Professional Documents

Culture Documents

PMCF7 Module 5

Uploaded by

Blackwolf SocietyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PMCF7 Module 5

Uploaded by

Blackwolf SocietyCopyright:

Available Formats

PMCF7

Module 5

PHILIPPINE AND FOREIGN

CURRENCY NOTES AND COINS

This module is a combination of

synchronous & asynchronous learning

and will last for ONE week.

April 13, 2023

Date Initiated

April 20, 2023

Date of Completion

PMCF7 – MONETARY POLICY AND CENTRAL BANKING

Ester C. Castillo, Instructor

MODULE 5

This module is designed to be discussed for a period of one week. Lesson delivery will be done in synchronous

learning. The platform to be used will be facebook messenger, google classroom and google meet created for the

class.

LEARNING OBJECTIVES:

At the end of the module, you are expected to:

• Identify important security features of money in circulation;

• Know the legal procedures in dealing with counterfeit bills and coins;

• Become familiar with the replacement and redemption of the legal tender mutilated money.

INPUT INFORMATION

I. PHILIPPINE AND FOREIGN CURRENCY NOTES AND COINS

The following rules and regulations shall govern the treatment and disposition of counterfeit Philippine and

foreign currency notes and coins, the reproduction and/or use of facsimiles of legal tender Philippine currency notes

and coins, the replacement and redemption of legal tender Philippine currency notes and coins considered mutilated

or unfit for circulation, and the treatment and disposition of Philippine currency notes and coins called in for

replacement.

Definition of terms. For purposes of this Section, the following terms are defined:

a. Legal Tender Philippine currency – Notes and coins issued and circulating in accordance with R.A. No. 7653, which

when offered for the payment of public or private debt must be accepted.

b. Counterfeit Note – An imitation of a legal and genuine note intended to deceive or to be taken for that which is

original, legal and genuine.

c. Counterfeit Coin – An imitation or forged design of a genuine and legal coin regardless of its intrinsic value or

metallic composition, intended to deceive or pass for the genuine coin.

d. Unauthorized reproduction of legal tender Philippine note – A reproduction of a facsimile or any illustration or object

bearing the likeness or similitude of legal tender Philippine currency note or any part thereof, without prior authority

from the Governor of Bangko Sentral or his duly authorized representative.

e. Unauthorized reproduction of legal tender Philippine coin – A reproduction of a facsimile or any object in metal form

bearing the likeness or similitude of legal tender Philippine currency coin or any part thereof, without prior authority

from the Governor of Bangko Sentral or his duly authorized representative.

Treatment and disposition of counterfeit Philippine and foreign currency notes and coins.

Any person or entity, public or private, who receives or takes hold of a note or coin which is counterfeit or

whose genuineness is questionable, whether Philippine or foreign currency, shall issue a temporary receipt to its

owner/holder and must indicate therein his name, address and community tax certificate number of a reference

number sourced from any Philippine government-issued ID or passport number, or in case of a foreigner, the date of

receipt, the denomination, serial number of the note or the coin series as the case may be. The owner/holder shall

be required to countersign the receipt and in case of refusal, the reason shall be stated in the receipt.

THE CURRENCY ISSUE AND INTEGRITY OFFICE

Security Plant Complex Bangko Sentral ng Pilipinas East Avenue

Diliman 1101 Quezon City

In cases where personal delivery to the Currency Issue and Integrity Office (CIIO), Bangko Sentral ng

Pilipinas, Quezon City, is not feasible, delivery of the afore stated notes or coins may be made through any of the

following agencies:

(1) The Bangko Sentral Regional

(2) Any banking institution under the supervision of the Bangko Sentral

Any law enforcement agency which conducted any seizure of notes and coins, whether Philippine or foreign,

which are counterfeits or suspected to be counterfeit currency, shall within five (5) working days from date of seizure,

PMCF7 – MONETARY POLICY AND CENTRAL BANKING

Ester C. Castillo, Instructor

advise in writing the CIIO, Bangko Sentral ng Pilipinas, Quezon City of said seizure enclosing therewith a copy of the

receipt and inventory taken on the seized items. All seized notes or coins which are not or no longer needed as

evidence in any investigation/legal proceedings shall be immediately turned over to the CIIO, Bangko Sentral ng

Pilipinas, for proper disposition.

The CIIO, Bangko Sentral ng Pilipinas, after examining all notes and coins, whether Philippine or foreign,

submitted to it for examination and/or determination as to its genuineness, shall:

(a) Issue a corresponding certification for the currency examined, if needed;

(b) Stamp the word “COUNTERFEIT” on both the front and the back of each note found to be counterfeit; and

(c) Return to the owner/holder, and/or sender the Philippine or foreign currency notes or coins found to be genuine in

accordance with existing accounting and auditing regulations.

All notes and coins, whether Philippine or foreign, determined by the CIIO, Bangko Sentral ng Pilipinas, to

be counterfeit currency, shall not be returned to the owner/holder, but shall be retained and later disposed of in

accordance with such guidelines as may be adopted by the Bangko Sentral, except those which will be used as

evidence in an investigation or legal proceedings, in which case, the same shall be retained and preserved by the

Bangko Sentral for evidentiary purposes.

The Bangko Sentral shall extend assistance as may be requested of it in the investigation, apprehension

and/or prosecution of person/s responsible for counterfeiting of notes and coins, both Philippine and foreign.

Clean note and coin policy.

As part of banks’ duties to effect an expeditious withdrawal from circulation of unfit Philippine currency notes

classified under this Section (Replacement and redemption of legal tender Philippine currency notes and coins

considered mutilated or unfit for circulation), banks and their branches shall observe the guidelines and procedures

governing currency deposits and withdrawals of banks.

Provincial branches of banks may make direct deposits of currency notes, duly identified and sorted, with the

nearest Bangko Sentral Regional Office/Branch. In areas where there are no Bangko Sentral Regional

Offices/Branches, provincial branches of banks shall arrange with their respective Head Offices the shipment of their

unfit or dirty notes for deposit with the CD, Bangko Sentral in Quezon City. Cost of shipment and other related

expenses to be incurred shall be solely for the account of the bank concerned.

Coins submitted by banks to Bangko Sentral for deposit determination of redemption value shall be

packed/bagged in accordance with the following procedure:

a. Coins shall be free from adhesive tapes;

b. Coins shall be sorted into fit, unfit or mutilated, per denomination and per series;

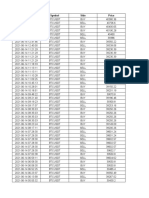

c. Each bag of coins shall contain the following standard number of pieces and amount per denomination:

Provided, however, That, in the case of unfit or mutilated coins, these could be packed in amounts

of One Thousand Pesos (P1,000.00) for denomination 10-,5-, and 1-piso; and fifty pesos (P50.00) for 25-, 10-, 5-,

and 1-sentimo.

Replacement and redemption of legal tender Philippine currency notes and coins considered mutilated or

unfit for circulation.

a. Unfit currency note.

A currency note shall be considered unfit for circulation when:

(1) It contains heavy creases which break the fiber of the paper and indicate that disintegration has begun; or

(2) It is badly soiled/contaminated and/ or with writings even if it has proper life or sizing; or

(3) It presents a limp or rag like appearance and/or it cannot sustain its upright position when held at the mid portion

of one of the shorter borders.

PMCF7 – MONETARY POLICY AND CENTRAL BANKING

Ester C. Castillo, Instructor

b. Mutilated currency note.

A currency note shall be considered mutilated when:

(1) Torn parts of banknote are joined together with adhesive tape aimed at preserving as nearly as possible the

original design and size of the note; or

(2) The original size of the note has been reduced/lost through wear and tear or has been otherwise torn, damaged,

defaced or perforated through action of insects, chemicals or other causes; or

(3) It is scorched or burned to such an extent that although recognizable as such, it has become frail and brittle as

to render further handling thereof impossible without disintegration or breaking; or

(4) It is split edgewise; or

(5) It has lost all the signatures inscribed thereon; or

(6) The Embedded Security Thread or Windowed Security Thread placed on the banknote is lost.

c. Unfit currency coin.

A currency coin shall be considered unfit for circulation when:

(1) It is bent or twisted out of shape or defaced, but its genuineness and/or denomination can still be readily and

clearly determined/identified; or

(2) It has been considerably reduced in weight by natural abrasion/wear and tear.

d. Mutilated currency coin.

A currency coin shall be considered mutilated when:

(1) It shows signs of filing, clipping or perforation; or

(2) It shows signs of having been burned or has been so defaced, that its genuineness and/or denomination cannot

be readily and clearly identified

e. Currency notes and coins considered unfit for circulation shall not be re-circulated, but may be presented for

exchange to or deposited with any bank.

f. Banks shall accept from the public mutilated notes and coins for referral/transmittal to CIIO, Bangko Sentral –

Quezon City or any of the Bangko Sentral Regional Offices/Branches for determination of redemption value. Banks

may charge reasonable handling fees from clients and/ or the general public relative to the handling/ transporting to

Bangko Sentral of mutilated notes and coins.

g. The Bangko Sentral shall replace or redeem notes and coins considered unfit for circulation or mutilated except

under the following conditions:

(1) Identification of notes and coins is impossible; or

(2) Coins that show signs of filing, clipping or perforations; or

(3) Notes which have lost more than two-fifths (2/5) of their surface or all of the signatures inscribed thereon; or

(4) Notes which are split edgewise resulting in the loss of the whole of or part of, either the face or back portion of

the banknote paper; or

(5) Notes where the Embedded Security Thread or Windowed Security Thread placed thereon is completely lost

except when the damage appears to be caused by wear and tear, accidental burning, action of water or chemical or

bites of rodents/insects and the likes.

Notes and coins falling under any of the classifications mentioned under Item “g” above shall be withdrawn

from circulation and demonetized without compensation to the owner/bearer.

Treatment and disposition of Philippine currency notes and coins called in for replacement.

Any person or entity, public or private, who receives, takes, holds or has in his possession Philippine currency

notes and coins called in for replacement shall forward the same during the redemption period to:

a. Any authorized agent banks of the Bangko Sentral when the notes are still considered legal tender, within one (1)

year from the date of call; or

b. The CD or Regional Offices/Branches of the Bangko Sentral, within the redemption period as may be determined

by the Monetary Board. The CD or Regional Offices/Branches of the Bangko Sentral shall exchange the notes/coins

called in for replacement if presented to the Bangko Sentral within the redemption period as determined by the

Monetary Board and subsequently dispose the same in accordance with Bangko Sentral procedures for disposal.

PMCF7 – MONETARY POLICY AND CENTRAL BANKING

Ester C. Castillo, Instructor

LEARNING ACTIVITIES

With attachment based on the frequently asked questions pertaining to the bank

notes security feature.

www. morb.bsp.gov.ph

PMCF7 – MONETARY POLICY AND CENTRAL BANKING

Ester C. Castillo, Instructor

You might also like

- Unclaimed Money - Step by Step Guide how you claim your moneyFrom EverandUnclaimed Money - Step by Step Guide how you claim your moneyNo ratings yet

- PMCF7 Module 4Document8 pagesPMCF7 Module 4Blackwolf SocietyNo ratings yet

- Rules on Counterfeit Currency and Reproduction of Peso Notes & CoinsDocument7 pagesRules on Counterfeit Currency and Reproduction of Peso Notes & CoinsjeysonmacaraigNo ratings yet

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaFrom EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaNo ratings yet

- New Central Bank Act FINALDocument50 pagesNew Central Bank Act FINALSharmaine SurNo ratings yet

- PDIC insures Philippine bank depositsDocument10 pagesPDIC insures Philippine bank depositsKyle DionisioNo ratings yet

- BanknotesDocument8 pagesBanknotesGorby ResuelloNo ratings yet

- Currency?: 1. Under What Authority Does The Bangko Sentral NG Pilipinas (BSP) IssueDocument9 pagesCurrency?: 1. Under What Authority Does The Bangko Sentral NG Pilipinas (BSP) Issuenia_artemis3414No ratings yet

- Printing and Minting of MoneyDocument3 pagesPrinting and Minting of Moneyrosalyn mauricioNo ratings yet

- Central Bank of Philippines updates check clearing proceduresDocument5 pagesCentral Bank of Philippines updates check clearing proceduresMigz DimayacyacNo ratings yet

- RBI Circular On Disposal of Counterfiet Note ProcedureDocument29 pagesRBI Circular On Disposal of Counterfiet Note ProcedureSupratik PandeyNo ratings yet

- BSP Circular No 580 77 PDFDocument5 pagesBSP Circular No 580 77 PDFneil peirceNo ratings yet

- Audit in CIS EnvironmentDocument5 pagesAudit in CIS EnvironmentKathlaine Mae ObaNo ratings yet

- AMLC FunctionsDocument4 pagesAMLC FunctionsjafernandNo ratings yet

- Banking LawsDocument32 pagesBanking LawsElSalvadorNo ratings yet

- Reportarde Unaosf TporaDocument13 pagesReportarde Unaosf TporaDonju JoyaNo ratings yet

- REPUBLIC ACT NO. 7653 - Part 2Document24 pagesREPUBLIC ACT NO. 7653 - Part 2Joel Guasis AyonNo ratings yet

- Bank Secrecy, Unclaimed Funds, PDIC and AMLADocument14 pagesBank Secrecy, Unclaimed Funds, PDIC and AMLAThe Brain Dump PHNo ratings yet

- CHARACTERISTICS-WPS OfficeDocument2 pagesCHARACTERISTICS-WPS OfficelayamcesaNo ratings yet

- Blnexo: SenrnalDocument2 pagesBlnexo: SenrnalJSTNo ratings yet

- Bank Secrecy PDFDocument6 pagesBank Secrecy PDFDwight BlezaNo ratings yet

- Foreign Currency Deposit Act of The PhilippinesDocument14 pagesForeign Currency Deposit Act of The PhilippinestheaNo ratings yet

- Chapter 2Document5 pagesChapter 2kaash2kaashNo ratings yet

- Eflp WF08Document56 pagesEflp WF08katieparson411No ratings yet

- PD 1034 - Offshore BankingDocument5 pagesPD 1034 - Offshore BankingSZNo ratings yet

- Notes - New Central Bank ActDocument4 pagesNotes - New Central Bank ActJingle BellsNo ratings yet

- CBP Circular Letter 580-89Document4 pagesCBP Circular Letter 580-89Joben OdulioNo ratings yet

- Bank 1Document57 pagesBank 1Laxmi Azmonaviv CampanerNo ratings yet

- Action On Fake NotesDocument25 pagesAction On Fake NotesK MuruganNo ratings yet

- Cancio v. CADocument3 pagesCancio v. CAMartinCroffsonNo ratings yet

- Banking LawsDocument67 pagesBanking LawsPatricia Ann CaubaNo ratings yet

- COMMISSION ON AUDIT CIRCULAR NO. 92-385 October 1, 1992 SubjectDocument4 pagesCOMMISSION ON AUDIT CIRCULAR NO. 92-385 October 1, 1992 SubjectJoanna Sarah T. DivaNo ratings yet

- Batas Pambansa Blg. 22: Batas Pambansa Bilang 22. The Anti-Bouncing Check LawDocument14 pagesBatas Pambansa Blg. 22: Batas Pambansa Bilang 22. The Anti-Bouncing Check LawmeriiNo ratings yet

- PDICDocument16 pagesPDICBrian Jonathan ParaanNo ratings yet

- Section 70: Purchase and Sales of Foreign ExchangeDocument12 pagesSection 70: Purchase and Sales of Foreign ExchangeCristine P. MasangcayNo ratings yet

- Group 4 - Banking Law Assignment - Forex BureausDocument24 pagesGroup 4 - Banking Law Assignment - Forex Bureausmoses machiraNo ratings yet

- Cancio v. Court of AppealsDocument2 pagesCancio v. Court of AppealsDum DumNo ratings yet

- AMLA NotesDocument5 pagesAMLA NotesRyDNo ratings yet

- Manual of Accounting Unit - 1Document62 pagesManual of Accounting Unit - 1Malaking Pulo Multi-Purpose CooperativeNo ratings yet

- Central Bank Act Amendments ExplainedDocument25 pagesCentral Bank Act Amendments ExplainedSam OneNo ratings yet

- Cancio v CTA Reverses Forfeiture of Undeclared Cash (1987Document3 pagesCancio v CTA Reverses Forfeiture of Undeclared Cash (1987- PBVisualNo ratings yet

- Chapter 8Document48 pagesChapter 8JM GuevarraNo ratings yet

- LockerDocument6 pagesLockerapi-3807149No ratings yet

- Cancio v. Court of AppealsDocument2 pagesCancio v. Court of AppealsDum DumNo ratings yet

- Allowed activities for foreign bank representative officeDocument4 pagesAllowed activities for foreign bank representative officeJakko MalutaoNo ratings yet

- Duties and Responsibilities of The Asset Management CompanyDocument19 pagesDuties and Responsibilities of The Asset Management Companysumairjawed8116100% (1)

- 2003-003 Audit of Intelligence Fund For LGUsDocument3 pages2003-003 Audit of Intelligence Fund For LGUsMikey BardoNo ratings yet

- Deposits in General AmlaDocument7 pagesDeposits in General AmlawakandaNo ratings yet

- RBI Notice For Depositing Counterfeit NotesDocument24 pagesRBI Notice For Depositing Counterfeit NotesaaannnnniiiiiiiiNo ratings yet

- Rules and Regulations Implementing the Anti-Money Laundering Act of 2001Document58 pagesRules and Regulations Implementing the Anti-Money Laundering Act of 2001Ceej DalipeNo ratings yet

- Philippine National Bank vs. F.F. Cruz and Co., Inc. 654 SCRA 333 (JULY 25, 2011)Document7 pagesPhilippine National Bank vs. F.F. Cruz and Co., Inc. 654 SCRA 333 (JULY 25, 2011)Biboy GSNo ratings yet

- Banking Laws Bank Secrecy Law PurposeDocument9 pagesBanking Laws Bank Secrecy Law PurposeTrevor Del MundoNo ratings yet

- RegulationsDocument14 pagesRegulationsA BNo ratings yet

- Philippine Passport Act summaryDocument8 pagesPhilippine Passport Act summaryErica NacenoNo ratings yet

- Retail Collection PolicyDocument39 pagesRetail Collection PolicyK Praveen RajNo ratings yet

- Bangladesh Bank Notes RegulationsDocument3 pagesBangladesh Bank Notes Regulationssayed126No ratings yet

- RFBT BankingDocument10 pagesRFBT Bankingferdinandstewart RapizNo ratings yet

- AMLA Summary: Anti-Money Laundering ActDocument45 pagesAMLA Summary: Anti-Money Laundering ActKeith Joshua GabiasonNo ratings yet

- Bangko Sentral NG PilipinasDocument11 pagesBangko Sentral NG PilipinasRacel AbulaNo ratings yet

- Special TopicsDocument5 pagesSpecial TopicsBlackwolf SocietyNo ratings yet

- Effectofbudgeting2 PDFDocument13 pagesEffectofbudgeting2 PDFAira Nicole SabornidoNo ratings yet

- Ratio ComputationDocument2 pagesRatio ComputationBlackwolf SocietyNo ratings yet

- Ratio Computation1Document3 pagesRatio Computation1Blackwolf SocietyNo ratings yet

- Module 4 - Introductory PageDocument13 pagesModule 4 - Introductory PageitschloeannecucioNo ratings yet

- Ecf2 Module 2Document6 pagesEcf2 Module 2Blackwolf SocietyNo ratings yet

- Pmcf7 Module 1Document7 pagesPmcf7 Module 1Blackwolf SocietyNo ratings yet

- Later Vedic Polity and EconomyDocument2 pagesLater Vedic Polity and EconomySaket SharmaNo ratings yet

- Rapport de Stage Academique NinaDocument32 pagesRapport de Stage Academique NinaTeka Derick TikumNo ratings yet

- FAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDocument3 pagesFAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDan Andrei BongoNo ratings yet

- Integrating Cryptocurrency Into Intermediate Financial Accounting Curriculum...Document5 pagesIntegrating Cryptocurrency Into Intermediate Financial Accounting Curriculum...Marshall AppsNo ratings yet

- 1081 Supporting BillDocument2 pages1081 Supporting BillAshirwad BanerjeeNo ratings yet

- 10 5923 J Economics 20180805 01Document4 pages10 5923 J Economics 20180805 01Amna NoorNo ratings yet

- His Hands International of Guatemaa O.N.G. PGL - L2L de Fecha 13032024 1Document11 pagesHis Hands International of Guatemaa O.N.G. PGL - L2L de Fecha 13032024 1albertjoe202No ratings yet

- Statement of HSBC Pulse Unionpay Dual Currency Diamond Card PulseDocument6 pagesStatement of HSBC Pulse Unionpay Dual Currency Diamond Card PulseCova ChanNo ratings yet

- 1 Ms Annual Syllabus Distribution Roaissat M 2020-2021 PDFDocument2 pages1 Ms Annual Syllabus Distribution Roaissat M 2020-2021 PDFrahmouni hamou0% (1)

- Neteller - WikipediaDocument3 pagesNeteller - WikipediaAnonymous PqxjViUtDtNo ratings yet

- Grancini - Dulcis ChristeDocument2 pagesGrancini - Dulcis Christemadmax610No ratings yet

- Registration: Student School IT Co-Ordinator (SSITC) Training ProgrammeDocument22 pagesRegistration: Student School IT Co-Ordinator (SSITC) Training ProgrammembadarshmbNo ratings yet

- Delta neutral options hedging strategies and option pricing modelsDocument1 pageDelta neutral options hedging strategies and option pricing modelskeshavNo ratings yet

- Flipping Markets Trading Plan V2Document51 pagesFlipping Markets Trading Plan V2MUDRICK ACCOUNTSNo ratings yet

- Crypto-Currency Price Prediction Using CNN and LSTM ModelsDocument10 pagesCrypto-Currency Price Prediction Using CNN and LSTM ModelsIJRASETPublicationsNo ratings yet

- Reglamento Smallworld Underground. InglesDocument16 pagesReglamento Smallworld Underground. InglesHéctor BarbaNo ratings yet

- Macroeconomics Exam Questions Covering GDP, Inflation, Fiscal & Monetary PolicyDocument2 pagesMacroeconomics Exam Questions Covering GDP, Inflation, Fiscal & Monetary PolicyElşən OrucovNo ratings yet

- Handout ASI 2403 Forex TransactionsDocument6 pagesHandout ASI 2403 Forex TransactionsMaureen Kaye PaloNo ratings yet

- MerchantAndBusiness PayPalUS Sept-21-2021 v1Document36 pagesMerchantAndBusiness PayPalUS Sept-21-2021 v1James SoraceNo ratings yet

- Managing FOREX ExposureDocument23 pagesManaging FOREX ExposureCijil Diclause0% (1)

- Dornbusch Exchange Rate Overshooting Model ExplainedDocument2 pagesDornbusch Exchange Rate Overshooting Model ExplainedTharindu WeerasingheNo ratings yet

- UNIT 13 Background InformationDocument15 pagesUNIT 13 Background Informationnguyen16023No ratings yet

- Reviewer MPCBDocument7 pagesReviewer MPCBMJ NuarinNo ratings yet

- Ark Exchange Traded Funds (Etfs)Document2 pagesArk Exchange Traded Funds (Etfs)Tam JackNo ratings yet

- Transmission Mechanism of MPDocument19 pagesTransmission Mechanism of MPDeni Wahyudi19No ratings yet

- Solved Assume That Interest Rate Parity Holds at The Beginning ofDocument1 pageSolved Assume That Interest Rate Parity Holds at The Beginning ofM Bilal SaleemNo ratings yet

- List of Circulating Currencies by CountryDocument21 pagesList of Circulating Currencies by CountrynaeemmudassirNo ratings yet

- Crompton +++ Revolut-GBP-Statement-Dec 2020Document2 pagesCrompton +++ Revolut-GBP-Statement-Dec 202013KARATNo ratings yet

- BTCUSDT TRADESDocument9 pagesBTCUSDT TRADESAtif MehmoodNo ratings yet

- The Trading Plan FSMDocument9 pagesThe Trading Plan FSMDinesh CNo ratings yet