Professional Documents

Culture Documents

As Non Company Entities CA Chintan Patel

Uploaded by

AkshayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As Non Company Entities CA Chintan Patel

Uploaded by

AkshayCopyright:

Available Formats

Pune Branch of WIRC of ICAI

Accounting Standards

Applicability for Non-

company entities

CA. Chintan N. Patel

RCM, WIRC of ICAI

13th June, 2021

Index

ICAI Announcement dated 31.03.21

Accounting Standards Applicability

Exemption/Relaxations from AS

FAQs

Commonly observed errors in Accounting

Standards

CA. Chintan N. Patel

ICAI Announcement dated 31.03.21

Applicability of AS to Non-Company

Entities (NCEs)

Classification of NCEs

• Level – 1 Large Size Entities

• Level – 2 Medium Size Entities

• Level – 3 Small Size Entities

• Level – 4 Micro Size Entities

Applicability: Accounting period

commencing on or after 1st April, 2020

CA. Chintan N. Patel

Level – I Entities

Non-company entities which fall in any one or more of the

following categories, at the end of the relevant accounting period

(i) Entities whose securities are listed or are in the process of listing

on any stock exchange, whether in India or outside India.

(ii) Banks (including co-operative banks), financial institutions or

entities carrying on insurance business.

(iii) All entities engaged in commercial, industrial or business

activities, whose turnover (excluding other income) exceeds rupees

two-fifty crore in the immediately preceding accounting year.

(iv) All entities engaged in commercial, industrial or business

activities having borrowings (including public deposits) in excess of

rupees fifty crore at any time during the immediately preceding

accounting year.

(v) Holding and subsidiary entities of any one of the above.

CA. Chintan N. Patel

Level – II Entities

Non-company entities which are not Level I entities but fall

in any one or more of the following categories

(i) All entities engaged in commercial, industrial or business

activities, whose turnover (excluding other income) exceeds

rupees fifty crore but does not exceed rupees two-fifty crore in

the immediately preceding accounting year.

(ii) All entities engaged in commercial, industrial or business

activities having borrowings (including public deposits) in

excess of rupees ten crore but not in excess of rupees fifty

crore at any time during the immediately preceding accounting

year.

(iii) Holding and subsidiary entities of any one of the above.

CA. Chintan N. Patel

Level – III Entities

Non-company entities which are not covered under Level I

and Level II but fall in any one or more of the following

categories

(i) All entities engaged in commercial, industrial or business

activities, whose turnover (excluding other income) exceeds

rupees ten crore but does not exceed rupees fifty crore in the

immediately preceding accounting year.

(ii) All entities engaged in commercial, industrial or business

activities having borrowings (including public deposits) in

excess of rupees two crore but does not exceed rupees ten

crore at any time during the immediately preceding accounting

year.

(iii) Holding and subsidiary entities of any one of the above.

Level 4 Entities: Non-company entities which are not

covered under Level I, Level II and Level III are

considered as Level IV entities.

CA. Chintan N. Patel

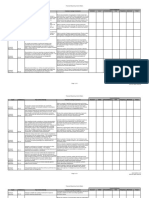

AS Applicability Summary

Level 1 Level 2 Level 3

Large Medium Small

Listed Yes - -

Banks, FI, Insurance Yes - -

Turnover > 250 Cr. > 50 Cr. >10 Cr

upto 250 Cr. upto 50 Cr

Borrowings > 50 Cr. > 10 Cr. >2 Cr.

upto 50 Cr. upto 10 Cr.

Holding or Subsidiary Yes Yes Yes

of any one of above

Level 4 Micro : Entities not covered in any of the above level.

CA. Chintan N. Patel

Is tax auditor required to comply with

Accounting Standards while carrying out Tax

Audit u/s. 44AB of Non-company entities?

Para 10.9 of Guidance Note on Tax Audit

under Section 44AB of the Income-tax Act,

1961:

AS also apply in respect of financial statements audited

under section 44AB of the Income-tax Act, 1961.

Accordingly, members should examine compliance with the

mandatory accounting standards when conducting such

audit.

CA. Chintan N. Patel

FAQ

Is Accounting Standards applicable in case

of Charitable or religious organisations?

CA. Chintan N. Patel

Taxation Audit Quality Review

Board

• Tax Audit

Scope • GST Audit

• Suo moto

• Reference by regulatory

Selection • Serious irregularities

highlighted by media

CA. Chintan N. Patel

Accounting Standards Applicability

Level-1: To comply in full with all Accounting Standards

AS Particulars Level II Level III Level IV

1 Disclosure of Accounting Policies Yes Yes Yes

2 Valuation of Inventories Yes Yes Yes

3 Cash Flow Statements NA NA NA

4 Contingencies and Events Yes Yes Yes

Occurring After the Balance Sheet

Date

5 Net Profit or Loss for the Period, Yes Yes Yes

Prior Period Items and Changes in

Accounting Policies

7 Construction Contracts Yes Yes Yes

9 Revenue Recognition Yes Yes Yes

CA. Chintan N. Patel

Accounting Standards Applicability

AS Particulars Level II Level III Level IV

10 Property, Plant and Equipment Yes Yes (DE) Yes (DE)

11. The Effects of Changes in Yes Yes (DE) Yes (DE)

Foreign Exchange Rates

12 Accounting for Government Yes Yes Yes

Grants

13 Accounting for Investments Yes Yes Yes (DE)

14 Accounting for Amalgamations Yes Yes NA *

15 Employee Benefits Yes (E) Yes (E) Yes (E)

16 Borrowing Costs Yes Yes Yes

17 Segment Reporting NA NA NA

18 Related Party Disclosures Yes NA NA

19 Leases Yes (DE) Yes (DE) Yes (DE)

20 Earnings Per Share NA NA NA

CA. Chintan N. Patel

Accounting Standards Applicability

AS Particulars Level II Level III Level IV

21 Consolidated Financial Stat. NA * NA * NA *

22 Accounting for Taxes on Income Yes Yes Yes (R)

23 Accounting for Investments in NA * NA * NA *

Associates in Consolidated FS

24 Discontinuing Operations Yes NA NA

25 Interim Financial Reporting NA * NA * NA *

26 Intangible Assets Yes Yes Yes (DE)

27 Financial Reporting of Interests NA * NA * NA *

in Joint Ventures

28 Impairment of Assets Yes (DE) Yes (DE) NA

29 Provisions, Contingent Liabilities Yes (DE) Yes (DE) Yes (DE)

and Contingent Assets

CA. Chintan N. Patel

Snapshot of Number of AS Applicable

Accounting Standards Level 1 Level 2 Level 3 Level 4

(Nos.)

Fully Applicable 27 16 12 8

Not Applicable 0 7 9 11

Applicable with 0 3 5 6

Disclosure exemptions

(DE)

Applicable with 0 1 1 1

exemptions (E) (AS-15)

Applicable for specific 0 0 0 1

provision (R) (AS-22)

Total 27 27 27 27

CA. Chintan N. Patel

List of Accounting Standards applicable to

All 4 categories of Non-company entities

Sr. Accounting Standard

No.

1. AS 1 Disclosures of Accounting Policies

2. AS 2 Valuation of Inventories

3. AS 4 Contingencies and Events Occurring After the Balance Sheet

Date

4. AS 5 Net Profit or Loss for the Period, Prior Period Items and

Changes in Accounting

Policies

5. AS 7 Construction Contracts

6. AS 9 Revenue Recognition

7. AS 12 Accounting for Government Grants

8. AS 16 Borrowing Cost

CA. Chintan N. Patel

List of Accounting Standards entirely not

applicable to Level II, III and IV categories of NCEs

Sr. Accounting Standard

No.

1. AS 3 Cash Flow Statement

2. AS 17 Segment Reporting

3. AS 20 Earnings Per Share

4. AS 21 Consolidated Financial Statements

5. AS 23 Accounting for Investments in Associates in Consolidated

Financial Statements

6. AS 25 Interim Financial Reporting

7. AS 27 Financial Reporting of Interests in Joint Ventures

CA. Chintan N. Patel

AS Particulars Level II Level III Level IV

15 Employee Benefits Yes (E) Yes (E) Yes (E)

(A) Entities whose average number of persons employed during the

year is 50 or more

S. Recognition and Measurement of Level II and III Level IV

N.

1. Short term accumulating Exempted Exempted

compensated absences which are

not vesting

2. - Payment to Defined Contribution No Discounting No Discounting

Plan

- Termination Benefits

that falls due more than 12

months after BS date

3. Post employment: Defined Benefit PUC Method Other Rational

Plans method

4. Other long term employee benefits PUC Method Other Rational

method

CA. Chintan N. Patel

AS Particulars Level II Level III Level IV

15 Employee Benefits Yes (E) Yes (E) Yes (E)

(B) Entities whose average number of persons employed during the

year is less than 50

S. Recognition and Measurement of Level II, III and

N. IV

1. Short term accumulating compensated absences Exempted

which are not vesting

2. - Payment to Defined Contribution Plan No Discounting

- Termination Benefits

that falls due more than 12 months after BS date

3. Post employment: Defined Benefit Plans Other Rational

method

4. Other long term employee benefits Other Rational

method

CA. Chintan N. Patel

AS Particulars Level II Level III Level IV

22 Accounting for Taxes on Income Yes Yes Yes (R)

Level IV:

Apply the

Transitional

requirements of AS 22

requirements

for Current tax

On the first occasion when a Non-

As defined in paragraph 4.4 of AS company entity gets classified as Level

22, with recognition as per IV entity, the accumulated deferred tax

paragraph 9, measurement as asset/liability appearing in the

per paragraph 20 of AS 22, and financial statements of immediate

presentation and disclosure as previous accounting period, shall be

per paragraphs 27-28 of AS 22. adjusted against the opening revenue

reserves.

CA. Chintan N. Patel

AS Particulars Level II Level III Level IV

28 Impairment of Assets Yes (DE) Yes (DE) NA

Level II and III:

• Allowed to measure the ‘value in use’ on the basis

of reasonable estimate thereof instead of

computing the value in use by present value

technique.

• If entity opts to measure value in use by not using

present value technique, relevant provisions

thereof not applicable.

Level III:

• Paragraphs 121(c)(ii); 121(d)(i); 121(d)(ii) and 123

relating to disclosures are not applicable

CA. Chintan N. Patel

Disclosure in FS if availed

exemptions/relaxations

Fact of being MSME and level

Compliance with Accounting Standards as applicable

Upgrade:- In case entities no longer eligible for exemption

that availed in previous period

Downgrade: Entities becoming eligible for

relaxation/exemption

Availment of exemption / relaxation for selective Accounting

Standard

Availament of selective exemption/relaxation of Accounting

Standard

CA. Chintan N. Patel

FAQ: Auditor Responsibility

What is the duty of an Auditor in case the

accounting standards are not complied with?

What is the duty of an Auditor in case Financial

Statements prepared on a basis other than

accrual?

Whether UDIN is required for Non-Corporate entities

which are not subject to Audit?

CA. Chintan N. Patel

WIRC Publication on Accounting Standards

Applicability for NCEs

Covering:

O Accounting Standards Applicability

O Exemptions/Relaxation List

O Frequently Asked Questions

O Model Auditor’s Report and FS

O Model Auditor Report

O Model Financial Statements

O Balance Sheet

O Profit & Loss Account

O Cash flow statements

O Notes on Accounts

O Appendix - ICAI Announcement of AS Applicability

CA. Chintan N. Patel

Resources

Sr. Particulars Location

No.

1. ICAI Announcement of applicability of https://resource.cdn.icai.org/64

Accounting Standards of Non-company 269asb51535.pdf

entities

2. Accounting Standards Quick https://resource.cdn.icai.org/64

Referencer for Micro Non-company 842asb52105.pdf

entities

3. Model Financials of Non-corporate https://wirc-

entities icai.org/images/publication/Mo

del-Financial-Statement-Final-

Book.pdf

4. Accounting Standards: Quick https://resource.cdn.icai.org/55

Referencer 939asb45327.pdf

5. Compendium of Accounting Standards https://resource.cdn.icai.org/56

169asb45450.pdf

CA. Chintan N. Patel

Thanks

chintan@nareshco.com CA. Chintan N. Patel

9099921163 Regional Council Member, WIRC of ICAI

You might also like

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Indian Accounting Standards All ChaptersDocument108 pagesIndian Accounting Standards All Chapterskunal100% (1)

- Solution Manual For Intermediate Accounting IFRS 4th Edition by Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield Chapter 1 - 24Document70 pagesSolution Manual For Intermediate Accounting IFRS 4th Edition by Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield Chapter 1 - 24marcuskenyatta27550% (2)

- Accounts Complier (QB) @mission - CA - InterDocument350 pagesAccounts Complier (QB) @mission - CA - Intershivangi sharma0907100% (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- FR Marathon Material - Bhavik ChokshiDocument82 pagesFR Marathon Material - Bhavik ChokshiRajat SharmaNo ratings yet

- Financial Reporting Important QuestionsDocument155 pagesFinancial Reporting Important QuestionsJuhi vohraNo ratings yet

- Nestle Project - AccountsDocument31 pagesNestle Project - AccountsNishant Shah75% (4)

- Intermediate Accounting IFRS 3rd EditionDocument20 pagesIntermediate Accounting IFRS 3rd EditionMalik MaulanaNo ratings yet

- Review Notes #2 PDFDocument9 pagesReview Notes #2 PDFJha Ya100% (3)

- Audit Planning Module 5Document53 pagesAudit Planning Module 5rogealynNo ratings yet

- Indian Accounting Standards (One Pager)Document29 pagesIndian Accounting Standards (One Pager)sridhartks100% (1)

- Independent University, Bangladesh.: Course Code: ACN-305Document19 pagesIndependent University, Bangladesh.: Course Code: ACN-305Ahsanur Hossain Tonmoy100% (1)

- Original PDF Finance For Non Financial Managers 7th Canadian Edition PDFDocument41 pagesOriginal PDF Finance For Non Financial Managers 7th Canadian Edition PDFpatrick.charriez697100% (36)

- Unit 2Document30 pagesUnit 2Dibyansu KumarNo ratings yet

- AccountingDocument437 pagesAccountingNeel Hati100% (1)

- Accounting Standard 170417Document32 pagesAccounting Standard 170417selvam sNo ratings yet

- Quick Guide To Ind AsDocument39 pagesQuick Guide To Ind AsGayathri NathanNo ratings yet

- Check List For The Chartered Accountant To Be Attached With Draft AccountsDocument7 pagesCheck List For The Chartered Accountant To Be Attached With Draft AccountsShrenik KatariyaNo ratings yet

- Accounting Standards 32Document91 pagesAccounting Standards 32bathinisridhar100% (3)

- CH 3 Unit 1 New Appilicability of Accounting StandardsDocument10 pagesCH 3 Unit 1 New Appilicability of Accounting StandardsAarti AgrawalNo ratings yet

- Unit - 2Document10 pagesUnit - 2Ram Prasad PatraNo ratings yet

- Accounting Standards Grp-1 Accounts by Accounts ManDocument52 pagesAccounting Standards Grp-1 Accounts by Accounts ManAlankritaNo ratings yet

- ASFR - Unit 2 - 2024Document89 pagesASFR - Unit 2 - 2024vishalsingh9669No ratings yet

- P1 Accounting ScannerDocument286 pagesP1 Accounting Scannervishal jalan100% (1)

- 74883bos60524 cp1Document42 pages74883bos60524 cp1cofinab795No ratings yet

- Electronic Way Bill Under GSTDocument46 pagesElectronic Way Bill Under GSTDeepak WadhwaNo ratings yet

- Accounting Standards (1 To 29)Document76 pagesAccounting Standards (1 To 29)Vipul I. PanchasaraNo ratings yet

- Ch13 DISCLOSURE PRINCIPLESDocument6 pagesCh13 DISCLOSURE PRINCIPLESralphalonzoNo ratings yet

- Testbank: Applying International Accounting StandardsDocument6 pagesTestbank: Applying International Accounting StandardsralphalonzoNo ratings yet

- Financial Reporting Disclosure Practices in Selected Small and Medium Enterprises (Smes) Listed On National Stock Exchange of IndiaDocument16 pagesFinancial Reporting Disclosure Practices in Selected Small and Medium Enterprises (Smes) Listed On National Stock Exchange of IndiaRajat RajatNo ratings yet

- 2018 10 K PDFDocument553 pages2018 10 K PDFSandro GilsâniaNo ratings yet

- f7f8601d805d458ab36eff46cb5d7146Document645 pagesf7f8601d805d458ab36eff46cb5d7146imgopi9999No ratings yet

- 5 TH Sem Advanced Accounting PPT - 2.pdf382Document21 pages5 TH Sem Advanced Accounting PPT - 2.pdf382Azhar Ali100% (3)

- Advanced Accounting New Syllabus Compiler 1.0 Nov 23 RTP UpdatedDocument635 pagesAdvanced Accounting New Syllabus Compiler 1.0 Nov 23 RTP Updatedsiddharthtripathi.gsaNo ratings yet

- Key Considerations in Filing ITR and 29B FinalDocument85 pagesKey Considerations in Filing ITR and 29B FinalCorman LimitedNo ratings yet

- Select Applicable Sheets Below by Choosing Y/N and Click On ApplyDocument69 pagesSelect Applicable Sheets Below by Choosing Y/N and Click On ApplysreetomapaulNo ratings yet

- Advanced Accounting Part 1 298 Pages Lyst9244Document298 pagesAdvanced Accounting Part 1 298 Pages Lyst9244viratkoolieNo ratings yet

- Accounting StandardsDocument6 pagesAccounting StandardsJohnsonNo ratings yet

- Accounting StandardDocument128 pagesAccounting StandardIndu GuptaNo ratings yet

- ITR-6 Acknowledgement for MAHIMA PRODUCTIONS LIMITEDDocument124 pagesITR-6 Acknowledgement for MAHIMA PRODUCTIONS LIMITEDRavi KumarNo ratings yet

- MyPayroll User Guide Investment DeclarationDocument18 pagesMyPayroll User Guide Investment DeclarationbhaavaNo ratings yet

- Accounting-Class 1: by - Sakshi SaxenaDocument26 pagesAccounting-Class 1: by - Sakshi SaxenaSakshiNo ratings yet

- Indian Accounting Standards (IndAS): Practical Aspects, Case Studies and Recent DevelopmentsDocument46 pagesIndian Accounting Standards (IndAS): Practical Aspects, Case Studies and Recent DevelopmentsKANADARPARNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate Governanceroman empireNo ratings yet

- Income Computation and Disclosure Standard (Icds) : CA. Ritesh MittalDocument143 pagesIncome Computation and Disclosure Standard (Icds) : CA. Ritesh MittalSubrat MohapatraNo ratings yet

- Othuser Guide For Investment Declaration 22-23 - MyPayroll User GuideDocument19 pagesOthuser Guide For Investment Declaration 22-23 - MyPayroll User GuideRiyaan SultanNo ratings yet

- Advanced Accounting StandardsDocument4 pagesAdvanced Accounting StandardsGedie RocamoraNo ratings yet

- 2.caro For Company AuditDocument43 pages2.caro For Company AuditchariNo ratings yet

- JAIIB AFM Practice MCQs Part 1Document17 pagesJAIIB AFM Practice MCQs Part 1preetmehtaNo ratings yet

- Form PDF 846262881191220Document80 pagesForm PDF 846262881191220Ravi KumarNo ratings yet

- Schedule III AmendmentsDocument38 pagesSchedule III AmendmentsGurvinder SinghNo ratings yet

- AS BookDocument68 pagesAS BookBHUVANESHNo ratings yet

- Amity Business School: NoidaDocument10 pagesAmity Business School: NoidaMansi VermaNo ratings yet

- Paper 18Document153 pagesPaper 18ahmedNo ratings yet

- FR MCQ'sDocument72 pagesFR MCQ'sMy KingdomNo ratings yet

- Training Content CTP W-O FeeDocument13 pagesTraining Content CTP W-O FeeRizwan MalikNo ratings yet

- CH 01Document20 pagesCH 01Sinta Ayu HikmahNo ratings yet

- Rev CMA Topic 10 ASDocument35 pagesRev CMA Topic 10 ASPrakhar BalyanNo ratings yet

- Financial Accounting and Reporting - 399Document37 pagesFinancial Accounting and Reporting - 399Jenny LinNo ratings yet

- Accounts Compiler by Rahul Malkan SirDocument301 pagesAccounts Compiler by Rahul Malkan SirKarthik Ram100% (1)

- Actg 10 Accounting For Governmental, Not-for-Profit Entities and Specialized IndustriesDocument3 pagesActg 10 Accounting For Governmental, Not-for-Profit Entities and Specialized IndustriesVanessa L. VinluanNo ratings yet

- Fabm1 (Lecture)Document10 pagesFabm1 (Lecture)Cabaral Ashley RussellNo ratings yet

- Dissertation Ias 40Document8 pagesDissertation Ias 40FindSomeoneToWriteMyPaperUK100% (1)

- Balance SheetDocument2 pagesBalance SheetChetan SinghNo ratings yet

- Final AssignmentDocument6 pagesFinal AssignmentTalimur RahmanNo ratings yet

- Auditing Mcqs-1-1Document27 pagesAuditing Mcqs-1-1Nasir LatifNo ratings yet

- ACCOUNTING - Definition, Phases, Importance With SpeechDocument6 pagesACCOUNTING - Definition, Phases, Importance With SpeechCaryl Anne MagalongNo ratings yet

- Bookkeeping MaterialDocument16 pagesBookkeeping MaterialPrincess Alyssa BarawidNo ratings yet

- Contemporary Auditing 11th Edition Knapp Solutions ManualDocument8 pagesContemporary Auditing 11th Edition Knapp Solutions ManualJohnTaylorredoj100% (85)

- Auditors Responsibility in Assessing Going ConcerDocument17 pagesAuditors Responsibility in Assessing Going ConcerNasrullah DjamilNo ratings yet

- Cs Executive: Corporate & Management AccountingDocument258 pagesCs Executive: Corporate & Management AccountingAksharaNo ratings yet

- Rovelyn E. Forcadas ABM-11 Activity #9-BDocument2 pagesRovelyn E. Forcadas ABM-11 Activity #9-BRovelyn E. ForcadasNo ratings yet

- Accounting Practices and Challenges of MSMEs in Quezon ProvinceDocument13 pagesAccounting Practices and Challenges of MSMEs in Quezon Provincely chnNo ratings yet

- ch14 Managerial AccountingDocument36 pagesch14 Managerial AccountingMNo ratings yet

- Daftar Pustaka: ULAYYA GEMPUR TIRANI, Zaki Baridwan, Prof., DR., M.SCDocument3 pagesDaftar Pustaka: ULAYYA GEMPUR TIRANI, Zaki Baridwan, Prof., DR., M.SCAnnisa AuliaNo ratings yet

- Accounting standard-GAAPDocument5 pagesAccounting standard-GAAPRifqi HuseinNo ratings yet

- Report PT Bukit Uluwatu Villa 30 September 2019Document146 pagesReport PT Bukit Uluwatu Villa 30 September 2019Hanif RaihanNo ratings yet

- BSSOXFinancial Reporting Control MatrixDocument4 pagesBSSOXFinancial Reporting Control MatrixDivine GraceNo ratings yet

- 01.CA Inter Audit BHASKAR Regular Notes Vol 1Document292 pages01.CA Inter Audit BHASKAR Regular Notes Vol 1Shivam GoyalNo ratings yet

- Resume Soni GargDocument4 pagesResume Soni GargSoni GargNo ratings yet

- CH - 8 Audit ReportDocument23 pagesCH - 8 Audit ReportBaljinder KaurNo ratings yet

- Week 7-8Document8 pagesWeek 7-8Kim Albero Cubel0% (1)

- CURRICULUM VITAE-FP SPV Tax Widasa Group Update 2Document11 pagesCURRICULUM VITAE-FP SPV Tax Widasa Group Update 2febrikafitriantiNo ratings yet

- Chapter 21 - Events After The Reporting PeriodDocument2 pagesChapter 21 - Events After The Reporting PeriodNazrin HasanzadehNo ratings yet

- PT Elnusa TBK Dan Entitas Anaknya/and Its SubsidiariesDocument115 pagesPT Elnusa TBK Dan Entitas Anaknya/and Its SubsidiariesNazila RahmahNo ratings yet

- Financial Statement Analysis HomeworkDocument2 pagesFinancial Statement Analysis HomeworkpratheekNo ratings yet

- Financial and Managerial Accounting ExplainedDocument4 pagesFinancial and Managerial Accounting Explainedsonam agrawalNo ratings yet

- 2 Multiple ChoiceDocument57 pages2 Multiple ChoiceMichael Brian TorresNo ratings yet