Professional Documents

Culture Documents

Balance Sheet Analysis

Uploaded by

ramyashraddha18Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet Analysis

Uploaded by

ramyashraddha18Copyright:

Available Formats

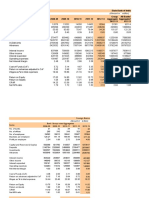

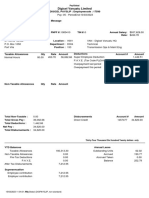

Year ended

3/31/2023 3/31/2022

Particulars

Audited

1. Interest earned (a+b+c+d) 651655 558767

a) Interest / discount on advances/ bills 532695 452548

b) Income on investments 109913 92478

c) Interest on balances with Reserve Bank 8260 13433

of India & other interbank funds

d) Other interest 787 308

2. Other income 115894 76906

3. Total income (1+2) 767549 635673

4. Interest expended 316774 287230

5. Operating expenses (i+ii) 203196 185422

(i) Employees cost 100596 94503

(ii) Other operating expenses 102600 90919

6. Total expenditure (excluding 519970 472652

provisions and contingencies) (4+5)

7. Operating profit before provisions and 247579 163021

contingencies (3-6)

8. Provisions (other than tax) and 103893 69929

contingencies

9. Exceptional items - -

10. Profit from ordinary activities before 143686 93092

tax (7-8-9)

11. Tax expense 33077 25765

12. Net profit from ordinary activities after 110609 67327

tax (10-11)

13. Extraordinary items (net of tax expense) - -

14. Net profit for the period (12-13) 110609 67327

15. Paid-up equity share capital (FV Rs.2/- 16041 16000

per share)

16. Reserves excluding revaluation reserve 842364 743620

17. Analytical ratio

(i) % of shares held by Government of - -

India

(ii) Capital adequacy ratio - Basel III (%) 18.56 19.21

(iii) Earnings per share (EPS) 1 (Rs.)

a) Basic EPS before and after 13.81 8.42

extraordinary items

b) Diluted EPS before and after 13.78 8.41

extraordinary items

(iv) NPA ratios

a) Gross NPA 145815 343104

b) Net NPA 46815 126079

c) % of Gross NPA 2.27 6.03

d) % of Net NPA 0.74 2.31

(v) Return on asset (annualised) (%) 1.27 0.86

18. Net worth 2 837867 741781

19. Paid up debt capital/ Outstanding 34.01 36.37

debt 3 (%)

20. Debt/equity ratio 4 0.05 0.09

21. Total debts to total assets 5 (%) 1.59 1.67

(Rs. In Lakh)

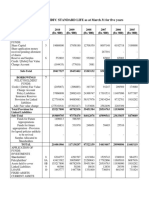

STATEMENT OF ASSETS AND LIABILITIES

As on As on

Particulars 31.03.2023 31.03.2022

(Audited) (Audited)

Capital and Liabilities

Capital 16041 16000

Reserves and surplus 842364 743620

Deposits 7663758 6848601

Borrowings 143201 133909

Other liabilities and 352578 265002

provisions

Total 9017942 8007132

Assets

Cash & balances with 427948 359426

Reserve Bank of India

Balances with banks and 41565 133191

money at call and short

notice

Investments 1880832 1721606

Advances 6313414 5466120

Fixed assets 43504 47849

Other assets 310679 278940

Total 9017942 8007132

(Rs. In Lakh)

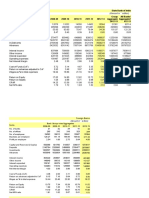

SEGMENT REPORTING FOR THE QUARTER/YEAR ENDED 31ST MARCH 2023

Quarter ended Year ended

3/31/2023 12/31/2022 3/31/2022 3/31/2023 3/31/2022

Business Segments

Audited Unaudited Audited Audited

Segment Revenue

1. Treasury 35734 30979 24666 124680 101825

2. 39551 43209 35148 157607 137351

Corporate/Wholesale

banking

3. Retail banking 139933 125853 100481 480325 392871

4. Other banking 1695 1230 1180 4937 3626

operations

Total 216913 201271 161475 767549 635673

Segment Results

1. Treasury 13113 10273 5596 41538 21790

2. 14674 15977 11122 55097 40810

Corporate/Wholesale

banking

3. Retail banking 51181 47966 32387 171785 120974

4. Other banking 1290 938 866 3734 2661

operations

Total 80258 75154 49971 272154 186235

Less: Unallocated 6353 6259 5840 24575 23214

income/expenses

Operating profit 73905 68895 44131 247579 163021

Tax expense 10822 3557 8772 33077 25765

Other provisions 29301 36409 14012 103893 69929

Net profit from 33782 28929 21347 110609 67327

ordinary activities

Extraordinary items - - - - -

Net profit 33782 28929 21347 110609 67327

Segment assets

1. Treasury 1937886 2047214 1848842 1937886 1848842

2. 1387959 1543134 1383603 1387959 1383603

Corporate/Wholesale

banking

3. Retail banking 4925455 4547189 4082517 4925455 4082517

4. Other banking - - - - -

operations

5. Unallocated 766642 763716 692170 766642 692170

Total segment 9017942 8901253 8007132 9017942 8007132

assets

Segment liabilities

1. Treasury 1769206 1857785 1738054 1769206 1738054

2. 1252671 1400589 1237855 1252671 1237855

Corporate/Wholesale

banking

3. Retail banking 4445801 4125842 3652676 4445801 3652676

4. Other banking - - - - -

operations

5. Unallocated 691859 693025 618928 691859 618928

Total (a) 8159537 8077241 7247513 8159537 7247513

Capital employed (Segment assets - Segment liabilities)

1. Treasury 168680 189429 110788 168680 110788

2. 135288 142545 145748 135288 145748

Corporate/Wholesale

banking

3. Retail banking 479654 421347 429841 479654 429841

4. Other banking - - - - -

operations

5. Unallocated 74783 70691 73242 74783 73242

Total (b) 858405 824012 759619 858405 759620

Total segment 9017942 8901253 8007132 9017942 8007132

liabilities (a+b)

(Rs. In Lakh)

CASH FLOW STATEMENT

As on 31.03.2023 As on 31.03.2022

Particulars

(Audited) (Audited)

Cash flow from operating activities

Net Profit as per 110609 67327

Profit and Loss

account

Adjustments for

Depreciationon 10566 11918

Bank’s property

Interest paid on 5820 5820

TIER II bonds

Provisions for other 18503 5334

contingencies

Provision for taxes 33078 25765

Provision for -1188 10713

depreciation on

investment

Provision for 3451 1699

standard assets

Provision for bad 71700 63485

and doubtful debts

Provision for non 10238 -589

performing

investments

Provision for 588 208

compensation

absences

Amortization of 10757 13574

premium paid on

Held to Maturity

(HTM) investments

Provision for 170 49

employees stock

option plan /

scheme

(Profit) /Losson -104 -110

sale of fixed assets

(net)

Operating profit 274188 205193

before working

capital changes

Adjustments for

working

capitalchanges

(Increase) / -58130 10213

Decrease in

investments(excludi

ng HTM

investments)

(Increase) / -918127 -558682

Decrease in

advances

(Increase) / -89758 -134735

Decrease in other

assets

Increase / 815157 540832

(Decrease) in

deposits

Increase / 9292 -118920

(Decrease) in

borrowings

Increase / 68599 54148

(Decrease) in other

liabilities and

provisions

101221 -1951

Direct taxes paid 20500 31500

Net cash flow 121721 29549

(from)/ used in

operating

activities

Cash flow from

investing

activities

Purchaseof fixed -6222 -5861

assets

(Increase)/ -120902 -153625

Decreasein HTM

investments

Sale of fixed assets 104 110

/ other assets

Net cash flowfrom -127020 -159376

/ (used in)

investing

activities

Cash flow from

financing

activities

Proceeds from 41 14

share capital

Proceeds from 767 253

share premium

Increase/ - -

(Decrease) in tier II

bonds

Interest paid on tier -5820 -5820

II bonds

Dividend paid -12793 -4037

Net cash flow -17805 -9590

from / (used in)

financing

activities

Net Increase/ -23104 -139417

(decrease) in cash

& cash

equivalents

Cash and cash 492617 632034

equivalents at the

beginning of the

year

Cash and cash 469513 492617

equivalents at the

end of the year

You might also like

- Federal Urdu University of Arts, Science and Technology, Islamabad Department of Business Administration Final Project Bba-3 SEMESTER Autumn-2020Document7 pagesFederal Urdu University of Arts, Science and Technology, Islamabad Department of Business Administration Final Project Bba-3 SEMESTER Autumn-2020Qasim Jahangir WaraichNo ratings yet

- HDFC Bank Q3 FY22 resultsDocument7 pagesHDFC Bank Q3 FY22 resultsknowme73No ratings yet

- ABC Ltd balance sheet and income statement analysis 2016Document4 pagesABC Ltd balance sheet and income statement analysis 2016Aanchal MahajanNo ratings yet

- Attock CementDocument18 pagesAttock CementDeepak MatlaniNo ratings yet

- SauravDocument2 pagesSauravSaurav RathiNo ratings yet

- Tubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307Document8 pagesTubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307M REVIVO ANDREA VADSYANo ratings yet

- Statement of Profit & Loss of TTK Prestige For The Year Ending Mar 31Document4 pagesStatement of Profit & Loss of TTK Prestige For The Year Ending Mar 31Neelu AggrawalNo ratings yet

- Horizontal and Vertical Analysis of Atlast CompanyDocument25 pagesHorizontal and Vertical Analysis of Atlast CompanyAnushayNo ratings yet

- Beneish M ScoreDocument11 pagesBeneish M ScorePuneet SahotraNo ratings yet

- Balance Sheet of Instrumentation LimitedDocument8 pagesBalance Sheet of Instrumentation Limited94629No ratings yet

- Amazon vs Wal-MartDocument21 pagesAmazon vs Wal-MartunveiledtopicsNo ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaRohit bitpNo ratings yet

- Inbamfi Equity CaseDocument19 pagesInbamfi Equity CaseBinsentcaragNo ratings yet

- BALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsDocument2 pagesBALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsNeelu AggrawalNo ratings yet

- MRF Limited: (Rs. in Lakhs)Document2 pagesMRF Limited: (Rs. in Lakhs)danielxx747No ratings yet

- Data Sheet TTK PRESTIGEDocument4 pagesData Sheet TTK PRESTIGEpriyanshu guptaNo ratings yet

- Analysis of Financial Statements: Bs-Ba 6Document13 pagesAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- Allahabad Bank:, Ill IutuiDocument17 pagesAllahabad Bank:, Ill IutuiAnupamdwivediNo ratings yet

- Toyota Inc Laporan Neraca 31 Maret 2013 Dan 31 Maret 2014Document17 pagesToyota Inc Laporan Neraca 31 Maret 2013 Dan 31 Maret 2014Diah ArtiryaniNo ratings yet

- Raman BSDocument4 pagesRaman BSYenkee Adarsh AroraNo ratings yet

- Gautam Engineers Limited Balance Sheet and Profit & Loss Statement AnalysisDocument11 pagesGautam Engineers Limited Balance Sheet and Profit & Loss Statement AnalysisRavi BhartiaNo ratings yet

- FIn Data of Texmaco and MEPDocument10 pagesFIn Data of Texmaco and MEPWasp_007_007No ratings yet

- Bank Results TitleDocument34 pagesBank Results TitleMohit SainiNo ratings yet

- MRF QTR 1 14 15 PDFDocument1 pageMRF QTR 1 14 15 PDFdanielxx747No ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2016 (Result)Document8 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2016 (Result)Shyam SunderNo ratings yet

- D-Mart Pranjali Agarwal - NMIMS BDocument440 pagesD-Mart Pranjali Agarwal - NMIMS BDewashish RaiNo ratings yet

- Crescent Fibres Income Statement For Years 2005-2009Document54 pagesCrescent Fibres Income Statement For Years 2005-2009Aaima SarwarNo ratings yet

- CITY UNION BANK LTD FINANCIAL PERFORMANCEDocument8 pagesCITY UNION BANK LTD FINANCIAL PERFORMANCESaurabh MittalNo ratings yet

- Atlas & Union Jute Press Co. Ltd. Balance Sheet and Statement of Profit and LossDocument9 pagesAtlas & Union Jute Press Co. Ltd. Balance Sheet and Statement of Profit and LossRavi BhartiaNo ratings yet

- Interloop Limited Income Statement: Rupees in ThousandDocument13 pagesInterloop Limited Income Statement: Rupees in ThousandAsad AliNo ratings yet

- Bishnu Pashu Tatha Machha FirmDocument238 pagesBishnu Pashu Tatha Machha FirmBIBUTSAL BHATTARAINo ratings yet

- L&T operating performance comparisonDocument5 pagesL&T operating performance comparisoninduNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- HUL Day 7Document21 pagesHUL Day 7Juzer JiruNo ratings yet

- BMW VS TeslaDocument8 pagesBMW VS Teslayariyevyusif07No ratings yet

- Schedule31Document2 pagesSchedule31meditation channelNo ratings yet

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five Years1Document3 pagesBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five Years1Sunil RAYALASEEMA GRAPHICSNo ratings yet

- APB30091213FDocument9 pagesAPB30091213FMoorthy EsakkyNo ratings yet

- APB30091213FDocument9 pagesAPB30091213FAshaNo ratings yet

- Assets and Financial RatiosDocument15 pagesAssets and Financial RatiosBushraKhanNo ratings yet

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Mary AmDocument86 pagesMary AmmaryamkaramyarNo ratings yet

- Drreddy - Ratio AnalysisDocument8 pagesDrreddy - Ratio AnalysisNavneet SharmaNo ratings yet

- Accounts FinalDocument15 pagesAccounts FinalDevaashish ParmarNo ratings yet

- ForecastingDocument9 pagesForecastingQuỳnh'ss Đắc'ssNo ratings yet

- Loganathan Exp 5Document2 pagesLoganathan Exp 5loganathanloganathancNo ratings yet

- Report F.MDocument12 pagesReport F.MMuhammad Waseem Anjum Muhammad Waseem AnjumNo ratings yet

- Hinopak Motors Financial Statement Analysis for 2022 vs 2021Document8 pagesHinopak Motors Financial Statement Analysis for 2022 vs 2021Shamsuddin SoomroNo ratings yet

- BsheetDocument4 pagesBsheetDeepak KumarNo ratings yet

- Performance Highlights and Financials of The Supreme Industries Limited from 2007-2017Document152 pagesPerformance Highlights and Financials of The Supreme Industries Limited from 2007-2017adoniscalNo ratings yet

- Comparative Balance Sheet of BSNL LTDDocument19 pagesComparative Balance Sheet of BSNL LTDsmarty19b100% (2)

- Consolidated Income Statement AnalysisDocument23 pagesConsolidated Income Statement AnalysisJayash KaushalNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Rbiformat 092009Document1 pageRbiformat 092009Ketan VermaNo ratings yet

- Idea Model TemplateDocument21 pagesIdea Model TemplateShilpi ShroffNo ratings yet

- 1272380424153-SEBI - FORMAT March2010Document5 pages1272380424153-SEBI - FORMAT March2010Harshitha UchilNo ratings yet

- Financial Statements Vodafone Idea LimitedDocument6 pagesFinancial Statements Vodafone Idea LimitedRamit SinghNo ratings yet

- LVB Audited Financials 31032019Document9 pagesLVB Audited Financials 31032019Maran VeeraNo ratings yet

- Lecture 12 Methods To Measure National IncomeDocument28 pagesLecture 12 Methods To Measure National IncomeDevyansh GuptaNo ratings yet

- FABM2 Q2 Mod13Document29 pagesFABM2 Q2 Mod13Fretty Mae Abubo100% (3)

- KetanDocument60 pagesKetanKetan SagwekarNo ratings yet

- Pay Slip: Navsarjan ConsultancyDocument1 pagePay Slip: Navsarjan ConsultancyRavi SarvaiyaNo ratings yet

- Income Tax Statement for Retired PharmacistDocument4 pagesIncome Tax Statement for Retired PharmacistSUREMAN FINANCIAL SERVICESNo ratings yet

- CapitaLand Limited SGX C31 Financials Income StatementDocument3 pagesCapitaLand Limited SGX C31 Financials Income StatementElvin TanNo ratings yet

- UGBA 120AB Chapter 18 With Solutions Spring 2020Document109 pagesUGBA 120AB Chapter 18 With Solutions Spring 2020yadi lauNo ratings yet

- Literature Review On Common Size StatementDocument5 pagesLiterature Review On Common Size Statementafdtukasg100% (1)

- Salary Deduction Certificate Us 149 FormatDocument1 pageSalary Deduction Certificate Us 149 FormatAbdul Qadir Inventory ContollerNo ratings yet

- IAS AssignmentDocument17 pagesIAS AssignmentImran BalochNo ratings yet

- IPPR Namibia QER Q3 2021 FinalDocument14 pagesIPPR Namibia QER Q3 2021 FinalPieter SteenkampNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisMuhammad FaizanNo ratings yet

- DocxDocument10 pagesDocxAiziel OrenseNo ratings yet

- Accounting: Marketing Academic Year 2021-2022, 1st SemesterDocument212 pagesAccounting: Marketing Academic Year 2021-2022, 1st SemesterVali CaciulanNo ratings yet

- Payslip 10-03-23Document1 pagePayslip 10-03-23gmelenamuNo ratings yet

- Data AnalysisDocument5 pagesData AnalysisMagical MakeoversNo ratings yet

- Plagiarism Declaration Form (T-DF)Document12 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- Part 1 Financial Statement Types Presentation Limitation Users - Qs 07 Aug 2021Document17 pagesPart 1 Financial Statement Types Presentation Limitation Users - Qs 07 Aug 2021Le Blanc0% (1)

- Financial Ratios Analysis for Encik SelamatDocument3 pagesFinancial Ratios Analysis for Encik SelamatNAJWA SUHA BINTI SELAMAT NAJWA SUHA BINTI SELAMATNo ratings yet

- Fa4 Prelim Exercises 1 Fa4 Current - LiabilitiesDocument6 pagesFa4 Prelim Exercises 1 Fa4 Current - LiabilitiesatashajaylevelasquezNo ratings yet

- Equity Valuation Assignment Chapter 7Document7 pagesEquity Valuation Assignment Chapter 7mehandiNo ratings yet

- Activity - Weighing The Market - RIVERA & OTERODocument2 pagesActivity - Weighing The Market - RIVERA & OTERORECEL ANN RIVERA100% (5)

- Business taxes and VAT explainedDocument4 pagesBusiness taxes and VAT explainedHyascintheNo ratings yet

- BIR RULING (DA-380-03) : International Manning Agents, IncDocument6 pagesBIR RULING (DA-380-03) : International Manning Agents, IncHADTUGINo ratings yet

- CHAPTER 18 - CAPITAL BUDGETING - IngDocument48 pagesCHAPTER 18 - CAPITAL BUDGETING - IngNuha RSNo ratings yet

- Accounting Training Manual and Solutions DBE PDFDocument239 pagesAccounting Training Manual and Solutions DBE PDFGift SphesihleeNo ratings yet

- Acc102 W6Document41 pagesAcc102 W6Moheb RefaatNo ratings yet

- Lab 4Document3 pagesLab 4Sherry Mhay BongcayaoNo ratings yet

- Gail & BradDocument2 pagesGail & BradAbid AliNo ratings yet