Professional Documents

Culture Documents

07 Activity 29

Uploaded by

21-55654Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Activity 29

Uploaded by

21-55654Copyright:

Available Formats

BM2211

Name Section Date

SAMPLE PROBLEMS ON FINANCIAL RATIOS

1. The management of International Heal Medical Company is evaluating the performance of its three

(3) divisions. The Booboo Division had an operating profit of ₱24,950 and, on average used assets

with a book value of ₱311,900. The Splint Division had an operating profit of ₱17,500 and used

average assets of ₱177,950. The Intensive Care Division had an operating profit of ₱28,500 and

average assets of ₱475,000. The company plans to award the Intensive Care Division, relying on its

high operating profit. Should the management continue with this decision? Justify your answer.

0.079 x 100 = 7.9%

= 0.06 x 100 = 6.0%

0.098 x 100 = 9.8%

No, the management should not

continue awarding the Intensive

Care Division. Because the

Intensive

Care Division's operating proft –

(6%) is so low in comparison to the

other two divisions. And Booboo

Division increased operating proft

by 7.9%, outpacing Intensive Care

Division. The Splint Division

recorded the highest operational

proft at 9.8%. The business must

award Splint Division with the prize

because of its larger operating proft

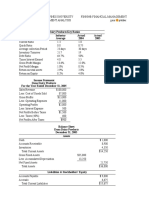

Booboo Division – 24,950/ 311,900 = 0.079 x 100 = 7.9% or 8%

Intensive Care Division -28,500/475,000 - 0.06 x 100 = 6.0% or 6%

Splint Division - 17,500/177,950 = 0.098 x 100 = 9.8%

No, the management should not continue awarding the Intensive Care Division. Because the

Intensive Care Division's operating profit – (6%) is so low in comparison to the other two divisions.

And Booboo Division increased operating profit by 7.9%, outpacing Intensive Care Division. The

Splint Division recorded the highest operational profit at 9.8%. The business must award Splint

Division with the prize because of its larger operating profit.

2. Charlie’s Construction Company is a growing construction business with a few contracts to build

storefronts in Pasay. Charlie’s balance sheet shows beginning assets of ₱1,000,000 and an ending

balance of ₱2,000,000 assets. During the current year, Charlie’s company had a net income of

₱20,000,000. Compute the company’s return on assets and interpret the results.

Return on Assets (ROA)= Net income/Average total assests

= 20,000,000/ (1,000,000+2,000,000)/2

= 20,000,000/ (3,000,000) /2

=20,000,000/ 1,500,000

= 13.33 or 1333.33%

3. Dave’s Guitar Shop is thinking about building an additional property onto the back of its existing

building for more storage. Dave consults with his banker about applying for a new loan. The bank

asks for Dave’s balance to examine his overall debt levels. Dave’s total assets is P5,000,000 while his

total liabilities is P25,000. Compute Dave’s debt ratio.

Debt Ratio = total liabilities/ total assets

= 25,000/5,000,000

Debt Ratio = 0.005

Rubric for checking:

CRITERIA POINTS

Complete solution/interpretation with the correct answer 5

The last two (2) major steps of the solution are incorrect/

4

correct answers, but no interpretation was given

Half of the solution is correct 3

The first two (2) major steps of the solution are correct 2

The first major step of the solution is correct 1

07 Activity 2 *Property of STI

Page 1 of 1

You might also like

- 07 Activity 2Document1 page07 Activity 2jjNo ratings yet

- The Booboo Division: Sample Problems On Financial RatiosDocument2 pagesThe Booboo Division: Sample Problems On Financial RatiosBryan BallesterosNo ratings yet

- 07 Activity 2Document2 pages07 Activity 2clarenceNo ratings yet

- Ragasa 07 Activity 2Document2 pagesRagasa 07 Activity 2EMILY M. RAGASANo ratings yet

- 07 Activity 2 BugnotDocument2 pages07 Activity 2 BugnotclarenceNo ratings yet

- Sample Problems On Financial Ratios: Property of STIDocument1 pageSample Problems On Financial Ratios: Property of STIarisu50% (4)

- Melroe Adriane M. Alcantara BSA 103 The Entrepreneurial MindDocument2 pagesMelroe Adriane M. Alcantara BSA 103 The Entrepreneurial MindRonald varrie BautistaNo ratings yet

- 07 Activity 23Document1 page07 Activity 23Jerick John EspinaNo ratings yet

- DfgergerDocument2 pagesDfgergerLorelyn TriciaNo ratings yet

- NICOLAS 07 Activity 2Document2 pagesNICOLAS 07 Activity 2mary joyce nicolasNo ratings yet

- Sample Problems On Financial RatiosDocument2 pagesSample Problems On Financial RatiosJaJe PHNo ratings yet

- 07 - Activity Sample Problems and Financial RatiosDocument2 pages07 - Activity Sample Problems and Financial RatiosLorielyn Arnaiz CaringalNo ratings yet

- Sample Problems On Financial RatiosDocument2 pagesSample Problems On Financial RatiosMatthew Josh AltarezNo ratings yet

- Urot IT101M - 07act2Document2 pagesUrot IT101M - 07act2dglouise5No ratings yet

- 07 Activity 2 by RamirezDocument2 pages07 Activity 2 by RamirezJoaquin Nico B. RamirezNo ratings yet

- Name: Saira D. Villar Date: Dec. 2021 Section: BSTM3101 Instructor: Mr. Edmund LahuylahuyDocument2 pagesName: Saira D. Villar Date: Dec. 2021 Section: BSTM3101 Instructor: Mr. Edmund LahuylahuySaira VillarNo ratings yet

- Sample Problems On Financial RatiosDocument1 pageSample Problems On Financial Ratiosmaria suarezNo ratings yet

- Name: Mejia, Andrew Ben M. Section: BSIT 1 - 1, AADocument1 pageName: Mejia, Andrew Ben M. Section: BSIT 1 - 1, AAandrewbenmejia13No ratings yet

- 07 Activity 2Document2 pages07 Activity 2thalhia navaNo ratings yet

- Sample Financial Ratios Activity - AnniversarioDocument2 pagesSample Financial Ratios Activity - Anniversarioben anniversarioNo ratings yet

- 07 Activity 2 Entrepreneurial MindDocument2 pages07 Activity 2 Entrepreneurial MindKim Ahn ObuyesNo ratings yet

- Entrep PTDocument3 pagesEntrep PTJassyNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosBae MaxZ100% (1)

- Joennel M. Semilla Ms. Rowena Garcia The Entrepreneurial Mind Sample Problems On Financial RatiosDocument2 pagesJoennel M. Semilla Ms. Rowena Garcia The Entrepreneurial Mind Sample Problems On Financial RatiosJoennel SemillaNo ratings yet

- 07 Activity 2Document6 pages07 Activity 2Gillai Marie IbardolazaNo ratings yet

- 07 Activity 2Document3 pages07 Activity 2marcusNo ratings yet

- 07 ACTIVITY 2 EntrepDocument1 page07 ACTIVITY 2 EntrepBea Lear BasiñoNo ratings yet

- Gitman Chapter 3 SolutionDocument21 pagesGitman Chapter 3 SolutionNauman Iqbal75% (4)

- Tutorial 3Document4 pagesTutorial 3Lê Thiên Giang 2KT-19No ratings yet

- 2015 - Valuation of SharesDocument31 pages2015 - Valuation of SharesGhanshyam KhandayathNo ratings yet

- Prelim/Advisory Exam: ACC 311 Managerial Accounting 1Document3 pagesPrelim/Advisory Exam: ACC 311 Managerial Accounting 1Dexter Joseph CuevasNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 11: Dividend and Share Repurchases (Common Questions)Document2 pagesNanyang Business School AB1201 Financial Management Tutorial 11: Dividend and Share Repurchases (Common Questions)asdsadsaNo ratings yet

- 5 Answerfsanalysisquiz04122023Document10 pages5 Answerfsanalysisquiz04122023Ralphjersy AlmendrasNo ratings yet

- 7 Activity 2Document2 pages7 Activity 2potchi.villaricoNo ratings yet

- 05fin221 spr08 Feb14Document11 pages05fin221 spr08 Feb14Sharath KumarNo ratings yet

- Group 7 Group AssignmentDocument16 pagesGroup 7 Group AssignmentAZLINDA MOHD NADZRINo ratings yet

- Quiz 5 - Chapter 12 & 13Document6 pagesQuiz 5 - Chapter 12 & 13マーチンMartinNo ratings yet

- (FR - F7 - Tài liệu ôn thi) Part D - Preparation of financial statementsDocument17 pages(FR - F7 - Tài liệu ôn thi) Part D - Preparation of financial statementsTrúc Diệp KiềuNo ratings yet

- FTX2024S - 2022 Test 2 Question PaperDocument9 pagesFTX2024S - 2022 Test 2 Question PaperhannaNo ratings yet

- Practice FRA BSAFDocument52 pagesPractice FRA BSAFHafiz Abdullah MushtaqNo ratings yet

- FM Chap 6 8 ProbsDocument41 pagesFM Chap 6 8 ProbsMychie Lynne Mayuga91% (11)

- Solution Ch#11Document13 pagesSolution Ch#11usman aliNo ratings yet

- Financial Administration Exercises 1Document8 pagesFinancial Administration Exercises 1ScribdTranslationsNo ratings yet

- R e V I e W Q U e S T I o N S A N D P R o B L e M SDocument21 pagesR e V I e W Q U e S T I o N S A N D P R o B L e M SMonina CahiligNo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- AREA D OTs ANSWERS UPDATEDDocument12 pagesAREA D OTs ANSWERS UPDATEDAmir HamzaNo ratings yet

- Assignment I - Numericals - Summer 2021Document5 pagesAssignment I - Numericals - Summer 2021Anhad SinghNo ratings yet

- Analysis of Financial Statements: S A R Q P I. QuestionsDocument22 pagesAnalysis of Financial Statements: S A R Q P I. QuestionsEstudyanteNo ratings yet

- Collier 1ce Solutions Ch13Document14 pagesCollier 1ce Solutions Ch13Oluwasola OluwafemiNo ratings yet

- Chapter 15 Financial and Nonfinancial PMDocument22 pagesChapter 15 Financial and Nonfinancial PMSophia Zavynne Ancheta BuenoNo ratings yet

- Class 12 - Quarterly Examination Q FINALDocument11 pagesClass 12 - Quarterly Examination Q FINALsubbuNo ratings yet

- Capital Structure and Leverage ExercisesDocument2 pagesCapital Structure and Leverage Exercisesjoseph90865No ratings yet

- CH 05Document50 pagesCH 05Gaurav KarkiNo ratings yet

- BE 601 Class 2Document17 pagesBE 601 Class 2Chan DavidNo ratings yet

- (PDF) FinMan Cabrera SM (Vol1)Document22 pages(PDF) FinMan Cabrera SM (Vol1)Florie May SaynoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 07 - Activity - 124 Ni MarDocument2 pages07 - Activity - 124 Ni Mar21-55654No ratings yet

- BSA 2105 Carandang CFAS Sem ProjectDocument16 pagesBSA 2105 Carandang CFAS Sem Project21-55654No ratings yet

- Table NG MalulupitDocument3 pagesTable NG Malulupit21-55654No ratings yet

- MEDICATION1Document2 pagesMEDICATION121-55654No ratings yet

- Cost ProblemsDocument4 pagesCost ProblemsMeteor MeteorNo ratings yet

- Process Flow Diagram (For Subscribers Who Visits Merchant Business Premises)Document2 pagesProcess Flow Diagram (For Subscribers Who Visits Merchant Business Premises)Lovelyn ArokhamoniNo ratings yet

- AgreementDocument2 pagesAgreementralvan WilliamsNo ratings yet

- Investment and Portfolio Management (Prelims - Module 1)Document1 pageInvestment and Portfolio Management (Prelims - Module 1)Nympha SalungaNo ratings yet

- Client: How Is Inventory Lead Time Calculated From An Inventory Amount (Pieces) in A Lean VSM?Document4 pagesClient: How Is Inventory Lead Time Calculated From An Inventory Amount (Pieces) in A Lean VSM?Rachidh UverkaneNo ratings yet

- International Economics 8th Edition Appleyard Solutions ManualDocument25 pagesInternational Economics 8th Edition Appleyard Solutions ManualMariaHowelloatq100% (56)

- INVOICE BPK LTD CKM Drg. Rendhy .ADocument2 pagesINVOICE BPK LTD CKM Drg. Rendhy .AYudi ArdiansahNo ratings yet

- Chapter 4 - Understanding The Global Context of BusinessDocument34 pagesChapter 4 - Understanding The Global Context of BusinessMarwan BakrNo ratings yet

- IAS 37 - SummaryDocument4 pagesIAS 37 - SummaryRenz Francis LimNo ratings yet

- Comparative Vs Absolute AdvantageDocument9 pagesComparative Vs Absolute AdvantageJayesh Kumar YadavNo ratings yet

- Presentation Title Goes HereDocument180 pagesPresentation Title Goes HereZouhair KalkhiNo ratings yet

- 2019 UST Golden Notes SalesDocument53 pages2019 UST Golden Notes SalesRAIZZ100% (1)

- Ebook Ebook PDF Principles of Managerial Finance Brief Global Edition 15th Edition PDFDocument42 pagesEbook Ebook PDF Principles of Managerial Finance Brief Global Edition 15th Edition PDFrosalie.ashworth789100% (38)

- London JetsDocument346 pagesLondon JetsQwertyNo ratings yet

- Transportation and Economic Development Challenges - (4 Distance in The Existence of Political Pathologies Rationalized Tran... )Document13 pagesTransportation and Economic Development Challenges - (4 Distance in The Existence of Political Pathologies Rationalized Tran... )monazaNo ratings yet

- Annual Report FY2020 21 BBL 0Document212 pagesAnnual Report FY2020 21 BBL 0Sourabh PorwalNo ratings yet

- Electricity Bill: Consumption Data Billing DetailsDocument1 pageElectricity Bill: Consumption Data Billing DetailsCliff Mokua100% (3)

- 08 Bond InvestmentDocument3 pages08 Bond InvestmentAllegria Alamo100% (1)

- MMXM ModelDocument145 pagesMMXM ModelOluwa COMEDY100% (4)

- IBE - 4 FinalDocument56 pagesIBE - 4 FinalMahima SinghNo ratings yet

- Jocket or Horse 2009Document41 pagesJocket or Horse 2009Maxens ANo ratings yet

- Unbalanced Growth Theory (Unit 5.1)Document3 pagesUnbalanced Growth Theory (Unit 5.1)C. MittalNo ratings yet

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeDocument5 pagesAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteNo ratings yet

- Caso Tata SteelDocument7 pagesCaso Tata SteelGaby Mendieta100% (1)

- KPMG Hyperloop One StudyDocument39 pagesKPMG Hyperloop One StudyQuez YoNo ratings yet

- My Break-Even NotesDocument3 pagesMy Break-Even Notesonline onlineNo ratings yet

- IFRA Final Exam Write-UpDocument2 pagesIFRA Final Exam Write-UpHealth ResultsNo ratings yet

- Emergence of Entreprenurial ClassDocument23 pagesEmergence of Entreprenurial ClassShweta GoelNo ratings yet

- Cox v. Hickman - Indian Case LawDocument3 pagesCox v. Hickman - Indian Case Lawakshara alexNo ratings yet

- ObligationDocument2 pagesObligationJustine Airra OndoyNo ratings yet