Professional Documents

Culture Documents

Year End Process

Year End Process

Uploaded by

viren.khatri94288Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Year End Process

Year End Process

Uploaded by

viren.khatri94288Copyright:

Available Formats

BUSY

Year - End Entries

In India, an accounting period from 1st April to 31st March is followed. Hence, on 31st of March,

closing of the accounts is done and the balances are carried forward to next financial year.

There are various entries, which are entered at the end of the financial year only, such as

depreciation charged on fixed assets, interest paid on loan, profit transferred to partners

account and tax (GST) payment for the last month of the year. In this document, we will discuss

posting of all these year – end entries in detail.

Year- End Entries

At the end of a financial year, a company needs to post various entries. These entries are yearly

entries which are entered only once in a year and that too at the end of the financial year. In

this document, we will try to cover all such entries that are posted at the end of the financial

year.

Entry 1: Depreciation charged on Fixed Assets

Depreciation is charged at the end of financial year on the Fixed Assets as per the rates

prescribed by the government. In BUSY, you need to enter a Journal voucher at the end of

financial year for posting of entry for depreciation charged on fixed assets.

In Journal voucher, you need to debit the Depreciation account and credit the Fixed Assets

account. For example, a Company has charged depreciation of Rs. 30,000 on the Maruti Van

that it uses to deliver goods to its dealers. To post this entry, Company will enter a Journal

voucher and debit / credit the following accounts.

Debit: Depreciation A/c 30,000

Credit: Van A/c 30,000

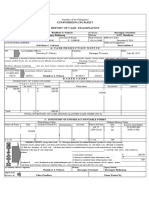

Given here is a screenshot displaying Journal voucher entered for the depreciation charged on

fixed asset.

BIPL Year-End Entries 1

BUSY

Entry 2: Interest paid on Loan taken from Bank

Another entry that needs to be posted at the end of financial year is for interest paid on loan

taken from bank. For posting this entry, you need to enter a Journal voucher and debit the

Interest on Loan account and credit the Bank Loan account.

For example, a Company has taken a loan of Rs. 10,00,000 from HDFC Bank on which interest of

Rs. 80,000 has been paid throughout the year. The Company will post the following entry in the

Journal voucher:

Debit: Interest on Loan A/c 80,000

Credit: HDFC Loan A/c 80,000

BIPL Year-End Entries 2

BUSY

Entry 3: Profit transferred to Partners account

Profit or loss of partnership firm needs to be posted to partners account. This entry is also

posted at the end of financial year. To transfer profit to partners account, you need to enter a

Journal voucher and debit the Profit & Loss account and credit the Capital account of partners.

For example, a Company has accrued a profit of Rs. 8,00,000 in a financial year. For this, the

Company will post the following entry in the Journal voucher:

Debit: Profit & Loss A/c 8,00,000

Credit: Capital A/c - Rakesh 4,00,000

Capital A/c - Ankit 2,00,000

Capital A/c - Amit 2,00,000

In the above entry, profit is divided according to capital invested by the partners in the firm.

In case of Proprietorship firm, the profit is transferred to Proprietor’s A/c.

Debit: Profit & Loss A/c

Credit: Proprietor’s A/c

In case of a Company, profit is transferred to Reserves & Surplus account.

Debit: Profit & Loss A/c

Credit: Reserves & Surplus A/c

Entry 4: GST Payment for the last month of the Year.

Apart from the entries explained above, one more entry that needs to be explained is of GST

payment of the last month of the year. Payment of GST to the government for the last month

of the year i.e. March will be made in the month of April. It means that although GST is of the

previous financial year but it is deposited in the current financial year. This entry needs to be

reflected in the reports of the previous financial year as payment of GST is for previous year

only. To enter entry for GST payment for the last month of the year, you need to perform the

following steps:

Step 1: Enter Journal voucher on 31st March in which debit the IGST/CGST/SGST Output account

and credit the GST Payable account (created under the head Current Liabilities).

BIPL Year-End Entries 3

BUSY

Step 2: Change Financial Year in BUSY. In the new financial year, enter a Payment voucher in

which debit the GST Payable account and credit the Bank account.

Step 3: Switch back to previous financial year in BUSY, open the Journal voucher in modify

mode and enter GST related details in it.

We will now discuss posting of these entries with the help of an example.

A Company’s GST payable amount is Rs. 10,000 for the month of March for 2019-20 financial

year. For this, the company will enter following entries in BUSY:

Step 1: Enter a Journal voucher on 31st March 2020 with following entry:

Debit: IGST/CGST/SGST Output A/c 10,000

Credit: GST Payable A/c 10,000

On saving the Journal voucher, a GST Adjustment Details window will appear because

GST account is debited in the voucher. In the window, details about the GST payment

such as Challan Number, Cheque Number are to be entered. Since the GST amount is

not yet deposited to the government and the Company is not having these details so

leave the window as blank.

Step 2: Change Financial Year in BUSY and enter a Payment voucher in the new financial year

with following entry:

Debit: GST Payable A/c 10,000

Credit: Bank A/c 10,000

Note: Above entry needs to be posted after depositing the GST to the government i.e. at any

time in the current financial year.

Step 3: Switch back to the previous financial year i.e. 2019-20 and open the Journal voucher

entered on 31st March 2020 in modify mode. Enter the required details in GST

Adjustment Details window.

Hope the document has helped you in solving queries related to Year-End Entries. For more

details you can refer to our Video on ‘Year – End Process’ which is hosted on YouTube.

<<< Thank You >>>

BIPL Year-End Entries 4

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Standard CostingDocument52 pagesStandard CostingSunday Oluwole0% (1)

- Class Xii Cbse Question Bank AccountancyDocument23 pagesClass Xii Cbse Question Bank AccountancyBinoy TrevadiaNo ratings yet

- Cash Tickets MonitoringDocument8 pagesCash Tickets MonitoringSeth Cabrera0% (1)

- Chapter 2Document86 pagesChapter 2Allison StewartNo ratings yet

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- Fatimat STMTDocument53 pagesFatimat STMTayo.adegokeNo ratings yet

- Chapter 13 Prob 1,3,4Document6 pagesChapter 13 Prob 1,3,4geyb awayNo ratings yet

- Journal of Cash TransactionsDocument2 pagesJournal of Cash TransactionsRobert Tayam, Jr.100% (1)

- Accounting Treatment of Goodwill at The Time of AdmissionDocument25 pagesAccounting Treatment of Goodwill at The Time of AdmissionMayurRawool100% (2)

- GSTR1 03ajdpk8658g1z5 032023Document7 pagesGSTR1 03ajdpk8658g1z5 032023SANJEEV KUMARNo ratings yet

- Trial Balance N Balance SheetDocument2 pagesTrial Balance N Balance SheetMimi MyshaNo ratings yet

- Ar2012 - 13 SVC BankDocument52 pagesAr2012 - 13 SVC Bankarya30111991No ratings yet

- Assignments QuestionDocument8 pagesAssignments Questionmuhammad qasim0% (1)

- Report On HBL PDFDocument60 pagesReport On HBL PDFWaseem AkbarNo ratings yet

- GST Audit Amendment Notes by Pankaj GargDocument12 pagesGST Audit Amendment Notes by Pankaj GargGopal Airan100% (2)

- Habib Bank Limited Cashier System: Cashier Tellers & Manager Tellers TrainingDocument34 pagesHabib Bank Limited Cashier System: Cashier Tellers & Manager Tellers TrainingMuhammad ShoaibNo ratings yet

- Welcome To ACT15: Intermediate Accounting 1Document37 pagesWelcome To ACT15: Intermediate Accounting 1Jashi SiñelNo ratings yet

- Procter and GambleDocument29 pagesProcter and Gamblepanchitoperez2014No ratings yet

- Ch08 ReceivablesDocument46 pagesCh08 ReceivablesimkrstnsntsNo ratings yet

- Using Accounts Receivable 9.01Document177 pagesUsing Accounts Receivable 9.01Nguyen Quang HungNo ratings yet

- Postal Test Papers - P5 - Intermediate - Syllabus 2012Document27 pagesPostal Test Papers - P5 - Intermediate - Syllabus 2012Viswanathan SrkNo ratings yet

- Accounting For Managers-Unit-1Document21 pagesAccounting For Managers-Unit-1VenkateshNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- Introductory Financial Accounting For Business 2Nd Edition Mark A Edmonds Full ChapterDocument67 pagesIntroductory Financial Accounting For Business 2Nd Edition Mark A Edmonds Full Chapterelisha.gardner158100% (5)

- Cpa Review School of The Philippines: Auditing Problems Audit of Liabilities Problem No. 1Document3 pagesCpa Review School of The Philippines: Auditing Problems Audit of Liabilities Problem No. 1ZeNo ratings yet

- ACCOUNTING Quiz 5 6 9Document7 pagesACCOUNTING Quiz 5 6 9andreajade.cawaya10No ratings yet

- HKZOpl CBB TTD 2 RawDocument14 pagesHKZOpl CBB TTD 2 RawSai RagiNo ratings yet

- PHIC ManualDocument88 pagesPHIC ManualThe Living memeNo ratings yet

- Accounting For CashDocument9 pagesAccounting For CashNatty STAN100% (1)