Professional Documents

Culture Documents

Problem Sheet On Cost of Capital

Uploaded by

shohel.parvezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Sheet On Cost of Capital

Uploaded by

shohel.parvezCopyright:

Available Formats

1. Consider a firm with initial value of $1000 has debt to equity ratio 3.

3. The firm has cost of debt 9 percent and

cost of equity 16 percent. The firm is considering a project with an initial investment requirement of $1000 and

this will be financed from debt only, which will increase the risk profile of the firm and increase the cost of

debt to 10 percent and cost of equity to 20 percent. What will be the minimum cost of capital of the project?

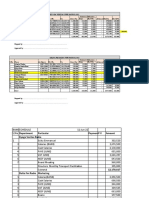

2. ABC Corporation maintains a capital structure of 60 percent debt and 40 percent equity. The components of

cost of capital are as follows:

Items Debt Equity

Cost of existing funds 6 percent 14 percent

Cost of new funds 7 percent 16 percent

The managers anticipate having $50,000 of income available for reinvestment in the business over the next

year. Depreciation, a non-cash expense, of $30,000 will be deducted in computing income. Compute ABC’s

cost of capital for different levels of investment requirements.

3. Refer to problem 2, consider ABC has following investment opportunities:

Investments A B C D

Cost 30,000 60,000 60,000 50,000

IRR 10.7% 10.2% 10% 9.6%

Comment on acceptance of the projects(s).

4. Jake’s Sound Systems has 210,000 shares of common stock outstanding at a market price of $36 a share. Last

month, Jake’s paid an annual dividend in the amount of $1.593 per share. The dividend growth rate is 4

percent. Jake’s also has 6,000 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 7

percent coupon, pay interest annually, and mature in 4.89 years. The bonds are selling at 99 percent of face

value. The company’s tax rate is 34 percent. What is Jake’s weighted average cost of capital?

5. Douglass Enterprises has a capital structure, which is based on 40 percent debt, 10 percent preferred stock, and

50 percent common stock. The after-tax cost of debt is 6 percent, the cost of preferred is 7 percent, and the cost

of common stock is 9 percent. The company is considering a project that is equally as risky as the overall firm.

This project has initial costs of $125,000 and cash inflows of $76,000 a year for two years. What is the

projected net present value of this project?

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Quizlet1 PDFDocument9 pagesQuizlet1 PDFohikhuare ohikhuareNo ratings yet

- FINC 312 Midterm Exam 1-Fall 2020Document6 pagesFINC 312 Midterm Exam 1-Fall 2020Gianna DeMarcoNo ratings yet

- FalseDocument13 pagesFalseJoel Christian Mascariña100% (1)

- Brigham Book Ed 13 - Dividend Policy SolutionsDocument9 pagesBrigham Book Ed 13 - Dividend Policy SolutionsNarmeen Khan0% (1)

- Mba722 Group Assignments September 2023Document4 pagesMba722 Group Assignments September 2023Rudo MukurungeNo ratings yet

- AL Financial Management Nov Dec 2013Document4 pagesAL Financial Management Nov Dec 2013hyp siinNo ratings yet

- February 2017 Subject: Financial Management 2 FM: 100 Program: BBA Semester V PM: 50 Subject Code: BBK2233 Time: 3hrsDocument3 pagesFebruary 2017 Subject: Financial Management 2 FM: 100 Program: BBA Semester V PM: 50 Subject Code: BBK2233 Time: 3hrsAditi JoshiNo ratings yet

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniNo ratings yet

- Fin103 LT4 JTA ComtechDocument3 pagesFin103 LT4 JTA ComtechJARED DARREN ONGNo ratings yet

- Quiz 2 - QUESTIONSDocument18 pagesQuiz 2 - QUESTIONSNaseer Ahmad AziziNo ratings yet

- Principles of Finance - (Fin 3301) Student Name: - Quiz - Capital Budgeting - Cost of CapitalDocument5 pagesPrinciples of Finance - (Fin 3301) Student Name: - Quiz - Capital Budgeting - Cost of CapitalHamza AmmadNo ratings yet

- 07 - Capital - Structure ProblemsDocument5 pages07 - Capital - Structure ProblemsRohit KumarNo ratings yet

- Chapter 7 - Risk and The Cost of CapitalDocument3 pagesChapter 7 - Risk and The Cost of CapitalLưu Nguyễn Hà GiangNo ratings yet

- FIN3701 Tutorial 2 QuestionsDocument4 pagesFIN3701 Tutorial 2 QuestionsYeonjae SoNo ratings yet

- Tutorial I, II, III, IV QuestionsDocument15 pagesTutorial I, II, III, IV QuestionsAninda DuttaNo ratings yet

- CH 14Document7 pagesCH 14AnsleyNo ratings yet

- CHAPTER 11 Without AnswerDocument3 pagesCHAPTER 11 Without Answerlenaka0% (1)

- Dividend QuestionsDocument6 pagesDividend QuestionsperiNo ratings yet

- I. Solve The Following Problems. Show Your Computations in Good FormDocument4 pagesI. Solve The Following Problems. Show Your Computations in Good FormAlelie dela CruzNo ratings yet

- Homework4 With Ans JDocument18 pagesHomework4 With Ans JBarakaNo ratings yet

- Risk Analysis, Cost of Capital and Capital BudgetingDocument10 pagesRisk Analysis, Cost of Capital and Capital BudgetingJahid HasanNo ratings yet

- 14.1 Equity Versus Debt Financing: Capital Structure in A Perfect MarketDocument5 pages14.1 Equity Versus Debt Financing: Capital Structure in A Perfect MarketAlexandre LNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- Problem Solving 10Document6 pagesProblem Solving 10Ehab M. Abdel HadyNo ratings yet

- FinanceDocument3 pagesFinanceAbrarNo ratings yet

- Merger & Acquisition: RequiredDocument19 pagesMerger & Acquisition: RequiredBKS SannyasiNo ratings yet

- Fa Finc 2302 Approved (Sem 2 2020 - 2021)Document9 pagesFa Finc 2302 Approved (Sem 2 2020 - 2021)Abdullah AlziadyNo ratings yet

- Revision Question 2023.11.21Document5 pagesRevision Question 2023.11.21rbaambaNo ratings yet

- Assignments FMDocument7 pagesAssignments FMPrachi Bajaj100% (1)

- Exercise Cost of CapitalDocument7 pagesExercise Cost of CapitalUmair Shekhani100% (2)

- Cost of Capital QuizDocument3 pagesCost of Capital QuizSardar FaaizNo ratings yet

- Tài Chính Công Ty Nâng CaoDocument8 pagesTài Chính Công Ty Nâng CaoTrái Chanh Ngọt Lịm Thích Ăn ChuaNo ratings yet

- Financial Management Assignment (2009)Document5 pagesFinancial Management Assignment (2009)sleshiNo ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument56 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global EditionKahtiNo ratings yet

- Capital Budgeting: Key Topics To KnowDocument11 pagesCapital Budgeting: Key Topics To KnowBernardo KristineNo ratings yet

- FM Lect 4Document6 pagesFM Lect 4Abdul Moiz AhmedNo ratings yet

- PAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateDocument3 pagesPAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateZaka HassanNo ratings yet

- Upload 5Document3 pagesUpload 5Meghna CmNo ratings yet

- Principles of FinanceDocument5 pagesPrinciples of FinanceELgün F. QurbanovNo ratings yet

- Risks and Cost of CapitalDocument8 pagesRisks and Cost of CapitalSarah BalisacanNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- Semester - IV End Semester Examination, 2021 FIN203-02: Business FinanceDocument4 pagesSemester - IV End Semester Examination, 2021 FIN203-02: Business FinanceDeval DesaiNo ratings yet

- Chap 16Document2 pagesChap 16zahoorNo ratings yet

- Coursework 2-Corporate FinanceDocument4 pagesCoursework 2-Corporate Financeyitong zhangNo ratings yet

- SEMINAR QuestionsDocument12 pagesSEMINAR Questions885scfzswrNo ratings yet

- FM Indiv AssignmentDocument1 pageFM Indiv AssignmentdanielNo ratings yet

- Capital Budgeting 2Document4 pagesCapital Budgeting 2Nicole Daphne FigueroaNo ratings yet

- BBA 125 - FinalDocument4 pagesBBA 125 - FinalLAZINA AZRINNo ratings yet

- CH 15 QuestionsDocument4 pagesCH 15 QuestionsHussainNo ratings yet

- Quiz Week 3 QnsDocument6 pagesQuiz Week 3 QnsRiri FahraniNo ratings yet

- Measuring Investment Returns: Questions and ExercisesDocument9 pagesMeasuring Investment Returns: Questions and ExercisesKinNo ratings yet

- Current Projected Next Yr: Problems and QuestionsDocument6 pagesCurrent Projected Next Yr: Problems and QuestionsKinNo ratings yet

- Subject: Financial Management: Faculty: Dr. Sitangshu KhatuaDocument4 pagesSubject: Financial Management: Faculty: Dr. Sitangshu KhatuaMittal Kirti MukeshNo ratings yet

- Actividad 8 en ClaseDocument2 pagesActividad 8 en Claseluz_ma_6No ratings yet

- COST OF CAPITAL Tutorial QuestionsDocument2 pagesCOST OF CAPITAL Tutorial QuestionsBaraka GabrielNo ratings yet

- 57b2e7d35a4d40b8b460abe4914d711a.docxDocument6 pages57b2e7d35a4d40b8b460abe4914d711a.docxZohaib HajizubairNo ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Final Exam - Fall 2023Document5 pagesFinal Exam - Fall 2023hani.sharma324No ratings yet

- Practice Final ExamDocument8 pagesPractice Final ExamrahulgattooNo ratings yet

- Chap 3 M4B TT 1Document10 pagesChap 3 M4B TT 1Mai Phương AnhNo ratings yet

- Unit 1 - Introduction To Financial ServicesDocument27 pagesUnit 1 - Introduction To Financial ServicesAzhar GaziNo ratings yet

- Marketing ResearchDocument75 pagesMarketing ResearchABUYENo ratings yet

- International Capital Budgeting - Raja Rani Scooters - Template For Students-1Document12 pagesInternational Capital Budgeting - Raja Rani Scooters - Template For Students-1Dhananjay SinghalNo ratings yet

- A Project On Camparative Study Between Private Sector and Public Sector BanksDocument75 pagesA Project On Camparative Study Between Private Sector and Public Sector Banksthaheerhauf1234No ratings yet

- Itxr20190016223 0906161005Document1 pageItxr20190016223 0906161005Rendy Eka PutraNo ratings yet

- Working Capital Management Final Paper Ramos, Karen Gail G.Document5 pagesWorking Capital Management Final Paper Ramos, Karen Gail G.Wang TomasNo ratings yet

- BA552 Week1Document29 pagesBA552 Week1Reza MohagiNo ratings yet

- Difference Between Departmental Stores and Multiple StoresDocument2 pagesDifference Between Departmental Stores and Multiple StoresadhiisreeNo ratings yet

- Test - : MAINS-2022Document60 pagesTest - : MAINS-2022BiswaNo ratings yet

- Casa Statement 230918155618945Document1 pageCasa Statement 230918155618945kristian.zega1No ratings yet

- Hill IB13e Ch01 PPT AccessibleDocument36 pagesHill IB13e Ch01 PPT AccessibleÁnh Dương Nguyễn PhạmNo ratings yet

- Day 1 1.1 Session-1 1.2 Banking System in India: AnswersDocument51 pagesDay 1 1.1 Session-1 1.2 Banking System in India: AnswersAkella LokeshNo ratings yet

- 2021 03 03 Inflation and The Stock MarketDocument4 pages2021 03 03 Inflation and The Stock MarketXavier StraussNo ratings yet

- The Contemporary WorldDocument6 pagesThe Contemporary WorldGwy RojasNo ratings yet

- Bank Schedle Sept 2022Document10 pagesBank Schedle Sept 2022Mercy FaithNo ratings yet

- Ril Pe Price 01.12.2016Document29 pagesRil Pe Price 01.12.2016Akshat JainNo ratings yet

- Reverse Charge MechanismDocument19 pagesReverse Charge MechanismSayyadNo ratings yet

- SUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowDocument2 pagesSUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowSayanta Biswas100% (1)

- Assignment 10 by Dayyan Ahmed 17u00374Document2 pagesAssignment 10 by Dayyan Ahmed 17u00374Dayyan Ahmed ChaudharyNo ratings yet

- 02 Liner TradesDocument4 pages02 Liner TradesSwaminathanbchnNo ratings yet

- Victor Kimutai Bank StatementDocument2 pagesVictor Kimutai Bank StatementVictor KimutaiNo ratings yet

- Chapter 29Document26 pagesChapter 29ENG ZI QINGNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- Indian Financial SystemDocument20 pagesIndian Financial SystemMudassir ParvezNo ratings yet

- Scaffold 2Document15 pagesScaffold 2AKIYA FAITH PLAZANo ratings yet

- Tally Financial Accounting ProgramDocument24 pagesTally Financial Accounting ProgramCA Tanmay BhavarNo ratings yet

- History of Economic Thought: Mercantilism: Rahul Kumar Department of Economics Vbu, HazaribagDocument16 pagesHistory of Economic Thought: Mercantilism: Rahul Kumar Department of Economics Vbu, HazaribagReshmi Nigar 9612No ratings yet

- Gepsuct PDFDocument16 pagesGepsuct PDFMario RanceNo ratings yet

- AirPods InvoiceDocument1 pageAirPods Invoicexavier francis100% (1)