 828 43.95% -273 -0.224

Noman vai is given two profit making concern NFPL and NWML.

Zaber is given three profit making concern like (TTPL, STML, NFFL), from the 148loss 99 is from fashion.

BUT SSTML and TTPL was initially given to me,why it is taken back.

Talha is given 5 profit making concern.

Whereas i am given only one profit making concern which is dependent on others and where the price is

set by you but in case of competition this price might not be accepted by my buyer.

2. The amount of land is also the lowest for me, and the loan asset ratio is the highest for me.

3. If you check the book value, my asset value is at least 250 crore lesser than any of my brothers , u can

argue that my asset value is lower, but if u check out the book value/asset ratio my value is the lowest

here.

4. If u check out the loss/liability ratio I am in the second position which means my companies are

having more risk than my other two brothers.

5. Regarding product mix I am given only one processing factory (which is loss incurring till date),

whereas all of my brothers are given at least two( two for noman bhai, three for each of other two).

So I can conclude that this is a discriminative distribution of asset, in other words its zulm on me.

Please redistribute them otherwise I will not accept it.

You might also like

- Accounting Analytics Week ThreeDocument5 pagesAccounting Analytics Week Threeburha50% (2)

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANNo ratings yet

- Case Background: Bhupesh Kumar (B18018)Document7 pagesCase Background: Bhupesh Kumar (B18018)Bhupesh KumarNo ratings yet

- Bagal Annexure II in Principle FormatDocument4 pagesBagal Annexure II in Principle FormatRamesh KulkarniNo ratings yet

- Bagal Annexure II in Principle Format PDFDocument4 pagesBagal Annexure II in Principle Format PDFRamesh KulkarniNo ratings yet

- IDFC First Bank LTD Performance Analysis: Total AssetsDocument6 pagesIDFC First Bank LTD Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Market Update 27th November 2017Document1 pageMarket Update 27th November 2017Anonymous iFZbkNwNo ratings yet

- Buy Electrotherm India LTDDocument7 pagesBuy Electrotherm India LTDshashi_svtNo ratings yet

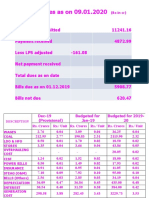

- Power Dues As On 09.01.2020Document2 pagesPower Dues As On 09.01.2020prasi1010No ratings yet

- 4 ProcurementandInventoryDocument20 pages4 ProcurementandInventoryPraddip KumarNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- Assignment On Ratio AnalysisDocument6 pagesAssignment On Ratio AnalysisSurbhî GuptaNo ratings yet

- Provisions and Contingencies Include Provision For TaxDocument6 pagesProvisions and Contingencies Include Provision For TaxSurbhî GuptaNo ratings yet

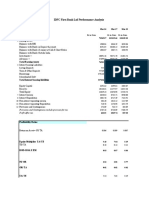

- TVS Motors Credit Risk AnalysisDocument21 pagesTVS Motors Credit Risk AnalysisBharat ChaudharyNo ratings yet

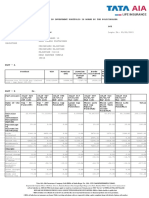

- Tata Motors One PagersDocument1 pageTata Motors One PagersdidwaniasNo ratings yet

- IDFC First Bank LTD Performance Analysis: Total AssetsDocument9 pagesIDFC First Bank LTD Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Current Ratios: InferenceDocument15 pagesCurrent Ratios: InferencesweetyakkuNo ratings yet

- Business Case ChallengeDocument6 pagesBusiness Case ChallengeHafida FifiNo ratings yet

- Assignment Sapm: Company OverviewDocument7 pagesAssignment Sapm: Company OverviewPiyush BhandariNo ratings yet

- Analisis Arus KasDocument7 pagesAnalisis Arus KasKojiro FuumaNo ratings yet

- Rights IssueDocument18 pagesRights Issuemuthum44499335No ratings yet

- DownloadDocument2 pagesDownloadPrachi DubeyNo ratings yet

- Payslip 202305Document1 pagePayslip 202305Kamu NanyakkNo ratings yet

- Chapter - 3 Truing Up For Fy15: 1. Approved V/s ActualsDocument36 pagesChapter - 3 Truing Up For Fy15: 1. Approved V/s Actualsdisha sodaniNo ratings yet

- Stock Analysis of Power Finance CorporationDocument5 pagesStock Analysis of Power Finance CorporationDeepak YadavNo ratings yet

- ValuEngine Weekly Newsletter February 25, 2011Document11 pagesValuEngine Weekly Newsletter February 25, 2011ValuEngine.comNo ratings yet

- Closingrates 202313junDocument19 pagesClosingrates 202313junTabrez IrfanNo ratings yet

- Advanced Excel Cia 1Document4 pagesAdvanced Excel Cia 1Sai Kiran ReddyNo ratings yet

- Vikas Lifecare LTD Financial Results and Price Chart - ScreenerDocument10 pagesVikas Lifecare LTD Financial Results and Price Chart - ScreenerNIrmalya SenguptaNo ratings yet

- JSPL Balance Sheet Analysis 2009Document16 pagesJSPL Balance Sheet Analysis 2009Kaustubh TiwaryNo ratings yet

- Other News:: TEL: TEL Will Not Engage With US Law Firms' Probe UBP: UBP Trims Stocks Rights Offering To Php12BilDocument3 pagesOther News:: TEL: TEL Will Not Engage With US Law Firms' Probe UBP: UBP Trims Stocks Rights Offering To Php12BilELMON RENTASIDANo ratings yet

- Stockmock PositionsDocument16 pagesStockmock Positionskumar mhNo ratings yet

- June 3, 2011: Market OverviewDocument10 pagesJune 3, 2011: Market OverviewValuEngine.comNo ratings yet

- BGD 01-02Document6 pagesBGD 01-02muthum44499335No ratings yet

- Prism Morning Call 11-18-09Document4 pagesPrism Morning Call 11-18-09PrismtradingschoolNo ratings yet

- Corporate Case StudiesDocument68 pagesCorporate Case StudiesAnand RajNo ratings yet

- Band Problem in DR-Utthan 47Document16 pagesBand Problem in DR-Utthan 47Atma Prakash SinhaNo ratings yet

- CERC Fixation of Trading MarginDocument17 pagesCERC Fixation of Trading MarginPranav SharmaNo ratings yet

- Irfan RREDocument7 pagesIrfan RREKarim SirNo ratings yet

- Holdings Long ShortDocument4 pagesHoldings Long Shorthimanshi.rathoreNo ratings yet

- Ratio Analysis: S.ClementDocument32 pagesRatio Analysis: S.ClementJugal ShahNo ratings yet

- Customer Rating Customer Ranking: # Heads Description UOM Target 1st FN - AprDocument39 pagesCustomer Rating Customer Ranking: # Heads Description UOM Target 1st FN - AprrajeshNo ratings yet

- Facts:: Sales 1.194% Cogs Marketing Expense AD & Other Expenses R&DDocument6 pagesFacts:: Sales 1.194% Cogs Marketing Expense AD & Other Expenses R&Dzain10684No ratings yet

- Stockmock PositionsDocument13 pagesStockmock Positionskumar mhNo ratings yet

- YOG Executive SummeryDocument3 pagesYOG Executive SummeryGAURAVAKARNo ratings yet

- Closingrates 202323novDocument20 pagesClosingrates 202323novsana.mba8120No ratings yet

- Risk and ReturnDocument6 pagesRisk and ReturnKaushlesh KumarNo ratings yet

- Vardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGDocument5 pagesVardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGshyamalmishra1988No ratings yet

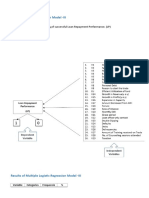

- Multiple Logistic Regression Model-LPDocument7 pagesMultiple Logistic Regression Model-LPmanjushreeNo ratings yet

- Trading Journal by Vipin Mohan Ver2.0Document6 pagesTrading Journal by Vipin Mohan Ver2.0AsifayiroorNo ratings yet

- Financials: The Walt Disney Company (Dis.N) : RevenueDocument5 pagesFinancials: The Walt Disney Company (Dis.N) : RevenueKimberly DyNo ratings yet

- PortfolioDocument14 pagesPortfolioMaritinaNo ratings yet

- Dynamic Asset Allocation Strategy-2Document19 pagesDynamic Asset Allocation Strategy-2AtiaTahiraNo ratings yet

- Energía Neta NRC 2012Document35 pagesEnergía Neta NRC 2012KarenNo ratings yet

- Chul Min Lee HW #1Document1 pageChul Min Lee HW #1Charles LeeNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- Stock Portfolio Tracker V1.0Document21 pagesStock Portfolio Tracker V1.0grayman05No ratings yet

- ITC LTD.: Presented ByDocument12 pagesITC LTD.: Presented BypavanNo ratings yet