Professional Documents

Culture Documents

Circular No 16 2023 - Refund-Abstact

Uploaded by

sakthijackOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Circular No 16 2023 - Refund-Abstact

Uploaded by

sakthijackCopyright:

Available Formats

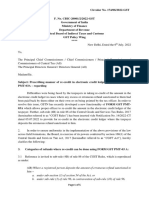

ABSTRACT

Refund related CCT circulars

Sl. No. CCT Circular No. Subject CBIC Circular No.

1 Circular No. 1/2017 (TNGST) Dated Submission of Bond/LUT by the exporter in respect of ---

11.08.2017 Exports without payment of IGST Act.

2 Circular No. 2/2017 (TNGST) Dated Submission of Bond/LUT by the exporter in respect of ---

10.10.2017 Exports without payment of IGST Act - Further

clarifications - issued.

3 Circular No. 1/2018 (TNGST) Dated Manual filing and processing of refund claims in respect of Circular No.17/17/2017-GST,

02.02.2018 Zero rated supplies - reg. Dated 15.11.2017

4 Circular No. 2/2018 (TNGST) Dated Manual filing and processing of refund claims on account Circular No.24/24/2017-GST,

02.02.2018 of inverted duty structure, deemed exports and excess Dated 21.12.2017

balance in electronic cash ledger - reg.

5 Circular No.3/2018 (TNGST) Dated Manual filing and processing of refund claims - Designation ---

02.02.2018 of Nodal Officers and workflow - reg.

6 Circular No.4/2018 (TNGST) Dated Clarifications on export related refund issues - reg. ---

27.03.2018

7 Circular No. 8(2017)/2019 (TNGST) Procedure regarding procurement of supplies of goods Circular No.14/14/2017-GST,

Dated 28.03.2019 from DTA by Export Oriented Unit (EOU) / Electronic Dated 06.11.2017

Hardware Technology Park EHTP) Unit / Software

Technology Park (STP) Unit / Bio-Parks (BTP) Unit under

deemed export benefits under section 147 of SGST Act,

2017- Regarding.

8 Circular No. 11(2017)/2019-TNGST Clarification on refund of unutilized input tax credit of GST Circular No.18/18/2017-GST,

Dated 28.03.2019 paid on inputs in respect of exporters of fabrics – dated 16.11.2017.

Regarding.

9 Circular No. 23(2018)/ 2019- Clarification on issues related to furnishing of Bond/Letter Circular No. 40/14/2018-GST,

TNGST Dated 29.03.2019 of Undertaking for exports – Reg. dated 06.04.2018

10 Circular No. 26(2018)/2019-TNGST Clarifications on refund related issues – reg. Circular No. 45/19/2018-GST,

Dated 29.03.2019 dated 30.05.2018

11 Circular No.28(2018)/2019-TNGST Circulars clarifying miscellaneous issues related to SEZ and Circular No. 48/22/2018-GST,

Dated 29.03.2019 refund of unutilized ITC for job workers- reg. dated 14.06.2018

Page 1 CCT_Refund circulars-ABSTRACT

ABSTRACT

Refund related CCT circulars

Sl. No. CCT Circular No. Subject CBIC Circular No.

12 Circular No.34(2018)/2019-TNGST Clarification regarding removal of restriction of refund of Circular No. 56/30/2018-GST,

Dated 05.04.2019 accumulated ITC on fabrics – Reg. dated 24.08.2018

13 Circular No. 37 (2018)/2019- Clarification on refund related issues- regarding Circular No. 59/33/2018-GST,

TNGST Dated 05.04.2019 dated 04-09-2018

14 Circular No.42(2018)/2019-TNGST Clarification on certain issues related to refund-Regarding Circular No. 70/44/2018-GST,

Dated 23.04.2019 dated 26.10.2018.

15 Circular No. 49 (2018) / 2019- Clarification on export of services under GST – Reg. Circular No. 78/52/2018-GST,

TNGST Dated 23.04.2019 dated 31-12-2018

16 Circular No. 50 (2018) / 2019- Clarifications on refund related issues – reg. Circular No. 79/53/2018-GST,

TNGST Dated 23.04.2019 dated 31.12.2018

17 Circular No. 58/2019-TNGST Dated Changes in Circulars issued earlier under the CGST Act, Circular No. 88/07/2019-GST,

23.04.2019 2017 - Reg. dated 01.02.2019

18 Circular No. 64/2019-TNGST Dated Clarifications on refund related issues under GST – reg. Circular No. 94/13/2019-GST,

23.04.2019 dated 28.03.2019

19 Circular No. 78/2019-TNGST Dated Refund of taxes paid on inward supply of indigenous goods Circular No. 106/25/2019-

05.07.2019 by retail outlets established at departure area of the GST, 29.06.2019

international airport beyond immigration counters when

supplied to outgoing international tourist against foreign

exchange -reg.

20 Circular No. 81/2019-TNGST Dated Corrigendum to Circular No. 26(2018)/2019-TNGST, Dated ---

22.07.2019 29.03.2019

21 Circular No. 83/2019-TNGST Dated Clarification in respect of goods sent/taken out of India for Circular No. 108/27/2019-

22.07.2019 exhibition or on consignment basis for export promotion - GST, dated 18.07.2019

reg.

22 Circular No. 86/2019-TNGST Dated Eligibility to file a refund application in FORM GST RFD-01 Circular No. 110/29/2019 -

20.12.2019 for a period and category under which a NIL refund GST, dated 03.10.2019

application has already been filed – regarding

Page 2 CCT_Refund circulars-ABSTRACT

ABSTRACT

Refund related CCT circulars

Sl. No. CCT Circular No. Subject CBIC Circular No.

23 Circular No. 87/2019-TNGST Dated Procedure to claim refund in FORM GST RFD-01 Circular No. 111/30/2019 -

20.12.2019 subsequent to favourable order in appeal or any other GST, dated 03.10.2019

forum – regarding

24 Circular No. 1(2019)/2020-TNGST Fully electronic refund process through FORM GST RFD-01 Circular No. 125/44/2019 -

Dated 23.03.2020 and single disbursement – regarding GST, 18.11.2019

25 Circular No. 7/2020-TNGST Dated Clarification in respect of certain challenges faced by the Circular No. 137/07/2020-

16.06.2020 registered persons in implementation of provisions of GST GST, dated 13.04.2020

Laws-reg.

26 Circular No. 9/2020-TNGST Dated Clarification on refund related issues – Reg Circular No.135/05/2020 -

20.06.2020 GST, dated 31.03.2020

27 Circular No. 10/2020-TNGST Dated Clarification on refund related issues – Reg Circular No. 139/09/2020-

20.06.2020 GST, dated 10.06.2020

28 Circular No. 5/2021-TNGST Dated Clarification on refund related issues – Reg. Circular No. 147/03/2021-

20.07.2021 GST, dated 12.03.2021

29 --- Clarification relating to export of services-condition (v) of Circular No. 161/17/2021-

section 2(6) of the IGST Act 2017–reg GST, dated 20.09.2021

30 Circular No. 2/2022-TNGST Dated Clarification in respect of refund of tax specified in section Circular No. 162/18/2021-

25.04.2022 77(1) of the CGST Act and section 19(1) of the IGST Act - GST, dated 25.09.2021

Reg

31 Circular No. 6/2022-TNGST Dated Clarification on certain refund related issues- reg Circular No. 166/22/2021-

25.04.2022 GST, dated 17.11.2021

32 --- Mechanism for filing of refund claim by the taxpayers Circular No. 168/24/2021 -

registered in erstwhile Union Territory of Daman & Diu for GST, dated 30.12.2021

period prior to merger with U.T. of Dadra & Nagar Haveli.

33 Circular No. 9/2022-TNGST Dated Clarification on various issue pertaining to GST- reg Circular No. 172/04/2022 -

02.09.2022 GST, dated 06.07.2022

Page 3 CCT_Refund circulars-ABSTRACT

ABSTRACT

Refund related CCT circulars

Sl. No. CCT Circular No. Subject CBIC Circular No.

34 Circular No. 10/2022-TNGST Dated Clarification on issue of claiming refund under inverted Circular No. 173/05/2022-

02.09.2022 duty structure where the supplier is supplying goods under GST, dated 06.07.2022

some concessional notification – reg

35 Circular No. 11/2022-TNGST Dated Prescribing manner of re-credit in electronic credit ledger Circular No. 174/06/2022-

02.09.2022 using FORM GST PMT-03A – regarding GST, dated 06.07.2022

36 Circular No. 12/2022-TNGST Dated Manner of filing refund of unutilized ITC on account of Circular No. 175/07/2022-

02.09.2022 export of electricity-reg. GST, dated 06.07.2022

37 Circular No. 13/2022-TNGST Dated Withdrawal of Circular No. 106/25/2019-GST dated Circular No. 176/08/2022-

02.09.2022 29.06.2019 – Reg GST, dated 06.07.2022

38 Clarification on refund related issues-reg. Circular No. 181/13/2022-

GST, dated 10.11.2022

39 Circular No. 3/2023-TNGST Dated Clarification with regard to applicability of provisions of Circular No. 185/17/2022-GST

04.01.2023 section 75(2) of Tamil Nadu Goods and Services Tax Act, dated 27.12.2022

2017 and its effect on limitation -reg

40 Prescribing manner of filing an application for refund by Circular No. 188/20/2022-GST

unregistered persons -reg. dated 27.12.2022

41 Circular No. 13/2023-TNGST Dated Clarification on refund related issues Circular No. 197/09/2023-GST

14.08.2023 dated 17.07.2023

Page 4 CCT_Refund circulars-ABSTRACT

You might also like

- Circular No 70 - NewDocument3 pagesCircular No 70 - NewHr legaladviserNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- Sec 183Document1 pageSec 183goelshubham92No ratings yet

- Circular No.63Document10 pagesCircular No.63Shrikant KulkarniNo ratings yet

- GST RatesDocument352 pagesGST RatesRaviJodidar AccountsNo ratings yet

- Recommendations of GST Council Related To Law &procedureDocument2 pagesRecommendations of GST Council Related To Law &procedurePunit AroraNo ratings yet

- Monthly Round-Up - August 2019: Editor'S NoteDocument15 pagesMonthly Round-Up - August 2019: Editor'S NoteSabrina CanoNo ratings yet

- Signed SCN of PP PlasticsDocument4 pagesSigned SCN of PP PlasticsADARSH TIWARINo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- Circular CGST 45 CorrigendumnDocument2 pagesCircular CGST 45 CorrigendumnHr legaladviserNo ratings yet

- Circular Refund 142 11 2020Document3 pagesCircular Refund 142 11 2020Gulrana AlamNo ratings yet

- List of Specific GuideDocument1 pageList of Specific Guideshirad anuarNo ratings yet

- 37th GSTC Meeting - 02Document2 pages37th GSTC Meeting - 02Sahil ShahNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Faiqa HamidNo ratings yet

- Indirect Tax Newsletter - July 2023Document15 pagesIndirect Tax Newsletter - July 2023ELP LawNo ratings yet

- Circular Refund 137 7 2020Document3 pagesCircular Refund 137 7 2020Shirish JainNo ratings yet

- Ram NameDocument2 pagesRam NameStock PsychologistNo ratings yet

- 37th GST Council Meet Final Press Release GSTPW 20092019Document2 pages37th GST Council Meet Final Press Release GSTPW 20092019AVASTNo ratings yet

- Circular CGST 95Document3 pagesCircular CGST 95Venkataramana NippaniNo ratings yet

- 37 Meeting of The GST Council, Goa 20 September, 2019 Press ReleaseDocument2 pages37 Meeting of The GST Council, Goa 20 September, 2019 Press ReleasePranay SaxenaNo ratings yet

- Circular CGST 197Document5 pagesCircular CGST 197Jaipur-B Gr-2No ratings yet

- CGST CircularsDocument18 pagesCGST Circularsdinesh kasnNo ratings yet

- Part B Rules 0710Document455 pagesPart B Rules 0710Bhavin DesaiNo ratings yet

- June 2020 SP 2Document27 pagesJune 2020 SP 2Avinash ShettyNo ratings yet

- Tax Laws Ns Ep June 2020Document29 pagesTax Laws Ns Ep June 2020sarvaniNo ratings yet

- Shree Karthik Papers Ltdvs Deputy Commissionerof Income TDocument4 pagesShree Karthik Papers Ltdvs Deputy Commissionerof Income TKaran GannaNo ratings yet

- Revenue IssuancesDocument3 pagesRevenue IssuancesLucifer MorningstarNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Claim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022Document3 pagesClaim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022ravindra kumar jainNo ratings yet

- Faq E-Invoice EnglishDocument57 pagesFaq E-Invoice English9155 Ashwini MetkariNo ratings yet

- Government of India: Press Information BureauDocument3 pagesGovernment of India: Press Information BureausummiNo ratings yet

- Press Release Part A. Law and Procedure Related Changes: Form Gstr-9 Form Gstr-9C Form Gstr-1 Form GSTR-1 Form Gstr-1Document3 pagesPress Release Part A. Law and Procedure Related Changes: Form Gstr-9 Form Gstr-9C Form Gstr-1 Form GSTR-1 Form Gstr-1CA Ishu BansalNo ratings yet

- Circular Refund 147-1.5 Times RefundDocument5 pagesCircular Refund 147-1.5 Times Refundbanerjeeankita13No ratings yet

- Relief For ITC Claimed For Unmatched Invoices in GSTR 2A For FYs 2017-18Document3 pagesRelief For ITC Claimed For Unmatched Invoices in GSTR 2A For FYs 2017-18sanket lunkadNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- Refund of IGST On Export of Goods PDFDocument7 pagesRefund of IGST On Export of Goods PDFCA Rahul ModiNo ratings yet

- Circular CGST 91Document2 pagesCircular CGST 91sridharanNo ratings yet

- GST Times - Vol.1, Issue-2Document25 pagesGST Times - Vol.1, Issue-2Milna JosephNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- Independence Day Edition: Adv. (CA) Ranjan MehtaDocument10 pagesIndependence Day Edition: Adv. (CA) Ranjan MehtaCA Ranjan MehtaNo ratings yet

- GST Circular No.64/38/2018Document3 pagesGST Circular No.64/38/2018RAVI TEJANo ratings yet

- Internal Circular (Restricted Circular For Office Use Only)Document16 pagesInternal Circular (Restricted Circular For Office Use Only)Manish K JadhavNo ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Instruction No 022022 GST Dated 22032022Document13 pagesInstruction No 022022 GST Dated 22032022GroupA PreventiveNo ratings yet

- Asmt 10 Asian Steels 19-20Document3 pagesAsmt 10 Asian Steels 19-20hakkim satharNo ratings yet

- Taxguru - in-GST Denying Refund of ITC Not Reflected in GSTR-2A - Is It ValidDocument3 pagesTaxguru - in-GST Denying Refund of ITC Not Reflected in GSTR-2A - Is It ValidMSFNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Customs Circular-No-18-2023Document1 pageCustoms Circular-No-18-2023Raja SinghNo ratings yet

- 1Document2 pages1asad khokharNo ratings yet

- 1Document2 pages1asad khokharNo ratings yet

- Circular CGST 123Document4 pagesCircular CGST 123AKSHATANo ratings yet

- Government of India Ministry of FinanceDocument7 pagesGovernment of India Ministry of FinanceJAYKISHAN VIDHWANINo ratings yet

- 1 Latest GSTR 9 and 9C TaxbykkDocument73 pages1 Latest GSTR 9 and 9C TaxbykkjitendraktNo ratings yet

- PRADIPDocument7 pagesPRADIPGovindNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- Panaji, 11th January, 2018 (Pausa 21, 1939) : Government of GoaDocument28 pagesPanaji, 11th January, 2018 (Pausa 21, 1939) : Government of Goaks1962No ratings yet

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- NZ Property Investor - September 2023Document84 pagesNZ Property Investor - September 2023kcNo ratings yet

- Economics RP Kartik Goel BBA - LLBDocument21 pagesEconomics RP Kartik Goel BBA - LLBKartikNo ratings yet

- GST Book PDFDocument606 pagesGST Book PDFsaddamNo ratings yet

- GST Accounting Entries in TallyDocument16 pagesGST Accounting Entries in TallyRevathi naiduNo ratings yet

- Booklet On Duty Drawback by CA Mithun Khatry Founder WWW - Gstbible.com Updated 15-02-2017Document84 pagesBooklet On Duty Drawback by CA Mithun Khatry Founder WWW - Gstbible.com Updated 15-02-2017Anonymous x1qH0ydNo ratings yet

- Reverse Charge Mechanism Under GSTDocument7 pagesReverse Charge Mechanism Under GSTramaiahNo ratings yet

- 133 GST JudgmentsDocument224 pages133 GST Judgmentsrohit100% (1)

- AustraliaDocument4 pagesAustraliaOana PopaNo ratings yet

- CH 3 Earning Money and TaxationDocument40 pagesCH 3 Earning Money and TaxationHarry White100% (1)

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1-19Document18 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1-192100 42 Shazma ShabanNo ratings yet

- Implementation of GST in MalaysiaDocument2 pagesImplementation of GST in MalaysiashanursofNo ratings yet

- Chemical Booklet For Lab Reagent and Dialysis 2024 25Document40 pagesChemical Booklet For Lab Reagent and Dialysis 2024 25metrixfoodandpharmaNo ratings yet

- Pap ManifestoDocument7 pagesPap ManifestoLee Jia HuiNo ratings yet

- Reverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inDocument19 pagesReverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inAjit GuptaNo ratings yet

- Driver AgreementDocument14 pagesDriver AgreementDindo Martin Mejia Amora100% (1)

- Tax Law Book 3 10 2019 Final PDFDocument780 pagesTax Law Book 3 10 2019 Final PDFAnwar BangiNo ratings yet

- CH 5 Place of SupplyDocument63 pagesCH 5 Place of SupplyManas Kumar SahooNo ratings yet

- GST Impact Indias Gold MarketDocument5 pagesGST Impact Indias Gold MarketSharad MundharaNo ratings yet

- PRSR Co Company ProfileDocument10 pagesPRSR Co Company ProfileGIRISH B MNo ratings yet

- Taxation Final Suggestion and StrategyDocument81 pagesTaxation Final Suggestion and StrategyAjoy MannaNo ratings yet

- PestelDocument2 pagesPestelSruthi DNo ratings yet

- Demand & Recovery and Offences & PenaltiesDocument8 pagesDemand & Recovery and Offences & PenaltiesKedarnath GajewarNo ratings yet

- ReceiptDocument1 pageReceiptSeLvA GaNaPaThINo ratings yet

- Tax Bulletin 54 PDFDocument68 pagesTax Bulletin 54 PDFABC 123No ratings yet

- Tool Development Charges - Export or Not Under GSTDocument11 pagesTool Development Charges - Export or Not Under GSTManish SachdevaNo ratings yet

- Ind As 18Document56 pagesInd As 18MSFNo ratings yet

- BEC and Bid MatrixDocument18 pagesBEC and Bid MatrixVinayak PabaleNo ratings yet

- Flemingo Travel Retail Limited Versus Union of India Ti Be EditedDocument51 pagesFlemingo Travel Retail Limited Versus Union of India Ti Be EditedmandiraNo ratings yet

- AssignmentDocument34 pagesAssignmentAnshika SharmaNo ratings yet

- Review of GST Vs SST Implementation in MalaysiaDocument10 pagesReview of GST Vs SST Implementation in Malaysiarajes wariNo ratings yet