0% found this document useful (0 votes)

100 views3 pagesBIR Form No. 0605 Payment Guidelines

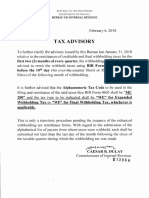

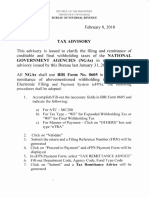

This document provides descriptions and filing dates for several Bureau of Internal Revenue (BIR) payment forms:

1) Form 0605 is used for tax payments not requiring a tax return, such as installment payments, penalties, and deposits. It must be filed every time a tax payment or penalty is due.

2) Form 0611-A is used for payments covered by Letter Notices from third-party information matching programs.

3) Form 0613 is used for payments of penalties assessed under Tax Compliance Verification programs. It must be filed every time a penalty is due.

4) Forms 0619-E and 0619-F are monthly remittance forms for income taxes with

Uploaded by

mijareschabelita2Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

100 views3 pagesBIR Form No. 0605 Payment Guidelines

This document provides descriptions and filing dates for several Bureau of Internal Revenue (BIR) payment forms:

1) Form 0605 is used for tax payments not requiring a tax return, such as installment payments, penalties, and deposits. It must be filed every time a tax payment or penalty is due.

2) Form 0611-A is used for payments covered by Letter Notices from third-party information matching programs.

3) Form 0613 is used for payments of penalties assessed under Tax Compliance Verification programs. It must be filed every time a penalty is due.

4) Forms 0619-E and 0619-F are monthly remittance forms for income taxes with

Uploaded by

mijareschabelita2Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd