Professional Documents

Culture Documents

Letter of Credit 2023 Version One

Uploaded by

Phillip KakuruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter of Credit 2023 Version One

Uploaded by

Phillip KakuruCopyright:

Available Formats

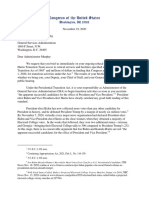

LETTER OF CREDIT APPLICATION

Branch Name______________________________________________________ Date D D M M Y Y

For any queries or clarifications on the Application Form, please call Trade Operations Department

on Tel. No: 0313114130

Please establish an irrevocable Letter of Credit for my / our account as below:

LC Transferrable LC

Applicant Name, Address & Contact Details Beneficiary Name, Address & Contact Details

Advise Through Bank/Beneficiary Bank Details

Goods/Services (Brief Description as per Proforma Invoice) __________________________________________________

_________________________________________________________________________________________________

Incoterm: CIF CFR CPT FOB EX-WORKS Other_______________________

Supporting Documents Attached: Pro-forma Invoice Insurance

Currency: ________________ Amount in Figures _____________________Credit Amount Tolerance +/- __________%

Amount in Words: __________________________________________________________________________________

_________________________________________________________________________________________________

Expiry Date: D D M M Y Y Latest Date of Shipment: D D M M Y Y

Place of Expiry: ____________________________________________________________________________________

LC Available with: _________ (a) ___________ by ___________ (b) __________. Please tick as applicable on the below

(a) Advising Bank Any Bank Issuing Bank

(b) Payment Acceptance Negotiation Deferred Payment Mixed Payment Terms

Tenor/Drafts at/ Deferred Payment Terms ______________________________________________________________

If it is a usance LC, Indicate the usance period i.e. -----xxxx--days from invoice date or Bill of Lading date or Delivery Note date etc.

Mixed Payment Terms ______________________________________________________________________________

_________________________________________________________________________________________________

Page 1 of 7 Please Turn Over

Partial Shipment Allowed Not Allowed Trans-Shipment Allowed Not Allowed

Confirmation: Required Not Required May Add

SHIPMENT DETAILS:

Port of Loading ____________________________________ Port of Discharge ________________________________

(For Multimodal or Local Transport Only)

Place of Final Destination/For Transportation to / Place of Delivery _________________________________________

Place of Taking in Charge ___________________________________________________________________________

Document Presentation Period _______________________________________________________________________

(If it is not indicated, the bank will take a default of 21 days from Shipment Date or Delivery Note Date)

DOCUMENTS REQUIRED

Tick as appropriate

Tick Details Number of Copies

Document Type Original Copies

Commercial Invoices

Full set of clean on-board bills of lading consigned to

Equity Bank Uganda Limited

Full set of Multimodal Bills of Lading consigned to

Equity Bank Uganda Limited

Marked: Freight Prepaid Freight payable at destination

Notify Party ________________________________________________

Certificate of Origin (Issued by: ____________________________________)

Certificate of Conformity (Issued by: ______________________________)

Certificate of Inspection (Issued by: ______________________________)

Packing List

Delivery Notes

Insurance certificate / Policy covering all risks for 110% of invoice value

Other Documents

Documents to be forwarded by the negotiating bank in one lot by courier unless otherwise stated

ADDITIONAL CONDITIONS

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Page 2 of 7 Please Turn Over

Bank charges are for:

Issuing Bank Charges Applicant Beneficiary

Advising Bank Charges Applicant Beneficiary

Confirming Bank Charges Applicant Beneficiary

Correspondent Bank charges Applicant Beneficiary

Bank Charges

Debit your charges from our account number ______________________________ Currency __________________

On receipt of SWIFT claim from the negotiating bank or upon your receipt of the relative import documents; you are

authorized to debit our account in settlement. Account Number ____________________ Currency _____________

Others (please specify) ____________________________________________________________________________

SECURITY DETAILS

(Please tick as applicable)

Pre-approved Bank Facility Cash covered

CASH COVER DETAILS (only applicable for cash covered Letters of Credit)

If Cash Covered, please insert the below details: Amount of cash cover (amount in figures and words)

Currency ___________________________ Amount in Figures _____________________________________________

Words ___________________________________________________________________________________________

_________________________________________________________________________________________________

CASH COVER ACCOUNT DETAILS:

Currency _____________________________ Account Number _____________________________________________

We authorize the Bank to debit the above account number with the above cash cover amount and we authorize

the bank to utilize the same cash cover/margin in settlement of any drawing under this LC.

Page 3 of 7 Please Turn Over

TERMS AND CONDITIONS

The account opening General terms and conditions are supplemental to these terms and conditions. In the event of conflict

between the account opening General terms and conditions and these terms and conditions, these terms and conditions

will prevail and take precedence.

1. In consideration of the Bank opening the Letter of Credit / i. The Applicant’s liabilities to the Bank are to continue in

Standby Letter of Credit (hereinafter both referred to as force and to be applicable to all transactions entered

Letter of Credit or as the context permits) as per into hereunder, notwithstanding any change in the

particulars stated overleaf: composition of the firm or firms, parties hereto, or in the

a. The Applicant authorizes the Bank to debit its account beneficiary(ies) hereunder. In the event these Terms and

with the applicable Bank commissions, charges, Conditions are signed by two or more parties, the

marginal deposits, and expenses together with those Applicant hereby declares that its liability hereunder is

of the Bank’s correspondents where applicable as and joint and several.

when they become due.

b. The Applicant hereby undertakes to accept and pay in j. The Applicant authorizes the Bank to debit the Applicant’s

due course all drafts within the terms thereof and/or to account with all charges incurred by the Bank’s

take up and pay for all documents negotiated Overseas Correspondents, notwithstanding the clause

thereunder on presentation and on default of the “Overseas Bank Charges for Beneficiary’s Account”, if

Applicant so doing, the Applicant authorizes the Bank the LC expires unutilized and/or such charges are

to sell the goods before or after arrival and adjust the refused by the overseas supplier.

proceeds against the amount due to the Bank. In case k. The Applicant agrees that the Bank may restrict

of any shortfall, the Applicant undertakes to make good negotiations under this Letter of Credit to its own offices

the amount of the shortfall. or to any Correspondent of its choice. Interest, where

c. The Applicant agrees that the Letter of Credit is subject applicable, is payable by the Applicant from the date of

to Uniform Customs and Practice for Documentary payment by the Bank’s Correspondent until the

Credits latest version, International Standby Practice reimbursement currency is available to the Bank, and

(ISP) latest version and International Standard Banking any exchange risks are for the Applicant’s account.

Practice (ISBP) latest version as the case shall be. l. The Bank retains the right to advise and/or restrict the

d. The Applicant hereby authorizes the Bank to hold the availability to honour or negotiate the LC to such

documents called for by the terms of the Letter of person(s) the Bank may specify, even if the Applicant

Credit and merchandise to which they relate and the stipulates otherwise in the Application Form.

relative insurance as security for all liabilities incurred m. The Bank will honour (for the Applicant’s account) all

by the Bank, its Correspondents or Agents in presentations made in compliance with the terms of the

connection with this Letter of Credit including LC.

expenses and charges, of whatever nature incurred in n. The Bank may reject any complying and/or non-complying

relation to the said merchandise or the obtaining of presentations under the LC even if:

possession or the disposal thereof. The Applicant (a) The Bank has notified the Applicant that the

hereby authorizes the Bank to incur expenses and presentation was compliant; or

charges in fulfillment of its obligations herein and (b) The Applicant instructs the Bank to waive all

undertakes to reimburse the Bank the expenses and discrepancies the Bank has advised the Customer.

charges thereof. o. If the Bank receives a complying presentation the Bank

e. The Applicant agrees to provide in the manner and to will comply with its Reimbursable Payment Obligation

the extent required by the Bank all insurance even if the Bank mistakenly informs the Applicant that

necessary for the full protection of the Bank’s interest the presentation was non-compliant. The Bank is not

in the goods shipped under this Letter of Credit, and on liable to the Applicant for any losses the Applicant may

behalf of the Bank and subject to its instructions to suffer or incur as a result of such mistake.

prosecute or to ensure the prosecution of any claim p. The Bank may select the advising bank without consulting

that may arise under any insurance and to pay the the Applicant even if the Applicant stipulates an advising

proceeds thereof to the Bank. bank in the Application Form.

f. The Applicant further agrees to pledge to the Bank any q. If the Applicant does not waive any discrepancies within 5

additional security that the Bank may, from time to Banking Days after the Bank’s notice of presentation of

time, require to cover the Applicant’s liabilities to the discrepant documents (the “Cut-Off Period”) the Bank

Bank hereunder and in the event of the Bank selling may return the documents to the presenter within 21

the merchandise, pay on demand, the amount of any days after the Cut-Off Period.

deficiency. r. The Applicant must ensure that any goods under the

g. The Applicant agrees to hold the Bank and its officers Letter of Credit are permitted to be imported to the

and Correspondents free from any responsibility for relevant country. If the Bank requires to inspect the

mistakes or delays which may result in and from the import license, the Applicant must provide the original

transmission of its instructions. of such import license to the Bank at the time of the

h. It is agreed that the Bank will not be held responsible application.

for the genuineness or correctness of the Air Way Bill / s. These Terms and Conditions will extend to all extensions,

Bill of Lading or other documents or any endorsement renewals, amendments, modifications, replacements or

thereon or for any mistake or misrepresentation as to variations of the Letter of Credit.

the quality, quantity, weight, marks or value of any

merchandise comprised or as to the terms, conditions

or sufficiency of the insurance policies or certificates.

Page 4 of 7 Please Turn Over

2. The following additional provisions will apply, in the event as principal or surety on any banking account or loan

the Bank issues any Back-to-Back LC on the Applicant’s account or upon any discount or other account or for any

Instruction or otherwise on the Applicant’s behalf. other matter or thing including the usual banking

a. Where the master credit is not advised by the Bank, charges and may be retained and at any time without

the Applicant will promptly notify the Bank upon notice to the Applicant be applied by the Bank in or

becoming aware of any amendment proposed to be towards payment or satisfaction of any such

made to the master credit. The Applicant will not indebtedness or liability whether presently payable or

agree to or reject any amendment to the master credit not.

without the written consent of the Bank. Any d. The Bank will be entitled without further notice to the

amendment to the slave credit will require the Bank’s Applicant at any time and from time to time to apply the

written consent and will only take effect after receipt whole or any part of the Cash Collateral thereon in

by the Bank of written consent from the relevant repayment of the whole or any part of the Applicant’s

parties to the slave credit. then indebtedness to the Bank of the said advances

b. Where both the master credit and the slave credit call and/or financial accommodation for principal, interest,

for the application of CIF terms in accordance with costs and charges (legal or otherwise and of any nature

Incoterms® 2020, the Bank may in the slave credit whatever) and may so apply the whole or any part of such

stipulate an insured value plus an appropriate higher amount until the Applicant’s obligations are fully settled.

percentage to match the insured value plus the e. Every such application of the Cash Collateral shall to the

percentage required by the master credit, to avoid the extent of the amount so applied discharge the

master credit being “underinsured”. indebtedness to the Bank in respect of the Cash

c. After documents are presented under the slave credit, Collateral in all respects as if the amount so applied had

the Applicant will on demand by the Bank deliver to been paid to us personally and accepted by the Bank as

the Bank the Applicant’s Draft, invoice and any other payment in whole or in part (as the case may be) of the

document required to facilitate a complying amount due or accruing to us in respect of the said Cash

presentation under the master credit. Collateral.

d. The Bank may: f. Until such time as all present or contingent indebtedness

i. Retain possession of any document presented of the Applicant to the Bank of whatsoever nature or kind

under the slave credit; is discharged in full, the Applicant shall not be entitled to

ii. Take any action including presenting documents to call for payment of or to be paid the whole of or any part

obtain payment under the master credit; of the Cash Collateral and the Bank shall be under no

iii. Negotiate or discount the master credit; and indebtedness to the Applicant in respect thereof.

iv. Apply the proceeds of any drawing under the g. The Cash Collateral referred to herein may be, if realized,

master credit to pay the corresponding drawing appropriated against any indebtedness of the Applicant

under the slave credit irrespective of any to the Bank, at the Bank’s sole discretion

discrepancy in any document presented under the notwithstanding that such indebtedness may be

slave credit. expressed in a currency other than the currency received

e. The Applicant will not, without the Bank’s prior written by the Bank in realization thereof. In the event that the

consent, assign any of the proceeds of the master Bank demands payment of any indebtedness of the

credit to any person. Applicant, the Bank reserves the right, at its sole

discretion, to switch any foreign currency indebtedness

3. The following additional conditions will apply when Cash by the Applicant into Uganda Shillings at the rate ruling

Collateral is provided to the Bank as security for issuance at the day of such switch. In exercising the rights to

of the Letter of Credit and/or Standby Letter of Credit: switch foreign currency indebtedness of the Applicant

a. The Applicant understands that where any cash margin into Uganda Shillings, the Bank will not be liable for any

(herein referred to as Cash Collateral) is held by the losses incurred by the Applicant resulting from exchange

Bank as security for above bank facility by the Bank rate fluctuations.

this will be released upon expiry or cancellation of the h. The Bank may at any time and without notice whatsoever

facility and confirmation of full settlement of the to the Applicant, combine or consolidate all or any of

Applicant’s obligations to the Bank. his/their existing accounts with the Bank and set off or

b. The Applicant further understands that no interest transfer any sum standing to the credit of any one or

shall accrue on the Cash Collateral and that the same more of those accounts in or towards the satisfaction of

will be held in the sole name of and shall be the any monies, obligations or liabilities of ours to the Bank

property of the Bank until utilization of the facility by whether those liabilities be present, future, actual,

the Bank at which time we shall be entitled on contingent, primary, collateral, joint or several.

demand made on that date to payment of the said

amount. 4. CONVERSION OF FACILITY

c. The Bank will be entitled to retain the receipt for the The Bank may, at its discretion and for any reason

Cash Collateral and to record a lien thereon. The whatsoever at any time convert the Facility or any

Applicant agrees that the Cash Collateral which may portion thereof into any other currency at a rate to be

from time to time stand to the Applicant’s credit on any determined by the Bank in its sole and absolute

account with the Bank shall be held as a security for discretion and all amounts due and owing by the Bank

the payment of any sum or sums of money now or (including interest and other costs, charges and

hereafter from time to time become due or owing to expenses) shall thenceforth be paid to the Bank in the

the Bank by the Applicant or by the Applicant jointly new currency.

with any other person or persons whether

Page 5 of 7 Please Turn Over

5. SET-OFF a. If delivered by hand or sent by registered post the

The Bank may, at any time without notice or demand to Applicant and/or Guarantor shown in section A of

the Applicant and notwithstanding any settlement of this letter or at the registered offices or any of the

account or other matter whatsoever, combine or principal places of business of the Applicant in

consolidate all or any then existing accounts of the Uganda. In the absence of evidence of earlier

Applicant (whether alone or jointly) with the Bank receipt, any notice or demand shall be deemed to

wherever situate including accounts in the name of the have been received if delivered by hand at the time

Bank (whether current, deposit, loan or of any other of delivery or if sent by registered post five (5) days

nature whatsoever, whether subject to notice or not and after the date of posting (notwithstanding that it be

in whatever currency denominated) and set off or undelivered or returned undelivered). Where a

transfer any sums standing to the credit of any one or notice or demand is sent by registered post it will be

more such accounts in or towards satisfaction of any sufficient to prove that the notice or demand was

obligations and liabilities of the Applicant to the Bank properly addressed and posted.

whether such liabilities be present, future, actual, b. By electronic media including phone, SMS, email,

contingent, primary, collateral, joint or several and the internet or other convenient means as notified to

Applicant expressly waives any rights of set-off that the the Bank by the Applicant and/or Guarantor or:

Applicant may have, so far as is permitted by law, in c. Through print media by a notice published in two

respect of any claim which it may now or at any time local dailies of nationwide circulation in Uganda.

hereafter have against the Bank.

10. DISCLOSURE

6. EXPENSES AND INDEMNITY To enable the Bank to comply with regulatory

The Applicant will pay to the Bank on demand all costs requirements, the Applicant, by its acceptance of the

charges and expenses incurred on the accounts of the Facility, irrevocably consents to the disclosure by the

Applicant with the Bank and will reimburse the Bank on Bank, its officers and agents in any manner however of

demand for all expenses, including legal expenses, any information relating to the Applicant and its

incurred by the Bank in connection with the negotiation account relationship with the Bank including without

and preparation of this Letter and with the preparation limitation, details of the Applicant’s Facility, the

and registration of the security, and will reimburse the security taken, the Applicant’s credit balances and

Bank on demand with all expenses incurred by the Bank deposits with the Bank, default under the Facility,

in suing for or recovering any sum due to the Bank under outstanding balances on the Facility and any

this Letter or the security or otherwise in protecting or enforcement action taken to (i) any regulatory or

enforcing its rights under this letter or the security and supervisory authority including fiscal authority in any

the Applicant will pay all legal fees stamp and other jurisdiction (ii) any potential assignee of the Bank or

duties and taxes (if any) to which this letter and the other participant in any of its rights and/or obligations

security may be subject or give rise and will indemnify in relation to the Applicant’s Facility (iii) any

the Bank against any and all liabilities with respect to or guarantors, third party pledge or security providers (iv)

resulting from any delay or omission on the part of the the Bank’s agents and (v) any Credit Reference Bureau

Applicant in the payment thereof. The Applicant will as required by law.

indemnify the Bank against any loss that the Bank may

suffer as a result of granting the Facility to the Applicant. 11. WAIVERS, REMEDIES CUMULATIVE

No failure or delay by the Bank in exercising any right,

7. APPOINTMENT OF ATTORNEY power or privilege under this Letter shall impair the

The Applicant hereby irrevocably appoints the Bank to be same or operate as a waiver for the same nor shall any

the attorney of the Applicant and in the name and on single or partial exercise of any right, power or

behalf of the Applicant to execute and do any privilege preclude any further exercise of the same or

assurances, acts and things which the Applicant ought to the exercise of any other right, power or privilege. The

execute and do under the covenants and agreements rights and remedies provided in this Letter are

herein contained and generally to use the name of the cumulative and not exclusive of any rights and

Applicant in the exercise of all or any of the powers remedies provided by law.

hereby or by law conferred on the Bank.

12. SEVERABILITY

8. ASSIGNMENT If, at any time, any provision herein is or becomes

The Applicant shall not be entitled to assign all or any illegal, invalid or unenforceable in any respect under

part of its rights obligations or benefits hereunder any law of any jurisdiction, neither the legality, validity

without the prior consent in writing of the Bank. The or enforceability of the remaining provisions nor the

Bank may assign or transfer all or any of its rights and legality, validity or enforceability of such provision

obligations under this Letter and/or any of the under the law of any other jurisdiction will in any way

Securities. The Applicant and the Guarantors will at the be affected or impaired. The Bank reserves the right to

Bank’s request execute all documents and enter into all create a loan account in the name of the Applicant for

such agreements specified by the Bank to be necessary the amount outstanding together with accrued interest,

to give effect to any such assignment or transfer. costs and commissions thereon which shall remain

due and payable until payment in full. The Applicant

9. NOTICES will indemnify the Bank against any loss (including loss

A notice or demand for payment by the Bank under these of profit) or expense which may be incurred as a

Terms and Conditions shall be deemed to have been consequence of any default in payment by the Applicant

properly served on the Applicant and/or Guarantor if of any sum hereunder when due and/or the occurrence

issued through any one of the following means: of any event of default.

Page 6 of 7 Please Turn Over

13. These Terms and Conditions shall be unlimited as to 15. These Terms and Conditions shall be governed,

amount or duration. construed, and interpreted in accordance with the

14. All complaints may be made in person in any laws of Uganda.

Equity Bank Branch, in writing, by email to 16. Any dispute arising out of or in connection with these

info@equitybank.co.ug or by telephone on 0312327000. Terms and Conditions that is not amicably resolved

The Bank takes all reasonable measures to resolve all between the Bank and the Customer shall be referred

complaints within a reasonable time. to the exclusive jurisdiction of the courts of Uganda.

In witness whereof the Applicant has hereunto subscribed his name, address, and signature the day and year first herein

before written.

I / We the undersigned confirm I / We have read and understood the terms of the Privacy Policy and hereby give express,

unequivocal, free, specific, and informed authority to Equity Bank (Uganda) Limited and its affiliates to collect, use and process

my / our data as per the policy provided at https://equitygroupholdings.com/privacy-policy/

To be signed as per account mandate held with the bank.

Authorized signatories of the Applicant

NAME SIGNATURE DATE

(1)

(2)

(3)

(4)

Page 7 of 7 Please Turn Over

You might also like

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Sav 5188Document3 pagesSav 5188sopor,es painNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)HACKER XNNo ratings yet

- GSA Bond PackageDocument26 pagesGSA Bond PackageJoshua Sygnal GutierrezNo ratings yet

- Chapter 189-The Stamp Duty Act PDFDocument92 pagesChapter 189-The Stamp Duty Act PDFEsther Maugo100% (1)

- Tax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceDocument1 pageTax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceJohnArbNo ratings yet

- Affidavit of Fact Bill Already Paid TEMPLATEDocument2 pagesAffidavit of Fact Bill Already Paid TEMPLATEMel FloresNo ratings yet

- Banker's Confirmation Request Form: Personal BankingDocument1 pageBanker's Confirmation Request Form: Personal BankingArsalan HafeezNo ratings yet

- Certified Funds: MemorandumDocument2 pagesCertified Funds: Memorandumbrittanilpeedin100% (2)

- SHULTZYS Bill Notice-First Letter 27-02-2023Document3 pagesSHULTZYS Bill Notice-First Letter 27-02-2023Michael SchulzeNo ratings yet

- Commerci Al L Aw Memory Aid Negotiable Instruments LawDocument11 pagesCommerci Al L Aw Memory Aid Negotiable Instruments LawGold Leonardo100% (1)

- STC Reimbursement GuidanceDocument8 pagesSTC Reimbursement GuidanceJhomer Claro100% (2)

- Securities and Exchange Commission (SEC) - Formt-1Document7 pagesSecurities and Exchange Commission (SEC) - Formt-1highfinanceNo ratings yet

- 2 Bill of Exchange TemplateDocument1 page2 Bill of Exchange Templatestormy griffith100% (2)

- Securities and Exchange Commission (SEC) - Form1-ADocument35 pagesSecurities and Exchange Commission (SEC) - Form1-AhighfinanceNo ratings yet

- Stop Payment OrdersDocument25 pagesStop Payment Orderssintayehusisay300No ratings yet

- Sample Letter of DefaultDocument1 pageSample Letter of DefaultWinnie WenNo ratings yet

- W-8BEN: Do NOT Use This Form IfDocument1 pageW-8BEN: Do NOT Use This Form IfdoyokaNo ratings yet

- Unit 13: 1. What Is A Negotiable InstrumentDocument7 pagesUnit 13: 1. What Is A Negotiable InstrumentAyas JenaNo ratings yet

- 2A-505. Cancellation and Termination and Effect of Cancellation, Termination, Rescission, or Fraud On Rights and RemediesDocument2 pages2A-505. Cancellation and Termination and Effect of Cancellation, Termination, Rescission, or Fraud On Rights and RemediesSheldon JungleNo ratings yet

- Hold Harmless and Indemnity Agreement No Hid - 220221 - Hhia Non-Negotiable - Private Between The PartiesDocument2 pagesHold Harmless and Indemnity Agreement No Hid - 220221 - Hhia Non-Negotiable - Private Between The Partiesliz knight100% (1)

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- Certificate of Fiduciary AuthorityDocument1 pageCertificate of Fiduciary AuthorityQueen Rena100% (1)

- Turkish Pharmaceuticals IndustryDocument33 pagesTurkish Pharmaceuticals IndustryAHNS123No ratings yet

- Dealing With Bankers . Credit Cards and Mortgages Etc. NotesDocument8 pagesDealing With Bankers . Credit Cards and Mortgages Etc. NotesNate BruceNo ratings yet

- Banking Resolution ReviewDocument2 pagesBanking Resolution Reviewalin99No ratings yet

- Irrevocable Stock or Bond PowerDocument1 pageIrrevocable Stock or Bond PowerTrent WindfontNo ratings yet

- GSA LetterDocument4 pagesGSA LetterAustin Denean100% (1)

- US Internal Revenue Service: I3520 - 1999Document12 pagesUS Internal Revenue Service: I3520 - 1999IRSNo ratings yet

- Lawyer Attorney Engagement Letter SampleDocument5 pagesLawyer Attorney Engagement Letter SampleluxNo ratings yet

- Escrow Agreement TemplateDocument32 pagesEscrow Agreement TemplateKyle0% (1)

- Negotiable Instruments ActDocument9 pagesNegotiable Instruments ActJohnson Nu100% (1)

- Service Agreement SampleDocument5 pagesService Agreement Samplemacebailey100% (7)

- 07 Securities LawDocument41 pages07 Securities LawChristy Amor P. LofrancoNo ratings yet

- Stamp Act 1899Document75 pagesStamp Act 1899Shreyas VijayNo ratings yet

- Letter of Credit Checklist and Sample LanguageDocument7 pagesLetter of Credit Checklist and Sample LanguageSeran TuraNo ratings yet

- Promissory NoteDocument6 pagesPromissory NoteJames HumphreysNo ratings yet

- F 4852Document2 pagesF 4852GoodinespressurewashingNo ratings yet

- Civil Cover SheetDocument2 pagesCivil Cover SheetJordan CrookNo ratings yet

- Performance Bond: (See Instructions On Reverse)Document2 pagesPerformance Bond: (See Instructions On Reverse)Pamela HowardNo ratings yet

- Security Agreement Letter of CreditDocument2 pagesSecurity Agreement Letter of CreditvishwahiremathNo ratings yet

- Custodial AgreementDocument4 pagesCustodial AgreementNicole SantoallaNo ratings yet

- Promissory Note: Borrower: LenderDocument1 pagePromissory Note: Borrower: LenderAmis SteigerNo ratings yet

- Notice of DishonorDocument1 pageNotice of DishonorGabrielNo ratings yet

- Application To File Declaration of Intention: U.S. Citizenship and Immigration ServicesDocument8 pagesApplication To File Declaration of Intention: U.S. Citizenship and Immigration ServicesCaleb BrownNo ratings yet

- Entry of Collateral by The Acting Trustee Secured PartyDocument1 pageEntry of Collateral by The Acting Trustee Secured PartyFRED CLARKNo ratings yet

- Entity Classification Check The BoxDocument5 pagesEntity Classification Check The Boxdeepangulo100% (1)

- Lesson 1-Simple and General AnnuitiesDocument23 pagesLesson 1-Simple and General AnnuitiesClifford Estrellado100% (1)

- 154 Chestnut Lane Demand Letter To HSBCDocument14 pages154 Chestnut Lane Demand Letter To HSBCkinkom100% (1)

- Certificate of Default Affidavit of Notary Presentment - Certification of MailingDocument1 pageCertificate of Default Affidavit of Notary Presentment - Certification of Mailingluke elbertNo ratings yet

- JJK, InC. Promissory Note - Lump - 080528Document4 pagesJJK, InC. Promissory Note - Lump - 080528Maurice FoxworthNo ratings yet

- Security Agreement For Borrowing Money: 1. NamesDocument5 pagesSecurity Agreement For Borrowing Money: 1. NamesRachelNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeVadic FactsNo ratings yet

- Main Wire Transfer FormDocument2 pagesMain Wire Transfer FormThierry Nhamo100% (1)

- Charge BackDocument1 pageCharge BackEyeAmNo ratings yet

- UCC IRS Private BankingDocument54 pagesUCC IRS Private BankingScribdTranslationsNo ratings yet

- Depository InvestorsguideDocument17 pagesDepository Investorsguideapi-3705645No ratings yet

- Promissory NoteDocument1 pagePromissory Noteapi-300362811No ratings yet

- Letter of Credit (English Version)Document10 pagesLetter of Credit (English Version)Mario MantapzNo ratings yet

- Bond & Debenture ValuationDocument12 pagesBond & Debenture ValuationAjinkya NikamNo ratings yet

- 8281 2010 PIMCO ExDocument1 page8281 2010 PIMCO ExBunny Fontaine100% (1)

- Documentary Schedule SamplesDocument2 pagesDocumentary Schedule Samplesgalal2720006810No ratings yet

- Ahme Paper RevisedDocument54 pagesAhme Paper Revisedkassahun meseleNo ratings yet

- JKSC TB 2 Nov 23Document80 pagesJKSC TB 2 Nov 23Narayan choudharyNo ratings yet

- PlumHQ Aims To Solve India's Missing Middle Puzzle in Digital InsuranceDocument9 pagesPlumHQ Aims To Solve India's Missing Middle Puzzle in Digital InsuranceShatir LaundaNo ratings yet

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina HughesNo ratings yet

- Introduction to E-Commerce and Car AggregatorsDocument80 pagesIntroduction to E-Commerce and Car AggregatorsM S AksharaNo ratings yet

- Life Insurance Premium Payment CalcDocument4 pagesLife Insurance Premium Payment Calcクマー ヴィーンNo ratings yet

- Westfall Technik Inc. 2021 Summary Annual Report 501Document2 pagesWestfall Technik Inc. 2021 Summary Annual Report 501Miguel FrancoNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument8 pagesStock Screener, Technical Analysis Scannerravi kumarNo ratings yet

- Bailment ProjectDocument29 pagesBailment ProjectBhavs100% (2)

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- PDIC v. Citi Bank and BADocument2 pagesPDIC v. Citi Bank and BAGlen BasiliscoNo ratings yet

- Exporting Raw Sugar to the UKDocument24 pagesExporting Raw Sugar to the UKKezia CasanovaNo ratings yet

- Overheating - Motors at Ore Processing Plant TestingDocument4 pagesOverheating - Motors at Ore Processing Plant TestingAlif GhazaliNo ratings yet

- Kotak Group Smart Cash - One Pager 2999 Rs VariantDocument1 pageKotak Group Smart Cash - One Pager 2999 Rs VariantMohammed Eidrees RazaNo ratings yet

- V - 62 Caroni, Trinidad, Thursday 9th February, 2023-Price $1.00 N - 23Document6 pagesV - 62 Caroni, Trinidad, Thursday 9th February, 2023-Price $1.00 N - 23ERSKINE LONEYNo ratings yet

- 2024.02.01FA ExerciseDocument2 pages2024.02.01FA ExerciseNgan Nguyen Ho KimNo ratings yet

- BEDA - CaseZ-Doctrines-InsuranceDocument5 pagesBEDA - CaseZ-Doctrines-InsuranceMalcolm CruzNo ratings yet

- Bay County, FL - Personnel-Policies-For-EmployeesDocument8 pagesBay County, FL - Personnel-Policies-For-EmployeesRaisa S.No ratings yet

- Bajaj Two Wheeler Insurance PolicyDocument7 pagesBajaj Two Wheeler Insurance PolicyManjunath BNo ratings yet

- Candidate Facing Benefits Sheet 2Document4 pagesCandidate Facing Benefits Sheet 2brendaNo ratings yet

- Get covered for paint protection with AAMI car insuranceDocument2 pagesGet covered for paint protection with AAMI car insuranceNeamat AliNo ratings yet

- LOMA Course CatalogueDocument1 pageLOMA Course CataloguePawan YadavNo ratings yet

- Working While Disabled: How We Can Help: SSA - GovDocument23 pagesWorking While Disabled: How We Can Help: SSA - GovKimberly Love AlgerNo ratings yet

- REV - Outpatient Claim Form - AIADocument2 pagesREV - Outpatient Claim Form - AIAYen SylvaniNo ratings yet

- BB202 Lecture 5 (New) PDFDocument18 pagesBB202 Lecture 5 (New) PDFUyên PhạmNo ratings yet

- CHOOSING THE RIGHT TERM PLANDocument1 pageCHOOSING THE RIGHT TERM PLANKumardasNsNo ratings yet