Chapter 5

Recording in the Journals or Journalizing

After analyzing and preparing business documents, the transactions are then recorded in the books of

the company. In double-entry accounting, transactions are recorded in the journal through journal

entries.

A journal, also known as Books of Original Entry, keeps records of business transactions in a systematic

order.

Transactions are recorded in the journal in chronological order, i.e. as they occur; one after the other.

A simple journal looks like this:

Date

Particulars Debit Credit

yyyy

mm dd Account debited amount

Account credited amount

dd Account debited amount

Account credited amount

A column for posting reference or folio may also be included to facilitate easier tracking and cross-

referencing with the ledger. Also, an explanation of the transaction may be included below the entry.

The journal would then look like this:

Date

Particulars PR Debit Credit

yyyy

mm dd Account debited ref. amount

Account credited ref. amount

Short explanation or annotation.

Illustration

Let's try to prepare the journal entry for this transaction: On June 3, 2019, our company purchased

computer equipment for its main office and paid $1,200.00 in cash.

When we analyze that transaction, it would show that the accounting effects would be an increase in an

asset account (Computer Equipment), and a decrease in another asset (Cash) since we paid for the

equipment.

�We would then increase Computer Equipment by debiting it and decrease Cash by crediting it. The

journal entry would be:

Date

Particulars Debit Credit

2019

Jun 3 Computer Equipment 1,200.00

Cash 1,200.00

To record purchase of computer.

.

You will have no trouble as long as you know how to use debits and credits and what accounts to record.

In the above example, computer equipment is an asset account. To increase an asset account, you debit

it. Hence, we debited Computer Equipment. Cash is also an asset account. However, there is a decrease

in cash because we paid for the computer equipment. And so, we credited Cash.

Compound Journal Entries

When there is only one account debited and one credited, it is called a simple journal entry. There are

however instances when more than one account is debited or credited. They are called compound

journal entries.

Let's take the previous transaction and change it up a bit. Here's the new transaction: On June 3, 2019,

our company purchased computer equipment for $1,200.00. Our company paid $800.00 and the

$400.00 balance will be paid after 30 days.

The journal entry would be:

Date

Particulars Debit Credit

2019

Jun 3 Computer Equipment 1,200.00

Cash 800.00

Accounts Payable 400.00

To record purchase of computer.

The journal entry shows that the company received computer equipment worth $1,200. Cash is

decreased by $800, the amount paid.

In addition, the company incurred in an obligation to pay $400 after 30 days. The liabilities of the

company increased. When we increase liabilities, we credit it. That is why we credited Accounts Payable

(a liability account) in the above entry.

�Notice that the total amount debited is equal to the total amount credited.

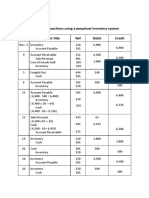

or additional practice and exposure in journalizing transactions, we will be showing more examples of

business transactions and their journal entries.

The transactions in this lesson pertain to Gray Electronic Repair Services, our imaginary small sole

proprietorship business.

For account titles, we will be using the chart of accounts presented in an earlier lesson.

All transactions are assumed and simplified for illustration purposes.

Note: We will also be using this set of transactions and journal entries in later lessons when we discuss

the other steps of the accounting process.

Let's start.

Transaction #1: On December 1, 2019, Mr. Donald Gray started Gray Electronic Repair Services by

investing $10,000. The journal entry should increase the company's Cash, and increase (establish) the

capital account of Mr. Gray; hence:

Date

Particulars Debit Credit

2019

De

1 Cash 10,000.00

c

Mr. Gray, Capital 10,000.00

Transaction #2: On December 5, Gray Electronic Repair Services paid registration and licensing fees for

the business, $370.

First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the

decrease in cash as a result of the payment.

5 Taxes and Licenses 370.00

Cash 370.00

Transaction #3: On December 6, the company acquired tables, chairs, shelves, and other fixtures for a

total of $3,000. The entire amount was paid in cash.

There is an increase in an asset account (Furniture and Fixtures) in exchange for a decrease in another

asset (Cash).

6 Furniture and Fixtures 3,000.00

Cash 3,000.00

Transaction #4: On December 7, the company acquired service equipment for $16,000. The company

paid a 50% down payment and the balance will be paid after 60 days.

�This will result in a compound journal entry. There is an increase in an asset account (debit Service

Equipment, $16,000), a decrease in another asset (credit Cash, $8,000, the amount paid), and

an increase in a liability account (credit Accounts Payable, $8,000, the balance to be paid after 60 days).

7 Service Equipment 16,000.00

Cash 8,000.00

Accounts Payable 8,000.00

Transaction #5: Also on December 7, Gray Electronic Repair Services purchased service supplies on

account amounting to $1,500.

The company received supplies thus we will record a debit to increase supplies. By the terms "on

account", it means that the amount has not yet been paid; and so, it is recorded as a liability of the

company.

7 Service Supplies 1,500.00

Accounts Payable 1,500.00

Transaction #6: On December 9, the company received $1,900 for services rendered. We will then

record an increase in cash (debit the cash account) and increase in income (credit the income account).

9 Cash 1,900.00

Service Revenue 1,900.00

Transaction #7: On December 12, the company rendered services on account, $4,250.00. As per

agreement with the customer, the amount is to be collected after 10 days. Under the accrual basis of

accounting, income is recorded when earned.

In this transaction, the services have been fully rendered (meaning, we made an income; we just haven't

collected it yet.) Hence, we record an increase in income and an increase in a receivable account.

12 Accounts Receivable 4,250.00

Service Revenue 4,250.00

Transaction #8: On December 14, Mr. Gray invested an additional $3,200.00 into the business. The entry

would be similar to what we did in transaction #1, i.e. increase cash and increase the capital account of

the owner.

14 Cash 3,200.00

Mr. Gray, Capital 3,200.00

Transaction #9: Rendered services to a big corporation on December 15. As per agreement, the $3,400

amount due will be collected after 30 days.

� 15 Accounts Receivable 3,400.00

Service Revenue 3,400.00

Transaction #10: On December 22, the company collected from the customer in transaction #7. We will

record an increase in cash by debiting it. Then, we will credit accounts receivable to decrease it. We are

reducing the receivable since it has already been collected.

17 Cash 4,250.00

Accounts Receivable 4,250.00

Actually, we simply transferred the amount from receivable to cash in the above entry.

Transaction #11: On December 23, the company paid some of its liability in transaction #5 by issuing a

check. The company paid $500 of the $1,500 payable.

To record this transaction, we will debit Accounts Payable for $500 to decrease it by the said amount.

Then, we will credit cash to decrease it as a result of the payment. The entry would be:

20 Accounts Payable 500.00

Cash 500.00

Accounts payable would now have a credit balance of $1,000 ($1,500 initial credit in transaction #5 less

$500 debit in the above transaction).

Transaction #12: On December 25, the owner withdrew cash due to an emergency need. Mr. Gray

withdrew $7,000 from the company.

We will decrease Cash since the company paid Mr. Gray $7,000. And, we will record withdrawals by

debiting the withdrawal account – Mr. Gray, Drawings.

25 Mr. Gray, Drawings 7,000.00

Cash 7,000.00

Transaction # 13: On December 29, the company paid rent for December, $ 1,500. Again, we will record

the expense by debiting it and decrease cash by crediting it.

29 Rent Expense 1,500.00

Cash 1,500.00

Transaction #14: On December 30, the company acquired a $12,000 short-term bank loan; the entire

amount plus a 10% interest is payable after 1 year.

Again, the company received cash so we increase it by debiting Cash. The company now has a liability.

We will record it by crediting the liability account – Loans Payable.

30 Cash 12,000.00

� Loans Payable 12,000.00

Transaction #15: On December 31, the company paid salaries to its employees, $3,500.

For this transaction, we will record/increase the expense account by debiting it and decrease cash by

crediting it. (Note: This is a simplified entry to present the payment of salaries. In actual practice,

different payroll accounting methods are applied.)

31 Salaries Expense 3,500.00

Cash 3,500.00

https://www.youtube.com/watch?v=2j_Lj2HBVIc

https://www.youtube.com/watch?v=vOGuOpkpBW8