Professional Documents

Culture Documents

Tax Exemption of Educational Institutions

Uploaded by

Wendz Gatdula0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

TAX EXEMPTION OF EDUCATIONAL INSTITUTIONS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageTax Exemption of Educational Institutions

Uploaded by

Wendz GatdulaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

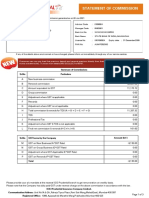

TAX EXEMPTION OF EDUCATIONAL INSTITUTIONS

NON-STOCK, NON-PROFIT PROPRIETARY

(Stock, Non-Profit/Profit)

As amended by RA 11635, the

requirement of “Non-Profit” is now

only applicable to Hospitals

REAL PROPERTY TAX Exempt (RCE, ADE), Consti Exempt (RCE, ADE), Consti

REVENUE TAX Exempt 10%

VAT (Condition: income received as such) Preferential Rate

LBT Sec 30(H), NIRC (Condition: income from unrelated

business or other activity does not

Issue on Use of the income: exceed 50% of the total gross

income)

Last paragraph of Sec 30, income

from property or income from 25% or 20%

activity conducted for profit, Regular Corporate Income Tax

regardless of disposition, is subject if the above condition is not met

to tax.

In DLSU Case, SC ruled that the last

paragraph of Sec 30 is not applicable

to NSNP-EI if the income is ADE for

educational purpose.

Exempt (ADE), Consti

If not ADE, income from activity

conducted for profit is taxable

Issue on Source of the Income:

The Consti did not qualify. Thus, the

income is exempt from taxes and

duties regardless of the source, as

long as ADE use.

VAT Exempt

(Condition: Educational Services

rendered by private schools duly

accredited by DepEd, CHED,

TESDA and government educational

institutions)

Sec 109(1)(H), NIRC

You might also like

- Lumbera Tax TABLEDocument2 pagesLumbera Tax TABLEJohn Matthew CruelNo ratings yet

- CREATE Act lowers taxes to support Philippine businessesDocument3 pagesCREATE Act lowers taxes to support Philippine businesseskaren mariz manaNo ratings yet

- CTA rules St. Luke's hospital not tax exemptDocument2 pagesCTA rules St. Luke's hospital not tax exemptAling KinaiNo ratings yet

- Corporate Income Tax Part 2Document8 pagesCorporate Income Tax Part 2Pilyang SweetNo ratings yet

- CIR vs. DLSUDocument38 pagesCIR vs. DLSUJoshua CuentoNo ratings yet

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreDocument9 pagesRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreAlicia Jane NavarroNo ratings yet

- CREATE Bill RA No. 11534 Final VersionDocument8 pagesCREATE Bill RA No. 11534 Final Versionericka maeNo ratings yet

- C.3. G.R. No. 203514-2017-Commissioner - of - Internal - Revenue - v. - St. LukesDocument16 pagesC.3. G.R. No. 203514-2017-Commissioner - of - Internal - Revenue - v. - St. Lukes0506sheltonNo ratings yet

- 54 TaxBits August-September2020Document18 pages54 TaxBits August-September2020Pearl Caryl Catantan-CadavisNo ratings yet

- 2 Tax Malupit Digest Jais 3rd MeetingDocument17 pages2 Tax Malupit Digest Jais 3rd MeetingDianne ComonNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Corporate TaxpayerDocument1 pageCorporate TaxpayerJP JimenezNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 13-2022 Issued On January 24, 2022 CircularizesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 13-2022 Issued On January 24, 2022 CircularizesKatherine SyNo ratings yet

- Taxation HandoutDocument9 pagesTaxation HandoutTricia mae DingsitNo ratings yet

- CREATE Law lowers corporate income tax ratesDocument5 pagesCREATE Law lowers corporate income tax ratesyejiNo ratings yet

- PROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimDocument16 pagesPROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimXerjiah YuagaNo ratings yet

- CIR v. DLSU - CONSTI IIDocument4 pagesCIR v. DLSU - CONSTI IIJan Chrys MeerNo ratings yet

- 4A Special DCDocument1 page4A Special DCJP JimenezNo ratings yet

- Salient Features: Company-Confidential 26.02.2010Document9 pagesSalient Features: Company-Confidential 26.02.2010Coolvishal AgnihotriNo ratings yet

- Module 9 Inclusions and Exclusions From Gross IncomeDocument10 pagesModule 9 Inclusions and Exclusions From Gross IncomeKurt CyrilNo ratings yet

- RR No. 3-2022Document4 pagesRR No. 3-2022try saguilotNo ratings yet

- LaMitipsJDY - INCOME TAXT, DST, ESTATE TAX, VATDocument5 pagesLaMitipsJDY - INCOME TAXT, DST, ESTATE TAX, VATJohn Dy FlautaNo ratings yet

- DTC - Jay GosraniDocument11 pagesDTC - Jay GosraniJayNo ratings yet

- Due Process and MCITDocument3 pagesDue Process and MCITJean Jamailah TomugdanNo ratings yet

- St. Luke's Medical Center Tax Exemption Case ExplainedDocument7 pagesSt. Luke's Medical Center Tax Exemption Case ExplainedJohnde MartinezNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument15 pages© The Institute of Chartered Accountants of IndiaRobinxyNo ratings yet

- CIR Vs St. Luke'sDocument32 pagesCIR Vs St. Luke'sSzia Darene MartinNo ratings yet

- In Two Minutes: GeneralDocument1 pageIn Two Minutes: Generalmahesh1307No ratings yet

- PM Reyes 2017 Bar SupplementDocument14 pagesPM Reyes 2017 Bar SupplementWayne MirandaNo ratings yet

- CIR v. DLSUDocument32 pagesCIR v. DLSURani MaeNo ratings yet

- Supreme Court Rules Proprietary Non-Profit Hospitals Exempt from Income TaxDocument17 pagesSupreme Court Rules Proprietary Non-Profit Hospitals Exempt from Income TaxOlivia JaneNo ratings yet

- Tax Law Review: CIR vs DLSUDocument3 pagesTax Law Review: CIR vs DLSUAnonymous 5MiN6I78I0No ratings yet

- Taxation - System in IndiaDocument12 pagesTaxation - System in Indiaahil XO1BDNo ratings yet

- Cir V. Dlsu: Tax RemediesDocument18 pagesCir V. Dlsu: Tax Remediesesmeralda de guzmanNo ratings yet

- Direct Tax Code Bill 2010 Personal Tax HighlightsDocument40 pagesDirect Tax Code Bill 2010 Personal Tax HighlightsAbhinanda DasNo ratings yet

- KPMG DTC 2010 Impact It ItesDocument11 pagesKPMG DTC 2010 Impact It ItesGs ShikshaNo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- Changes Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActDocument7 pagesChanges Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActYietNo ratings yet

- Tax Cases by LamosteDocument5 pagesTax Cases by LamosteJade Marlu DelaTorreNo ratings yet

- Republic of the Philippines Supreme Court Rules on Tax Exemption for Non-Profit HospitalsDocument17 pagesRepublic of the Philippines Supreme Court Rules on Tax Exemption for Non-Profit HospitalsDianne YcoNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument15 pages© The Institute of Chartered Accountants of IndiaAnkitaNo ratings yet

- BLT Business Income OnwardsDocument16 pagesBLT Business Income OnwardsAybern BawtistaNo ratings yet

- Summary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoDocument6 pagesSummary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoNievelita OdasanNo ratings yet

- KSA Cabinet Approves Double Tax Treaty With The UAE: in BriefDocument3 pagesKSA Cabinet Approves Double Tax Treaty With The UAE: in BriefRahul MandalNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- 303535-2021-Clarifications On Certain Provisions Of20220324-11-Tltia8Document5 pages303535-2021-Clarifications On Certain Provisions Of20220324-11-Tltia8Anya ForgerNo ratings yet

- Commissioner of Internal Revenue vs. St. Luke's Medical Center, Inc. (GR 195909, September 26, 2012)Document25 pagesCommissioner of Internal Revenue vs. St. Luke's Medical Center, Inc. (GR 195909, September 26, 2012)nnn aaaNo ratings yet

- Commissioner of Internal Revenue vs. St. Luke's Medical Center, Inc. (GR 195909, September 26, 2012) Full TextDocument25 pagesCommissioner of Internal Revenue vs. St. Luke's Medical Center, Inc. (GR 195909, September 26, 2012) Full Textnnn aaaNo ratings yet

- 7 Understanding Taxation in Indonesia 1 PDFDocument13 pages7 Understanding Taxation in Indonesia 1 PDFYlaine Gonzales-PanisNo ratings yet

- Income Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winDocument26 pagesIncome Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winJaydeep DasadiyaNo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- 1601-C July For ApprovalDocument1 page1601-C July For ApprovalJa'maine ManguerraNo ratings yet

- Statement of Commission: Commission Generated As On 26 Jun 2021Document3 pagesStatement of Commission: Commission Generated As On 26 Jun 2021Lalan Kumar SinghNo ratings yet

- Tax XXXXXXDocument27 pagesTax XXXXXXMiltoniusKNo ratings yet

- Aiiim Tax 1 DigestsDocument8 pagesAiiim Tax 1 DigestsJohn Matthew CruelNo ratings yet

- Tax DigestDocument7 pagesTax DigestPhilip UlepNo ratings yet

- MODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSDocument9 pagesMODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSangclaire47No ratings yet

- ATLP - Practice - Questions - Direct Tax - & - International - Taxation PDFDocument86 pagesATLP - Practice - Questions - Direct Tax - & - International - Taxation PDFChanchal MisraNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part J)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part J)John Carlos DoringoNo ratings yet

- Fin Acc Part 2Document6 pagesFin Acc Part 2Jolina cunananNo ratings yet

- This Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)Document5 pagesThis Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)KATHRYN CLAUDETTE RESENTE100% (1)

- Chapter 1 - Introduction To Financial AnalysisDocument42 pagesChapter 1 - Introduction To Financial AnalysisMinh Anh NgNo ratings yet

- Federal Income Tax Computation and DefinitionsDocument42 pagesFederal Income Tax Computation and Definitionsabmo33No ratings yet

- Chapter 6 The Impacts of Tourism and HospitalityDocument15 pagesChapter 6 The Impacts of Tourism and HospitalityGrethel Heart DejerioNo ratings yet

- 2.3.1 Financial Statement PresentationDocument10 pages2.3.1 Financial Statement PresentationRichard Jr RjNo ratings yet

- Analysis and RatioDocument35 pagesAnalysis and RatioJP80% (5)

- Tax Question PaperDocument20 pagesTax Question PaperSAMAR SINGH CHAUHANNo ratings yet

- Chapter 17 Solutions 7eDocument46 pagesChapter 17 Solutions 7epenelopegerhardNo ratings yet

- AC2105 SG07 Presentation 5Document48 pagesAC2105 SG07 Presentation 5Kwang Yi JuinNo ratings yet

- The Nature of Financial Accounting ConventionsDocument6 pagesThe Nature of Financial Accounting ConventionsRui Isaac FernandoNo ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- Arzadon - My Own Learnings and Advocacy (BS Arch 1-3)Document4 pagesArzadon - My Own Learnings and Advocacy (BS Arch 1-3)Moira Nicole ArzadonNo ratings yet

- International Business 300 Exam AnswersDocument19 pagesInternational Business 300 Exam Answersđặng nguyệt minhNo ratings yet

- Fall 2022 Exam Erm GCDocument32 pagesFall 2022 Exam Erm GCSuperswag CollieNo ratings yet

- A Comparative Study On The Financial Performance and Earnings Values of Ultratech Cement and Ramco CementDocument6 pagesA Comparative Study On The Financial Performance and Earnings Values of Ultratech Cement and Ramco CementSushank AgrawalNo ratings yet

- AC213 Ch04 ExerciseSolutionsDocument28 pagesAC213 Ch04 ExerciseSolutionsRezzan Joy Camara MejiaNo ratings yet

- Profit & Loss Statement: PD MitraDocument2 pagesProfit & Loss Statement: PD MitraFaie RifaiNo ratings yet

- CH 11 Income On House PropertyDocument11 pagesCH 11 Income On House PropertyJewelNo ratings yet

- Nelson, Robert, H. - Economics and ReligionDocument2 pagesNelson, Robert, H. - Economics and ReligionsyiraaufaNo ratings yet

- CHAPTER 9 PROBLEMS SOLUTIONDocument7 pagesCHAPTER 9 PROBLEMS SOLUTIONjeanNo ratings yet

- Master CTC Calculator & Salary Hike CalculatorDocument6 pagesMaster CTC Calculator & Salary Hike Calculatorvirag_shahsNo ratings yet

- Non Current Assets Held For SaleDocument31 pagesNon Current Assets Held For SaleKimivy BusaNo ratings yet

- CPA Reviewer FARDocument14 pagesCPA Reviewer FARCristine LetranNo ratings yet

- The Shadow Economy, Its Causes and Its ConsequencesDocument16 pagesThe Shadow Economy, Its Causes and Its ConsequencesCristian BarrosNo ratings yet

- Business Finance - Google Forms - MCQ - Rev3Document24 pagesBusiness Finance - Google Forms - MCQ - Rev3rathaNo ratings yet

- Comparative Income Statement (Examples, Analysis, Format)Document14 pagesComparative Income Statement (Examples, Analysis, Format)Sakthi sNo ratings yet

- Responsibility Accounting LNDocument7 pagesResponsibility Accounting LNzein lopezNo ratings yet

- The Costs of Production: Manzur AhmadDocument20 pagesThe Costs of Production: Manzur AhmadManzur AhmadNo ratings yet