Professional Documents

Culture Documents

Classicbuysellday

Classicbuysellday

Uploaded by

yusufOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classicbuysellday

Classicbuysellday

Uploaded by

yusufCopyright:

Available Formats

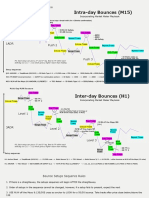

CLASSIC BUY DAY

High

HTF PD array

Close

Open

00:00am

Jud

as S

win

g

Previous day PD Array

Low (FVG, Order block, Rejection block,

2am - 4am Asian Range/CBDR)

[NY time]

Profile Characteristics

00:00am - 02:00am

Creates the Judas Swing

[typically 15-30 pips down]

02:00am - 04:00am

Forms the low of the day taking out

previous day significant sell stops

[often during London Open]

Daily candle

LUCIUS

CLASSIC BUY DAY

ANTICIPATION

low of the week buy day

M T W T F

% %

Expansion

O L H C

lowest probability weekly objective met reversal + expansion HTF liquidity objective

IF objective is met in

conditions

off the higher timeframe anticipate using previous time THEN retracement

no trade day seek new objective

discount PD array sessions is likely

htf pd array from previous

accumulation day session

highest chance of

expansion

asian range

london killzone new york killzone

Low of the Week

reversal + forms tight creates High of the Week Thursday execution

Monday range low purge consolidation [asian range] after previous weeks high applying daily + weekly profiles

was violated

[Classic Buy Day + Tuesday Low of the Week]

LUCIUS

CLASSIC BUY DAY

CHA R T E X AMPL E

2

5

EURUSD HTF PD array

Asian Range

Midnight Open

1 24 pip

Judas

2am - 4am

3

CLASSIC BUY DAY O V E RV I E W

1 2 3 4 5

Range forms

Midnight open

Purge

Expansion

High of the Day

CBDR / Asian range

market falls below MO time dependent

Above Midnight Open after tagging HTF

before seeking higher toward premium prices PD array

prices KILLZONE

London Open

LUCIUS

CLASSIC S E LL DAY

2am - 4am Previous day PD Array

High (FVG, Order block, Rejection block,

Asian Range/CBDR)

g

win

as S

Jud

Open

00:00am

Close

HTF PD array

Low

[NY time]

Profile Characteristics

00:00am - 02:00am

Creates the Judas Swing

[typically 15-30 pips up]

02:00am - 04:00am

Forms the high of the day taking out

previous day significant buy stops

[often during London Open]

Daily candle

LUCIUS

CLASSIC S E LL DAY

ANTICIPATION

sell day

M T W T F

% % %

Expansion

O H L C

lowest probability low probability liquidity objective met

probability depends on IF objective is met in time

conditions

conditions

HTF premium PD array purge previous session THEN relief is likely

no trade day ideal to also avoid and revert outcome before weekly close

accumulation day accumulation day look for change in state

of delivery

red folder news

[economic calendar]

state of delivery change

intra-week high taken

asian range

red folder news

as driver

mondays low

High of the Week

Wednesday execution

[red folder news]

applying daily + weekly profiles

accumulation days

[Classic Sell Day + Midweek Reversal]

LUCIUS

CLASSIC S E LL DAY

CHA R T E X AMPL E

2

GBPUSD

3

2am - 4am

1 19 pip judas

Midnight Open

Asian Range

4

HTF pd array

CLASSIC S E LL DAY O V E RV I E W

1 2 3 4 5

Range forms

Midnight open Purge

Distribution

Low of the Day

CBDR / Asian

during London Open Below Midnight Open

toward HTF discount

LUCIUS

You might also like

- Star Wars-Scarcity, Incentives, and Markets: Part 1 - Key Terms - Fill in The Blanks With OneDocument5 pagesStar Wars-Scarcity, Incentives, and Markets: Part 1 - Key Terms - Fill in The Blanks With OneOlufemi AderintoNo ratings yet

- VuManChu Cipher B Indicator Trading StrategyDocument1 pageVuManChu Cipher B Indicator Trading StrategyJeffrey LiwanagNo ratings yet

- The Araujo Report: Institutional Position Analysis and ForecastDocument7 pagesThe Araujo Report: Institutional Position Analysis and ForecastHoratiuBogdanNo ratings yet

- Float Charts SimplifiedDocument26 pagesFloat Charts Simplifiednguyenvanlanh0725No ratings yet

- Harvard EconDocument47 pagesHarvard Econscribewriter1990No ratings yet

- Mactan Townhouse PRESENTATION 03Document25 pagesMactan Townhouse PRESENTATION 03Michael Francis RamosNo ratings yet

- Strong Abi System M15 M60Document4 pagesStrong Abi System M15 M60hunter0123100% (1)

- Pbe Form 1Document3 pagesPbe Form 1sam yadavNo ratings yet

- Daily Market Analysis & ChecklistDocument1 pageDaily Market Analysis & ChecklistAkash BiswalNo ratings yet

- ICT Forex - The ICT ATM MethodDocument3 pagesICT Forex - The ICT ATM Methodhuda EcharkaouiNo ratings yet

- KSP - Swinger - Trading Process 13feb'22Document24 pagesKSP - Swinger - Trading Process 13feb'22Halimah MahmodNo ratings yet

- Safety Trade ChecklistDocument11 pagesSafety Trade ChecklistmajidyNo ratings yet

- Eight-To-Ten New Record Lows and HighsDocument12 pagesEight-To-Ten New Record Lows and HighsHalimah MahmodNo ratings yet

- My MM TradingNotesDocument5 pagesMy MM TradingNotesnyagweyaNo ratings yet

- Forex 4h Stochastic-Ema Trading StartegyDocument5 pagesForex 4h Stochastic-Ema Trading StartegyApothey EmmanuelNo ratings yet

- Strict Trading PlanDocument2 pagesStrict Trading PlanAngeloMartinNo ratings yet

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Lecture 020 FTR Failed To Return PDFDocument10 pagesLecture 020 FTR Failed To Return PDFHicham MAYANo ratings yet

- Better Volume Indicator DescriptionDocument3 pagesBetter Volume Indicator Descriptionmd rizwanNo ratings yet

- 200 Ema Reversal StrategyDocument20 pages200 Ema Reversal StrategyarjeetNo ratings yet

- ICT IPDA Diagram TinyVizslaDocument1 pageICT IPDA Diagram TinyVizslabahadr41331No ratings yet

- Rising & Downward Trend LinesDocument63 pagesRising & Downward Trend LinesPrajwal WakhareNo ratings yet

- Fundamentals 2. COT 3. Technicals: Idea GenerationDocument1 pageFundamentals 2. COT 3. Technicals: Idea GenerationIsaac Osabu AnangNo ratings yet

- The NY SessionDocument7 pagesThe NY SessionpetefaderNo ratings yet

- Modifications - Thuba Simon NgubaneDocument5 pagesModifications - Thuba Simon NgubaneSagar BhandariNo ratings yet

- G5-T7 How To Use WilliamsDocument4 pagesG5-T7 How To Use WilliamsThe ShitNo ratings yet

- Swap Zones-1 PDFDocument5 pagesSwap Zones-1 PDFNakata YTNo ratings yet

- MMT RojanDocument27 pagesMMT RojanRoshan Giri0% (1)

- Trade ScoreDocument30 pagesTrade ScoreSudarsan PNo ratings yet

- ProfitX CandlesDocument27 pagesProfitX CandlesDickson MakoriNo ratings yet

- ForexDocument62 pagesForexbrightmemoir 3DNo ratings yet

- 2.1 3.2 Volume With Marubozu CandleDocument6 pages2.1 3.2 Volume With Marubozu CandleJardel QuefaceNo ratings yet

- Gann Master Forex Course 4Document51 pagesGann Master Forex Course 4Trader RetailNo ratings yet

- Binary Formula 1Document43 pagesBinary Formula 1Rabia SeherNo ratings yet

- Candlesticks 1Document158 pagesCandlesticks 1rudy gullitNo ratings yet

- Forex Strategy - Dreamliner HFT MethodDocument14 pagesForex Strategy - Dreamliner HFT MethodfuraitoNo ratings yet

- Symmetrical TriangleDocument6 pagesSymmetrical Trianglekarthick sudharsanNo ratings yet

- Forex Price Action Scalping Strategy: Tools of The TradeDocument2 pagesForex Price Action Scalping Strategy: Tools of The Tradegunawan kertosonoNo ratings yet

- Market Scanner Guide 2017Document5 pagesMarket Scanner Guide 2017Mark Mark100% (1)

- Timeframe To Understand Market Direction and Supply DemandDocument2 pagesTimeframe To Understand Market Direction and Supply DemandPksh LwagunNo ratings yet

- Zero Hero: Strategy by Uncle LeeDocument12 pagesZero Hero: Strategy by Uncle LeeZeib Shelby100% (1)

- 15min Strategy and Checklist - TCC Batch 02Document3 pages15min Strategy and Checklist - TCC Batch 02Nirmal WickramarathnaNo ratings yet

- GFF - Using Price Action To Identify TrendsDocument14 pagesGFF - Using Price Action To Identify Trendslilli-pilli100% (1)

- Ote StrategyDocument1 pageOte StrategyAliNo ratings yet

- Photon LQ Entry ModelsDocument7 pagesPhoton LQ Entry ModelsDayal GhoshNo ratings yet

- BTMM - The BenchmarkDocument10 pagesBTMM - The BenchmarkHycienth Okonweze100% (1)

- Low Resis High ResisDocument12 pagesLow Resis High Resissatori investmentsNo ratings yet

- TTC Workshop Brochure With FeeDocument4 pagesTTC Workshop Brochure With Feesiddheshpatole153No ratings yet

- Breaker PDFDocument6 pagesBreaker PDFKUNAL PATILNo ratings yet

- What Are The Best Chart Time Frames To Trade PDFDocument8 pagesWhat Are The Best Chart Time Frames To Trade PDFRahul KatariyaNo ratings yet

- Trading Plan EnglishDocument3 pagesTrading Plan Englishهادی جهانیNo ratings yet

- Lecture - 023 - How To Predict Rallies PDFDocument18 pagesLecture - 023 - How To Predict Rallies PDFHicham MAYANo ratings yet

- Buyers Confidences/No RestrictionDocument16 pagesBuyers Confidences/No RestrictionBoyka KirovNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- SCALPING - PIVOT STRATEGY - The Prop TraderDocument7 pagesSCALPING - PIVOT STRATEGY - The Prop Traderyoussner327No ratings yet

- Intravest Forex Trading JournalDocument26 pagesIntravest Forex Trading JournalEDWIN100% (1)

- Liquidity Vol.1 4 PagesDocument4 pagesLiquidity Vol.1 4 PagesThuy Nguyen Thi NgocNo ratings yet

- Pseudo Breaker ExplanationDocument1 pagePseudo Breaker ExplanationgokahNo ratings yet

- Diamant Capital: Elite StrategyDocument20 pagesDiamant Capital: Elite StrategybacreatheNo ratings yet

- Smart Money Concept On Synthetic IndicesDocument75 pagesSmart Money Concept On Synthetic IndicesshedrackNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- TVL HK SHS Q3 M4Document7 pagesTVL HK SHS Q3 M4Maureen BalanonNo ratings yet

- 终稿Global Compensation Plan-Angelo AfricaDocument18 pages终稿Global Compensation Plan-Angelo AfricaEstherNo ratings yet

- Water Cooled - DWSC & DWDC C Series - Product Flyer - ECPEN22-468 - English01Document8 pagesWater Cooled - DWSC & DWDC C Series - Product Flyer - ECPEN22-468 - English01Moustafa ElshennawyNo ratings yet

- Solution Manual For John e Freunds Mathematical Statistics With Applications 8 e Miller MillerDocument11 pagesSolution Manual For John e Freunds Mathematical Statistics With Applications 8 e Miller MillerStevenRobertsonideo100% (37)

- CASA Statement 1675166411863Document4 pagesCASA Statement 1675166411863I Putu GedeNo ratings yet

- Department TestDocument41 pagesDepartment Testajmal veNo ratings yet

- Black Decker To3290xsd ManualDocument46 pagesBlack Decker To3290xsd ManualRaul Roberto OcampoNo ratings yet

- Bjcorp 98Document156 pagesBjcorp 98H Nhung TruongNo ratings yet

- Pfaff-918 938Document40 pagesPfaff-918 938May OchoaNo ratings yet

- Pricing & Costing:: Including Budgeting & Life Cycle CostingDocument45 pagesPricing & Costing:: Including Budgeting & Life Cycle Costingecell_iimkNo ratings yet

- Powtorki - Gramatyczne - B1 B2 - Przymiotniki Strona BiernaDocument2 pagesPowtorki - Gramatyczne - B1 B2 - Przymiotniki Strona BiernaBeata KucNo ratings yet

- Fire Protection Management: Guideline For The Persons Responsible in The Plant and CompanyDocument16 pagesFire Protection Management: Guideline For The Persons Responsible in The Plant and CompanyMarwenNo ratings yet

- Sample - Superstore Sales (Excel)Document804 pagesSample - Superstore Sales (Excel)MANIKANTH TALAKOKKULANo ratings yet

- Acct Statement XX6194 28072023Document4 pagesAcct Statement XX6194 28072023Mohammad Sharafat KhanNo ratings yet

- Scientific Writing - SlidesDocument19 pagesScientific Writing - SlidesDenise MacielNo ratings yet

- Statement 20230202Document10 pagesStatement 20230202philip balsomNo ratings yet

- Accomplishment ReportDocument19 pagesAccomplishment ReportEllorvie Carcueva SandoyNo ratings yet

- Law and EconomicsDocument5 pagesLaw and EconomicsHell rockarNo ratings yet

- Abaca 3Document260 pagesAbaca 32020dlb121685No ratings yet

- Modul 2 Ground HandllingDocument21 pagesModul 2 Ground HandllingDesiNo ratings yet

- IF 07C Special Instruction Form Form - 07 03 January 2022 4Document2 pagesIF 07C Special Instruction Form Form - 07 03 January 2022 4chqaiserNo ratings yet

- Teodor Shanin - The Awkward Class. Political Sociology of Peasantry in A Developing Society - Russia 1910-1925-At The Clarendon Press (1972)Document269 pagesTeodor Shanin - The Awkward Class. Political Sociology of Peasantry in A Developing Society - Russia 1910-1925-At The Clarendon Press (1972)José Manuel MejíaNo ratings yet

- Perimeter Length: 560m: QTY Unit U-Cost Amount Description I. PreliminariesDocument1 pagePerimeter Length: 560m: QTY Unit U-Cost Amount Description I. PreliminariesJaykee Joel TevesNo ratings yet

- Goodwork EF SchumacherDocument93 pagesGoodwork EF SchumacherRamsubbu100% (1)

- Activity-Chapter 5: Ans. 4,000,000 Solution: 20x1Document2 pagesActivity-Chapter 5: Ans. 4,000,000 Solution: 20x1Randelle James FiestaNo ratings yet

- EstimateDocument2 pagesEstimateJohn vincent SalazarNo ratings yet