Professional Documents

Culture Documents

Individual Record Form IRF

Uploaded by

Anselmo DelimaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Record Form IRF

Uploaded by

Anselmo DelimaCopyright:

Available Formats

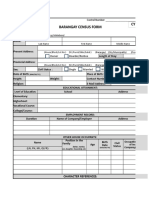

TEACHER/EMPLOYEE INDIVIDUAL RECORD FORM

Division: Station:

Division Code: Station Code: Employee No.:

Name (Last, Given, Middle):

Address:

Telephone No.: Cellular Phone No. (If Any)

Date of Birth: (MM/DD/YYYY) Citizenship: FILIPINO

Sex: ✘ Male Female

Position: Employment Status: Permanent Basic Salary:

Business Partner No.: Pag-ibig ID No.:

Philhealth Number: TIN Number:

Civil Status: ✘ Single/Widow/Widower/Legally Separated (No dependents)

Head of the Family

Single with qualified dependent Legally separated with qualified dependent

Widow/Widower with qualified dependent Benefactor of a qualified senior citizen

Married

Number of children below 21 years old

Husband claims additional exemption

Husband claims additional exemption (attach waiver of husband)

AUTHORIZED DEDUCTIONS: (Monthly Basis)

Regular Deductions:

Life and Retirement: Philhealth:

Pag-ibig: Withholding Tax:

Other deductions from Government and Private Institutions: (please indicate if there's any)

Deduction Code Name of Loan/Insurance Period Covered

PREPARED BY: CERTIFIED CORRECT:

PRINTED NAME & SIGNATURE PRINTED NAME & SIGNATURE

OF TEACHER/PERSONNEL OF PRINCIPAL/TEACHER-IN

CHARGE/ADMIN. OFFICER

You might also like

- Individual Record FormDocument1 pageIndividual Record FormRose Ann ChavezNo ratings yet

- Individual Record FormDocument4 pagesIndividual Record FormRichard HisanzaNo ratings yet

- Colour Labels Limited Employee Information: Personal Information (Attach Copies of Statutory Documents)Document4 pagesColour Labels Limited Employee Information: Personal Information (Attach Copies of Statutory Documents)JamesNo ratings yet

- Application For Student Bursary Scheme 2022Document3 pagesApplication For Student Bursary Scheme 2022Prashant Singh RajputNo ratings yet

- Waiver Application Form 101: Primary Applicant InformationDocument1 pageWaiver Application Form 101: Primary Applicant InformationLogia GamerNo ratings yet

- Application For Student Bursary Scheme 2021Document3 pagesApplication For Student Bursary Scheme 2021Finau KakalaNo ratings yet

- Teacher Employee Individual Record Form PDFDocument1 pageTeacher Employee Individual Record Form PDFSheree Joie PolonanNo ratings yet

- Teacher Employee Individual Record FormDocument1 pageTeacher Employee Individual Record FormDave A. MaravillaNo ratings yet

- VJC-PD-FRM-12 Form Job Application - 059Document2 pagesVJC-PD-FRM-12 Form Job Application - 059Pon VịtNo ratings yet

- HRD 2 Application For EmploymentDocument4 pagesHRD 2 Application For Employmentkaiyunlim7No ratings yet

- VJC-PD-FRM-12 Form Job Application - 014Document2 pagesVJC-PD-FRM-12 Form Job Application - 014Ram prakash verma0% (1)

- Employment Application Form: Licenses or Certified Membership To Any Trade/ProfessionDocument12 pagesEmployment Application Form: Licenses or Certified Membership To Any Trade/ProfessionjS132No ratings yet

- FM-HR-002 Candidate Application Form For InterviewDocument2 pagesFM-HR-002 Candidate Application Form For InterviewAqmar Aqeem Bin AzharNo ratings yet

- Buyer'S Information Sheet: Relationship To Principal BuyerDocument1 pageBuyer'S Information Sheet: Relationship To Principal BuyerYAJ 56No ratings yet

- Master Benefit ApplicationDocument6 pagesMaster Benefit ApplicationJulia RiveraNo ratings yet

- Aplication For Employment: Personal InformationDocument1 pageAplication For Employment: Personal InformationKrisha AraujoNo ratings yet

- AIPGE Membership Application FormDocument1 pageAIPGE Membership Application Formjoecil mayorNo ratings yet

- Employment Application FormDocument2 pagesEmployment Application FormBBC Operations ManagerNo ratings yet

- Solo Parent Application FormDocument1 pageSolo Parent Application Formjeffrey yokoto100% (3)

- Application Form No. 16Document3 pagesApplication Form No. 16Iskolar TimeNo ratings yet

- Employment Application FormDocument4 pagesEmployment Application FormMardieNo ratings yet

- Application Form MITDocument3 pagesApplication Form MITBudi TooleeNo ratings yet

- Employment Application FormDocument6 pagesEmployment Application FormizhamkhatimNo ratings yet

- Contact Name: Contact PH: Email:: Please Submit Your Application For Bonding ToDocument2 pagesContact Name: Contact PH: Email:: Please Submit Your Application For Bonding ToMelanie LejanoNo ratings yet

- Application For Non Teaching FillableDocument2 pagesApplication For Non Teaching FillableRaniel Eran AgellonNo ratings yet

- SBC Auto Loan Individual KimDocument2 pagesSBC Auto Loan Individual KimKarl LabagalaNo ratings yet

- Application Form For Employment - NewDocument5 pagesApplication Form For Employment - NewTedi NurjenNo ratings yet

- Personal Information: Last Name First Name Middle NameDocument2 pagesPersonal Information: Last Name First Name Middle NameEdith Mendoza Sabanto100% (1)

- Select/Premier Medical Plan: Application FormDocument6 pagesSelect/Premier Medical Plan: Application Formadobo sinigangNo ratings yet

- Last First Middle: (As in Your Passport)Document2 pagesLast First Middle: (As in Your Passport)sauravsanky guhathakurataNo ratings yet

- Final Loan Application Form 2023 - With Co-BorrowerDocument4 pagesFinal Loan Application Form 2023 - With Co-BorrowerJianna Maeve Celeste TorresNo ratings yet

- Foundever Application FormDocument3 pagesFoundever Application Formangel gomezNo ratings yet

- New Intern Information FormDocument6 pagesNew Intern Information FormKurt CaneroNo ratings yet

- Application Form: Personal DetailsDocument2 pagesApplication Form: Personal DetailsKagiso kegodileNo ratings yet

- W.R.C. ApplicationDocument2 pagesW.R.C. ApplicationCole TonyNo ratings yet

- 02 - Application FormDocument8 pages02 - Application FormuolracNo ratings yet

- Agame of R-Employment-1-1Document4 pagesAgame of R-Employment-1-1ANIL KUMARNo ratings yet

- Human ResourcesDocument6 pagesHuman ResourcesSabelo RonNo ratings yet

- Page1 PDFDocument1 pagePage1 PDFConnor GriffinNo ratings yet

- Franchise Evaluation FormDocument3 pagesFranchise Evaluation FormTrina MananganNo ratings yet

- Employee Application Form Secana R3Document5 pagesEmployee Application Form Secana R3TiawidyalestariNo ratings yet

- Welcome To Parents - Students PageDocument2 pagesWelcome To Parents - Students Pageclementenikko61No ratings yet

- Job Application FormDocument3 pagesJob Application FormVikashkumarNo ratings yet

- Application Form-1Document2 pagesApplication Form-1blue silverNo ratings yet

- GC Application FormDocument4 pagesGC Application FormmuzzamilNo ratings yet

- Application FormDocument2 pagesApplication Formmilaflor zalsosNo ratings yet

- TGI Employment Application FormDocument2 pagesTGI Employment Application FormReago FedelinNo ratings yet

- TGI Employment Application FormDocument2 pagesTGI Employment Application FormReago FedelinNo ratings yet

- 006-Employement Application Form - BBDocument3 pages006-Employement Application Form - BBrazagujjarNo ratings yet

- Job Application FormDocument2 pagesJob Application FormKTK100% (1)

- Admission Form - Kooweerup Regional Health ServiceDocument1 pageAdmission Form - Kooweerup Regional Health ServiceAileen ThomsNo ratings yet

- ApplicationDocument1 pageApplicationMichael AngeloNo ratings yet

- Auto-Riser Car Loan & Insurance Services: Clients InformationDocument1 pageAuto-Riser Car Loan & Insurance Services: Clients InformationMichael AngeloNo ratings yet

- Consolidated CRF For Non BOTDocument2 pagesConsolidated CRF For Non BOTfloridaroxangregoNo ratings yet

- App For Registration Instructions Work Permit ID Form ALPCD 11 Rev 7 30 ...Document4 pagesApp For Registration Instructions Work Permit ID Form ALPCD 11 Rev 7 30 ...Retchh Ihsel De TorresNo ratings yet

- 2 - Diya Application Form - ULDocument6 pages2 - Diya Application Form - ULJan Sher Khan86% (21)

- Registrasi Calon Karyawan BaruDocument6 pagesRegistrasi Calon Karyawan Baruerzaayu95No ratings yet

- Barangay Census FormDocument4 pagesBarangay Census Formzee67% (12)

- Form Employment ApplicationDocument3 pagesForm Employment Applicationchris devisNo ratings yet