Professional Documents

Culture Documents

C4-Factors Affecting IR

Uploaded by

Duong Ha Thuy0 ratings0% found this document useful (0 votes)

5 views24 pagesOriginal Title

C4-Factors affecting IR

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views24 pagesC4-Factors Affecting IR

Uploaded by

Duong Ha ThuyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

Adopted from “Financial Markets and Institutions” – Mishkin & Eakins (9E)

For TCHE401/TCH401E Classes in FTU only, no further distribution/reproduction allowed.

In the early 1950s, short-term Treasury bills were yielding about

1%. By 1981, the yields rose to 15% and higher. But then dropped

back to 1% by 2003. In 2007, rates jumped up to 5%, only to fall

back to near zero in 2008, though 2016.

What causes these changes?

In this chapter, we examine the forces the move interest rates and

the theories behind those movements. Topics include:

Determining Asset Demand

Supply and Demand in the Bond Market

Changes in Equilibrium Interest Rates

An asset is a piece of property that is a store of value. Facing the

question of whether to buy and hold an asset or whether to buy

one asset rather than another, an individual must consider the

following factors:

Wealth, the total resources owned by the individual, including all assets

Expected return (the return expected over the next period) on one asset

relative to alternative assets

Risk (the degree of uncertainty associated with the return) on one asset

relative to alternative assets

Liquidity (the ease and speed with which an asset can be turned into cash)

relative to alternative assets

The quantity demanded of an asset differs by factor.

Wealth: Holding everything else constant, an increase in wealth raises the

quantity demanded of an asset

Expected return: An increase in an asset’s expected return relative to that of

an alternative asset, holding everything else unchanged, raises the quantity

demanded of the asset

Risk: Holding everything else constant, if an asset’s risk rises relative to that

of alternative assets, its quantity demanded will fall

Liquidity: The more liquid an asset is relative to alternative assets, holding

everything else unchanged, the more desirable it is, and the greater will be

the quantity demanded

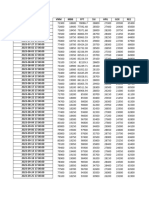

Variable Change in Variable Change in Quantity

Demanded

Wealth Increase Increase

Expected Return relative to other Increase Increase

assets

Risk relative to other assets Increase Decrease

Liquidity relative to other assets Increase Increase

We are going to examine how interest rates are determined—from

a demand and supply perspective.

Keep in mind that these forces act differently in different bond markets.

That is, current supply/demand conditions in the corporate bond market are

not necessarily the same as, say, in the mortgage market.

However, because rates tend to move together, we will proceed as

if there is one interest rate for the entire economy.

Wealth: in a business cycle expansion with growing wealth, the demand

for bonds rises, conversely, in a recession, when income and wealth are

falling, the demand for bonds falls

Expected returns: higher expected interest rates in the future decrease

the demand for long-term bonds, conversely, lower expected interest

rates in the future increase the demand for long-term bonds

Risk: an increase in the riskiness of bonds causes the demand for bonds

to fall, conversely, an increase in the riskiness of alternative assets (like

stocks) causes the demand for bonds to rise

Liquidity: increased liquidity of the bond market results in an increased

demand for bonds, conversely, increased liquidity of alternative asset

markets (like the stock market) lowers the demand for bonds

Expected Profitability of Investment Opportunities: In a business

cycle expansion, the supply of bonds increases. Conversely, in a

recession, when there are far fewer expected profitable investment

opportunities, the supply of bonds falls.

Expected Inflation: An increase in expected inflation causes the

supply of bonds to increase.

Government Activities: Higher government deficits increase the

supply of bonds. Conversely, government surpluses decrease the

supply of bonds.

We’ve done the hard work. Now we turn to some special cases. The

first is the Fisher Effect. Recall that rates are composed of several

components: a real rate, an inflation premium, and various risk

premiums.

What if there is only a change in expected inflation?

As seen in the next slide, if e ↑

1. Relative Re ↓, Bd shifts in to left

2. Bs ↑, Bs shifts out to right

3. P ↓, i ↑

If expected inflation rises from 5% to 10%, the expected return on

bonds relative to real assets falls and, as a result, the demand for

bonds falls.

The rise in expected inflation also means that the real cost of

borrowing has declined, causing the quantity of bonds supplied to

increase.

When the demand for bonds falls and the quantity of bonds

supplied increases, the equilibrium bond

price falls.

Since the bond price is negatively related to the interest rate, this

means that the interest rate will rise.

Another good thing to examine is an expansionary business cycle.

Here, the amount of goods and services for the country is

increasing, so national income is increasing.

What is the expected effect on interest rates?

As the next slide shows, in a Business Cycle Expansion,

Wealth ↑, Bd ↑, Bd shifts out to right

Investment ↑, Bs ↑, Bs shifts right

If Bs shifts more than Bd then P ↓, i ↑

In the wake of the global financial crisis, interest rates in Europe

and the United

States, as well as in Japan, have fallen to extremely low levels. How

can we explain that within the framework discussed so far?

It’s a little tricky, but we can do it!

Negative inflation lead to Bd ↑

Bd shifts out to right

Negative inflation lead to ↓ in real rates

Bs shifts out to left

Net effect was an increase in bond prices (falling interest rates).

Business cycle contraction lead to ↓ in interest rates

Bs shifts out to left

Bd shifts out to left

But the shift in Bd is less significant than the shift in Bs, so the net

effect was also an increase in bond prices.

Determining Asset Demand: We examined the forces that affect the

demand and supply of assets.

Supply and Demand in the Bond Market: We examine those forces

in the context of bonds, and examined the impact on interest rates.

Changes in Equilibrium Interest Rates: We further examined the

dynamics of changes in supply and demand in the bond market,

and the corresponding effect on bond prices and interest rates.

You might also like

- Presented by Amir KhanDocument47 pagesPresented by Amir KhanSyed Arham MurtazaNo ratings yet

- How Interest Rates Are DeterminedDocument33 pagesHow Interest Rates Are DeterminedAhmad RahhalNo ratings yet

- M&B Ch.5 A.2023Document4 pagesM&B Ch.5 A.2023Amgad ElshamyNo ratings yet

- MONEYDocument55 pagesMONEYDora IskandarNo ratings yet

- Money Interest Rates and Exchange RatesDocument44 pagesMoney Interest Rates and Exchange RatesSaim GöküşNo ratings yet

- HW 3Document4 pagesHW 3Marino NhokNo ratings yet

- Lecture No 2 Fundamentals of Financial Markets Interest RateDocument41 pagesLecture No 2 Fundamentals of Financial Markets Interest RateNimco CumarNo ratings yet

- Finance 5Document11 pagesFinance 5namien koneNo ratings yet

- Chapter 4 Interest RatesDocument31 pagesChapter 4 Interest RatesnoorabogamiNo ratings yet

- Fin 616Document7 pagesFin 616Boby PodderNo ratings yet

- Money, Interest Rates, and Exchange Rates (Lecture 7)Document8 pagesMoney, Interest Rates, and Exchange Rates (Lecture 7)nihadsamir2002No ratings yet

- The Behavior of Interest Rates: Cecchetti, Chapter 7Document41 pagesThe Behavior of Interest Rates: Cecchetti, Chapter 7Trúc Ly Cáp thịNo ratings yet

- Chap 2 - noteDocument6 pagesChap 2 - notePeo PaoNo ratings yet

- INTEREST RATES AND ASSET DEMANDDocument10 pagesINTEREST RATES AND ASSET DEMANDPhương Anh NguyễnNo ratings yet

- Ch-2, Determination of Intt RatesDocument19 pagesCh-2, Determination of Intt RatesAR RafiNo ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesRhazes Zy100% (1)

- Lecture-3 Determination of Interest RatesDocument31 pagesLecture-3 Determination of Interest RatesZamir StanekzaiNo ratings yet

- StocksDocument4 pagesStocksAmina YuldashevaNo ratings yet

- How Interest Rates Impact Stocks and InflationDocument7 pagesHow Interest Rates Impact Stocks and InflationSandeep BabajiNo ratings yet

- Chapter Two Determination of Interest RatesDocument4 pagesChapter Two Determination of Interest RatesMay AlanbaieNo ratings yet

- Determination of Exchange RateDocument14 pagesDetermination of Exchange RateAshish Tagade100% (2)

- Why Interest Rates ChangeDocument15 pagesWhy Interest Rates ChangeAniket GuptaNo ratings yet

- Name Class Assignment DateDocument6 pagesName Class Assignment Datehyna_khanNo ratings yet

- Ch. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument11 pagesCh. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandBing TinsleyNo ratings yet

- 1gD9bOgblWhqP pCynE6pjN9cyctX Zd3Document18 pages1gD9bOgblWhqP pCynE6pjN9cyctX Zd3Asifur RahmanNo ratings yet

- Chapter 2 - Money, Interest Rate and Exchange RateDocument43 pagesChapter 2 - Money, Interest Rate and Exchange RateBipNo ratings yet

- Effects of Inflation:: Inflation and Interest RateDocument10 pagesEffects of Inflation:: Inflation and Interest RatesangramlifeNo ratings yet

- Interest RatesDocument18 pagesInterest Ratesapi-555390406No ratings yet

- What Determins Intrest RateDocument4 pagesWhat Determins Intrest RateAbdullah MalikNo ratings yet

- Lesson 9 - Money and Interest RatesDocument5 pagesLesson 9 - Money and Interest RatesAnthony BandaNo ratings yet

- The Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionDocument38 pagesThe Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionHiền NguyễnNo ratings yet

- It Starts With InflationDocument3 pagesIt Starts With InflationVelayNo ratings yet

- Eco Tes 2Document2 pagesEco Tes 2coki11111No ratings yet

- b8.Makro-Monetary PolicyDocument19 pagesb8.Makro-Monetary PolicyEvan AlviyanNo ratings yet

- Econ 330 Answers to Practice Questions #1Document4 pagesEcon 330 Answers to Practice Questions #1Phương HàNo ratings yet

- International Economics II Distance ModuleDocument94 pagesInternational Economics II Distance ModuleBereket Desalegn100% (1)

- Determinants of Interest Rates ExplainedDocument4 pagesDeterminants of Interest Rates ExplainedJunvy AbordoNo ratings yet

- Fin 480 Exam2Document14 pagesFin 480 Exam2OpheliaNiuNo ratings yet

- Chapter # 01Document11 pagesChapter # 01A LiaNo ratings yet

- Monetary Policy PDFDocument7 pagesMonetary Policy PDFDaniel SozonovNo ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesAhmad RahhalNo ratings yet

- Solution Manual For Financial Markets and Institutions 7th Edition by SaundersDocument24 pagesSolution Manual For Financial Markets and Institutions 7th Edition by SaundersRobertGonzalesyijx100% (33)

- Why Do Interest Rates Change?Document41 pagesWhy Do Interest Rates Change?YSLHKHKHKNo ratings yet

- Factors That Influence Exchange RatesDocument2 pagesFactors That Influence Exchange RatesJoelene ChewNo ratings yet

- Chapter 2 and Chapter 3Document46 pagesChapter 2 and Chapter 3Park Min YoungNo ratings yet

- Loanable Funds Chapter 2 NoteDocument27 pagesLoanable Funds Chapter 2 NotePark Min YoungNo ratings yet

- Monetary and Fiscal PolicyDocument5 pagesMonetary and Fiscal PolicyJanhavi MinochaNo ratings yet

- Financial Markets and InstitutionsDocument72 pagesFinancial Markets and InstitutionsMarioNo ratings yet

- Four Factors That Impact a Company's Cost of CapitalDocument4 pagesFour Factors That Impact a Company's Cost of Capitalsanjana sethNo ratings yet

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- Impact of Interest Rates on Foreign Exchange, Equity & Debt Mutual FundsDocument9 pagesImpact of Interest Rates on Foreign Exchange, Equity & Debt Mutual FundsTariq MahmoodNo ratings yet

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- Chapter 25Document7 pagesChapter 25Tasnim SghairNo ratings yet

- Money & Rate of Interest Theories ExplainedDocument34 pagesMoney & Rate of Interest Theories ExplaineduzmaNo ratings yet

- NullDocument22 pagesNullapi-28191758100% (1)

- 9 - ch27 Money, Interest, Real GDP, and The Price LevelDocument48 pages9 - ch27 Money, Interest, Real GDP, and The Price Levelcool_mechNo ratings yet

- Oro AaAccDocument5 pagesOro AaAccLysterh FuentesNo ratings yet

- Interest Rates and The Loanable Funds FrameworkDocument4 pagesInterest Rates and The Loanable Funds FrameworkIvy RosalesNo ratings yet

- 6 Factors That Influence Exchange RatesDocument2 pages6 Factors That Influence Exchange RatesfredsvNo ratings yet

- Lower Bound For European Call Option Prices Lower Bound C Buy The OptionDocument1 pageLower Bound For European Call Option Prices Lower Bound C Buy The OptionDuong Ha ThuyNo ratings yet

- C3-Interest RateDocument39 pagesC3-Interest RateDuong Ha ThuyNo ratings yet

- .All DataDocument4 pages.All DataDuong Ha ThuyNo ratings yet

- Classifying and Dertermining Inventory: Chapter 6: InventoriesDocument3 pagesClassifying and Dertermining Inventory: Chapter 6: InventoriesDuong Ha ThuyNo ratings yet

- 24.3 - Principles of AccountingDocument3 pages24.3 - Principles of AccountingDuong Ha ThuyNo ratings yet

- GROUP 9/reportDocument21 pagesGROUP 9/reportDuong Ha ThuyNo ratings yet

- 5.1.2.8 Lab - Viewing Network Device MAC AddressesDocument5 pages5.1.2.8 Lab - Viewing Network Device MAC Addresseschristian hallNo ratings yet

- Engro Foods Limited Case StudyDocument5 pagesEngro Foods Limited Case Studymubin_ashraf0% (1)

- 23NM60ND STMicroelectronicsDocument12 pages23NM60ND STMicroelectronicskeisinhoNo ratings yet

- TDS - Cu-9 SchultzDocument2 pagesTDS - Cu-9 SchultzFabiola ArceNo ratings yet

- Harvard Referencing GuideDocument73 pagesHarvard Referencing GuideCassidy WilliamsNo ratings yet

- Well BlowdownDocument47 pagesWell BlowdownMask BlackNo ratings yet

- Labour Welfare Management at Piaggio vehicles Pvt. LtdDocument62 pagesLabour Welfare Management at Piaggio vehicles Pvt. Ltdnikhil kumarNo ratings yet

- Principles of BioenergyDocument25 pagesPrinciples of BioenergyNazAsyrafNo ratings yet

- Chevron Annual Report SupplementDocument68 pagesChevron Annual Report SupplementLaurentiu CiobotaricaNo ratings yet

- Top Triangle Bikini Kinda PatternDocument5 pagesTop Triangle Bikini Kinda PatternVALLEDOR, Dianne Ces Marie G.No ratings yet

- Solution Manual For C Programming From Problem Analysis To Program Design 4th Edition Barbara Doyle Isbn 10 1285096266 Isbn 13 9781285096261Document19 pagesSolution Manual For C Programming From Problem Analysis To Program Design 4th Edition Barbara Doyle Isbn 10 1285096266 Isbn 13 9781285096261Gerald Digangi100% (32)

- String & Math FunctionsDocument38 pagesString & Math FunctionsThanu shreeNo ratings yet

- Gsrtc. 2 - 1 - 24Document1 pageGsrtc. 2 - 1 - 24Mitanshu BhavsarNo ratings yet

- NBC 2019 - AE Div B - Part 9 PDFDocument62 pagesNBC 2019 - AE Div B - Part 9 PDFviksursNo ratings yet

- DSP1800 Temperature and Humidity ProbeDocument2 pagesDSP1800 Temperature and Humidity ProbeGerardo SanchezNo ratings yet

- Полнотекстовый Поиск В Postgresql За МиллисекундыDocument54 pagesПолнотекстовый Поиск В Postgresql За МиллисекундыSzERGNo ratings yet

- C.J LetterDocument2 pagesC.J LetterIan WainainaNo ratings yet

- Orientation and TrainingDocument31 pagesOrientation and TrainingSyurga FathonahNo ratings yet

- Item 1 - Ficha Tecnica IBOP Upper Canrig 1250 ACDocument6 pagesItem 1 - Ficha Tecnica IBOP Upper Canrig 1250 ACanghelo marquezNo ratings yet

- Manuale NanoVIP3 Rel. 1.5 en (UK)Document76 pagesManuale NanoVIP3 Rel. 1.5 en (UK)ECNo ratings yet

- Business Environment of Micro Producers in General Santos CityDocument148 pagesBusiness Environment of Micro Producers in General Santos CityAlbedo KreideprinzNo ratings yet

- 05.10.20 - SR - CO-SUPERCHAINA - Jee - MAIN - CTM-8 - KEY & SOL PDFDocument8 pages05.10.20 - SR - CO-SUPERCHAINA - Jee - MAIN - CTM-8 - KEY & SOL PDFManju ReddyNo ratings yet

- B757-767 Series: by Flightfactor and Steptosky For X-Plane 11.35+ Produced by VmaxDocument35 pagesB757-767 Series: by Flightfactor and Steptosky For X-Plane 11.35+ Produced by VmaxDave91No ratings yet

- Group Assignment 1 - FinalDocument13 pagesGroup Assignment 1 - FinalWanteen LeeNo ratings yet

- Mocha Pro UserGuideDocument441 pagesMocha Pro UserGuideHamidreza DeldadehNo ratings yet

- Nestle Announcement It Is Pulling The Plug On Eldred TownshipDocument2 pagesNestle Announcement It Is Pulling The Plug On Eldred TownshipDickNo ratings yet

- Question Bank RTOSDocument3 pagesQuestion Bank RTOSjaswanth19907No ratings yet

- Home Appliances Controlling Using Bluetooth On Android Mobile AbstractDocument2 pagesHome Appliances Controlling Using Bluetooth On Android Mobile AbstractramyaNo ratings yet

- The Concept of Mutuum Legal Provisions and CasesDocument129 pagesThe Concept of Mutuum Legal Provisions and CasesGerard TinampayNo ratings yet

- GoogleDocument88 pagesGoogleAshrin KumarNo ratings yet