Professional Documents

Culture Documents

122 - CP2 - P1 - Audit Trail

Uploaded by

Chirag KohliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

122 - CP2 - P1 - Audit Trail

Uploaded by

Chirag KohliCopyright:

Available Formats

INSTITUTE AND FACULTY OF ACTUARIES

EXAMINATION

April 2022

AUDIT TRAIL

Subject CP2 – Modelling Practice

Core Practices

Paper One

Institute and Faculty of Actuaries

CP2 Paper 1, A2022-1

Objective

The Bank wishes to consider offering a new mortgage product, which combines a savings

account and a mortgage. The Bank wants to consider the difference between the total mortgage

repayments for the fixed rate option and those that would be due if a variable interest rate was

used.

We have been asked to produce a model that will calculate:

the deposit that is expected to be accumulated by the customer over the two year initial

period under both the fixed rate approach and the variable rate approach (multiple

simulations are completed for the variable rate approach);

the expected monthly mortgage repayment under both the fixed rate approach and the

variable rate approach (multiple simulations are completed for the variable rate

approach);

the difference between the total mortgage repayments under the fixed rate option and the

variable rate option.

We also consider an alternative mortgage product (for both the fixed rate and variable rate

options) that has a shorter savings period and an initial five-year term for the mortgage, after

which the client will be given an option to re-assess the remaining mortgage (re-assessment is

not in the scope of our project).

Data

Our actuarial colleagues have provided us with a set of 4,800 random numbers. These are in the

format of 200 rows by 24 columns. We have been advised that these numbers come from the

Normal (0,1) distribution.

For the original scenario, the marketing team of the Bank advised that:

a customer will be able to save $1,000 per month;

the average house price is $200,000; and

the term of the mortgage is expected to be 25 years.

For the alternative scenario, the operation team has advised that the customer would be expected

to make monthly savings of $2,000 per month.

The Bank has suggested that a fixed interest rate of 5.0% per annum is appropriate for the fixed

interest option.

CP2 Paper 1, A2022-2

The operations team of the Bank has confirmed that the current base interest rate is 4.5% per

annum and this should be used for the variable rate option. The operations team has also

confirmed that the expected movement in the variable rate can be determined as follows:

Interest rate at t+1 = Interest rate at t + 0.50% if X ≥ 2.0

+ 0.25% if 2.0 >X ≥ 1.5

+ 0.00% if 1.5 >X ≥ -1.5

- 0.25% if -1.5 >X ≥ -2.0

- 0.50% if -2.0 >X

Where t is measured in months and X is a random number from the Normal (0,1) distribution.

Assumptions

The random numbers provided are suitable to simulate the variations in interest rate

during the savings phase of the product.

The formula for the movement in the variable interest is accurate and will apply for the

full two-year projection.

The monthly deposits into the savings account have been assumed to be made in advance.

Customers will make the saving payment during each month of the savings phase and

there will no withdrawals.

Customers only use the funds they will have in the savings account of the product

towards their house purchase i.e. no additional funds are used for the house purchase (like

some other savings).

The marketability of both products is similar.

There is no need to consider defaults on mortgage repayments.

There is no regulations that prevent the setting interest rates under the proposed

approaches.

No additional costs need to be considered for the purchase of the home i.e. bank fees,

solicitor fees.

Mortgage repayments have been assumed to be made in arrears.

There will be no increase in house prices between the inception of the product and the

end of the two-year savings period.

Customers will be able to afford the increased monthly saving amount for the alternative

product.

The following sections describe each part of the model.

CP2 Paper 1, A2022-3

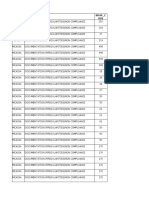

Raw data

This tab includes the 4,800 random numbers in 200 rows by 24 columns.

Checks on this data are completed from column Z onwards.

In AA4, we have counted the number of random numbers using the COUNT function. We

would expect there to be 4,800 numbers and so an automatic check is included in cell AE4.

In AA5 and AA6, we have also counted the number of random numbers which are less than 0

and greater than 0 respectively. This is completed using the COUNTIF function. Again,

automatic checks are included in cells AE5 and AE6 to ensure that the total number in each

‘bucket’ is approximately equal to half the total random numbers. This check calculates the

actual total divided by the expected total less 1 and then ensures that the absolute value of the

result is less than the assumed tolerance of 2%.

We have also calculated the mean and standard deviation from all the random numbers in cells

AA8 and AA9 using the AVERAGE and STDEVA functions respectively. We have included

the expected values for the Normal (0,1) in cells AC8 and AC9 (we expect the mean to be 0 and

the standard deviation to be 1). An automatic check has been included in AE8 and AE9 to

ensure that the calculated values are within a level of tolerance (included in cells AD8 and AD9)

to the expected values.

We have also produced a histogram to show the distribution of the random numbers. We have

determined 16 buckets (the 2 outer buckets are less than -3.5 and more than 3.5, the remaining

buckets have 0.5 intervals). The upper limits of these buckets are included in Z14 to Z29. The

cumulative number of random numbers under each of these limits is calculated in column AA

using the COUNTIF function. However, for cell AA29, the total number of random numbers is

included. The frequency for each bucket is then calculated in column AC and this data is used to

plot the histogram, shown on the same tab.

A chi-squared test is completed in cells AF12 to AI35. The same buckets are used as per the

histogram. Column AF shows the observed frequency in each bucket, which was calculated in

column AC. The expected cumulative frequency is then calculated in column AG using the

NORM.DIST function and multiplying this figure by the total number of random numbers in the

sample. From these cumulative values, the expected number in each bucket is calculated in

column AH. Column AI then calculates (actual-expected)2/expected for each range and then

sums these values across all ranges. This total has been compared with the chi-squared test

statistic (CHIINV) calculated in cell AI33 at the appropriate degrees of freedom (cell AI31 =

number of ranges - 1) and a given test level (85%). If the total is less than the test statistic, then

we cannot reject the hypothesis that the random numbers come from a N[0,1] distribution at the

chosen confidence level. An automatic check is included in AI35.

CP2 Paper 1, A2022-4

All automatic checks are passed and the histogram illustrates that the random numbers broadly

reflect the normal distribution N(0,1).

This evidence therefore supports that the random numbers provided are from the Normal (0,1)

distribution.

Parameters

This worksheet provides a list of all parameters to support the calculations. Parameters are

split into those which apply to the first mortgage product and the alternative mortgage product.

Most parameters were provided by different departments in the Bank as described in the data

section.

Fixed rate projection

This worksheet calculates the expected accumulated deposit and the expected monthly mortgage

repayment amounts for the fixed rate option.

Initially, the fixed annual interest rate (cell B4 taken from the parameters worksheet) is

converted to an interest rate convertible monthly in cell C4 using the formula:

1

(12) 12

i =12∗( ( 1+i ) −1)

An annuity rate based on this interest rate is calculated in C5 using the formula:

−Mort term

1− (1+i )

annuity= (12)

i

The accumulated deposit is calculated in rows 9 and 10 for a period of 24 months. Row 9 sets

out the months over the initial savings period from the first month to the last month. The initial

deposit accumulation amount is set at the monthly payment for the beginning of month 1 in cell

C10, which is flagged in yellow and shouldn’t be copied across. For subsequent months (2 to 24)

in cells D10 to Z10, the deposit accumulation is calculated as:

(12)

i

Deposit acc. at previous month * (1 + ) + monthly payment

12

The total deposit accumulated at the start of the mortgage phase is then calculated in cell AA10.

This is equal to the deposit accumulation amount at the beginning at the previous month

(

multiplied by 1+

i(12)

12 )

.

CP2 Paper 1, A2022-5

An automatic check is included in cells AA3 and AA4. AA3 calculates an estimated total

deposit (assuming even repayments over the period) using the following formula:

Estimated total deposit = Monthly deposit * 12 * Deposit Term * (1+i)(Deposit term/2)

The automatic check passes if the difference between the estimated total deposit and the total

deposit calculated in AA10 is less than 1%.

The mortgage amount required is then calculated in cell AC10 as the expected house price less

the total deposit. The monthly mortgage repayment is then calculated in cell AE10 as the

mortgage amount divided by the annuity rate (C5) divided by 12.

The total monthly repayments over the term of the mortgage are calculated in cell AE3 by

multiplying the monthly payment by 12 times the term of the mortgage product.

Reasonableness check: A mortgage of c$175,000 is to be repaid in 25 years. Allowing for the

5%pa interest over the mortgage term and assuming even repayments over the period we have

175,000 * (1.05)^12.5 = $322,000 (vs $303,069).

Interest rate projection

This worksheet projects the variable interest rates (annualised and convertible monthly)

Each row of 24 random numbers is used for one simulation. Therefore, we have produced 200

simulations. Column A indicates the simulation number.

Annual variable interest rate

For each simulation, columns B to Z calculate the projected annual variable interest rate on a

monthly basis. For each simulation, column B is set equal to the initial interest rate provided by

the Bank. For each subsequent month, the annual interest rate is equal to:

Interest rate from previous month + the monthly movement for that month

The monthly increase for that month is calculated using a vlookup based on the corresponding

random number in the “Rawdata” worksheet and the interest rate movements array in the

“Parameters” worksheet. For the vlookup, the last parameter is set at TRUE so that the closest

match in ascending order is found.

In rows 3 and 4, an automatic check is included. Row 3 calculates the average annual interest

rate for that month of projection and row 4 checks that this is no greater than a reasonable

tolerance level (0.1%) of the initial interest rate.

CP2 Paper 1, A2022-6

In columns AB to AZ, the annual interest rates are converted to interest rates convertible

monthly for each simulation (using the same formula as described above).

Variable rate projection

This worksheet is used to calculate the expected accumulated deposit under each simulation for

the variable interest rate and calculate the resulting monthly mortgage payment to compare

against the fixed interest rate mortgage payment.

In columns B to Z, the customer’s deposit is projected.

The initial deposit accumulation amount is set at the monthly payment for the beginning of

month 1 in column B. For subsequent months (2 to 24) in columns C to Y, the deposit

accumulation is calculated as:

(12)

i

Deposit acc. at previous month * (1 + ) + monthly payment

12

where i(12) is taken from the variable interest rate convertible monthly projection for that month

for that simulation.

The total deposit accumulated at the start of the mortgage phase is then calculated in column Z.

This is equal to the deposit accumulation amount at the beginning at the previous month

( )

(12)

i

multiplied by 1+ for the last month for that simulation.

12

Columns AB to AE then calculate the annuity rate for that simulation. For each simulation,

column AB shows the annual interest rate for month 25 pulled through from the “Interest rate

projection” worksheet. Column AC shows the interest rate convertible monthly for month 25

also pulled from the “Interest rate projection” worksheet. A check is included in column AD to

ensure that these rates are consistent. The annuity rate for that simulation is then calculated

using the formula:

−Mort term

1− (1+i )

annuity= (12)

i

Where i is the annual interest rate in month 25 for that simulation and i(12)is the variable interest

rate convertible monthly in month 25 for that simulation.

The monthly variable rate mortgage repayment is then calculated in columns AG to AI. AG

shows the deposit with interest taken from column Z. The mortgage amount is then calculated in

column AH as the expected house price less the deposit with interest. The monthly payment is

then calculated in column AI by dividing the mortgage amount by the annuity rate for each

simulation and dividing this amount by 12.

CP2 Paper 1, A2022-7

Reasonableness check

The minimum mortgage repayment amount is 762 while the maximum is 1,133 and the average

is 965. These amounts seem reasonable given the repayment amount under the fixed rate option

was 1,010.

Column AK calculates the total repayments under the fixed rate option less the total repayments

under the variable interest rate option. This is calculated for each simulation by subtracting:

the monthly variable payment in column AI multiplied by the product term and 12

less

the monthly payment in the “Fixed rate projection” worksheet multiplied by the product term and

12.

Summary statistics of these differences are then included in cells AN7 to AN9, in particular the

minimum, maximum and average – all calculated using the standard excel functions.

The probability that the total mortgage repayments under the fixed rate option will be less than

the total mortgage repayments under the variable rate option is calculated in cell AN11 by:

Using the COUNTIF function to calculate the number of entries in column AK which are

less than zero;

Dividing this number by the total number of entries in column AK i.e. the total number of

simulations.

Scenario 2 “Alternative Product” - Fixed rate projection Alt

This worksheet recalculates the monthly mortgage payment under the fixed rate option based on

the revised mortgage terms.

This is a copy of the “Fixed rate projection” worksheet but the projection of the deposit in the

savings account is completed for 12 months only. Column O therefore includes the deposit

available. This is then used to calculate the monthly payment as per the original worksheet.

Reasonableness checks

The deposit available is broadly similar to that under the original scenario. This is reasonable

because while the period over which the deposit is saved has halved, the monthly deposit savings

have doubled.

CP2 Paper 1, A2022-8

CP2 Paper 1, A2022-9

Scenario 2 “Alternative Product” - Variable rate projection Alt

This worksheet is used to calculate the expected accumulated deposit under each simulation for

the variable interest rate using the shorter saving term and calculates the resulting monthly

mortgage payment for the shorter period to compare against the fixed interest rate mortgage

payment.

This is a copy of the “Variable rate projection” worksheet but the projection of the deposit is

completed for only 12 months. The variable interest rates for the first 12 months are therefore

only required in columns B to M. The accumulated deposit is then shown in column N.

The annual interest rate for the mortgage annuity is then taken from month 13 (column N) of the

“Interest rate projection” worksheet and the monthly interest rate is obtained from column AN of

the same worksheet. These rates are shown in columns P and Q of the “Variable projection Alt”

worksheet.

To compare the total repayments under the fixed option with those under the variable option, the

difference of the monthly payment from the “Fixed rate projection Alt” worksheet and the

monthly payment for each simulation is calculated and multiplied by the fixed mortgage period

under this alternative option (i.e. 5 years) multiplied by 12. This calculation is included in

column Y. Summary statistics (cells AA7 to AB11) are produced as per the “Variable

projection” worksheet.

Reasonableness checks

The summary statistics are significantly lower as the term of the alternative scenario is only 6

years in total compared to 27 years in the original scenario.

The probability that the total repayments under the fixed interest option are lower than the

repayments under the variable interest option has reduced due to the shorter period over which

interest rates have been projected.

END OF AUDIT TRAIL

CP2 Paper 1, A2022-10

You might also like

- Fin 425 Final NIKEDocument11 pagesFin 425 Final NIKEcuterahaNo ratings yet

- Libby 10e Chap002 PPT AccessibleDocument47 pagesLibby 10e Chap002 PPT Accessible許妤君No ratings yet

- ISU BillingDocument3 pagesISU Billingrafay123100% (1)

- RETScreen Help-Sensitivity and Risk AnalysisDocument17 pagesRETScreen Help-Sensitivity and Risk AnalysisAbolfazl PezeshkzadehNo ratings yet

- Sample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaDocument36 pagesSample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaChristen CastilloNo ratings yet

- APSR-17.7Annual Verification CertificateDocument2 pagesAPSR-17.7Annual Verification CertificatekkkothaNo ratings yet

- Bus 306 Exam 2 - Fall 2012 (A) - SolutionDocument15 pagesBus 306 Exam 2 - Fall 2012 (A) - SolutionCyn SyjucoNo ratings yet

- Major Assignment 3 Excel Grading Sheet: Rubric Category (% Weighting For Assignment)Document14 pagesMajor Assignment 3 Excel Grading Sheet: Rubric Category (% Weighting For Assignment)pet tubeNo ratings yet

- Notes On Cash FlowDocument6 pagesNotes On Cash FlowlehlabileNo ratings yet

- Alllied Food ProductsDocument4 pagesAlllied Food ProductsHaznetta HowellNo ratings yet

- MP1 - Engineering EconomyDocument7 pagesMP1 - Engineering EconomyNeill TeodoroNo ratings yet

- AU FINC 501 MidTerm Winter 2013hhh SsDocument16 pagesAU FINC 501 MidTerm Winter 2013hhh SsSomera Abdul QadirNo ratings yet

- MidtermDocument2 pagesMidtermSumanth MuvvalaNo ratings yet

- ISE211 Chapter4SSand5FallDocument37 pagesISE211 Chapter4SSand5FallV GozeNo ratings yet

- Basic 5Document2 pagesBasic 5Venky DNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- Financial Economics HEC, Paris: Problem Set 3Document2 pagesFinancial Economics HEC, Paris: Problem Set 3DuporteauNo ratings yet

- KWK 4th Append DDocument6 pagesKWK 4th Append DAnonymous O5asZmNo ratings yet

- Bad Debt Expense $ 7,100 Sales Returns and Allowances (40,000)Document8 pagesBad Debt Expense $ 7,100 Sales Returns and Allowances (40,000)Miccah Jade CastilloNo ratings yet

- Analytical Tools - End Term - Tri 3 Set 1Document9 pagesAnalytical Tools - End Term - Tri 3 Set 1wikiSoln blogNo ratings yet

- Capital BudgettingDocument9 pagesCapital BudgettingRussel BarquinNo ratings yet

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDocument14 pagesBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNo ratings yet

- Present ValueDocument8 pagesPresent ValueFarrukhsgNo ratings yet

- A Time Value of Money Primer: by David B. Hamm, MBA, CPA For Finance and Quantitative Methods ModulesDocument28 pagesA Time Value of Money Primer: by David B. Hamm, MBA, CPA For Finance and Quantitative Methods ModulesMSA-ACCA100% (2)

- P1 Sept 2013Document20 pagesP1 Sept 2013Anu MauryaNo ratings yet

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadNo ratings yet

- Activity 3 36 PointsDocument3 pagesActivity 3 36 PointsFatima AnsariNo ratings yet

- Inflation With Capital BudgetingDocument10 pagesInflation With Capital BudgetingRUMA AKTERNo ratings yet

- Whirlpool Europe ExDocument9 pagesWhirlpool Europe ExJosé Ma Orozco A.0% (1)

- MainExam 2018 PDFDocument12 pagesMainExam 2018 PDFAnonymous hGNXxMNo ratings yet

- 5mfz SampleDocument46 pages5mfz SampledutersNo ratings yet

- Loan, Depreciation, Frequency and Regression QuestionsDocument7 pagesLoan, Depreciation, Frequency and Regression QuestionsAnushka GehlotNo ratings yet

- Chapter 4 Nominal and Effective Interest RateDocument42 pagesChapter 4 Nominal and Effective Interest RateRama Krishna100% (1)

- Swarnarik Chatterjee 23405018005 CA2 Management AccountingDocument9 pagesSwarnarik Chatterjee 23405018005 CA2 Management AccountingRik DragneelNo ratings yet

- ISU BillingDocument3 pagesISU BillingMohd ArifNo ratings yet

- Make Use of All Points, Then Make The: Equals The Sum of Deviations Below The LineDocument3 pagesMake Use of All Points, Then Make The: Equals The Sum of Deviations Below The LineMiccah Jade CastilloNo ratings yet

- Mathematics Of Finance: (Toán Tài Chính Căn Bản)Document112 pagesMathematics Of Finance: (Toán Tài Chính Căn Bản)Nguyễn Thanh TâmNo ratings yet

- CT 1201404Document22 pagesCT 1201404Lee Shin LeongNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- MATHINVS - Compounding 2.1Document8 pagesMATHINVS - Compounding 2.1Kathryn SantosNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- Assessment Module Code: AF5008 Module Title: Financial Mathematics and StatisticsDocument9 pagesAssessment Module Code: AF5008 Module Title: Financial Mathematics and StatisticsUmar AliNo ratings yet

- Managerial Level: May 2007 ExaminationsDocument31 pagesManagerial Level: May 2007 ExaminationsJadeNo ratings yet

- The Excel PV Function: Rate Nper (PMT) (PMT) (FV) (FV) Nper (FV) (Type) (Type)Document6 pagesThe Excel PV Function: Rate Nper (PMT) (PMT) (FV) (FV) Nper (FV) (Type) (Type)saurabh449No ratings yet

- Understanding Money Management - Engineering EconomicsDocument38 pagesUnderstanding Money Management - Engineering EconomicsQuach Nguyen100% (1)

- Exam FileDocument14 pagesExam FileAbelNo ratings yet

- HVAC Life Cycle CostingDocument18 pagesHVAC Life Cycle CostingmajortayNo ratings yet

- Using Solver For Financial PlanningDocument4 pagesUsing Solver For Financial PlanningAmna JupićNo ratings yet

- AB1201 Exam - Sem1 AY 2020-21 - ADocument6 pagesAB1201 Exam - Sem1 AY 2020-21 - AEn Yu HoNo ratings yet

- C1 D1 Doc Tech 2Document4 pagesC1 D1 Doc Tech 2Suman TiwariNo ratings yet

- C1 D1 Doc Tech 2Document4 pagesC1 D1 Doc Tech 2Anggi Gayatri SetiawanNo ratings yet

- P1 - Performance OperationsDocument20 pagesP1 - Performance OperationsshibluNo ratings yet

- MAY06P1BOOKDocument35 pagesMAY06P1BOOKDhanushka RajapakshaNo ratings yet

- Chapter One Introduction To Financial Modeling and ValuationDocument6 pagesChapter One Introduction To Financial Modeling and ValuationBobasa S AhmedNo ratings yet

- Self PracticeDocument1 pageSelf Practiceloislam12345No ratings yet

- Regression Analysis MethodDocument6 pagesRegression Analysis MethodMiccah Jade CastilloNo ratings yet

- Chapter 4.11: Financial Management Short Type QuestionsDocument5 pagesChapter 4.11: Financial Management Short Type QuestionsYogesh WadhwaNo ratings yet

- Masters Students - Final - Project - Format - For - Banking Sector PDFDocument16 pagesMasters Students - Final - Project - Format - For - Banking Sector PDFKhalil AkramNo ratings yet

- Economics ALLDocument302 pagesEconomics ALLThakurNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- Indirects User ManualDocument29 pagesIndirects User ManualArman JAfriNo ratings yet

- 03 How To Calculate Present ValuesDocument15 pages03 How To Calculate Present Valuesddrechsler9No ratings yet

- Disbursements Through Tax Remittance AdviceDocument3 pagesDisbursements Through Tax Remittance AdvicePostbae GaloneNo ratings yet

- Time Value of MoneyDocument45 pagesTime Value of MoneyKimberly BanuelosNo ratings yet

- Write The Required Information's - Maximum Mark Allotted: 50% - Feedback Provided To The Email Provided by The College On or Before The Time AllowedDocument7 pagesWrite The Required Information's - Maximum Mark Allotted: 50% - Feedback Provided To The Email Provided by The College On or Before The Time AllowedMwenda MongweNo ratings yet

- BFD Past Paper AnalysisDocument8 pagesBFD Past Paper AnalysisAqib SheikhNo ratings yet

- Non Banking Financial InstitutionsDocument18 pagesNon Banking Financial InstitutionsNimesh Shah100% (1)

- Literature ReviewDocument4 pagesLiterature ReviewkictoddNo ratings yet

- Concurrent Review Data - May 2021Document1,069 pagesConcurrent Review Data - May 2021Tamilmani SubramaniyanNo ratings yet

- JLK 1975Document8 pagesJLK 1975fdila_5No ratings yet

- Supplement Exercises: Exercise 15-33Document7 pagesSupplement Exercises: Exercise 15-33rudyNo ratings yet

- Life Insurance BasicsDocument42 pagesLife Insurance BasicsYogesh GuptaNo ratings yet

- What Is Insurance and Why You Need It!Document2 pagesWhat Is Insurance and Why You Need It!FACTS- WORLDNo ratings yet

- Solution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsDocument8 pagesSolution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsHerry SugiantoNo ratings yet

- Statement 115377 Oct-2022Document8 pagesStatement 115377 Oct-2022Mary MacLellanNo ratings yet

- ACCA AA Planner Sep 22 - FinalDocument2 pagesACCA AA Planner Sep 22 - FinalSyed HamzaNo ratings yet

- DAY0 PM Maintenances 14.6.0.0.0Document28 pagesDAY0 PM Maintenances 14.6.0.0.0najusmaniNo ratings yet

- Effectiveness of The Monetary Policy in NigeriaDocument5 pagesEffectiveness of The Monetary Policy in NigeriaVinayak Arun SahiNo ratings yet

- Sujarwo, 2019Document10 pagesSujarwo, 2019Putu Krisna Bayu PutraNo ratings yet

- KMC Balance Sheet Stand Alone NewDocument2 pagesKMC Balance Sheet Stand Alone NewOmkar GadeNo ratings yet

- # CH-1 - Transaction - AnalysisDocument3 pages# CH-1 - Transaction - AnalysisGetaneh ZewuduNo ratings yet

- Bank StatementDocument6 pagesBank StatementJayden PrasadNo ratings yet

- Tutorial Letter 102/3/2021: Financial Accounting ReportingDocument57 pagesTutorial Letter 102/3/2021: Financial Accounting ReportingAbdullah SalieNo ratings yet

- Five Ways Mobile Technology Will Revolutionize Atms: White PaperDocument10 pagesFive Ways Mobile Technology Will Revolutionize Atms: White Paperrahul vermaNo ratings yet

- E-Banking System in Sbi: Mr. Arun Kumar KaushikDocument23 pagesE-Banking System in Sbi: Mr. Arun Kumar KaushikMohammed JashidNo ratings yet

- Subic Paradise Center: CARD SME BANK Inc. A Thrift Bank A Member of CARD MRIDocument16 pagesSubic Paradise Center: CARD SME BANK Inc. A Thrift Bank A Member of CARD MRIMa Ancionette SanchezNo ratings yet

- List of Automatic Crossover Trading Partner (Insurers) in Production Do Not Include Number Shown Below On Incoming ClaimsDocument23 pagesList of Automatic Crossover Trading Partner (Insurers) in Production Do Not Include Number Shown Below On Incoming Claimsspicypoova_899586184No ratings yet

- Ep1 - MONEY VS. CURRENCY NOTESDocument8 pagesEp1 - MONEY VS. CURRENCY NOTESTin PangilinanNo ratings yet

- Pulse TNC Booklet CombinedffdDocument62 pagesPulse TNC Booklet CombinedffdRrdNo ratings yet