Professional Documents

Culture Documents

Corporate Tax Planning Management

Uploaded by

abh ljknOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Tax Planning Management

Uploaded by

abh ljknCopyright:

Available Formats

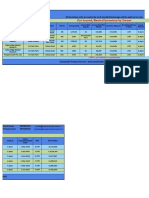

Paper Total Total

Paper Title Credit

Code Sessions hours

5.8 Corporate Tax Planning & Management 20-22 30-32 3

Course Objective

To provide working knowledge tax planning and provide insight into various devices available to minimize the

tax bill. After completion of the syllabus student should be able to appreciate enormous amount of activities in

direct taxes being undertaken by Finance Ministry to provide stable and equitable platform to all industries and

how corporate undertakings diverts the flow of new investment in tax lucrative zones.

Course Outcomes (COs)

By the end of this course the students will be able to:

CO 1: Developing an understanding in the concept of tax planning.

CO 2: Enhancing decision making skill to ensure sustainability in business through tax planning.

CO 3: Gaining insight as regards to the tax laws for non-residents.

CO 4: Understanding the complex tax laws with reference to mergers & demergers.

CO 5: Learning tax planning in India through various decided court cases.

Course Outcomes - Program Outcomes (POs) Matrix

PO 1 PO 2 PO 3 PO 4 PO 5

Expected to To engage in life Expected to Ability to identify, Ability to use

understand long self-learning demonstrate analyse, present relevant and

theoretical & apply appropriate ethical business issues and advanced

framework of programme individual & make quantitative information &

COs

management learning to collaborative and qualitative communicatio

fundamentals practical business behavioural decisions in the n tools

situations dimensions at work respective

and in society specialization

CO 1 3 1 1 1 -

CO 2 3 3 2 1 -

CO 3 3 1 1 1 -

CO 4 3 1 2 2 -

CO 5 3 2 2 2 -

Teaching Pedagogy

The focus will be on interactive learning through lectures and class room discussions. Besides, the students may

also be required to work on class / assignments / project reports, on individual or group basis.

Teaching aids include white board, audio-video and other relevant tools.

Evaluation Pattern

Internal Assessment 40%

End Term Examination 60%

Course Content

UNIT TOPICS SESSIONS

Taxation and Concept of Tax Planning

Concept of Tax

Tax planning, Tax Avoidance and Tax Evasion

1 Deduction under section 80-C to 80-U 6

Computation of taxable income of an person (covering various heads

of income)

Tax Planning for non-residents. Double Taxation.

Corporate Taxation

Meaning of company and computation of tax liability.

Minimum Alternate Tax on Companies

2 Special Provisions relating to Tax on Distributed Profits of Domestic 4

Companies

Tax provisions relating to free trade zones.

Tax planning for new business.

Specific managerial and financial decisions

Tax considerations in respect of specific managerial decisions like

Make or Buy, Own or Lease, Close or Continue, Sale in Domestic

3 Markets or Exports. 4

Transfer pricing (in India and between India and other countries) and

tax implications

Remuneration Planning & Tax Management

Case studies on planning of salary packages or employees on different

4 managerial positions so as to minimize the tax bill. Deduction 4

available in respect of remuneration in the hands of employer.

Penalties and Prosecutions, Appeals and Revisions. Advance Ruling

Goods and services Tax act( GST)

Concept of GST and its working

IGST

5 SGST 3

Tax category in GST

Item exempted from GST

Suggested Readings:

Fundamental of Goods & Services Tax, FCA. Vineet Gupta & Dr. N.K. Gupta, Bharat’s

Corporate Tax Planning & Management, Dr. Girish Ahuja & Dr. Ravi Gupta, Wolters Kulwer

Corporate Tax Planning & Business Tax Procedures, Dr. Vinod K. Singhania & Dr. Monica Singhania,

Taxmann’s

The list of cases and specific references including recent articles will be announced in the class.

You might also like

- S. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchDocument5 pagesS. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchsiddheshNo ratings yet

- Course Title: Corporate Tax Planning& Management Course Code: ACCT801 Credit Units:03 Level: PGDocument5 pagesCourse Title: Corporate Tax Planning& Management Course Code: ACCT801 Credit Units:03 Level: PGradhika makkarNo ratings yet

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverNo ratings yet

- Programme: MBA: Teaching - Learning PlanDocument8 pagesProgramme: MBA: Teaching - Learning PlanHarsh KandeleNo ratings yet

- Tax 2 Flexible Obtl Midyear 2021Document13 pagesTax 2 Flexible Obtl Midyear 2021Jamaica DavidNo ratings yet

- Indirect Taxation: IntermediateDocument290 pagesIndirect Taxation: IntermediateShreya JainNo ratings yet

- Indirect Taxation (Section B) : The Institute of Cost Accountants of IndiaDocument344 pagesIndirect Taxation (Section B) : The Institute of Cost Accountants of IndiaSagar Verma100% (1)

- Legal Aspects of Business Adv GehaniDocument5 pagesLegal Aspects of Business Adv GehaniVishal PaithankarNo ratings yet

- Taxation 3A 2018 - CGT Learning GuideDocument10 pagesTaxation 3A 2018 - CGT Learning GuideZiphozonkeNo ratings yet

- Course Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Document8 pagesCourse Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Jackie RaborarNo ratings yet

- Business Law-Courseplan-2022-23Document13 pagesBusiness Law-Courseplan-2022-23Rohit GoyalNo ratings yet

- (MBA ACC Major OBE CO) Corporate Tax ManagementDocument5 pages(MBA ACC Major OBE CO) Corporate Tax ManagementMahfuz Ur RahmanNo ratings yet

- Tax Planning Project - Final 2022Document60 pagesTax Planning Project - Final 2022sreeja kandula789100% (1)

- APCIT Programme-Oct2022-FinalDocument6 pagesAPCIT Programme-Oct2022-FinalAditya BahariNo ratings yet

- Mba - Sem Ii - CF Syllabus LTPDocument5 pagesMba - Sem Ii - CF Syllabus LTPKanchana GuntupalliNo ratings yet

- Lecture 1.3Document14 pagesLecture 1.3Ratan KalraNo ratings yet

- P15 - New - CmaDocument640 pagesP15 - New - Cmaideal100% (1)

- Initial PagesDocument17 pagesInitial PagesAadityaNo ratings yet

- Article ReviewDocument2 pagesArticle ReviewDiana CostaNo ratings yet

- SOB - Accounting For Business Combinations - M1 PDFDocument40 pagesSOB - Accounting For Business Combinations - M1 PDFRyana ConconNo ratings yet

- ACCO 20133 Income TaxationDocument113 pagesACCO 20133 Income Taxationrhoshelle beleganio100% (1)

- Indirect Tax Laws and Practice: The Institute of Cost Accountants of IndiaDocument1,016 pagesIndirect Tax Laws and Practice: The Institute of Cost Accountants of IndiaSripragna Reddy Puli100% (1)

- Simonpoh@Nus - Edu.Sg: Mcgraw-Hill Isbn No 978-9-814-82199-5Document2 pagesSimonpoh@Nus - Edu.Sg: Mcgraw-Hill Isbn No 978-9-814-82199-5Chloe NgNo ratings yet

- Course File MBA 516 Business LegislationDocument20 pagesCourse File MBA 516 Business LegislationAnubhav SonyNo ratings yet

- Direct Taxation: IntermediateDocument550 pagesDirect Taxation: IntermediateShreya JainNo ratings yet

- L3 DifefrenceDocument16 pagesL3 DifefrenceJass PablaNo ratings yet

- Income Tax Syllabus Rev. August 4 2022Document23 pagesIncome Tax Syllabus Rev. August 4 2022Nezer VergaraNo ratings yet

- Course Title: Corporate Tax Planning & Management Course Code: ACCT801 Credit Units:03 Level: PGDocument5 pagesCourse Title: Corporate Tax Planning & Management Course Code: ACCT801 Credit Units:03 Level: PGAkash Singh RajputNo ratings yet

- Direct Taxation (Section A) : The Institute of Cost Accountants of IndiaDocument628 pagesDirect Taxation (Section A) : The Institute of Cost Accountants of IndiakrupithkNo ratings yet

- ACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgDocument8 pagesACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgRoschelle MiguelNo ratings yet

- Course Plan-Business LawDocument13 pagesCourse Plan-Business Lawkowsheka.baskarNo ratings yet

- S. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchDocument6 pagesS. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchNavil BordiaNo ratings yet

- Acco 20173 Business TaxesDocument26 pagesAcco 20173 Business TaxesBea BonitaNo ratings yet

- Tax 2Document14 pagesTax 2EgildNo ratings yet

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Document14 pagesACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNo ratings yet

- TX-UK J24-M25 Syllabus and Study Guide - FinalDocument24 pagesTX-UK J24-M25 Syllabus and Study Guide - FinalKhin Lapyae TunNo ratings yet

- Tax Management SyllabusDocument2 pagesTax Management Syllabusbs_sharathNo ratings yet

- BEPS 2.0 - Global Minimum Tax - KPMG CanadaDocument5 pagesBEPS 2.0 - Global Minimum Tax - KPMG CanadaZaid KamalNo ratings yet

- AFM & ITR SyllabusDocument4 pagesAFM & ITR Syllabusmanusri ANo ratings yet

- GST Module 1 Compiled PDFDocument285 pagesGST Module 1 Compiled PDFRahul DoshiNo ratings yet

- 27 B.com Computer Applications (Hons) MajorDocument72 pages27 B.com Computer Applications (Hons) MajorYUVASHAKTHI COMPUTERSNo ratings yet

- Corporate TaxationDocument3 pagesCorporate TaxationSHIVANSHUNo ratings yet

- Cost Best Theory NoteDocument84 pagesCost Best Theory NotebinuNo ratings yet

- Instructional Materials For Income TaxationDocument126 pagesInstructional Materials For Income TaxationNadi HoodNo ratings yet

- COURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationDocument6 pagesCOURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationNoor FatimaNo ratings yet

- Saintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914Document7 pagesSaintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914SNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- Department of Finance and Accounting: IBS, IFHE, HyderabadDocument54 pagesDepartment of Finance and Accounting: IBS, IFHE, HyderabadRUTHVIK NETHANo ratings yet

- Bpcba Cbcs Syllabus Sem VDocument16 pagesBpcba Cbcs Syllabus Sem VAshwani PNo ratings yet

- Business Taxation Win 21Document71 pagesBusiness Taxation Win 21Sanaiya JokhiNo ratings yet

- Financial Accounting Course Outline Fall 2023-Undergraduate LevelDocument6 pagesFinancial Accounting Course Outline Fall 2023-Undergraduate LevelUmer SiddiquiNo ratings yet

- Appendix-20Document56 pagesAppendix-20SivahariNo ratings yet

- English Manajemen PerpajakanDocument16 pagesEnglish Manajemen PerpajakanfifiNo ratings yet

- Questionnaire NS 2023feb 1722Document3 pagesQuestionnaire NS 2023feb 1722Mohd ArmanNo ratings yet

- MADM Course Outline 2020 - 21 - v2Document6 pagesMADM Course Outline 2020 - 21 - v2KaranNo ratings yet

- 2 Advanced Stage TAX Module Outline Sept 2018Document5 pages2 Advanced Stage TAX Module Outline Sept 2018Aniss1296No ratings yet

- 2,3 (Economics) Cooperative EconomicsDocument117 pages2,3 (Economics) Cooperative EconomicskefeNo ratings yet

- Course Outline FM 2 (1.5)Document5 pagesCourse Outline FM 2 (1.5)KaranNo ratings yet

- Bos 41987 in It PagesDocument17 pagesBos 41987 in It PagesAnju TresaNo ratings yet

- Towards an XBRL-enabled corporate governance reporting taxonomy.: An empirical study of NYSE-listed Financial InstitutionsFrom EverandTowards an XBRL-enabled corporate governance reporting taxonomy.: An empirical study of NYSE-listed Financial InstitutionsRating: 1 out of 5 stars1/5 (1)

- MCQ2Document27 pagesMCQ2rattan24No ratings yet

- Cost APProachDocument40 pagesCost APProachMANNAVAN.T.N100% (1)

- 1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?Document163 pages1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?sudhakarNo ratings yet

- Negotiable InstrumentsQ&ADocument11 pagesNegotiable InstrumentsQ&AMelgen100% (1)

- Tata Group - M&ADocument24 pagesTata Group - M&Aankur_khushu66100% (1)

- Financial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDocument87 pagesFinancial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDaniel YebraNo ratings yet

- Account Statement From 1 Jan 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Jan 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceKrishna YadavNo ratings yet

- 2009 CFA Level 1 Mock Exam MorningDocument38 pages2009 CFA Level 1 Mock Exam MorningForrest100% (1)

- Partnership Agreement (Short Form)Document2 pagesPartnership Agreement (Short Form)Legal Forms91% (11)

- Fundamental Analysis of ACCDocument10 pagesFundamental Analysis of ACCmandeep_hs7698100% (2)

- Account Statement BY90MTBK30140008000003271543Document1 pageAccount Statement BY90MTBK30140008000003271543savasdvsdavsadvdNo ratings yet

- A Project Report On: "Money & Banking"Document57 pagesA Project Report On: "Money & Banking"Tasmay EnterprisesNo ratings yet

- UMKC Econ431 Fall 2012 SyllabusDocument25 pagesUMKC Econ431 Fall 2012 SyllabusMitch GreenNo ratings yet

- Cover Cek MaybankDocument2 pagesCover Cek MaybankArifa HasnaNo ratings yet

- New Zealand 2009 Financial Knowledge SurveyDocument11 pagesNew Zealand 2009 Financial Knowledge SurveywmhuthnanceNo ratings yet

- Sustainable Pre Leased 06122019Document2 pagesSustainable Pre Leased 06122019vaibhav vermaNo ratings yet

- Sample Loan ProposalDocument20 pagesSample Loan Proposalhardmoneyteam94% (16)

- Entrepreneurship Simulation The Startup Game - Wharton University of PennsylvaniaDocument46 pagesEntrepreneurship Simulation The Startup Game - Wharton University of PennsylvaniaMetin ReyhanogluNo ratings yet

- Technical Analysis: Dow TheoryDocument11 pagesTechnical Analysis: Dow TheorySiwat Thongsuk100% (1)

- Long-Term Funds:: Sources and CostsDocument23 pagesLong-Term Funds:: Sources and CostsArmilyn Jean Castones0% (1)

- Exter's Pyramid, by Paul MylchreestDocument10 pagesExter's Pyramid, by Paul MylchreestTFMetalsNo ratings yet

- Lehman Examiner's Report, Vol. 4Document493 pagesLehman Examiner's Report, Vol. 4DealBookNo ratings yet

- Mba IimDocument3 pagesMba IimYashwanth Reddy YathamNo ratings yet

- Buffalo Accounting Go-Live ChecklistDocument16 pagesBuffalo Accounting Go-Live ChecklistThach DoanNo ratings yet

- APC Corporation Exercises Chapter 10Document5 pagesAPC Corporation Exercises Chapter 10AnnGabrielleUretaNo ratings yet

- Soft OfferDocument3 pagesSoft OfferRicardo CagnoniNo ratings yet

- SIP Report OldDocument27 pagesSIP Report OldAbhishek rajNo ratings yet

- AR 2009 EngDocument252 pagesAR 2009 EngmorgunovaNo ratings yet

- SaranshYadav Project Report GoldDocument25 pagesSaranshYadav Project Report Goldanon_179532672No ratings yet

- H HJ KJHKJDocument15 pagesH HJ KJHKJEmmanuel BatinganNo ratings yet