Professional Documents

Culture Documents

Chapter 1 - Liabilities

Uploaded by

Patrick Jayson Villademosa0 ratings0% found this document useful (0 votes)

13 views3 pagesLiabilities Valix

Original Title

Chapter 1- Liabilities

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLiabilities Valix

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesChapter 1 - Liabilities

Uploaded by

Patrick Jayson VillademosaLiabilities Valix

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Economic resource is an asset, thus, the

Chapter 1: Liabilities term share dividends payable are

considered as an accounting liability,

because the obligation is to issue an entity's

LIABILITIES

own share. Thus, dividends payable is

Liabilities are 1. Present obligations of an classified as an equity rather than

entity 2. To transfer an economic resource accounting liability.

3. As a result of past events.

1. An obligation is a responsibility that an

3. Liability only arises on past events

entity has no practical ability to avoid.

because the liability is not recognized until it

Present obligations may be legal or is incurred.

constructive.

Obligating events creates a present

A legal obligation arises because of a obligation as a result of an event that has no

binding contract or statutory requirement. alternative solution but to settle the

obligation created by the event.

Legal Example: (Statutory requirement) To

pay tax, (Binding contract) To pay the Ex. When an entity tries to secure a loan, an

entity’s accounts payable. obligating event only arises, when the cash

has already been received.

The constructive obligation arises by the

reason of conducting a normal business

practice, a desire to alleviate or maintain

Measurement of liabilities

good business relations.

Constructive Example: As the entity Initial Subsequent

promotes its sales, the entity must conduct

Short-term - FV FV

some sort of gimmick like, buy 1 take 1 or

Interest

50% off, therefore, entity’s obligated to bearing

deliver their goods or services lower than

the original price. Short-term - FV FV

Non Interest

The payee to whom the obligation is owed, Bearing

the time, and the no. of individuals that

Long-term - FV FV

entities oblige into are not necessarily

Interest

needed. bearing

2. Economic resource is the asset that Long-term - PV Amortized

represents a right with a potential to Non Interest

produce economic benefits. Bearing

Obligation must be to pay cash, non-cash,

or provide a service at some future time.

Example of Liabilities as current, it'll be classified as noncurrent.

Noncurrent liabilities include the ff:

A. Accounts payable.

A. Noncurrent portion of long-term

B. Withholding tax or incentives. debt

C. Accrued payable. B. Finance lease liability

D. Dividends payable (excluding C. Deferred tax liability

share dividends payable)

D. Long-term obligation to officers

E. Advances from the customer.

E. Long -term deferred revenue

F. Debt payable like notes,

mortgage, and bonds Long-term debt falling due within a year.

G. Income tax payable Basically, the long-term debt falling due

within a year is reclassification of a

H. Deferred or Unearned revenue long-term liability.

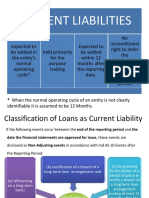

Current liabilities If the entity decides that they would

refinance, the liability that is falling within a

Current liabilities shall be classified when year, it will be classified as still non-current

one of the following arises: liability, if they decided not to, the liability will

be reclassified as current liability; still, it will

A. The entity expects to settle it

depend on the contract on who has the right

within the operating cycle.

of the power in the liability.

B. The entity holds the liability

A. Original term was for a period longer

primarily for the purpose of

than 12 months.

TRADING.

B. An agreement to refinance or to

C. The liability is due to be settled

reschedule payment on a long-term

within 12 months after the

basis is completed after the reporting

reporting period.

period and before the financial

D. The entity does not have the right statements are authorized for issue.

at the end of the reporting period

Covenants

to defer settlement of the liability

for at least 12 months after the Covenants are often attached to borrowing

reporting period. agreements which represent undertakings

by the borrower.

Noncurrent liabilities

These covenants are restrictions on the

The term noncurrent liabilities is a residual

borrower as to undertaking further

definition, meaning that if it's not classified

borrowings, paying dividends, maintaining

specified level of working capital and so Income less: Bonus = After bonus x Bonus

forth. rate

Breach of covenants

If a certain condition has been breached,

the liability becomes payable on demand.

This liability is classified as current because

at the end of the reporting period, the entity

does not have the right to defer settlement

for at least 12 months after the end of the

reporting period.

However, the liability is classified as

noncurrent if the lender agreed on or before

the end of the reporting period to provide a

grace period ending at least 12 months after

the end of the reporting period.

Grace period

Is the period within which the entity can

rectify the breach and during which the

lender cannot demand immediate payment.

Est. liabilities

Are obligations which exist at the end of the

reporting period although their amount is not

definite.

Deferred or Unearned revenue

Is an income already received but not yet

earned. It may be realizable within a year or

more than a year after the end of the

reporting period.

Bonus Computation

Before bonus and tax

Income x Bonus

After bonus but before tax

You might also like

- Learning Resource 1 Lesson 1Document11 pagesLearning Resource 1 Lesson 1Novylyn AldaveNo ratings yet

- Learning Material 1Document7 pagesLearning Material 1salduaerossjacobNo ratings yet

- ULOa. Liabilities - 1Document47 pagesULOa. Liabilities - 1pam pamNo ratings yet

- Chapter 1Document18 pagesChapter 1clarizaNo ratings yet

- Understanding LiabilitiesDocument28 pagesUnderstanding LiabilitiesRacelle FlorentinNo ratings yet

- Module 001 Accounting For Liabilities-Current Part 1Document6 pagesModule 001 Accounting For Liabilities-Current Part 1Gab BautroNo ratings yet

- VALIX IA2 Chapter 1Document5 pagesVALIX IA2 Chapter 1M100% (1)

- Audit of LiabilitiesDocument13 pagesAudit of LiabilitiesJoshua Catalla MabilinNo ratings yet

- Definition Explained:: Liabilities A Liability Is ADocument26 pagesDefinition Explained:: Liabilities A Liability Is ACurtain SoenNo ratings yet

- Chapter 1 Liabilities PDFDocument9 pagesChapter 1 Liabilities PDFKesiah FortunaNo ratings yet

- Chapter 1 - Liabilities LiabilitiesDocument4 pagesChapter 1 - Liabilities LiabilitiesJessica AllyNo ratings yet

- Chapter 1Document3 pagesChapter 1clarizaNo ratings yet

- Present ObligationDocument6 pagesPresent ObligationArgem Jay PorioNo ratings yet

- Module 1Document7 pagesModule 1Alextrasza LouiseNo ratings yet

- Financial Accounting and ReportingDocument3 pagesFinancial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- Ms. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phDocument26 pagesMs. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phCrisangel de LeonNo ratings yet

- Current Liab Trade and Other PayablesDocument6 pagesCurrent Liab Trade and Other PayablesRamainne Chalsea RonquilloNo ratings yet

- Module 1-LIABILITIES and PREMIUM LIABILITYDocument10 pagesModule 1-LIABILITIES and PREMIUM LIABILITYKathleen SalesNo ratings yet

- Ia 2 - ReviewerDocument3 pagesIa 2 - ReviewerCenelyn PajarillaNo ratings yet

- College of Business and Accountancy: Obligating EventDocument4 pagesCollege of Business and Accountancy: Obligating EventAnthony DyNo ratings yet

- Understanding LiabilitiesDocument2 pagesUnderstanding LiabilitiesXienaNo ratings yet

- Aks 2023 - 2024 - Far 4 - Day 1Document8 pagesAks 2023 - 2024 - Far 4 - Day 1John Carl TuazonNo ratings yet

- Account for Liabilities in AccountingDocument8 pagesAccount for Liabilities in Accountingpam pamNo ratings yet

- Intacc 2 NotesDocument25 pagesIntacc 2 Notescoco credoNo ratings yet

- Introduction To LiabilitiesDocument1 pageIntroduction To LiabilitiesAJ GasparNo ratings yet

- SUMMARY For INTERMEDIATE ACCOUNTING 2 PDFDocument20 pagesSUMMARY For INTERMEDIATE ACCOUNTING 2 PDFArtisan100% (1)

- Current LiabilitiesDocument3 pagesCurrent Liabilitiesreymonastrera07No ratings yet

- Chapter 1: LiabilitiesDocument1 pageChapter 1: LiabilitiesJen Bernadette CiegoNo ratings yet

- Current LiabilityDocument5 pagesCurrent LiabilityMaria AngelicaNo ratings yet

- Chapter 13 Notes: Liabilities and Current LiabilitiesDocument8 pagesChapter 13 Notes: Liabilities and Current LiabilitiesOmar MetwaliNo ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Current Liabilities - ProblemsDocument15 pagesCurrent Liabilities - ProblemsJames Ryan AlzonaNo ratings yet

- Questions 14,54,81, and 114Document5 pagesQuestions 14,54,81, and 114Damian Sheila MaeNo ratings yet

- Intermediate Acctg Lecture On Liabilities 22Document3 pagesIntermediate Acctg Lecture On Liabilities 22Tracy Lyn Macasieb NavidadNo ratings yet

- Intermediate Accounting 2 LiabilitiesDocument17 pagesIntermediate Accounting 2 LiabilitiesAngel MilanNo ratings yet

- Know About LiabilitiesDocument1 pageKnow About LiabilitiesStorm ShadowNo ratings yet

- Current LiabilitiesDocument14 pagesCurrent LiabilitiesESTRADA, Angelica T.No ratings yet

- Financial Accounting and Reporting - Accounting For LiabilitiesDocument5 pagesFinancial Accounting and Reporting - Accounting For LiabilitiesLuisitoNo ratings yet

- (Liabilities) : Lecture AidDocument20 pages(Liabilities) : Lecture Aidmabel fernandezNo ratings yet

- Current Liabilities and ContingenciesDocument6 pagesCurrent Liabilities and ContingenciesDivine CuasayNo ratings yet

- Intermediate Accounting Volume 2 by Robles and Empleo 2017 (book) chapterDocument13 pagesIntermediate Accounting Volume 2 by Robles and Empleo 2017 (book) chapterAbraham ChinNo ratings yet

- Know About LiabilitiesDocument1 pageKnow About LiabilitiesMandapalli SatishNo ratings yet

- LiabilitiesDocument3 pagesLiabilitiesClyn CFNo ratings yet

- IA2 - Key accounting concepts and principlesDocument2 pagesIA2 - Key accounting concepts and principlesAsh imoNo ratings yet

- Tax Receivables and Payables: Understanding Debt Types and CharacteristicsDocument9 pagesTax Receivables and Payables: Understanding Debt Types and CharacteristicsEKI TEENENo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Current Liabilities: When The Normal Operating Cycle of An Entity Is Not ClearlyDocument9 pagesCurrent Liabilities: When The Normal Operating Cycle of An Entity Is Not Clearlysispita dashNo ratings yet

- Accounting for Refundable Deposits, Premiums, and WarrantiesDocument4 pagesAccounting for Refundable Deposits, Premiums, and WarrantiesJadon MejiaNo ratings yet

- Financial Reporting CaseDocument2 pagesFinancial Reporting CaseChristian Lloyd Alquiroz VillanuevaNo ratings yet

- Module 008 Week003-Finacct3 Statement of Financial PositionDocument6 pagesModule 008 Week003-Finacct3 Statement of Financial Positionman ibeNo ratings yet

- Chapter 1 Current LiabilitiesDocument5 pagesChapter 1 Current LiabilitiesEUNICE NATASHA CABARABAN LIMNo ratings yet

- Chapter 1 LiabilitiesDocument7 pagesChapter 1 LiabilitiesVirgilio EvangelistaNo ratings yet

- Accounting 2: Liabilities and Financial ClassificationsDocument37 pagesAccounting 2: Liabilities and Financial ClassificationsAndrei GoNo ratings yet

- Assignment 1: Chapter 12 LiabilitiesDocument5 pagesAssignment 1: Chapter 12 LiabilitiesKarylle Ynah MalanaNo ratings yet

- LiabilitiesDocument4 pagesLiabilitiesreymonastrera07No ratings yet

- LIABILITIESDocument12 pagesLIABILITIESJOHANNANo ratings yet

- Module 1: Classifying Current LiabilitiesDocument8 pagesModule 1: Classifying Current LiabilitiesMicah Mae MarquezNo ratings yet

- Dwnload Full Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions Manual PDFDocument36 pagesDwnload Full Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions Manual PDFvaginulegrandly.51163100% (8)

- Far 20Document7 pagesFar 20Yusra PangandamanNo ratings yet

- Conflicts Digests and Notes Av PDFDocument189 pagesConflicts Digests and Notes Av PDFRostum AgapitoNo ratings yet

- Philbanking v. Lui She land lease caseDocument2 pagesPhilbanking v. Lui She land lease caseAljenneth Micaller100% (1)

- Hollis V Dow Corning CorporationDocument2 pagesHollis V Dow Corning CorporationAlice Jiang100% (1)

- Stodu 10Document6 pagesStodu 10Ahmad NafisNo ratings yet

- Liability of PartiesDocument16 pagesLiability of PartiesSGTNo ratings yet

- National Bank Of Lahore Ltd. vs Sohan Lal Saigal Case MemorialDocument16 pagesNational Bank Of Lahore Ltd. vs Sohan Lal Saigal Case MemorialTiger Khan0% (1)

- National Housing Authority Vs BasaDocument2 pagesNational Housing Authority Vs BasaMilagros Isabel L. VelascoNo ratings yet

- Prenuptial AgreementDocument2 pagesPrenuptial AgreementYavin FizowojNo ratings yet

- Conciliation Settlement Agreement AbhuDocument3 pagesConciliation Settlement Agreement AbhuABHINAV CHAUHANNo ratings yet

- Preweek Handouts in Business Law May 2014 BatchDocument8 pagesPreweek Handouts in Business Law May 2014 BatchPhilip CastroNo ratings yet

- Escheats - Guardianship - AdoptionDocument9 pagesEscheats - Guardianship - AdoptionIrish AnnNo ratings yet

- Fletcher v. City of AberdeenDocument1 pageFletcher v. City of AberdeenMadison MonzonNo ratings yet

- DLL General-Mathematics Q2 W5Document13 pagesDLL General-Mathematics Q2 W5Princess DeramasNo ratings yet

- Critically Examine the Doctrine that by Giving Time to the Principal Debtor, the Creditor Discharges the SuretyDocument14 pagesCritically Examine the Doctrine that by Giving Time to the Principal Debtor, the Creditor Discharges the SuretyDigvijay SinghNo ratings yet

- John Floyd ContractDocument3 pagesJohn Floyd ContractRobert GouveiaNo ratings yet

- Rallos V Felix Go Chan & Sons Realty CorpDocument3 pagesRallos V Felix Go Chan & Sons Realty CorpCocoi ZapantaNo ratings yet

- G.R. No. 225033 - Spouses Beltran v. Spouses CangaydaDocument6 pagesG.R. No. 225033 - Spouses Beltran v. Spouses CangaydaThalia Rose RomanovNo ratings yet

- Probate Court Determines Bank Account OwnershipDocument2 pagesProbate Court Determines Bank Account OwnershipAngela Louise SabaoanNo ratings yet

- Cruz, Chielsea - Civil LawDocument6 pagesCruz, Chielsea - Civil LawChielsea CruzNo ratings yet

- 13 Sps Santos vs. Court of AppealsDocument2 pages13 Sps Santos vs. Court of AppealsMyla RodrigoNo ratings yet

- C Syed Wajih 10kW Hybrid ESSDocument5 pagesC Syed Wajih 10kW Hybrid ESSChaudhary Muhammad Suban TasirNo ratings yet

- Opposition To Reopening Chapter 7 CaseDocument5 pagesOpposition To Reopening Chapter 7 Caserobertosantana1No ratings yet

- Jupiter International LimitedDocument6 pagesJupiter International LimitedRahul syalNo ratings yet

- Remission of Debt ExtinguishmentDocument3 pagesRemission of Debt ExtinguishmentRhos Bernadette Suico100% (2)

- CFA Level1 - Fixed Income - SS14 v2021Document154 pagesCFA Level1 - Fixed Income - SS14 v2021Carl Anthony FabicNo ratings yet

- Bank Mergers and Acquisitions Employee AgreementsDocument2 pagesBank Mergers and Acquisitions Employee AgreementsCPMMNo ratings yet

- Corpo ReviewerDocument24 pagesCorpo ReviewerJovie Hernandez-MiraplesNo ratings yet

- Deed of Absolute Sale: 45,000.00), Philippine Currency, To Me in Hand Paid ByDocument2 pagesDeed of Absolute Sale: 45,000.00), Philippine Currency, To Me in Hand Paid Bylyndon melvi sumiogNo ratings yet

- Mini-Case Study 1Document4 pagesMini-Case Study 1Ana-Maria SIMIONNo ratings yet

- Professional Liability Insurance Policy Summary For Errors and Omissions MiscellaneousDocument3 pagesProfessional Liability Insurance Policy Summary For Errors and Omissions MiscellaneousQBE European OperationsNo ratings yet