Professional Documents

Culture Documents

Tax ID-W9

Uploaded by

traduccionesluisahurtadoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax ID-W9

Uploaded by

traduccionesluisahurtadoCopyright:

Available Formats

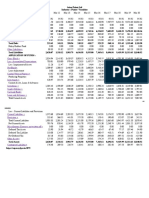

Form W-9

(Rev. October 2018)

RequestforTaxpayer

ldentification Number and Certification

Give Form to the

requester. Do not

Department of the Treasury send to the IRS.

Interna! Revenue Service .,. Go to www.irs.gov/ FormW9 for instructions and the latest information.

1 Name (as shown on your income tax return). Name is required on this line; do not leave this line blank.

Fross Zelnic k Lehrman & Z issu, P.C.

2 Business name/disregarded entity name, if difieren! from above

C'Í 4 Exemptions (codes apply only

(j)

3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of

Dl

the to certain entities, not individua1s;

"eo following seven boxes. see instructions on page 3):

o Individual/sale

'.

a o. e

C D

single-member LLC

proprietor or IZJ C Corporation O Corporation O Partnership

S O Trust/estate Exempt payee code (if any)

. "'

o :e

o Limitad liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) ... _

Note: Check the approprlate box in the ti ne above for the tax classification of the sing!e-member owner. Do not check

Exemption from FATCA report ing

o...

code (if any)

LLC if the LLC is classified as a single-member LLC that is disregarded from the owner unless the owner of the LLC is

"... e another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a single-member LLC

-:;; that

is disregarded from the owner shou!d check the appropriate box for the tax classification of its owner.

(AppJ/es to accounts malntalned outskJe the

't: .5 5 Address (number, street, and apt. or suite no.) See instructions.

U.S.)

Requester's name and addrass (oplional)

Cl.. o

¡¡::

'¡j 151 West 42nd Street, 17th FI

C D 6 City, state, and ZIP code

a

VI.

New York, NY 10036

(j) 7 Lis! account number(s) here (optional)

CD

·-

rf)

•':E:l Taxpayer ldentification Number (TIN)

Enter your TIN in_ the appmpriate box. The TIN provided must_match the name given on line 1 to avoid 1 Socialsecurity number 1

[[JJ -DJ

backup w1thholdin g. For 1nd1v1duals, th1s 1s generally your soc ial secunty number (SSN). Howeve r, for

a

residen!alien, sole proprietor, or disregarded ent ity, see the instructions for Part 1 , later. For other -1 1 1 1 1

entities, it is your employer identification number (EIN). lf you do not have a number , see How to get

a or

TIN, later. 1 Employer identification number

Note: lf the account is in more than one name, see the instructions for line 1. Also see What Name

and Number To Give the Requester for guidelines on whose number to enter. 3 - 3 o 6 2 8

Certification

Under penalties of perjury , 1 certify that:

1. The number shown on this form is my corree! taxpaye r identification number (or 1 am waiting for a number to be issued to me); and

2.1 am not subject to backup withholding because: (a) 1 am exempt from backup withholding , or {b) 1 have not been notified by the Interna! Revenue

Service (IRS) that 1 am subject to backup withholding as a result of a failure to report all interest or dividends, or (e) the IRS has notified me that 1

am no longer subject to backup withho lding; and

3. 1 ama U.S. citizen or other U.S. person {defined below); and

4. The FATCA code{s) entered on this form (if any) indicating that 1 am exempt f rom FATCA reporting is correct.

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subjeet to baekup withholding

because you have falled to report ali interest and dividends on your tax return. For real estate transactions , item 2 does not apply. For mortgage interest

paid, acquisition or abandonment of secured property,eaneellation o!debt , cont ributions toan individual retirement arrangement (IRA), and generally ,

payments other than interest and dividends, you are not required to sign the cert ification, but you must prov ide your corree!TIN. See the instructions for

Part 11, later.

Sign Signature of

Here U.S. person ._ Date ...

• Form 1099-DIV (dividends , ineluding those from stocks or

mutual funds)

Section references are to the lntemal Revenue Code unless • Form 1099-MISC (various types of income, prizes, awards , or gross

otherwise noted. proceeds)

Future developments . For the lates! information about develo • Form 1099- B (stock or mutual f und sales and certain

pments related to Form W-9 and its instructions, such as legislation other transac tions by brokers)

enacted after they were published, go to www.irs.gov/ FormW9.

• Form 1099-S (proceeds from real estate transact ions)

Purpose of Form • Form 1099-K (merchant card and third party network transactions)

An individual or entity (Form W-9 requester) who is required to file • Form 1098 (home mortgage interest) , 1098-E (student loan

an information return with the IRS mus! obtain your corree! taxpayer interest), 1098-T (tuition)

identification number (TIN) whic h may be your social security • Form 1099-C (canceled debt)

number (SSN), individual tax payer identification number {ITIN),

adoption • Form 1099-A (acquisition or abandonment of secured property)

taxpayer identification number {ATIN), or employer identification Use Form W -9 only if you are a U.S. person (including a

number residen!

{EIN), to report on an information return the amount paid to you, or alien), to provide your correct TIN.

other amount reportable on an information return. Examples of

lf you do not retum Form W-9 to the reques ter with a TIN, you

information returns include, but are not llmited to, the following .

might be subject to backup withholding. See What is backup

• Form 1099-INT Dnterest earned or paid) withholdi ng, later.

Cat. No. 10231X Form W-9 (Rev. 10-2018)

You might also like

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Img 0001 PDFDocument9 pagesImg 0001 PDFAnonymous mzkNojivNo ratings yet

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- Identification Number and Certificationrequest For Taxpayer: Purpose of FormDocument6 pagesIdentification Number and Certificationrequest For Taxpayer: Purpose of FormJacqueline CostictNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- W8Document6 pagesW8Muhammad Husnain Ijaz0% (1)

- w9 @HackersFather66Document6 pagesw9 @HackersFather66Lucky DavidNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationcoldsunlightNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and CertificationTaj R.100% (1)

- Brochure 125877Document6 pagesBrochure 125877scott.maisonNo ratings yet

- NKC Form w9 SignedDocument4 pagesNKC Form w9 SignedLakes EvansNo ratings yet

- Snow Media LLC w9Document6 pagesSnow Media LLC w9Carlos DanielNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationHusnain AfzalNo ratings yet

- w-9 FormDocument4 pagesw-9 Formapi-350005045No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationhanakog5972No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationtestNo ratings yet

- New Customer Info PacketDocument7 pagesNew Customer Info Packet3ga GroupNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationYut ChiaNo ratings yet

- W9 October 2018Document7 pagesW9 October 2018liset cortesNo ratings yet

- W9Document6 pagesW9Michael CohenNo ratings yet

- W-9 FormDocument4 pagesW-9 FormLouiseDulceNo ratings yet

- W9 Blank FormDocument4 pagesW9 Blank FormKathy AcostaNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFAnonymous wGM3bC2NNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFAnonymous afg1EDxNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJason VelazquezNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnton Elena-CarmenNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationKelsey MonsonNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJason VelazquezNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationfrankiedd18No ratings yet

- fw9 PDFDocument4 pagesfw9 PDFjengNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationgayan sadaruwanNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFAldar AltanbayarNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous 2g7ZwR2hY4No ratings yet

- w9 PDFDocument4 pagesw9 PDFoceanic23No ratings yet

- fw9 PDFDocument4 pagesfw9 PDFVictoria BeeNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFchristopherNo ratings yet

- Fatca PDFDocument4 pagesFatca PDFalexcentruNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous 2g7ZwR2hY4No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationClifford HallNo ratings yet

- W-9 Blank FormDocument4 pagesW-9 Blank FormMonnommiNo ratings yet

- fw9 3 PDFDocument4 pagesfw9 3 PDFRoosevelito MaitreNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMarc HardingNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAprilNo ratings yet

- Form W-9 PDFDocument4 pagesForm W-9 PDFRobert MooreNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFRosita Barbosa AndalioNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFJon MannNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFMoises TovarNo ratings yet

- Form W9 PDFDocument4 pagesForm W9 PDFtmturnbullNo ratings yet

- W9 Form PDFDocument4 pagesW9 Form PDFNicoleNo ratings yet

- Super Secret Tax DocumentDocument4 pagesSuper Secret Tax Documentk11235886% (7)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationfastchennaiNo ratings yet

- Blank W-9 2014Document4 pagesBlank W-9 2014Carrie AlbersNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationjoshblackmanNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationLouiseDulceNo ratings yet

- 27-Tax-Tax Incidence Theory The Effects of Taxes On The Distribution of Income (Peter Mieszkowski 1969)Document23 pages27-Tax-Tax Incidence Theory The Effects of Taxes On The Distribution of Income (Peter Mieszkowski 1969)Orlando BookNo ratings yet

- BilledStatements 2950 12-01-23 08.27Document1 pageBilledStatements 2950 12-01-23 08.27Murali KrishnaNo ratings yet

- Credit Rating ProjectDocument97 pagesCredit Rating Project1234bindu50% (2)

- Invoice: Yiwu Miaofu Home Decor CompanyDocument8 pagesInvoice: Yiwu Miaofu Home Decor CompanyAldair CarazasNo ratings yet

- Personal Particulars: Rachel M.V AnggangDocument5 pagesPersonal Particulars: Rachel M.V AnggangRachel ValentineNo ratings yet

- A ReportDocument53 pagesA ReportJayNo ratings yet

- Capital BudgetingDocument67 pagesCapital BudgetingRosanna RosalesNo ratings yet

- Manual ManualDocument2 pagesManual ManualBobNo ratings yet

- How To Start A Business Ultimate GuideDocument31 pagesHow To Start A Business Ultimate GuideJean Fajardo BadilloNo ratings yet

- G-1 RTP Compiled MAY 2024 - WDocument99 pagesG-1 RTP Compiled MAY 2024 - WSairamNo ratings yet

- 1 Energy Coils - Corner TradesDocument54 pages1 Energy Coils - Corner TradesMihaiNo ratings yet

- PHD Consolidated Financials - 31 December 2020Document46 pagesPHD Consolidated Financials - 31 December 2020Aly A. SamyNo ratings yet

- Acct 4220 Additional Review Questions For Final ExamDocument5 pagesAcct 4220 Additional Review Questions For Final ExamrakutenmeeshoNo ratings yet

- ACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Document3 pagesACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Lucas BantilingNo ratings yet

- Category 1 MessagesDocument17 pagesCategory 1 MessagesSun City TVNo ratings yet

- Syllabus 3310 MasterDocument39 pagesSyllabus 3310 MasterRaju SharmaNo ratings yet

- Whitepaper KapechainDocument17 pagesWhitepaper KapechainLPM STAI Kuala KapuasNo ratings yet

- BMAN21011 Online Exam PaperDocument3 pagesBMAN21011 Online Exam PaperXinwei LinNo ratings yet

- Midterm Exam - FA2 (Current and Non - Current) With QuestionsDocument5 pagesMidterm Exam - FA2 (Current and Non - Current) With Questionsjanus lopezNo ratings yet

- J. S. Digest of Banking & Finance: HighlightsDocument46 pagesJ. S. Digest of Banking & Finance: Highlightskaus9199No ratings yet

- Jcsgo Christian Academy: Senior High School DepartmentDocument4 pagesJcsgo Christian Academy: Senior High School DepartmentFredinel Malsi ArellanoNo ratings yet

- KPI Book Sample PDFDocument90 pagesKPI Book Sample PDFAnonymous fZ93HP4UYg100% (3)

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Investment Thesis SampleDocument7 pagesInvestment Thesis Samplestephaniebenjaminclarksville100% (2)

- Undergraduate Funding Guide For 2023Document16 pagesUndergraduate Funding Guide For 2023Aimen HakimNo ratings yet

- Cash Count SheetDocument1 pageCash Count SheetPrincessa LeeNo ratings yet

- Make and Grow Money The Right Way (Free Sample)Document12 pagesMake and Grow Money The Right Way (Free Sample)Ankit ChawlaNo ratings yet

- QP HY 09-10 - Class - 10Document59 pagesQP HY 09-10 - Class - 10promitiamNo ratings yet

- Aid and DevelopmentDocument17 pagesAid and DevelopmentAbubakar GafarNo ratings yet