Professional Documents

Culture Documents

Premium Certificate

Uploaded by

Mohd NaimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premium Certificate

Uploaded by

Mohd NaimCopyright:

Available Formats

Premium Certificate

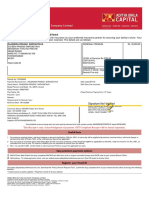

For the purpose of deduction under section 80D of Income Tax amendment act, 1961 and any amendments made thereafter.

We confirm receipt of premium amount* of Rs. 24020 as per below details towards the proposal/policy number 2122368698101 proposed by

Awadhesh Yadav

Instrument

Receipt Number Dated Drawn by Relationship Amount Payment Mode Bank name

Number

DR22231223536 113053173660 10/21/2023 Awadhesh Yadav Self 24020 JP_normal

Deduction under section 80D:

Financial Year Year wise proportionate Premium

202324 24020

* Amount is rounded off to nearest rupee and is inclusive of all taxes and cesses as applicable. For exact premium, please refer to Section VII of

Policy Schedule.

Note: The year wise deductions as mentioned above are as per provision of Section 80D and this would be subjected to the specified annual limits

and other provisions as applicable for respective years as per Income Tax Act. For your eligibility and deductions please refer to provisions of Income

Tax Act 1961 as modified and/or consult your tax consultant.

Any amount paid in cash towards premium will not qualify for tax benefits.

For and on behalf of Aditya Birla Health Insurance Co. Limited

Date : 10/21/2023

Place : Mumbai

Authorized Signatory

Aditya Birla Health Insurance Co. Limited. IRDAI Reg. 153. CIN No. U66000MHPLC263677

Email: care.healthinsurance@adityabirlacapital.com Website: adityabirlahealthinsurance.com Address:

10th Floor, RTech Park, Nirlon Compound, Next to HUB Mall, Off Western Express Highway, Goregoan East,

Mumbai 400063.

Trademark/Logo Aditya Birla Capital is owned by Aditya Birla Management Corporation Private Limited and

Trademark/logo HelathReturns, Health Heart Score and Active Dayz are owned by MMI Group Limited. These

Trademark/Logos are being used by Aditya Birla Health Insurance Co. Limited under licensed user

agreement(s).

You might also like

- Health Insurance RecieptDocument2 pagesHealth Insurance RecieptRAWAN100% (1)

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Max Bupa Premium Reeipt - Parents PDFDocument1 pageMax Bupa Premium Reeipt - Parents PDFAnand29% (7)

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- Payment Receipt 0015491365 PDFDocument1 pagePayment Receipt 0015491365 PDFNilay GandhiNo ratings yet

- Education Loan InterestDocument1 pageEducation Loan Interestravi lingam100% (2)

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceSiddharth ElangoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- Premium Certificate: Prohlt155005754 Manipalcigna Prohealth Insurance - Policy Schedule (Ctthlip18045V031819)Document1 pagePremium Certificate: Prohlt155005754 Manipalcigna Prohealth Insurance - Policy Schedule (Ctthlip18045V031819)Rajesh AdluriNo ratings yet

- Interest Certificate: Dharmendra Kumar SamtaniDocument1 pageInterest Certificate: Dharmendra Kumar SamtanideepNo ratings yet

- Premium Receipt: Harsha Patil Contact Number: 9611700115 Email ID: Pharsha1515@yahoo - Co.in Client DetailsDocument1 pagePremium Receipt: Harsha Patil Contact Number: 9611700115 Email ID: Pharsha1515@yahoo - Co.in Client DetailsHarshaNo ratings yet

- Health Insurance ParentsDocument1 pageHealth Insurance ParentsReema Khati67% (3)

- HDFC Tli Converted by AbcdpdfDocument1 pageHDFC Tli Converted by Abcdpdfharshim guptaNo ratings yet

- RenewalReceipt 502-7066983 PolicyRenewalDocument2 pagesRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNo ratings yet

- CreditCardStatement PDFDocument3 pagesCreditCardStatement PDFSrinivasDukkaNo ratings yet

- 21 21 0593825 01 PDFDocument2 pages21 21 0593825 01 PDFtamil2oooNo ratings yet

- 40-23-0012664-00 20230820 PCDocument1 page40-23-0012664-00 20230820 PCMukesh ThakurNo ratings yet

- 2023 PDF1681368243183Document2 pages2023 PDF1681368243183RpPaNo ratings yet

- Mediclaim Policy - SelfDocument1 pageMediclaim Policy - SelfAmol Suresh BachhaoNo ratings yet

- IN30267933627262Document2 pagesIN30267933627262CLANCY GAMING COMUNITYNo ratings yet

- Syamanthakam SK 2021-2022Document1 pageSyamanthakam SK 2021-2022ms poornimaNo ratings yet

- Premium AcknowledgementDocument2 pagesPremium AcknowledgementSuman SinghNo ratings yet

- PROHLR010513527 PremiumCertificate 02232018Document1 pagePROHLR010513527 PremiumCertificate 02232018shreerajpatiloppNo ratings yet

- Appolo Munich PolicyDocument3 pagesAppolo Munich PolicyEswar VakkalagaddaNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMaheshreddy GNo ratings yet

- Legal NoticeDocument2 pagesLegal NoticeAjay rawatNo ratings yet

- Max Bupa Premium Reeipt ParentDocument1 pageMax Bupa Premium Reeipt ParentsanojcenaNo ratings yet

- 2020 MediclaimDocument1 page2020 Mediclaimrathorevikas81221No ratings yet

- Duplicate Receipt Dear Sandip KamaniDocument2 pagesDuplicate Receipt Dear Sandip KamaniSandip PatelNo ratings yet

- Provisional Letter CommDocument1 pageProvisional Letter CommShekharNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVijay KumarNo ratings yet

- Date: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022Document2 pagesDate: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022sandeep kumarNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Premium Receipt 2Document1 pagePremium Receipt 2dinesh 407No ratings yet

- Dear Mayoor MehraDocument1 pageDear Mayoor MehramayoorNo ratings yet

- MCLMDocument13 pagesMCLMcibil scoreNo ratings yet

- Tax Certificate - 008857356 - 161253Document1 pageTax Certificate - 008857356 - 161253gaurav sharmaNo ratings yet

- HDFC Tli - Converted - by - AbcdpdfDocument1 pageHDFC Tli - Converted - by - Abcdpdfharshim guptaNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- Max Bupa Premium Reeipt SelfDocument1 pageMax Bupa Premium Reeipt SelfsanojcenaNo ratings yet

- Ratnakar Bhanj InsuranceDocument14 pagesRatnakar Bhanj InsurancedigitalworldjnkpNo ratings yet

- Rajendra Prasad ShrivastavaDocument2 pagesRajendra Prasad ShrivastavaSourabh ShrivastavaNo ratings yet

- Health Companion UIN: IRDAI/HLT/MBHI/P-H/V.III/2/2017-18Document1 pageHealth Companion UIN: IRDAI/HLT/MBHI/P-H/V.III/2/2017-18Rakesh AggarwalNo ratings yet

- Renewal NoticeDocument1 pageRenewal NoticevishalmprojectNo ratings yet

- PPCFinacial Year 2022Document2 pagesPPCFinacial Year 2022Subroto JenaNo ratings yet

- ULIP 50000 2022 MageshDocument1 pageULIP 50000 2022 Mageshmagi9999No ratings yet

- Policy and Payment Details: Premium Paid CertificateDocument1 pagePolicy and Payment Details: Premium Paid CertificateAbhishek Kumar SinghNo ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- PREMIUM-RECEIPT DineshDocument1 pagePREMIUM-RECEIPT Dineshdinesh 407No ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Ghulam Mohi U Din Tax CeDocument1 pageGhulam Mohi U Din Tax Cesinghgurmanan7No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Definition of Terms - Medical InsuranceDocument67 pagesDefinition of Terms - Medical InsuranceAviNo ratings yet

- RT00013461 Offer LetterDocument12 pagesRT00013461 Offer LetterMohd NaimNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsMohd NaimNo ratings yet

- APC Incentive StructureDocument17 pagesAPC Incentive StructureMohd NaimNo ratings yet