Professional Documents

Culture Documents

Ibs BBFL

Uploaded by

R O N N I E GamingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ibs BBFL

Uploaded by

R O N N I E GamingCopyright:

Available Formats

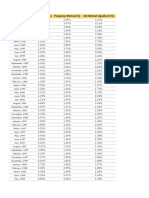

The battle between

bulls and bears

Bear markets But bulls have a tendency

may be brutal...

vs. to charge back

Bear markets since 19601 Subsequent bull markets1

Time Period Length (Months) Market Decline Time Period Length (Months) Market Increase

January 1960–October 1960 10 -17.4% October 1960–December 1961 14 29.8%

December 1961–June 1962 6 -27.1% June 1962–February 1966 44 85.7%

February 1966–October 1966 8 -25.2% October 1966–December 1968 26 32.4%

December 1968–May 1970 18 -35.9% May 1970–April 1971 11 50.6%

April 1971–November 1971 7 -16.1% November 1971–January 1973 14 31.8%

January 1973–December 1974 23 -45.1% December 1974–September 1976 22 75.7%

September 1976–February 1978 17 -26.9% February 1978–September 1978 6 22.3%

September 1978–April 1980 19 -16.4% April 1980–April 1981 12 34.9%

April 1981–August 1982 16 -24.1% August 1982–November 1983 16 65.7%

November 1983–July 1984 8 -15.6% July 1984–August 1987 37 150.6%

August 1987–October 1987 2 -36.1% October 1987–July 1990 33 72.5%

July 1990–October 1990 3 -21.2% October 1990–July 1998 93 294.8%

July 1998–August 1998 1 -19.3% August 1998–January 2000 16 55.5%

January 2000–September 2001 20 -29.7% September 2001–March 2002 6 29.1%

March 2002–October 2002 7 -31.5% October 2002–October 2007 60 94.4%

October 2007–March 2009 17 -53.8% March 2009–April 2011 26 95.7%

April 2011–October 2011 5 -16.8% October 2011–May 2015 44 71.9%

May 2015–February 2016 9 -14.5% February 2016–February 2020 48 88.7%

February 2020–March 2020 1 -37.1% March 2020–January 2022 21 97.9%

January 2022–September 2022 9 -21.9% September 2022–? — —

Bear facts Bull facts

Number of bear markets since 1960 20 Number of bull markets since 1960 20

Average frequency 1 every 2.4 years Average frequency 1 every 0.86 years

Average duration 10 months Average duration 28 months

Average market decline -26.6% Average market increase 77.9%

Talk with your financial professional about Franklin Templeton investments you

can use to build a portfolio for both bull and bear markets.

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to

factors affecting individual companies, particular industries or sectors, or general market conditions.

Past performance does not guarantee future results.

1. In this illustration the market is represented by the Dow Jones Industrial Average. Sources: © 2023 Ned Davis Research, Inc., Dow Jones & Company, Inc. Ned Davis Research defines a bear market as a 30%

drop in the Dow Jones Industrial Average after 50 calendar days or a 13% decline after 145 calendar days. A bull market requires a 30% rise in the Dow Jones Industrial Average after 50 calendar days or a 13% rise

after 155 calendar days. Average frequency, duration and market decline/increase does not reflect the current bear/bull market. Indexes are unmanaged and one cannot invest directly in an index. Index returns

do not reflect any fees, expenses or sales charges.

(800) 342-5236 franklintempleton.com Not FDIC Insured | May Lose Value | No Bank Guarantee

© 2023 Franklin Distributors, LLC. Member FINRA/SIPC. All rights reserved. IBS BBFL 06/23

You might also like

- Workbook Contents: Europe Brent Spot Price FOB (Dollars Per Barrel)Document10 pagesWorkbook Contents: Europe Brent Spot Price FOB (Dollars Per Barrel)Monica EllaNo ratings yet

- Workbook Contents: Cushing, OK WTI Spot Price FOB (Dollars Per Barrel)Document10 pagesWorkbook Contents: Cushing, OK WTI Spot Price FOB (Dollars Per Barrel)Pritam KarmakarNo ratings yet

- Crude Oil History Data SetDocument50 pagesCrude Oil History Data SetbasitNo ratings yet

- RWTCMDocument15 pagesRWTCMAMILCAR CONTRERAS CORTEZNo ratings yet

- TCB BE PortfolioDocument45 pagesTCB BE Portfoliopalpat.cmgNo ratings yet

- Pet Move Expc DC Nus-Nve MBBLPD MDocument43 pagesPet Move Expc DC Nus-Nve MBBLPD MpmellaNo ratings yet

- Black Green Lid Purple Bin Calendar Wednesday (2023-2024)Document1 pageBlack Green Lid Purple Bin Calendar Wednesday (2023-2024)sjkidd69No ratings yet

- F 01 HistDocument44 pagesF 01 HistYoel ChristopherNo ratings yet

- Washington DC WeatherDocument4 pagesWashington DC WeatherAdoree RamosNo ratings yet

- Calculo AntiguedadDocument13 pagesCalculo AntiguedadMarcos MoralesNo ratings yet

- Botswana Interbank Settlement System StatisticsDocument1 pageBotswana Interbank Settlement System Statisticsthelordblue4710No ratings yet

- Item Contractor's Scheduled Progress (%) Contractor'sA Ctual Progress (%) Original Construction Period Original Approved Site Staff AppointmentDocument1 pageItem Contractor's Scheduled Progress (%) Contractor'sA Ctual Progress (%) Original Construction Period Original Approved Site Staff AppointmentjohnsonNo ratings yet

- Distribucion Parcelas TotalDocument1 pageDistribucion Parcelas Totalanairdha1629No ratings yet

- James C Snyder PDFDocument2 pagesJames C Snyder PDFfirjaNo ratings yet

- Government Gazette: Christmas/New Year PublicationDocument8 pagesGovernment Gazette: Christmas/New Year Publicationtalafatima03No ratings yet

- Jujun S SuriasumantriDocument2 pagesJujun S SuriasumantriLukman HadiNo ratings yet

- Workbook Contents: U.S. Natural Gas Exports To MexicoDocument21 pagesWorkbook Contents: U.S. Natural Gas Exports To MexicoLuis M. Callejas YescasNo ratings yet

- Inflation-Growth AnalysisDocument362 pagesInflation-Growth AnalysisSdc NunNo ratings yet

- Infrate 2012Document26 pagesInfrate 2012Lip SyncersNo ratings yet

- Investing in Hedge FundsDocument4 pagesInvesting in Hedge FundsTraderCat SolarisNo ratings yet

- Calendar 2023 Course Dates 1Document2 pagesCalendar 2023 Course Dates 1sossoucalixteNo ratings yet

- Curva S AvanceDocument4 pagesCurva S AvanceJessica TatianaNo ratings yet

- Case Shiller Seasonality 2 Dec 2010Document8 pagesCase Shiller Seasonality 2 Dec 2010kettle1No ratings yet

- AttritionDocument95 pagesAttritionashishNo ratings yet

- Savings Securities Maturity Chart: Series E and Ee, Savings Notes, Series I, Series H and HHDocument1 pageSavings Securities Maturity Chart: Series E and Ee, Savings Notes, Series I, Series H and HHMichaelNo ratings yet

- Chart Fantasy Mariah - )Document43 pagesChart Fantasy Mariah - )musclebunny23No ratings yet

- CA TimetableDocument3 pagesCA TimetableSearching SoulNo ratings yet

- Bergamo Airport Bus ScheduleDocument2 pagesBergamo Airport Bus ScheduleBismin BabuNo ratings yet

- Planilha Inflação - MMDocument9 pagesPlanilha Inflação - MMLuisa HelenaNo ratings yet

- Plate 12 PieDocument8 pagesPlate 12 PieRay Allen Bionson RomeloNo ratings yet

- Student Weekly Lesson Completion Sy 2022-23Document2 pagesStudent Weekly Lesson Completion Sy 2022-23api-574053704No ratings yet

- The Monthly Weather Report of Temperature and HumidityDocument6 pagesThe Monthly Weather Report of Temperature and HumidityLucas KaungNo ratings yet

- Workbook Contents: Henry Hub Natural Gas Spot Price (Dollars Per Million Btu)Document8 pagesWorkbook Contents: Henry Hub Natural Gas Spot Price (Dollars Per Million Btu)Alexander SeminarioNo ratings yet

- GermanyDocument30 pagesGermanyRadhika KushwahaNo ratings yet

- Fase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoDocument15 pagesFase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoArturo Saenz ArteagaNo ratings yet

- AIRAC Effective DatesDocument1 pageAIRAC Effective DatesgiganticvisNo ratings yet

- Pet Move Exp DC Nus-Z00 MBBLPD MDocument152 pagesPet Move Exp DC Nus-Z00 MBBLPD MpmellaNo ratings yet

- Daily New Cases With 7-Day Rolling Average: OklahomaDocument4 pagesDaily New Cases With 7-Day Rolling Average: OklahomaKFORNo ratings yet

- Bustat HW11111Document5 pagesBustat HW11111Jay GadainganNo ratings yet

- Jadwal Pembersihan StetoskopDocument2 pagesJadwal Pembersihan StetoskopSiti RahmahNo ratings yet

- Postcard Rates To 2009Document1 pagePostcard Rates To 2009Aimee Dars EllisNo ratings yet

- Historico UsuraDocument3 pagesHistorico UsuraMaria Nancy GarciaNo ratings yet

- Pet Move Impcus A2 Nus Epc0 Im0 MBBLPD MDocument224 pagesPet Move Impcus A2 Nus Epc0 Im0 MBBLPD MpmellaNo ratings yet

- Moonplanner PDFDocument4 pagesMoonplanner PDFAnonymous tinvt9No ratings yet

- GPF-RATE-OF-INTEREST From 1956Document1 pageGPF-RATE-OF-INTEREST From 1956rameshaakavi_4046025No ratings yet

- Peak Discharges Indus RiverDocument14 pagesPeak Discharges Indus RiverIrfan QureshiNo ratings yet

- Mba Executive Academic Calendar 2022Document1 pageMba Executive Academic Calendar 2022Abubakar IsmailNo ratings yet

- SCRA-GR No. Conversion TableDocument9 pagesSCRA-GR No. Conversion TableKourt MonteroNo ratings yet

- US Internal Revenue Service: rr-07-39Document11 pagesUS Internal Revenue Service: rr-07-39IRSNo ratings yet

- Early Journal Content On JSTOR, Free To Anyone in The WorldDocument5 pagesEarly Journal Content On JSTOR, Free To Anyone in The WorldIsra Al-KautsarNo ratings yet

- CPM Scurve Semua 2Document7 pagesCPM Scurve Semua 2Syed SyedamirulNo ratings yet

- Us InflationDocument4 pagesUs Inflationđá dsadsaNo ratings yet

- Temperatura Maxima y Minima Del Año 2000 Hasta El 2022Document7 pagesTemperatura Maxima y Minima Del Año 2000 Hasta El 2022bryan alejandro cruz maciasNo ratings yet

- Archivo Base para Ejercicio CreditoDocument19 pagesArchivo Base para Ejercicio Creditojoan david perez tenorioNo ratings yet

- Workbook Contents: U.S. Imports From Colombia of Crude Oil and Petroleum Products (Thousand Barrels)Document10 pagesWorkbook Contents: U.S. Imports From Colombia of Crude Oil and Petroleum Products (Thousand Barrels)Sebastian SanchezNo ratings yet

- Graficos TP EconomiaDocument8 pagesGraficos TP EconomiaHernan CruzNo ratings yet

- Copia de TARIFARIODocument2 pagesCopia de TARIFARIOPinky CampozanoNo ratings yet

- Silver Price HistoryDocument15 pagesSilver Price HistoryremNo ratings yet

- MA516-816 Contingencies I Section 10 Assurances and Annuities Involving Two Lives Complete NotesDocument9 pagesMA516-816 Contingencies I Section 10 Assurances and Annuities Involving Two Lives Complete NotesYomi BrainNo ratings yet

- Blueoptimum Plus Ppo Plan: Benefit SummaryDocument4 pagesBlueoptimum Plus Ppo Plan: Benefit Summarylooksmart111No ratings yet

- Car Finance NotesDocument1 pageCar Finance NotesarqumcNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Microeconomics 8th Edition Pindyck Solutions Manual 1Document36 pagesMicroeconomics 8th Edition Pindyck Solutions Manual 1jeffperryxbjingqmfp100% (28)

- # 22 Insular vs. EbradoDocument2 pages# 22 Insular vs. EbradoMona LizaNo ratings yet

- Instapdf - in 80c To 80u Deduction List 363Document16 pagesInstapdf - in 80c To 80u Deduction List 363Kallu CartoonNo ratings yet

- Void Void: Geico Casualty CompanyDocument2 pagesVoid Void: Geico Casualty CompanyIndia BrooksNo ratings yet

- Guide To Video IVDocument2 pagesGuide To Video IVasswordNo ratings yet

- Microsoft PowerPoint Presentation IFRSDocument27 pagesMicrosoft PowerPoint Presentation IFRSSwati SharmaNo ratings yet

- Abhishek ProjectDocument77 pagesAbhishek ProjectSachin AroraNo ratings yet

- New Home Budget PlannerDocument192 pagesNew Home Budget Plannerjiguparmar1516100% (1)

- NhhbjuiDocument29 pagesNhhbjuiMaryJoyBernalesNo ratings yet

- HDFC Ergo Annual Report Fy 2020 21Document136 pagesHDFC Ergo Annual Report Fy 2020 21krishnashastriNo ratings yet

- Direct Auto Celebrates 30-Year Anniversary With Daily Gift Card Giveaways and Grand PrizeDocument3 pagesDirect Auto Celebrates 30-Year Anniversary With Daily Gift Card Giveaways and Grand PrizePR.comNo ratings yet

- True/False Questions: Business Law & Ethics-Chapter 9bDocument2 pagesTrue/False Questions: Business Law & Ethics-Chapter 9bareejjooryNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest Returnsakash bangaNo ratings yet

- Chapter13 - Answer PDFDocument5 pagesChapter13 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- FIRST Wealth PrivilegesDocument23 pagesFIRST Wealth PrivilegesSushant KoulNo ratings yet

- Alok - Annual Report 2010-11 - Low Rais-2Document200 pagesAlok - Annual Report 2010-11 - Low Rais-2Parvez khanNo ratings yet

- Health SchemesDocument70 pagesHealth SchemesA J FathimaNo ratings yet

- Lesson Plan in Business MathematicsDocument12 pagesLesson Plan in Business MathematicsMontenegro Roi Vincent100% (1)

- What My Family Should KnowDocument11 pagesWhat My Family Should KnowRamya Malarini100% (1)

- PPT-SEBI (ICDR) Regulations 2023Document6 pagesPPT-SEBI (ICDR) Regulations 2023ritu.kaushik.mba25No ratings yet

- Summary Notes CPL Module 4Document9 pagesSummary Notes CPL Module 4Kashish ChhabraNo ratings yet

- Analysis of Investments and Mangement of Portfolios International 10th Edition Reilly Test BankDocument25 pagesAnalysis of Investments and Mangement of Portfolios International 10th Edition Reilly Test BankPaulaJamesjcrb100% (56)

- Transfer Tax FormDocument8 pagesTransfer Tax FormJen PalmerNo ratings yet

- CPC Rule 48 Order 21Document8 pagesCPC Rule 48 Order 21kaartheekvyyahruti4291No ratings yet

- Assessment of Knowledge and Utilization of Health Insurance Scheme Among Residents of Ilorin Metropolis, Kwara StateDocument40 pagesAssessment of Knowledge and Utilization of Health Insurance Scheme Among Residents of Ilorin Metropolis, Kwara StatederryrealsNo ratings yet

- Form PDF 322866990290623Document7 pagesForm PDF 322866990290623Indra TripathiNo ratings yet