Professional Documents

Culture Documents

Maia

Maia

Uploaded by

Abid AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maia

Maia

Uploaded by

Abid AliCopyright:

Available Formats

Page 63, 265

Memorandum

Client: Maia

Subject:

Prepared By: Tax Senior

Date: 1 Jun 2023

Part (a):

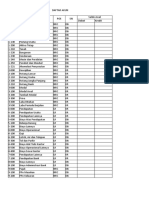

Comparison of taxable income and income tax liability for year 23/24 and 24/25 is as follows:

23/24 24/25

Salary 25,200 25,200

Mobile Phone (exempt) - -

Home Cinema (1,700 * 20%) 320 320

Shares remuneration 1,800 -

Shares Value 2,100

Amount Paid (300)

Non-cash benefit 1,800

Dividend 420 420

Taxable Salary 27,740 25,940

Income Tax liability 12,570 * 0% / 12,570 * 0% 0 0

14,750 * 20% / 12,950 * 20% 2950 2590

420 * 0% / 420 * 0% 0 0

Class 1 NIC 12630 * 13.5% 1705 1705

Cashflow of Josh: 23/24 24/25

Salary 25,200 25,200

Dividend 420 420

Income tax Liability (2950) (2,590)

NIC (1705) (1705)

Payment for shares (300) -

Rent and living expenses (2,500 * 12) (30,000) (30,000)

Cash in hand (9,335) (8,675)

Class 1 employee NIC is payable on cash benefits. Mobile phones are an exempt benefit. Shares will be

considered as noncash benefit because they are in an unquoted company. Furthermore, home cinema is

also a noncash benefit. So, no NIC will be paid by Josh.

Josh requires additional cash of 7,906 in year 23/24 and 6,906 in year 24/25.

Difference in additional cash required in both years in due to extra non cash taxable benefits in the form

of shares and home cinema.

You might also like

- 15 Rules For Negotiating A Job OfferDocument4 pages15 Rules For Negotiating A Job Offersandeepnabar100% (1)

- Job Application FormDocument6 pagesJob Application Formwahab1No ratings yet

- Compensation and Benefits at State Bank PakistanDocument11 pagesCompensation and Benefits at State Bank PakistanRehma Salman33% (3)

- Csec Poa January 2012 p2Document9 pagesCsec Poa January 2012 p2Renelle RampersadNo ratings yet

- Compensation Administration - Final Exam ReviewDocument73 pagesCompensation Administration - Final Exam ReviewRyan NicholasNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Hurley Employment Agreement - Final ExecutionDocument22 pagesHurley Employment Agreement - Final ExecutionHelen BennettNo ratings yet

- PatanjaliDocument5 pagesPatanjaliTathagata Sanyal100% (1)

- Letter of Appoinment For The Position of Beverage Manager'Document4 pagesLetter of Appoinment For The Position of Beverage Manager'Azhar SudiroNo ratings yet

- Betoy V Board of DirectorsDocument1 pageBetoy V Board of DirectorsPauline CarilloNo ratings yet

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- Assignment 4 - Financial Accounting - February 11Document4 pagesAssignment 4 - Financial Accounting - February 11Ednalyn PascualNo ratings yet

- Demand LetterDocument6 pagesDemand Lettervineeth907No ratings yet

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Topic 6 Test ISBS 3E4Document5 pagesTopic 6 Test ISBS 3E4LynnHanNo ratings yet

- October 27 - Special DeductionsDocument3 pagesOctober 27 - Special DeductionsDarius DelacruzNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- BAF11Document3 pagesBAF11tembo groupNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Lessor AccountingDocument4 pagesLessor AccountingShinny Jewel VingnoNo ratings yet

- Solutions Tax InvestigationDocument15 pagesSolutions Tax InvestigationWahida AmalinNo ratings yet

- Financial Accounting-Assignment-4Document4 pagesFinancial Accounting-Assignment-4Margaux JohannaNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Solution Capital StatementDocument10 pagesSolution Capital StatementhilmanNo ratings yet

- Income and ExpensesDocument6 pagesIncome and ExpensesZEESHAN ZAFARNo ratings yet

- Income and ExpensesDocument6 pagesIncome and ExpensesMayur PrajapatiNo ratings yet

- Format IS and BSDocument2 pagesFormat IS and BSckyn greenleafNo ratings yet

- Neraca LajurDocument16 pagesNeraca Lajurawalludin riyatNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- Excel Task 2Document4 pagesExcel Task 2michael songaNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- المحاضرة الرابعه د ايمانDocument5 pagesالمحاضرة الرابعه د ايمانgood goodNo ratings yet

- JonnyDocument3 pagesJonnyAbid AliNo ratings yet

- Interest Expense Interest PayableDocument23 pagesInterest Expense Interest PayableBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Assignment 1Document6 pagesAssignment 1Nichole TumulakNo ratings yet

- Estate ExercisesDocument12 pagesEstate ExercisesAmira SyahiraNo ratings yet

- RM RM RM Net Sales: Less: Cost of Goods SoldDocument2 pagesRM RM RM Net Sales: Less: Cost of Goods SoldDESIREE DESSY MAIDI STUDENTNo ratings yet

- Submission Tutorial 2 - SolutionDocument5 pagesSubmission Tutorial 2 - SolutionNdisa ChumaNo ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Final AssignmentDocument7 pagesFinal Assignmentmishal zikriaNo ratings yet

- 4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsDocument39 pages4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsKASHISH GUPTANo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Mavesto LTD and Its SubsidiaryDocument4 pagesMavesto LTD and Its SubsidiaryTawanda Tatenda HerbertNo ratings yet

- Problem 20-01 Requirement 1: Cecil-Booker Vending Company General Journal Account Debit Credit To Record The ChangeDocument12 pagesProblem 20-01 Requirement 1: Cecil-Booker Vending Company General Journal Account Debit Credit To Record The ChangeVishal P RaoNo ratings yet

- Week 4 - Extension Question SolutionsDocument10 pagesWeek 4 - Extension Question Solutionsichika20010201No ratings yet

- 2021 S2 18 Limited COmpanyDocument2 pages2021 S2 18 Limited COmpanyJingyiNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- 07 Activity 1 (24) .DocsDocument2 pages07 Activity 1 (24) .DocsNICOOR YOWWNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- Week 3 - Lecture Illustration SolutionDocument2 pagesWeek 3 - Lecture Illustration Solutionichika20010201No ratings yet

- Group-8 F2 CCE-2 CMA Cost SheetDocument12 pagesGroup-8 F2 CCE-2 CMA Cost SheetNAMRATANo ratings yet

- Buenaventura EJ BSA1-B Prob#8 Page159Document6 pagesBuenaventura EJ BSA1-B Prob#8 Page159AnonnNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- SS Tutorial 2Document2 pagesSS Tutorial 2Nur PasilaNo ratings yet

- Bacayo 07 Activity 1 EntrepDocument3 pagesBacayo 07 Activity 1 EntrepDavid GutierrezNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Four Sons EnterpriseDocument2 pagesFour Sons EnterpriseNur Aqilah Fatonah Binti Ahmad RasidiNo ratings yet

- Computation of Business IncomeDocument9 pagesComputation of Business IncomeSuseela PNo ratings yet

- Registration No.: Wazir ArifDocument1 pageRegistration No.: Wazir ArifAbid AliNo ratings yet

- 174522Document4 pages174522Abid AliNo ratings yet

- ZittiDocument3 pagesZittiAbid AliNo ratings yet

- Accounting For Creamery and Dairy ProductsDocument15 pagesAccounting For Creamery and Dairy ProductsAbid AliNo ratings yet

- Human Resource ManagementDocument21 pagesHuman Resource Managementsaurav prasadNo ratings yet

- Doctoral Inphinit Retaining 2024 2Document9 pagesDoctoral Inphinit Retaining 2024 2Zara LauraNo ratings yet

- Delhi School Education Rules - Chapter 8 9 10Document20 pagesDelhi School Education Rules - Chapter 8 9 10Madhav BhatiaNo ratings yet

- What To Expect at A CRA InterviewDocument18 pagesWhat To Expect at A CRA InterviewadiNo ratings yet

- Wage Distortion and 13th Month PayDocument16 pagesWage Distortion and 13th Month PayJennybabe PetaNo ratings yet

- HLF124 AuthorityToDeduct V04Document1 pageHLF124 AuthorityToDeduct V04Jemuel CastilloNo ratings yet

- GHD Superannuation Plan: Product Disclosure StatementDocument32 pagesGHD Superannuation Plan: Product Disclosure StatementNick KNo ratings yet

- Job Enlargement N EnrichmentDocument14 pagesJob Enlargement N EnrichmentrachealllNo ratings yet

- Varmora Ceramics PVT LTD (S.y.b.b.a.)Document79 pagesVarmora Ceramics PVT LTD (S.y.b.b.a.)Gohil Manish100% (2)

- Valuation of PerquisitesDocument9 pagesValuation of PerquisitesAbhishek ChandorkarNo ratings yet

- Mtob NotesDocument66 pagesMtob NotesUpendra RaoNo ratings yet

- MTM0 MDG 3 Y2 Ztcy 1 K YzgzDocument17 pagesMTM0 MDG 3 Y2 Ztcy 1 K YzgzSaeed RasoolNo ratings yet

- Personal Record FormDocument4 pagesPersonal Record FormmesfinmulugetaNo ratings yet

- HR Interview QuestionsDocument22 pagesHR Interview QuestionsShamshu ShaikNo ratings yet

- SIP Food House vs. BatolinaDocument5 pagesSIP Food House vs. BatolinaAnonymous 33LIOv6LNo ratings yet

- Globalisation and Labour Market Flexibility: A Study of Contractual Employment in IndiaDocument16 pagesGlobalisation and Labour Market Flexibility: A Study of Contractual Employment in IndiaRaymond ChongNo ratings yet

- Final - Report - BBMDocument53 pagesFinal - Report - BBMtomalNo ratings yet

- Grameenphone Employee Motivation Practice (Maslow's Theory)Document3 pagesGrameenphone Employee Motivation Practice (Maslow's Theory)Samira Sahel67% (3)

- Employee Benefits and Retirement PlanningDocument20 pagesEmployee Benefits and Retirement PlanningchiposityNo ratings yet

- Employee # HVAC 25 Muhammad Usman Designation: Supervisor Pay & Allowances Amount SDocument3 pagesEmployee # HVAC 25 Muhammad Usman Designation: Supervisor Pay & Allowances Amount SRASHIDNo ratings yet

- Attrition RateDocument10 pagesAttrition RateVashu SalunkheNo ratings yet