Professional Documents

Culture Documents

Capoa

Uploaded by

jai vanamalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capoa

Uploaded by

jai vanamalaCopyright:

Available Formats

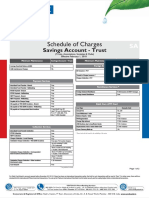

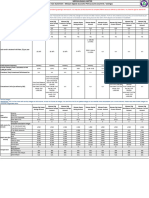

Annexure # 1

AXIS BANK - BUSINESS BANKING

CURRENT ACCOUNT FOR POWER OF ATTORNEY CLIENTS (CAPOA)- Schedule of Charges (w.e.f 30th March 2012)

MONTHLY FREE LIMITS

Cash Transaction Limits(Ad Valorem limit) Non Cash Services(Ad Valorem limit)

Local Cheque Account Maintenance

Monthly Home Branch Non Home Non Home Branch Non Cash Ad Valorem

Collection and Chequebook (free

Product Average Deposit Branch Deposit2 Home Branch Withdrawal Withdrawal3 Limit4 (in

Payments + Fund leaves)

Balance (MAB)1 (in Rs) (in Rs) (in Rs) Rs) Total Free

Transfer

Transactions 5

No cheque book

CAPOA 10,000 Unlimited Unlimited No withdrawal facility Unlimited Unlimited

facility

CHARGES BEYOND FREE LIMITS

Non Maintenance

Cash Transactions Non Cash Services

of MAB Account Maintenance

Local Cheque

Product

Penal Tariff Charges Home Branch Home Branch Non Home Branch Collection and Non Cash Transaction Charges

Non Home Branch Deposit1 Chequebook

( Rs / txn) (Rs) Deposit Withdrawal Withdrawal6 Payments + Fund Transactions ( Rs / txn)

Transfer

CAPOA NIL 500 NIL NA NIL NA Rs.300/per month

NEFT

Free

RTGS

COMMON CHARGES

Other Common Charges

Upto Rs. 1 lac - Rs. 100 per instrument;

Cheques Deposited at any Axis Bank branch for outstation collection

Above Rs. 1 lac - Rs. 200 per instrument (Charges inclusive of postage)

Demand Drafts ( payable at Correspondent Bank locations under Desk Drawing arrangement) Re 1.00/1000 ; Min Rs 25 per DD

Demand Drafts purchased from other banks Actual + Rs 0.50/1000; Min Rs 50 per DD

DD drawn on Axis Bank branches- Cancellation , Reissuance or Revalidation Rs 100/- per instance

DD drawn on Correspondent Bank branches- Cancellation , Reissuance or Revalidation Rs 100/- per instance+ other bank's charges at actuals if any

Signature Verification Certificate Rs 100 per verification

Current Year : Free

Certificate of Balance

Previous year: Rs 200

Retrieval of old records or query More than 1 year old : Rs 100 per record/ query

Less than 1 year old : Rs 500

Account Closure Charges

Older than 1 year : Rs 250

Standing Instructions Free

Stop Payment Charges Per Instrument : Rs 100 , Per Series: Rs 250

Mobile Alerts Nil

Clearing Cheque Return - Issued by Customer Rs. 350 / cheque for first 2 cheques; Rs. 450 / cheque for 3rd cheque to 5th cheque; Rs. 750 / cheque 6th cheque onwards

Clearing Cheque Return - Deposited by Customer Rs. 125 / cheque

Clearing Cheque Return - Deposited by Customer for Outstation Collection 50% of OSC commission; Minimum Rs. 50 / cheque + Other bank charges if any

Account Statement - By post and e-mail Free

Account Statement - Duplicate statement from Branch Rs 100 per statement

1

No MAB relaxation for semi urban / rural branches

2

Maximum Non Home Branch Cash deposit shall be Rs 2,00,000 per day. Maximum third party deposit up to Rs 50,000 per day.

3

Maximum Non Home Branch Cash withdrawal shall be Rs 5,00,000 per day.

4

Non Cash Transactions includes Anywhere Banking and Demand Drafts/Pay Orders

5

Total Free transactions include all Cash, Clearing and Transfer transactions .Outstation Cheque Collection , NEFT/RTGS , ATM and i-Connect transactions are outside the purview of these charges

6

Maximum Rs 50,000 per transaction for third party Non Home Branch Cash Withdrawal

All the terms are subject to change without any prior notice.

All the service charges will attract service tax as applicable.

The charge cycle period shall be 01st of every month to the last day of the same month. (e.g. 01st August to 31st August)

Cheque Transactions are subject to 48 hours notice and Bank's confirmations for transaction exceeding Rs. 1 cr. a day where the destination branch is a Non-RBI centre. (RBI centres are: Mumbai, Chennai, Kolkata, New Delhi, Ahmedabad, Hyderabad,

Jaipur, Kanpur, Nagpur, Trivandrum, Bhubaneswar, Chandigarh, Bangalore, Guwahati, Bhopal & Patna)

All cash Transaction of Rs. 10 lacs and above on a single day will require prior intimation and approval of the Branch at least one working day in advance.

The monthly charges applicable in a current account will be based on the scheme code of that account at the end of previous charge cycle.

Physical statements will not be sent for the current account where there are no transactions consecutively for 6 months

You might also like

- Letter Request Waiver On Penalty InterestDocument2 pagesLetter Request Waiver On Penalty InterestHayati Ahmad56% (18)

- Strother v. 3464920 Canada Inc.Document2 pagesStrother v. 3464920 Canada Inc.Alice JiangNo ratings yet

- Global Marketing DjarumDocument20 pagesGlobal Marketing DjarumcindyoclNo ratings yet

- Model LLP AgreementDocument20 pagesModel LLP AgreementSoumitra Chawathe71% (21)

- Caart PDFDocument2 pagesCaart PDFvinodNo ratings yet

- Au Royale: Schedule ofDocument2 pagesAu Royale: Schedule ofsahilNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Kina Bank Fees Charges ScheduleDocument15 pagesKina Bank Fees Charges SchedulemarcialitovivaresNo ratings yet

- Au Abhi 31-MarchDocument2 pagesAu Abhi 31-MarchShubhra Kanti GopeNo ratings yet

- SocmgmDocument2 pagesSocmgmidforemon6898No ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Regular Business Account 1 LakhDocument2 pagesRegular Business Account 1 LakhNiraj PandeyNo ratings yet

- Midxix Republic Salary AccountDocument1 pageMidxix Republic Salary Accountsagar khareNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- KFS HBL@ Work Conventional AccountsDocument6 pagesKFS HBL@ Work Conventional AccountsArslan BaigNo ratings yet

- q1 2023 Pricing English VersionDocument6 pagesq1 2023 Pricing English VersionRickarldo FelrittoNo ratings yet

- Standard Schedule of Charges For SB-CA-NRI-July 1 2016Document4 pagesStandard Schedule of Charges For SB-CA-NRI-July 1 2016Vasundhara GuptaNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Priority Banking Soc Con Nov 2019Document1 pagePriority Banking Soc Con Nov 2019sundarkspNo ratings yet

- Consolidated Socs For Current AccountDocument2 pagesConsolidated Socs For Current AccountRavikGangulyNo ratings yet

- KFS HBL Conventional Saving Account 28-12-2023Document6 pagesKFS HBL Conventional Saving Account 28-12-2023Awais PanhwarNo ratings yet

- Abw2209 003 MW Priceupdate Web-99 PDFDocument1 pageAbw2209 003 MW Priceupdate Web-99 PDFBenny BerniceNo ratings yet

- KFS HBL Conventional Current Account-07-Nov-2022Document6 pagesKFS HBL Conventional Current Account-07-Nov-2022Faique MemonNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Stanbicpricingguide2022 2023Document1 pageStanbicpricingguide2022 2023Yaseen QariNo ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges NewTharun KumarNo ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges Newganesh gowthamNo ratings yet

- Schedule of Charges BandhanDocument3 pagesSchedule of Charges BandhanSoumya ChatterjeeNo ratings yet

- Service Charges South Indian BankDocument18 pagesService Charges South Indian Bankmuthoot2009No ratings yet

- Discovery Bank Platinum Credit Card Fees 2022Document1 pageDiscovery Bank Platinum Credit Card Fees 2022CornelVermaakNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Mercantile Bank Consolidated Pricing Guide - 11march2022Document5 pagesMercantile Bank Consolidated Pricing Guide - 11march2022sipho5mlnNo ratings yet

- DollarOne TradeCharges 1nov2020Document1 pageDollarOne TradeCharges 1nov2020Pratik IngaleNo ratings yet

- Í - !, (È0Â Corriente Antoineâdom . Ç/B Î Mr. Antoine Dominic - CorrienteDocument2 pagesÍ - !, (È0Â Corriente Antoineâdom . Ç/B Î Mr. Antoine Dominic - CorrienteMarcus FlintNo ratings yet

- In-House CashDocument5 pagesIn-House Cashdgz5qm8kcwNo ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- FAR 04 ReceivablesDocument10 pagesFAR 04 ReceivablesRoseNo ratings yet

- Metrobank Business Account SummaryDocument3 pagesMetrobank Business Account SummaryJack ChardwoodNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Tariff List: Category Tariff Products Category TariffDocument1 pageTariff List: Category Tariff Products Category TariffsrajkrishnaNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

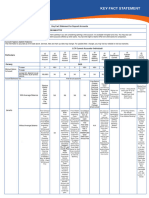

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- Myworld Pricing 2021Document3 pagesMyworld Pricing 2021carinaNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- In Mid Savings AccountDocument4 pagesIn Mid Savings Accountjb6c8h4rnmNo ratings yet

- YES Prosperity Savings Account W.E.F. 1st March 2018 PDFDocument2 pagesYES Prosperity Savings Account W.E.F. 1st March 2018 PDFJeyakumara Vel CNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- New StartupDocument2 pagesNew StartupAmey ChavanNo ratings yet

- Saving Accounts: Key Fact StatementDocument6 pagesSaving Accounts: Key Fact StatementAfaq YousafNo ratings yet

- Small Business Services Pricing 2023Document1 pageSmall Business Services Pricing 2023Blur VisualsNo ratings yet

- Financial Reporting and Analysis 101Document10 pagesFinancial Reporting and Analysis 101Samrat KanitkarNo ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges NewMuhammad Al javadNo ratings yet

- JIFI Charges PDFDocument2 pagesJIFI Charges PDFRamesh SinghNo ratings yet

- Basic and Classic Savings Account Effective September 2020Document3 pagesBasic and Classic Savings Account Effective September 2020moviejunk97No ratings yet

- Sep2023Document8 pagesSep2023jai vanamalaNo ratings yet

- Core Java Interview Questions and AnswersDocument38 pagesCore Java Interview Questions and Answershappy happyNo ratings yet

- Testimonial Contest2022Document1 pageTestimonial Contest2022jai vanamalaNo ratings yet

- SBM FD FaqDocument2 pagesSBM FD Faqjai vanamalaNo ratings yet

- 50 Common Interview Questions and Answers: Cover TBCDocument25 pages50 Common Interview Questions and Answers: Cover TBCSaeid AlamiNo ratings yet

- Css Tutorial PDFDocument28 pagesCss Tutorial PDFTahpehs Phiri0% (1)

- Common Backend Interview QuestionsDocument5 pagesCommon Backend Interview Questionsjai vanamalaNo ratings yet

- Research Methods For Architecture Ebook - Lucas, Ray - Kindle StoreDocument1 pageResearch Methods For Architecture Ebook - Lucas, Ray - Kindle StoreMohammed ShriamNo ratings yet

- Employee Performance Management Literature ReviewDocument6 pagesEmployee Performance Management Literature Reviewea8d1b6nNo ratings yet

- ACT 141-Module 1-Assurance ServicesDocument98 pagesACT 141-Module 1-Assurance ServicesJade Angelie FloresNo ratings yet

- AIS Review QuestionnairesDocument4 pagesAIS Review QuestionnairesKesiah FortunaNo ratings yet

- Social Compact SummaryDocument5 pagesSocial Compact SummaryAlisa OngNo ratings yet

- AC415 Fixed Variable Costs BreakEven 1 - 11 - 2017Document35 pagesAC415 Fixed Variable Costs BreakEven 1 - 11 - 2017blablaNo ratings yet

- GPOA (PR Consultant)Document7 pagesGPOA (PR Consultant)Jeydrew TVNo ratings yet

- Use Case: From Wikipedia, The Free EncyclopediaDocument6 pagesUse Case: From Wikipedia, The Free EncyclopediaLisset Garcia PerezNo ratings yet

- OneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporeDocument11 pagesOneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporejaitleyarushiNo ratings yet

- Income Under The Head Capital Gains: LTCG Arising From The Transfer of RHP and Is Reinvested in New RHP (Exemption U/s 54)Document14 pagesIncome Under The Head Capital Gains: LTCG Arising From The Transfer of RHP and Is Reinvested in New RHP (Exemption U/s 54)dosadNo ratings yet

- Chapter 20 FirmsDocument4 pagesChapter 20 FirmsBasheer KhaledNo ratings yet

- Organization Development and Change: Chapter Five: Diagnosing OrganizationsDocument20 pagesOrganization Development and Change: Chapter Five: Diagnosing OrganizationsIsra AmeliaaNo ratings yet

- Jakawali ParachuteDocument1 pageJakawali Parachuteparasailing jakartaNo ratings yet

- MQ1 1Document1 pageMQ1 1shaira alliah de castroNo ratings yet

- 2023 Macroeconomics Final Test SampleDocument2 pages2023 Macroeconomics Final Test Samplek. nastyasNo ratings yet

- 5.tender Process N DocumentationDocument35 pages5.tender Process N DocumentationDilanka MJ Dassanayake100% (1)

- Roles and Skills of ManagersDocument9 pagesRoles and Skills of Managersarjun SinghNo ratings yet

- GX Cloud Banking 2030 FsiDocument12 pagesGX Cloud Banking 2030 FsiMoidin AfsanNo ratings yet

- Std. X Ch. 3 Money and Credit WS (21 - 22)Document3 pagesStd. X Ch. 3 Money and Credit WS (21 - 22)YASHVI MODINo ratings yet

- Letter of AcceptanceDocument2 pagesLetter of AcceptanceDisha DarjiNo ratings yet

- IE 317 Case Study 4: Bsie Ii Group 7Document37 pagesIE 317 Case Study 4: Bsie Ii Group 7Chel Armenton100% (1)

- Actividad 19 Evidencia 7 Taller "Talking About Logistics, Workshop"Document5 pagesActividad 19 Evidencia 7 Taller "Talking About Logistics, Workshop"claudia gomezNo ratings yet

- Guide To SQL 9th Edition by Pratt Last Solution ManualDocument13 pagesGuide To SQL 9th Edition by Pratt Last Solution Manualcatherinebergtjkxfanwod100% (25)

- Commercial Law Reviewer, MercantileDocument60 pagesCommercial Law Reviewer, MercantilecelestezerosevenNo ratings yet

- List of PEREgistered On DLTDocument4,812 pagesList of PEREgistered On DLTVishalChaturvediNo ratings yet

- Project Cycle Management Report (AEPAM Pub.288)Document64 pagesProject Cycle Management Report (AEPAM Pub.288)Waqar AhmadNo ratings yet