Professional Documents

Culture Documents

FA1 Chapter8

Uploaded by

Abdinasir HassanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA1 Chapter8

Uploaded by

Abdinasir HassanCopyright:

Available Formats

Chapter 8

Authorizing and Making

Payments

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Contents

1 Controls over payments

2 Cheque requisition forms

3 Expenses claim forms

4 The timing and methods of payments

5 Payments by cash

6 Payments by cheque

7 Bank giro credits (credit transfers)

8 Payments by banker's draft (payable order)

9 Payments by standing order and direct debit

10 Documentation to go out with payments

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Controls Over Payments

Controls Over Payments

• Payment Controls monitors the payments you

send and can block these in real time to

prevent fraud. Define stronger policy to

protect your operations By understanding the

patterns of payments you send over time.

• Let’s understand it with an example.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Controls Over Payments

Controls Over Payments

Suppose that a company buys goods costing $5,000.

Step 1 - It will receive an invoice from the supplier. This is the documentary evidence of the

reason for and amount of the payment.

Step 2 - The invoice will be approved by the purchasing director. This approval is the

authorization of the payment.

Step 3 -At some time later, the payment will be made to the supplier, probably by cheque. For a

payment of $5,000, perhaps only the finance director or managing director will be permitted to

sign the cheque, and so the authority to make the payment would be limited to these two

people.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Controls Over Payments

Controls Over Payments

• Every payment must be approved by an authorized

person. This person will often be a manager or supervisor

in the department that initiated the expense, but every

organization has its own system.

• Which individuals can authorize particular expenses

• The maximum amount of expenditure that an individual

can authorize

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Controls Over Payments

When a person authorizes a payment, he or she should evidence this approval by putting a signature

or recognizable initials on the appropriate document (invoice, cheque requisition form, expenses

claim form, or similar document) and ideally also the date.

Without the signature or initials of an authorized person, the accounts department should refuse to

make the payment, and should send the document back for the approval to be properly given.

Some companies use a sticker or stamp which they put on invoices received.

INVOICE PAYMENT

APPROVED BY

• Name ..................................................................

• Dept ....................................................................

• Date ....................................................................

• Initials ..................................................................

This makes it easier later for the accounts department to check that the invoice has been properly

authorized for payment.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Cheque Requisition Forms

Cheque Requisition Forms

• Cheque requisition forms are used when primary

documentation such as an invoice has not been received.

Cheque requisition forms help to ensure authorization

and recording of payments.

• A cheque requisition form is simply a form requesting

that a cheque should be drawn to make a payment.

• A cheque requisition form is an internal document for use

within the business, and so there is no standard design.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Expenses Claim Forms

Expenses Claim Forms

• In many organizations, employees will make payments out of their own pocket for

items of business expense, and then claim back the money from their organization.

Expenses for which payments might be claimed include the following.

• Money spent by the employee on business travel

• The cost of newspapers or magazines that the employee buys for business use

• Part or all the employee's domestic telephone bill

• Petrol

• Car service and repair bills (for company cars)

VERTEX LEARNING SOLUTIONS - https://vls-online.com

The Timing and Methods of Payments

The Timing and Methods of

Payments

A business will use a variety of methods to make

payments. Ignoring payroll (wages and salaries) and

petty cash, the most common and convenient methods

of payment are by cheque and by automated transfer.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

When should Payments be made and who to?

When should Payments be made and who to?

Suppliers submitting invoices will usually grant a period of credit to a customer.

(a) 'Net 30 days' on an invoice means that payment is due 30 days from the date of the

invoice.

(b) Similarly, 'net 60 days' and 'net 90 days' allow 60 and 90 days respectively from the

date of the invoice.

(c) Some suppliers specify the latest date for payment on the invoice (such as 'Payment

due by 30 November 20X7').

(d) If the invoice is not paid by the specified date, then it becomes overdue, and

reminders and telephone calls may be received from the supplier.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

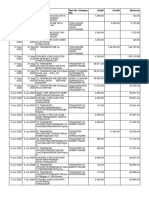

Who Decides?

Who Decides?

• Decisions about who should be paid and when are made by a senior person in the

company, perhaps the chief accountant. To help the decision-making an accounts

clerk might be required to draw up a list of unpaid invoices.

• Overdue

• Outstanding for longer than a certain period, say two months

• Miscellaneous payments not made to trade suppliers will be paid at various dates

during the month as they fall due, whereas trade bills tend to be paid at the end of

the month.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Methods of Payment

Methods of Payment

The methods that a business uses to make payments for goods and

services, wages and salaries, rent and rates and so on are broadly

the same as the methods of receiving payments. However, a

business is likely to use some methods of payment much more

often than others, and the following are most used.

• Cheques

• Automated transfers (especially for salaries and wages)

• Internet payments

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Methods of Payment

Methods of Payment

Other payment methods are as follows.

• Cash

• Banker's draft

• Standing order

• Direct debit

• Company credit card or charge card

• Mail transfer and telegraphic transfer

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Payments by Cash

Payments by Cash

• Cash payments are used for the following.

• For small payments out of petty cash, sometimes for wages

• Using cash to pay large amounts of money to suppliers ought to be very rare indeed.

• (a) Cash needs to be kept secure: it is easily stolen.

• (b) Cash can get lost in the post.

• (c) It will be difficult to keep control over cash if it is used often for making payments.

• (d) Unless a supplier issues a receipt, there will be no evidence that a cash payment has

been made. This is bad for record keeping.

• Not surprisingly, the use of cash to make large payments to suppliers is sometimes

associated with shady or dishonest dealers in backstreet or underworld businesses and may

be subject to money laundering regulations.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Payments by Cheque

Payments by Cheque

• The most common method of payment by businesses (excluding wages and salary

payments) is by cheque. Most companies and government agencies or departments use

computer-produced cheques.

• Cheques are for payments out of a current account at a bank. The accounts department of a

company

• will be provided with cheque books for its current account by its bank, each book containing

perhaps 50 crossed cheques.

• An individual in the accounts department will be responsible for the safekeeping of the

cheque book(s). They should be kept under lock and key, perhaps in a safe and at the very

least in a locked drawer. Cheque books, or individual cheques from a book, might be stolen

by someone who intends to use them deceptively. The person responsible for safekeeping

may also be responsible for ordering new cheque books when the old ones run out.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Signatures on Business Cheques

Signatures on Business Cheques

• A bank will not permit a payment by cheque from a customer's account unless it has been

properly signed.

(a) For company cheques, only certain specified individuals within the company will be

permitted to sign a cheque on behalf of the company, and the names and signatures of these

individuals must be supplied to the bank on a bank mandate form or in a bank mandate letter.

(b) In many cases, cheques above a certain value must contain two authorized signatures.

(c) Authorized signatories for company cheques are selected by the company itself, but might

consist of the chairman, all the directors and the chief accountant or financial controller.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Advantages and Disadvantages of using Cheques

Advantages and Disadvantages of using Cheques

Cheques are widely used in business to pay for supplies and other expenses. It is worth thinking

briefly about the advantages and disadvantages of using cheques as a method of payment.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Payments by Banker’s Draft (Payable Order)

Payments by Banker’s Draft (Payable Order)

A supplier might sometimes ask a customer to pay by banker's draft. Unlike company

cheques, a banker's draft cannot be stopped or cancelled after it has been issued, and

so when a supplier receives the draft, payment is guaranteed. Banker's drafts are not

used for small value items but might be used when a large payment is involved, such

as for the purchase of a company car.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Payments by Standing Order and Direct Debit

Payments by Standing Order and

Direct Debit

Direct debits are not often used for payments by businesses

but might occasionally be used for convenience.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Standing Orders

Standing Orders

Standing order payments might be used by a business to make regular payments of a fixed

amount.

(a) Rental payments to the landlord of a building occupied by the business.

(b) Paying insurance premiums to an insurance company.

Although the supplier (the landlord, or insurance company) might request payment by standing

order, it is up to the paying business to ask its bank to set up a standing order arrangement.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Standing Orders

Standing Orders

The business must specify the following to its bank.

(a) That it would like a standing order arrangement for regular payments from its account

(b) The fixed amount of each payment

(c) The frequency of each payment and the due date

(d) Banking details of the supplier to which the payments should be made

If the business subsequently needs to alter the amount of each payment, or to stop future

payments, it must send the relevant instructions to the bank in writing.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Direct Debits

Direct Debits

Direct debits, like standing orders, are used for regular payments. They differ from standing

orders in the following ways.

(a) It is the person who receives the payments who initiates each payment and informs the

paying bank of the amount of each payment.

(b) Payments can be for a variable amount each time, and at irregular intervals, as well as for

fixed amounts at regular intervals.

If a company decides that it wants to pay some of its bills by direct debit, it must fill in a Direct

Debit Instruction. This will be sent back to the supplier, not to the bank, and the supplier will

then decide through its own bank to set up the direct debit payments.

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Documentation to go out with Payments

Documentation to go out with

Payments

A business should send proper explanatory documentation

with all payments to avoid confusion. Copies of the relevant

documents should be filed in such a way that the documents

are easy to retrieve

VERTEX LEARNING SOLUTIONS - https://vls-online.com

Documentation to go out with Payments

Documentation to go out with Payments

So far, we have concentrated in this chapter on the payment itself, but when a payment is made, it is

usual to send out another document with the payment to inform the recipient as to what the payment

is for and who it is from. This document might be any of the following.

(a) A remittance advice, either created by the customer or is part of the statement sent by the supplier

(b) An order form for payments which are sent with the order itself

(c) A copy of a pro-forma invoice where this has been provided by the supplier for payments with an

order

(d) A bank giro credit form for telephone, electricity and other similar bills

(e) A covering letter explaining what the payment is for, when other forms of documentation do not

exist

VERTEX LEARNING SOLUTIONS - https://vls-online.com

You might also like

- Payment Collection for Small Business: QuickStudy Laminated Reference Guide to Customer Payment OptionsFrom EverandPayment Collection for Small Business: QuickStudy Laminated Reference Guide to Customer Payment OptionsNo ratings yet

- FA1 Chapter5Document21 pagesFA1 Chapter5Abdinasir HassanNo ratings yet

- Fia Fa1 Authorizing and Making PaymentsDocument29 pagesFia Fa1 Authorizing and Making PaymentsKj Nayee100% (1)

- Ferrer Chapter 2 Study NotesDocument4 pagesFerrer Chapter 2 Study NotesCiara FerrerNo ratings yet

- Cash Handling BasicsDocument49 pagesCash Handling BasicsHassan MphandeNo ratings yet

- Group 3 - Cash and Marketable SecuritiesDocument71 pagesGroup 3 - Cash and Marketable SecuritiesNaia SNo ratings yet

- Payment Gateway and Processing OptionsDocument28 pagesPayment Gateway and Processing OptionsZulaika AliNo ratings yet

- Cash Transfer MethodsDocument20 pagesCash Transfer MethodsPUNEET MAKHANINo ratings yet

- Guide to Payment Types, With Pros and Cons for EachDocument14 pagesGuide to Payment Types, With Pros and Cons for EachJeffreyNo ratings yet

- Guide to Cash Transfer Methods, Costs, and ControlsDocument62 pagesGuide to Cash Transfer Methods, Costs, and ControlsMa. Eliza CerveraNo ratings yet

- Cost Contro Ass2 - SemisDocument2 pagesCost Contro Ass2 - Semissamantha horlinaNo ratings yet

- Cash - Management and Fraud PreventionDocument21 pagesCash - Management and Fraud PreventionnathanielNo ratings yet

- FIN 302 Notes 2Document79 pagesFIN 302 Notes 2Courtney MosekiNo ratings yet

- IDM - E-Commerce - Payment Systems & SEODocument33 pagesIDM - E-Commerce - Payment Systems & SEOBhaswati PandaNo ratings yet

- Cash ManagementDocument51 pagesCash ManagementDebasmita SahaNo ratings yet

- Office Administration Ii DPK3023: Financial Information ProcessDocument30 pagesOffice Administration Ii DPK3023: Financial Information ProcessRong Chun WeiNo ratings yet

- Remittances and Other Functions in Banks: by Mrs. M.K. GangakhedkarDocument16 pagesRemittances and Other Functions in Banks: by Mrs. M.K. GangakhedkarsharventhiriNo ratings yet

- Remittances and Other Functions in Banks: by Mrs. M.K. GangakhedkarDocument16 pagesRemittances and Other Functions in Banks: by Mrs. M.K. GangakhedkarsharventhiriNo ratings yet

- Preparing Matching and Processing Receipts CorrectedDocument14 pagesPreparing Matching and Processing Receipts CorrectedAbdi Mucee Tube100% (1)

- Chapter 9 - Authorizing and Making PaymentsDocument26 pagesChapter 9 - Authorizing and Making Paymentsshemida100% (2)

- Overdraft Fees ExplainedDocument8 pagesOverdraft Fees ExplainedKimberlyNo ratings yet

- Credit Card Organizations: Rohit Pandey Lecturer Finance IMS GhazibadDocument35 pagesCredit Card Organizations: Rohit Pandey Lecturer Finance IMS GhazibadRohit PandeyNo ratings yet

- Group 2 HandoutsDocument5 pagesGroup 2 HandoutsGem. SalvadorNo ratings yet

- Applied Audititng Chapter-OneDocument39 pagesApplied Audititng Chapter-OneKumera Dinkisa ToleraNo ratings yet

- UntitledDocument19 pagesUntitledchef JamesNo ratings yet

- FAA Accounts Recievable ManagementDocument101 pagesFAA Accounts Recievable ManagementankjinzNo ratings yet

- Cash and Marketable Securities-AuditDocument8 pagesCash and Marketable Securities-AuditFaruk H. IrmakNo ratings yet

- L5 Electronic Payment SystemsDocument28 pagesL5 Electronic Payment SystemsKenneth Kibet NgenoNo ratings yet

- Group 4 - Bank Reconciliation PresentationDocument16 pagesGroup 4 - Bank Reconciliation Presentationelvis page kamunanwireNo ratings yet

- Acc 222 Final HandoutsDocument6 pagesAcc 222 Final HandoutsChi BellaNo ratings yet

- Ecomerce NotesDocument28 pagesEcomerce NotesManageITafricaNo ratings yet

- MK1-P11 Cash and Marketable Securities ManagementDocument39 pagesMK1-P11 Cash and Marketable Securities ManagementF.A.A ChannelNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsAngel Chane OstrazNo ratings yet

- E-Payments Methods and ProcessingDocument37 pagesE-Payments Methods and ProcessingAninda DuttaNo ratings yet

- Trade Services Let Our Expertise Work For YouDocument4 pagesTrade Services Let Our Expertise Work For YouMohit HulkNo ratings yet

- Demat AccountDocument7 pagesDemat AccountGaurav Punjabi100% (1)

- Fia Fa1 Banking Monies ReceivedDocument22 pagesFia Fa1 Banking Monies ReceivedKj NayeeNo ratings yet

- Lecture Notes On Cash Book & Petty Cash BookDocument7 pagesLecture Notes On Cash Book & Petty Cash BookINSHAN IMRAN RAMSAROOPNo ratings yet

- Accounting for Cash ControlDocument98 pagesAccounting for Cash ControlNabuteNo ratings yet

- Cash and Marketable Securities ManagementDocument56 pagesCash and Marketable Securities Managementkhanglala100% (3)

- Chasebankusanationalassociation 489913 Wilmingtondelaware 19Document39 pagesChasebankusanationalassociation 489913 Wilmingtondelaware 19Efrain CabreraNo ratings yet

- Various Ways To Speed Up The Collection Process 1. Earlier BillingDocument2 pagesVarious Ways To Speed Up The Collection Process 1. Earlier BillingFarhan KhanNo ratings yet

- ACHC Implementation GuideDocument30 pagesACHC Implementation GuidetderuvoNo ratings yet

- AP PROCESSDocument9 pagesAP PROCESSSuhas YadavNo ratings yet

- Module 4ADocument6 pagesModule 4Aashley.cyang1988No ratings yet

- Accounting Source DocumentsDocument5 pagesAccounting Source DocumentsJasvinder SinghNo ratings yet

- Credit Policy - 3Document23 pagesCredit Policy - 3harunraajNo ratings yet

- VouchersDocument9 pagesVouchersRaviSankar100% (2)

- EpaymentDocument11 pagesEpaymentShyam ShobhasanaNo ratings yet

- Document Set (for JESUS HENRIQUE HERNANDEZ ALBORNOZ)_encrypted_Document9 pagesDocument Set (for JESUS HENRIQUE HERNANDEZ ALBORNOZ)_encrypted_jesushernandez.alNo ratings yet

- Accounting Ch-5 Cash & ReceivablesDocument97 pagesAccounting Ch-5 Cash & ReceivablesFeda EtefaNo ratings yet

- Hanoi University Banking Service CourseDocument11 pagesHanoi University Banking Service CourseNgân KhổngNo ratings yet

- Bank of America Matter Banking ConceptsDocument8 pagesBank of America Matter Banking ConceptsJithendar ReddyNo ratings yet

- Internal Control Over Cash TransactionsDocument18 pagesInternal Control Over Cash TransactionsEYOB AHMEDNo ratings yet

- Cash ManagementDocument42 pagesCash ManagementJay-ar Castillo Watin Jr.No ratings yet

- Secure Electronic TransactionDocument7 pagesSecure Electronic TransactionGurpreet BansalNo ratings yet

- Banking and Cash SummaryDocument5 pagesBanking and Cash SummaryLiam Ting WeiNo ratings yet

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Unit 7: Finance Cycle ApplicationsDocument14 pagesUnit 7: Finance Cycle Applicationsyadelew likinaNo ratings yet

- Comparative Analysis of Mutual Fund of HDFC ICICIDocument33 pagesComparative Analysis of Mutual Fund of HDFC ICICIAniket Ramteke100% (1)

- Introduction of Information Technology Act 2000 Information Technology Is One of The Important Law Relating To Indian Cyber LawsDocument2 pagesIntroduction of Information Technology Act 2000 Information Technology Is One of The Important Law Relating To Indian Cyber LawsEbadur RahmanNo ratings yet

- HDFC - Annual Report 2010Document196 pagesHDFC - Annual Report 2010Sagari KiriwandeniyaNo ratings yet

- 3int - 2007 - Jun - QUS CAT T3Document10 pages3int - 2007 - Jun - QUS CAT T3asad19100% (1)

- Zurich Files - Revelations of A Swiss BankerDocument6 pagesZurich Files - Revelations of A Swiss BankerZurich FilesNo ratings yet

- Hotel Reservation ProcedureDocument2 pagesHotel Reservation ProcedureTrisha Juliene Villar100% (1)

- 2009-12-06 064119 StarkeyDocument5 pages2009-12-06 064119 StarkeyAnne KatNo ratings yet

- Angol Szituaciok B2 2008 Gazdasági Nyelvvizsga BGEDocument43 pagesAngol Szituaciok B2 2008 Gazdasági Nyelvvizsga BGEmagenheim80% (5)

- Math 20-3Document6 pagesMath 20-3api-308587685No ratings yet

- Advertisement and Promotion Strategy of Jamuna Bank Ltd.Document60 pagesAdvertisement and Promotion Strategy of Jamuna Bank Ltd.SAEID RAHMANNo ratings yet

- Cross CreditDocument2 pagesCross CreditLouis PhanNo ratings yet

- Suarez, Francis - FORM 1 - 2013 PDFDocument3 pagesSuarez, Francis - FORM 1 - 2013 PDFal_crespoNo ratings yet

- Analysis of Business Environment of Top 5 Banks - PPT 2.Ppt 1Document16 pagesAnalysis of Business Environment of Top 5 Banks - PPT 2.Ppt 1Shanky DargeNo ratings yet

- Part I-Introduction (Financial Market)Document56 pagesPart I-Introduction (Financial Market)Steve Jhon James TantingNo ratings yet

- R Gordon RichardDocument8 pagesR Gordon RichardCalWonkNo ratings yet

- Veeraiyan 02Document10 pagesVeeraiyan 02Unlimited AppsNo ratings yet

- 04.practice Set Ibps Cwe Clerk-IVDocument14 pages04.practice Set Ibps Cwe Clerk-IVDinesh ItankarNo ratings yet

- Print Your Own Money, Your Crypto-Based MoneyDocument196 pagesPrint Your Own Money, Your Crypto-Based Moneythe1uploaderNo ratings yet

- Time Value of Money ExplainedDocument85 pagesTime Value of Money ExplainedDaniel DicksonNo ratings yet

- Corporate Finance Project Finance AssignmentDocument10 pagesCorporate Finance Project Finance AssignmentGaurav PandeyNo ratings yet

- GBTA Glossary For Payment Terms 1685850185Document23 pagesGBTA Glossary For Payment Terms 1685850185itzmymark2011No ratings yet

- FSR 2018 19 1Document96 pagesFSR 2018 19 1Prashant chaudharyNo ratings yet

- Cash App October 2023 Account Statement C3faDocument7 pagesCash App October 2023 Account Statement C3fatonnjames97No ratings yet

- Statement PDFDocument6 pagesStatement PDFPeterJamesNo ratings yet

- THE UNITED STATES, Plaintiff-Appellee, vs. JOSE M. IGPUARA, Defendant-AppellantDocument3 pagesTHE UNITED STATES, Plaintiff-Appellee, vs. JOSE M. IGPUARA, Defendant-AppellantJay Nielsen PagulayanNo ratings yet

- Statement 06may2023Document4 pagesStatement 06may2023Jordan JohnsonNo ratings yet

- TUTORIAL TVM Feb17Document15 pagesTUTORIAL TVM Feb17Phong DươngNo ratings yet

- Bangladesh Bank: (Base Year: 2020, Job ID: 10151)Document1 pageBangladesh Bank: (Base Year: 2020, Job ID: 10151)taxes zone 5No ratings yet

- Obyc - Sap Simple DocsDocument6 pagesObyc - Sap Simple DocsmongkonyNo ratings yet

- Monetary and Portfolio Balance Approach To External BalanceDocument38 pagesMonetary and Portfolio Balance Approach To External BalanceWinda SafitriNo ratings yet