Professional Documents

Culture Documents

Ey Aarsrapport 2021 22 35

Uploaded by

Ronald RunruilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ey Aarsrapport 2021 22 35

Uploaded by

Ronald RunruilCopyright:

Available Formats

NOTES

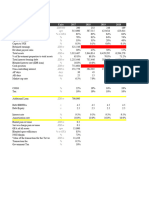

25 Financial risks and financial instruments, continued

Trade receivables

Outstanding receivables are followed up upon centrally on an ongoing basis in accordance with the Group's policy for trade

receivables. In case of uncertainty as to the client's ability or willingness to pay and if it is deemed that the claim involves a risk,

write-down is made to the expected recoverable amount.

The assessment did not result in any further losses being recognised.

Expected Loss Expected Loss

Group

Balance default rate allowance Balance default rate allowance

2021/22 2021/22 2021/22 2020/21 2020/21 2020/21

DKKm % DKKm DKKm % DKKm

Not past due 473.7 0.1% 0.5 378.1 0.2% 0.8

1-30 days 74.5 0.5% 0.4 80.3 0.5% 0.4

30-90 days 34.0 1.5% 0.5 37.5 1.5% 0.5

91-180 days 11.3 9.6% 1.1 11.1 11.5% 1.3

More than 180 days 22.5 20.9% 4.7 13.9 47.6% 6.6

616.0 7.2 520.9 9.6

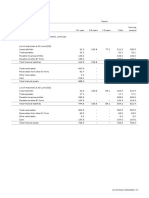

Expected Loss Expected Loss

Parent Balance default rate allowance Balance default rate allowance

2021/22 2021/22 2021/22 2020/21 2020/21 2020/21

DKKm % DKKm DKKm % DKKm

Not past due 472.2 0.1% 0.5 377.0 0.2% 0.7

1-30 days 74.3 0.5% 0.4 72.9 0.5% 0.4

30-90 days 33.6 1.5% 0.5 37.4 1.5% 0.6

91-180 days 11.6 9.2% 1.1 10.8 11.4% 1.2

More than 180 days 22.3 20.5% 4.5 13.7 47.6% 6.4

614.0 7.0 511.8 9.3

With the implementation of IFRS 9, EY has applied the simplified expected credit loss model to measure the expected credit

loss allowance for all trade receivables. Based on the low realised losses on receivables historically, adjustments to reflect

current and forward-looking information on macroeconomic factors affecting the ability of clients to settle the receivable such

as GDP and unemployment rates do not increase the risk of losses significantly.

Insurance

The Group is covered by insurance in all respects, including professional liability. The Group only cooperates with established

insurance companies, and it is assessed that there is no risk associated with the credit quality of the insurance companies used.

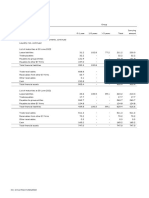

Liquidity risk

The Group primarily finances its activities via balances with the Parent Company.

The Group's financial assets and liabilities fall due for payment as specified below where the amounts reflect the non-

discounted nominal amounts falling due for payment in accordance with the underlying agreements, including future interest

payments, calculated based on current market conditions.

Methods and assumptions underlying the fair value measurement:

Financial assets and liabilities with short credit periods (less than one year)

It is assessed that the fair value of all the Group's financial assets and liabilities with short credit periods corresponds to the

carrying amount.

Annual Report 2021/2022 | 35

You might also like

- Federal Reserve Consumer Credit-G.19Document3 pagesFederal Reserve Consumer Credit-G.19Jackson SinnenbergNo ratings yet

- A. Qualitative FactorsDocument39 pagesA. Qualitative FactorsSangtani PareshNo ratings yet

- Top Affiliate Networks + Traffic SourceDocument20 pagesTop Affiliate Networks + Traffic SourceJames Niel100% (1)

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Marketing Project Perfume - RemovedDocument33 pagesMarketing Project Perfume - Removedparsaniyamanan100% (1)

- 190523 2018 Hyundai Oilbank AR 영문 FinalDocument76 pages190523 2018 Hyundai Oilbank AR 영문 FinalHashaira AlimNo ratings yet

- Rise of Digital Banks in Indonesia - MW - March 2021 - Updated May 2021Document26 pagesRise of Digital Banks in Indonesia - MW - March 2021 - Updated May 2021Dimas Surya PrakarsaNo ratings yet

- Q3 2020 High Yield Bank Loan ReportDocument16 pagesQ3 2020 High Yield Bank Loan Reportrwmortell3580No ratings yet

- Contoh DCF ValuationDocument17 pagesContoh DCF ValuationArie Yetti NuramiNo ratings yet

- Fundamental Analysis of Fertilizer SectorDocument13 pagesFundamental Analysis of Fertilizer SectorAmit SinghNo ratings yet

- Janata Bank Id.79 & 69Document13 pagesJanata Bank Id.79 & 69mulham.bba.20210202079No ratings yet

- PWC Ghana 2023 Budget DigestDocument49 pagesPWC Ghana 2023 Budget DigestAl SwanzyNo ratings yet

- AccraDocument3 pagesAccraPranav HansonNo ratings yet

- Solvency Position: 1. Debt-Equity RatioDocument5 pagesSolvency Position: 1. Debt-Equity RatioShilpiNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- AccountingDocument15 pagesAccountingVishwas tomarNo ratings yet

- Sapm AssignmentDocument4 pagesSapm Assignment401-030 B. Harika bcom regNo ratings yet

- Corporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDDocument11 pagesCorporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDpurvi jainNo ratings yet

- PER SizeShare 20190906Document4 pagesPER SizeShare 20190906felipearanzazugNo ratings yet

- UntitledDocument15 pagesUntitledIshu SainiNo ratings yet

- Opportunity Day EPG: Financial Results Q3 2022/23Document21 pagesOpportunity Day EPG: Financial Results Q3 2022/23sozodaaaNo ratings yet

- Consumer Decision MakingDocument38 pagesConsumer Decision Makingahsan tareenNo ratings yet

- NG Debt Press Release June 2023 1Document2 pagesNG Debt Press Release June 2023 1Ma. Theresa BerdanNo ratings yet

- Horizontal Vertical AnalysisDocument12 pagesHorizontal Vertical AnalysisKath Lea Sanchez AbrilNo ratings yet

- SailashreeChakraborty 13600921093 FM401Document12 pagesSailashreeChakraborty 13600921093 FM401Sailashree ChakrabortyNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Financial Analysis 2.0Document6 pagesFinancial Analysis 2.0Jammie Rose MallariNo ratings yet

- Q42022 Results Press ReleaseDocument40 pagesQ42022 Results Press ReleaseAditya DeshpandeNo ratings yet

- Assignment6 HW6Document7 pagesAssignment6 HW6RUPIKA R GNo ratings yet

- Nightscout Weekly SuccessDocument1 pageNightscout Weekly SuccessEzequiel DevotoNo ratings yet

- JPMorgan Global Growth & Income PLC (GB - EN) (25 - 05 - 2022)Document3 pagesJPMorgan Global Growth & Income PLC (GB - EN) (25 - 05 - 2022)George StevensonNo ratings yet

- FRB - H15 Assignment 1Document4 pagesFRB - H15 Assignment 1Wambui Isaac KimNo ratings yet

- P/E Ratio (Price-to-Earnings Ratio)Document3 pagesP/E Ratio (Price-to-Earnings Ratio)bhowmickrionNo ratings yet

- FM Assignment 22021241198Document14 pagesFM Assignment 22021241198Sanchit GoteNo ratings yet

- Beacon Pharma Ltd. - UpdateDocument12 pagesBeacon Pharma Ltd. - UpdateMd. Mustak AhmedNo ratings yet

- Tugas 2 Analisis Laporan KeuanganDocument11 pagesTugas 2 Analisis Laporan Keuangangestinalia55No ratings yet

- BBBBDocument1 pageBBBBLife GroovyNo ratings yet

- AMT Geninterest STD 2018Document9 pagesAMT Geninterest STD 2018Mai SuwanchaiyongNo ratings yet

- Practice Exercise - Berger PaintsDocument8 pagesPractice Exercise - Berger PaintsKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Project ValuesDocument30 pagesProject ValueshariharanpNo ratings yet

- DCF Valuation Method - Indosat-HutchinsonDocument4 pagesDCF Valuation Method - Indosat-HutchinsonRobin DharmawanNo ratings yet

- Fca B SiddharthDocument12 pagesFca B SiddharthSiddharth SangtaniNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Assignment Help Guide SheetDocument11 pagesAssignment Help Guide SheetShakil KhanNo ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- ValuationDocument18 pagesValuationsanket patilNo ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- CK Healthcare Limited - Financial Model - All Errors FixedDocument82 pagesCK Healthcare Limited - Financial Model - All Errors FixedjvNo ratings yet

- Grasim LTD CashflowDocument21 pagesGrasim LTD Cashflowrjaman9981No ratings yet

- Accenture Fin Model - Par - V1Document9 pagesAccenture Fin Model - Par - V1shahsamkit08No ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- 7E IntepretationDocument4 pages7E IntepretationNurin SyazarinNo ratings yet

- Ta BellaDocument1 pageTa BellagaleNo ratings yet

- Atlas HondaDocument15 pagesAtlas HondaQasim AkramNo ratings yet

- Internsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchDocument19 pagesInternsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchShafayet JamilNo ratings yet

- PEST Analysis of PakistanDocument36 pagesPEST Analysis of PakistanArslan Ahmed RajputNo ratings yet

- Capital Struture Analysis Oman CompaniesDocument9 pagesCapital Struture Analysis Oman CompaniesSalman SajidNo ratings yet

- 2022 Financial ReportDocument116 pages2022 Financial ReportTran Thi ThuongNo ratings yet

- Branch FormatDocument1 pageBranch FormatShweta YaragattiNo ratings yet

- Press Release Arman Q3FY21Document5 pagesPress Release Arman Q3FY21Forall PainNo ratings yet

- Money Market Instrumennts AnalysisDocument5 pagesMoney Market Instrumennts AnalysisManu KrishNo ratings yet

- Intrinsic Value Calculator by MeDocument6 pagesIntrinsic Value Calculator by Menkw123No ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Flash Note On GUINNESS Plan To Cease Distribution and Importation of Diageo ProductsDocument3 pagesFlash Note On GUINNESS Plan To Cease Distribution and Importation of Diageo Productsaffordablesolutions0No ratings yet

- Ey Aarsrapport 2021 22 38Document1 pageEy Aarsrapport 2021 22 38Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 37Document1 pageEy Aarsrapport 2021 22 37Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 13Document1 pageEy Aarsrapport 2021 22 13Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 14Document1 pageEy Aarsrapport 2021 22 14Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 40Document1 pageEy Aarsrapport 2021 22 40Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 39Document1 pageEy Aarsrapport 2021 22 39Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 36Document1 pageEy Aarsrapport 2021 22 36Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 11Document1 pageEy Aarsrapport 2021 22 11Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 9Document1 pageEy Aarsrapport 2021 22 9Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 11Document1 pageEy Aarsrapport 2021 22 11Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 10Document1 pageEy Aarsrapport 2021 22 10Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 8Document1 pageEy Aarsrapport 2021 22 8Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 7Document1 pageEy Aarsrapport 2021 22 7Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 10Document1 pageEy Aarsrapport 2021 22 10Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 8Document1 pageEy Aarsrapport 2021 22 8Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 14Document1 pageEy Aarsrapport 2021 22 14Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 13Document1 pageEy Aarsrapport 2021 22 13Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 9Document1 pageEy Aarsrapport 2021 22 9Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-45Document1 page(ES) +Mr+Jeff +Business+in+a+Box-45Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 7Document1 pageEy Aarsrapport 2021 22 7Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-4Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-4Ronald RunruilNo ratings yet

- TATA Motors EVDocument24 pagesTATA Motors EVKarthick FerruccioNo ratings yet

- Chapter 7 Terms of PaymentDocument20 pagesChapter 7 Terms of Paymentmatthew kobulnickNo ratings yet

- AIS AssignmentDocument18 pagesAIS AssignmentImran Azad100% (1)

- Describe in Detail All The Facets of Jetblue'S Product. What Is Being Exchanged in A Jetblue Transaction?Document2 pagesDescribe in Detail All The Facets of Jetblue'S Product. What Is Being Exchanged in A Jetblue Transaction?Phuong Vy PhamNo ratings yet

- thanh thảoDocument10 pagesthanh thảolinhthienan133No ratings yet

- Customer-Driven Marketing Strategy: Creating Value For Target CustomersDocument27 pagesCustomer-Driven Marketing Strategy: Creating Value For Target Customerssemeneh haileNo ratings yet

- Namibia PROCUREMENT COORDINATOR JOB DESCRIPTIONDocument2 pagesNamibia PROCUREMENT COORDINATOR JOB DESCRIPTIONTsholofeloNo ratings yet

- Assignment Coversheet Student'S Name: Dinesh Anthony AngammanaDocument65 pagesAssignment Coversheet Student'S Name: Dinesh Anthony AngammanaRoshan Dilip PereraNo ratings yet

- ABCR2103 Principles of Corporate Communication - Emay23 (CS)Document183 pagesABCR2103 Principles of Corporate Communication - Emay23 (CS)Joanne IsabellNo ratings yet

- A Study of Recruitment and Selection at Deeesha Fin TechDocument10 pagesA Study of Recruitment and Selection at Deeesha Fin TechAtrangi StoodiyoNo ratings yet

- Completed AssignmentDocument85 pagesCompleted AssignmentJulianaJamilNo ratings yet

- Workshop 2 - Customer Service Karen OrtizDocument8 pagesWorkshop 2 - Customer Service Karen OrtizOlga Lucia Escobar SernaNo ratings yet

- Khalil QuestionnaireDocument6 pagesKhalil QuestionnaireAffan KhanNo ratings yet

- Dialog Axiata PLC Capital TRUST Securities 14-03-2016 PDFDocument16 pagesDialog Axiata PLC Capital TRUST Securities 14-03-2016 PDFerandi.pereraNo ratings yet

- Quotation Kanematsu 2401027784Document3 pagesQuotation Kanematsu 2401027784sofianro.sitepuNo ratings yet

- Advertising: DR Seema BashierDocument26 pagesAdvertising: DR Seema Bashierburhan mattooNo ratings yet

- BUS 520 - Question and Answer - Md. Inzamul Hauque Chowdhury - ID#2016034060Document19 pagesBUS 520 - Question and Answer - Md. Inzamul Hauque Chowdhury - ID#2016034060Inzamul HaqueNo ratings yet

- Fundamentals of Corporate Finance 12th Edition Ross Test BankDocument35 pagesFundamentals of Corporate Finance 12th Edition Ross Test Bankadeliahue1q9kl100% (19)

- Creative Google Docs Resume TemplateDocument1 pageCreative Google Docs Resume TemplateXoneNo ratings yet

- BL ExportacionDocument1 pageBL ExportacionKevin Jael Garzon CasadiegoNo ratings yet

- Harsh Vora - Team 1 - Task 1Document6 pagesHarsh Vora - Team 1 - Task 1Harsh VoraNo ratings yet

- A Study On Consumer Buying Behaviour On Honda Motor CyclesDocument38 pagesA Study On Consumer Buying Behaviour On Honda Motor CyclesNaga Jyothi Kiran BusamNo ratings yet

- Annual Report 2017 of National Tea Company LimitedDocument86 pagesAnnual Report 2017 of National Tea Company LimitedSohag AMLNo ratings yet

- SPERRYVILLE - Virginia Business EntitiesDocument6 pagesSPERRYVILLE - Virginia Business EntitiesChuck JacksonNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet