Professional Documents

Culture Documents

Ray, Shanira

Ray, Shanira

Uploaded by

Abid AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ray, Shanira

Ray, Shanira

Uploaded by

Abid AliCopyright:

Available Formats

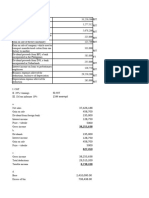

Pg 57, 242

Memorandum

Client: Ray

From: Tax Senior

Subject: Tax advice on Ray’s unincorporated business, Shanira’s gifts, and Kelly’s income

tax issues

Part (b):

Gift of house: (22/23)

MV of gift 360000

(Cost) (280000)

Gain 80000

Annual Exemption (12300)

Chargeable gain 67700

CGT @ 28% 18956

No double taxation relief will be available on the gift of house since there is no taxation on gains in the

country of xyz.

CGT is paid on 31 Jan after the end of fiscal year. So, the CGT payable date will be 31 Jan 24.

Gift of Painting: (23/24)

Market Value 7000

(Cost) (15000)

Capital Loss (8000)

Gift of shares:

MV of shares (7400 * 9.2) 68080

Cost (W1) (7400 * 1.6) (11840)

Gain 56240

Gain per share 7.6

Working 1:

Value of shares in Beem Plc (3700) 12960

Per share purchase price 3.6

Gain on takeover,

7400 shares in solaris (8.4 * 7400) 62160

Cash 14800

76960

Value received against a share of beem plc 20.8

Gain/share of beem chargeable at the time of takeover 4

Gain/share of beem deferred ((62160-12960)/3700) 13.2

Gain/share of solaris deferred ((62160-12960)/7400) 6.6

New cost per share of solaris plc ((62160/7400)-6.6) 1.8

Gift of shares should be divided into two gifts such that the loss from the gift of painting and annual

exemption of CGT is fully used for tax year 23/24 without creating any tax liability.

Number of shares in solaris plc that can be gifted without any CGT liability are:

Annual exempt amount 12300

Loss on gift of painting 8000

20300

Number of shares (20300 / 7.6) 2671

2671 shares in solaris plc can be gifted in tax year 23/24 without creating any CGT liability.

Inheritance Tax Implications:

There is no inheritance tax charged on gifts between spouses or civil partners. However, the gift of house

was before marriage and hence will be considered as potentially exempt transfer and no life time tax will

arise on the gift of house.

You might also like

- Top 13 'How To Beat A Speeding Ticket' MythsDocument6 pagesTop 13 'How To Beat A Speeding Ticket' Mythsjeffmull100% (6)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- EPF Universal Account NumberDocument1 pageEPF Universal Account NumberetrshillongNo ratings yet

- The Karachi Residents Directory 1932 Pages 1-27 - OCRDocument27 pagesThe Karachi Residents Directory 1932 Pages 1-27 - OCRRishi100% (1)

- Adnexal MassDocument28 pagesAdnexal MassJuan P. RuedaNo ratings yet

- Taro Ice Cream: Elaine Jade PascuaDocument31 pagesTaro Ice Cream: Elaine Jade PascuaBlesvill BaroroNo ratings yet

- Self-Occupied: Com Putati On of I Ncom E and Tax Pai DDocument5 pagesSelf-Occupied: Com Putati On of I Ncom E and Tax Pai DAnshika GoelNo ratings yet

- 73 Azure Security Best Practices Everyone Must Follow - SkyhighDocument6 pages73 Azure Security Best Practices Everyone Must Follow - SkyhighRohit JainNo ratings yet

- Presented By: Ashlee Barbeau Student Occupational Therapist, Queen's UniversityDocument22 pagesPresented By: Ashlee Barbeau Student Occupational Therapist, Queen's UniversityDanielle Stella N'LucaNo ratings yet

- SolMan Empleo Robles Intangible AssetDocument18 pagesSolMan Empleo Robles Intangible AssetJohanna Raissa CapadaNo ratings yet

- Knowledge Management in Project-Based OrganizationsDocument23 pagesKnowledge Management in Project-Based OrganizationsADB Knowledge Solutions100% (1)

- Computation Ajesh SoniDocument8 pagesComputation Ajesh SoniAditya AroraNo ratings yet

- APT Tax AssignmentDocument11 pagesAPT Tax AssignmentMalik JavidNo ratings yet

- Btax - Plq1-Answer KeyDocument6 pagesBtax - Plq1-Answer KeyJohn Victor Mancilla MonzonNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Memorandum Question 12 Mandlacoal LTD 2021Document8 pagesMemorandum Question 12 Mandlacoal LTD 2021NOKUHLE ARTHELNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Week 8 Tutorial 7Document4 pagesWeek 8 Tutorial 7umstudyNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- ZittiDocument3 pagesZittiAbid AliNo ratings yet

- 20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFDocument6 pages20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFEdjon AndalNo ratings yet

- Final Bomb (Before Main Body)Document7 pagesFinal Bomb (Before Main Body)Mohammad helal uddin ChowdhuryNo ratings yet

- Taxation of Income of Partnership-1 - 034114Document6 pagesTaxation of Income of Partnership-1 - 034114temiladeadeyemi11No ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- JJJJJDocument3 pagesJJJJJMursid mohammedNo ratings yet

- September 8 - Capital Gains TaxDocument2 pagesSeptember 8 - Capital Gains TaxAlbert XuNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Atxuk Sample Marjun 2019 ADocument10 pagesAtxuk Sample Marjun 2019 AAdam KhanNo ratings yet

- How To Calculate Total IncomeDocument16 pagesHow To Calculate Total IncomeAshish ChatrathNo ratings yet

- Gail & BradDocument2 pagesGail & BradAbid AliNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- PGBPDocument32 pagesPGBPKartikNo ratings yet

- Taxation AccountingDocument10 pagesTaxation Accountingjanahh.omNo ratings yet

- Assignment 6-2Document30 pagesAssignment 6-2Beenish JafriNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Profit After Tax: Revenue 25% Contribution Margin (% Change From Last y - 2%Document29 pagesProfit After Tax: Revenue 25% Contribution Margin (% Change From Last y - 2%Henry TranNo ratings yet

- TaxationsDocument12 pagesTaxationsKansal AbhishekNo ratings yet

- Exercise 2 (Cashflow Statements)Document2 pagesExercise 2 (Cashflow Statements)Prince TshepoNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- The University of Hong Kong School of Business ACCT3107/BUSI0018 - Hong Kong Taxation Self Test Question - Personal Assessment (Answers)Document2 pagesThe University of Hong Kong School of Business ACCT3107/BUSI0018 - Hong Kong Taxation Self Test Question - Personal Assessment (Answers)Edwin LawNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- Adjusting Entries Practice Question December 22, 2022Document5 pagesAdjusting Entries Practice Question December 22, 2022Mohammed AhamadNo ratings yet

- Answers - Chapter 6 - Employee Benefits (Part 2)Document6 pagesAnswers - Chapter 6 - Employee Benefits (Part 2)Lhica EsterasNo ratings yet

- CGT 1Document25 pagesCGT 1Donald HollistNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- f6 ANSDocument14 pagesf6 ANSSarad KharelNo ratings yet

- Please Send Me HackDocument3 pagesPlease Send Me Hackgaurav.verma17No ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Rit Rit Rit Rit Rit Rit FT Rit Rit Rit RitDocument4 pagesRit Rit Rit Rit Rit Rit FT Rit Rit Rit RitCJAY SOTELONo ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- R2. TAX ML Solution CMA January 2022 ExaminationDocument6 pagesR2. TAX ML Solution CMA January 2022 ExaminationPavel DhakaNo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Example 21.19 Text BookDocument4 pagesExample 21.19 Text BookNUR DARWISYAH KAMARUDINNo ratings yet

- Registration No.: Wazir ArifDocument1 pageRegistration No.: Wazir ArifAbid AliNo ratings yet

- 174522Document4 pages174522Abid AliNo ratings yet

- ZittiDocument3 pagesZittiAbid AliNo ratings yet

- Accounting For Creamery and Dairy ProductsDocument15 pagesAccounting For Creamery and Dairy ProductsAbid AliNo ratings yet

- Uncw Big Feb2022Document84 pagesUncw Big Feb2022Art AdvertisingNo ratings yet

- Light Sources: 1. Natural Sources of Light 2. Artificial Sources of LightDocument25 pagesLight Sources: 1. Natural Sources of Light 2. Artificial Sources of Lightsiva ramanNo ratings yet

- Oil and Fatty Acid Composition Analysis of Ethiopian Mustard (Brasicacarinataa. Braun) LandracesDocument11 pagesOil and Fatty Acid Composition Analysis of Ethiopian Mustard (Brasicacarinataa. Braun) LandracesPremier PublishersNo ratings yet

- Human Biology: Prepared By: Alerna Irene Cal, RRTDocument66 pagesHuman Biology: Prepared By: Alerna Irene Cal, RRTCarl GonzalesNo ratings yet

- Examples of Dependent ClausesDocument4 pagesExamples of Dependent ClausesHombink NurhadiNo ratings yet

- Health 8 Q3 TGDocument67 pagesHealth 8 Q3 TGAngelica TumamakNo ratings yet

- Consumer Behaviour Towards Four Wheeler: With Special Reference To Hyundai CarsDocument21 pagesConsumer Behaviour Towards Four Wheeler: With Special Reference To Hyundai CarskumardattNo ratings yet

- Student Advisory Form: Institute of Space TechnologyDocument6 pagesStudent Advisory Form: Institute of Space Technologyjawad khalidNo ratings yet

- (English) The Danger of AI Is Weirder Than You Think - Janelle Shane (DownSub - Com)Document8 pages(English) The Danger of AI Is Weirder Than You Think - Janelle Shane (DownSub - Com)DevanshNo ratings yet

- Pas TutDocument9 pagesPas TutHằng HàNo ratings yet

- Rural Tourism in UkraineDocument4 pagesRural Tourism in UkraineАнастасія Вадимівна СандигаNo ratings yet

- Measuring Instruments - Metrology - OverviewDocument31 pagesMeasuring Instruments - Metrology - OverviewRohan100% (1)

- Qwixalted Character SheetsDocument5 pagesQwixalted Character SheetsJason StierleNo ratings yet

- Siebel Release Notes / Known IssuesDocument99 pagesSiebel Release Notes / Known Issues谢义军No ratings yet

- (CÔ PHÍ THỊ BÍCH NGỌC) EBOOK 300 CÂU NGỮ PHÁP TINH TÚY KÈM ĐÁP ÁN CHI TIẾT 130 TRANGDocument134 pages(CÔ PHÍ THỊ BÍCH NGỌC) EBOOK 300 CÂU NGỮ PHÁP TINH TÚY KÈM ĐÁP ÁN CHI TIẾT 130 TRANGnguyenhoang210922No ratings yet

- Chatting About A Series ListeningDocument3 pagesChatting About A Series ListeningIvan CruzNo ratings yet

- Npad PGP2017-19Document3 pagesNpad PGP2017-19Nikhil BhattNo ratings yet

- Summertime 2015Document32 pagesSummertime 2015Lakeville JournalNo ratings yet

- 2017 PRS For Music Annual Transparency ReportDocument46 pages2017 PRS For Music Annual Transparency ReportJah-Son Shamma Shamma DennisNo ratings yet

- Building Split-Level Corner StairsDocument8 pagesBuilding Split-Level Corner StairsMiraLynnSmithNo ratings yet

- d100 - Simple Weapon EnchantmentsDocument2 pagesd100 - Simple Weapon EnchantmentsSergiVillarNo ratings yet

- Women's Topic On ModestyDocument6 pagesWomen's Topic On ModestyGlesa SalienteNo ratings yet