Professional Documents

Culture Documents

Vodafone Idea Limited

Uploaded by

Raviraj TirukeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vodafone Idea Limited

Uploaded by

Raviraj TirukeCopyright:

Available Formats

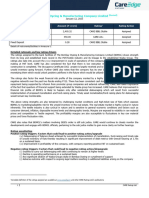

Press Release

Vodafone Idea Limited

November 01, 2023

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

Long-term bank facilities 12,203.00 CARE B+; Stable Reaffirmed

4,000.00

Short-term bank facilities CARE A4 Reaffirmed

(Enhanced from 2,000.00)

Non-convertible debentures - - Withdrawn

Details of instruments/facilities in Annexure-1.

Rationale and key rating drivers

CARE Ratings Limited (CARE Ratings) has reaffirmed the ratings assigned to the bank facilities of Vodafone Idea Limited (VIL)

which factor in the experienced management team, pan-India telecom presence with high brand recognition supported by a stable

outlook for the Indian telecommunications industry, stance of the promoter groups [i.e., the Aditya Birla group (ABG) and the

Vodafone group Plc (VGP)] in assisting the entity and majority shareholding (33.14% as on June 30, 2023) of the Government of

India (GoI) through the Department of Investment and Public Asset Management (DIPAM).

Furthermore, the ratings take cognisance of the receipt of commitment from a promoter group entity confirming direct or indirect

financial support to the extent of ₹2,000 crore to address impending obligations of the company arising out of any cash flow

mismatches.

The ratings, however, remain underpinned by VIL’s deteriorated financial risk profile, wherein, the tangible net-worth has eroded,

its constantly declining subscriber base and delay in raising funds - both debt and equity, thereby dampening its efforts to gain

market share through expansion of 4G services and timely rollout of 5G services.

Furthermore, the ratings take into account the company’s exposure to the inherent regulatory risks of the industry and the

intensely competitive business environment and takes cognisance of the delay in fund raising from investors and financial

institutions against the envisaged timelines. Going forward, the ability of the company to raise funds to address the existing strain

in liquidity and undertake capex to implement 5G to augment the subscriber base and consequent traction in revenues will be

key rating monitorable.

Additionally, CARE Ratings has withdrawn the rating assigned to the NCD issue (INE669E08318) of VIL aggregating Rs.1,500

crore, with immediate effect, as the company has repaid the NCD issue in full and there is no amount outstanding under the issue

as on date.

Rating sensitivities: Factors likely to lead to rating actions

Positive factors

• Successful tie-up of debt from banks/FIs and infusion of equity aiding sustainability.

Negative factors

• Significant delay in fund raising plans (including debt and equity infusion) thereby weakening VIL’s financial risk profile.

• Significant impact in revenue on account of erosion in subscriber base.

Analytical approach: Consolidated

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

List of subsidiaries and associated entities getting consolidated:

S.No. Name of the company % shareholding as on June 30, 2023

1 Vodafone Idea Manpower Services Limited 100.00%

2 Vodafone Idea Business Services Limited 100.00%

3 Vodafone Idea Communication System Limited 100.00%

4 Vodafone Idea Shared Services Limited 100.00%

5 You Broadband India Limited 100.00%

6 Vodafone Foundation 100.00%

7 Vodafone Idea Telecom Infrastructure Limited 100.00%

8 Vodafone Idea Technology Solutions Limited 100.00%

9 Connect India Mobile Technologies Private Limited* 100.00%

10 Vodafone M-Pesa Limited 100.00%

11 Firefly Networks Limited^ 50.00%

^ Joint Venture; *Merged with VICSL

Outlook: Stable

The ‘Stable’ outlook reflects the expectation of continuous support from the promoter groups and infusion of funds by way of

equity and long-term debt funds, which will provide liquidity support to VIL, implement 5G roll out to augment the subscriber

base and improve revenue visibility.

Detailed description of the key rating drivers

Key weaknesses

Weak financial risk profile of the company

VIL’s financial risk profile continued to be weak in FY23 (refers to the period April 2022 to March 2023). The total operating

income of the company surged by 9.5% from ₹38,509 crore from FY22 to ₹42,160 crore supported by increase in 4G subscriber

resulting in change in subscriber mix, increase in tariff plans despite witnessing decline in overall subscriber base by 7% from

243.8 mn as of Q4FY22 to 225.9 mn as of Q4FY23. Yet the company made losses at profit after tax (PAT) level of ₹29,301 crore

in FY23 as compared to ₹28,245 crore in FY21 which has further eroded its networth.

The decline in the subscriber base continued through Q1FY24 and VIL incurred losses of ₹7,840 crore at PAT level as against

₹7297 crore for the corresponding period of previous year, while the operating income has been stable at ₹10,655 crore as against

₹10,410 crore for the corresponding quarter. This is largely attributed to change in subscriber mix with migration of more users

to 4G.

Furthermore, the independent auditor’s report on audited consolidated financial results of the company mentions the ability to

continue as a going concern is dependent on raising additional funds as required, successful negotiations with lenders and vendors

for continued support and generation of cash flow from operations that it needs to settle its liabilities as they fall due.

The total gross debt (excluding lease liabilities and including interest accrued but not due) stood at ₹2,11,760 crore, comprising

deferred spectrum payment obligations of ₹1,33,740 crore (including ₹17,260 crore towards spectrum acquired in the recent

spectrum auction) and adjusted gross revenue (AGR) liability of ₹66,860 crore payable to the Government of India (GoI) and

debt from banks and financial institutions of ₹9,500 crore followed by Optionally Convertible Debentures (OCD) amounting to

₹1,600 crore as on June 30, 2023.

Delay in fund-raising plan leading to strain in liquidity

VIL had planned raising of funds from the promoters/FIIs and long-term debt from lenders for capex related to the 4G expansion

and roll-out of 5G services, in a bid to arrest the declining subscriber base and augment it further, in Q1FY24. However, as there

has been delay in raising the aforementioned funds beyond the envisaged timelines, VIL has been unable to implement its plans

for revival and has continued focussed capital expenditure (capex) in operationally relevant circles. While the company has started

rolling out 5G services, as the 5G live locations for the TSP remain limited as compared to competitors, the ability of the company

to raise funds for remaining competitive continues to be the key rating monitorable.

Additionally, VIL has repaid bulky obligations due in Q2FY24 towards 5G spectrum instalment and bank debt through short term

loans and deferment of operational creditors. Furthermore, the OCD repayment obligation due in August 2023, aggregating ₹800

crore, has been deferred in agreement with the investor for 18 months. While bulky repayments are expected to be in place for

January 2024, commitment from a promoter group entity confirming direct or indirect financial support to the extent of ₹2,000

crore provides comfort.

However, CARE Ratings believes that a long term-financing plan is of immediate requirement to VIL in order to address the

existing liquidity strain arising from cashflow mismatches, implement 5G to augment the subscriber base and improve revenues,

2 CARE Ratings Ltd.

Press Release

and thus timely infusion of funds continues to be a key rating monitorable.

Judgement by Hon’ble Supreme Court on AGR dues payable by VIL to the Department of Telecommunications

(DoT)

Hon’ble Supreme Court in its ruling on September 01,2020 directed telecom companies to pay 10% of total AGR dues by March

31, 2020 and balance amount in annual instalments commencing from April 01, 2021 upto March 31, 2031 payable by March 31

of every succeeding financial year. Furthermore, on July 23, 2021, the Hon’ble Supreme Court dismissed the applications filed by

major TSPs, including VIL, raising the issue of alleged errors in the calculation in the figure of AGR related dues payable by them.

The company had filed a review petition with the Hon’ble Supreme Court, on August 10, 2021, for considering to hear the

modification application on correction of manifest / clerical / arithmetic errors in the computation of AGR demands. As on August

10, 2023, the matter is sub-judice.

Persistent competitive intensity in Indian Telecom industry impacting VIL’s operational performance

The ARPU for VIL improved to ₹139 as on June 30, 2023, as compared to ₹128 as on June 30, 2022, the improvement is primarily

driven by increase in 4G subscriber base by 4 Mn for the corresponding period resulting in change in subscriber mix and increase

in tariff plan. However, VIL is continuously losing its subscriber base to its competitors, which has declined by 7.9% to 221.4 Mn

as of Q1FY24 from 240.4 Mn as of Q1FY23. As of March 31, 2023, the subscriber market share of the company stands at 20.7%

as per TRAI subscription reports, which has declined from 22.8% as on March 31, 2022. Based on gross revenue, VIL’s market

share declined from 19.5% to 18.1% for the aforementioned period.

Key strengths

Established promoter group

VIL is a part of ABG and VGP. ABG is one of the largest and oldest corporate houses in India with multinational presence. Led by

Kumar Mangalam Birla, ABG has leading presence across several sectors including metals, cement, telecom, financial services,

textiles and other manufacturing industries in the country. The group’s operations span over 36 countries. VGP is one of the

world’s largest telecommunications companies and provides a range of services including voice, messaging, data and fixed

communications. VGP has mobile and fixed network operations in 22 countries and partners with mobile networks in 47 more,

and fixed broadband operations in various markets.

VIL’s operations are handled by a team of experienced and professionally qualified personnel headed by Akshaya Moondra as the

Chief Executive Officer. Furthermore, Ravinder Takkar, the Non-Executive Chairman of the Board of VIL, has over 30 years of

experience, which includes 28 years with VIL.

Conversion of interest dues by GOI

The company has availed the one-time opportunity in exercising the 4-year deferment of spectrum auction instalment and AGR

dues. In this regard, based on the directive of GOI dated February 3,2023, the company has converted ₹16,133 crore of NPV of

the interest amount in to shares, thereby GOI holds 33.44% as on February 7,2023. In view of the above development, it paves

way for VIL to explore bank finance and or any other negotiations with creditors, new strategic investors etc. However, the ability

of the company to raise equity, additional debt or refinance the existing debt from lenders or markets is viewed critical from credit

perspective.

Industry outlook

The outlook of telecom sector is expected to be stable supported by an increasing rural penetration, growth in broadband

subscribers and roll-out of 5G services which will lead to improvement in Average Revenue per Users (ARPU). The government

has also taken major reforms to improve the profitability of the telecom operators which will provide the requisite cash flows to

support growth.

During September 2021, the GoI announced major reforms for the telecom sector to address the liquidity issue of the telecom

service providers (TSPs), encourage investment and to promote healthy competition in the industry. The DoT, vide its

communication dated October 14, 2021, provided various options to VIL w.r.t the reforms package, including the opportunity to

defer the payment of spectrum instalment and AGR and related dues for a period of 4 years and to exercise the option of paying

interest for the 4 years of deferment on the deferred obligations by way of conversion into equity. VIL subsequently opted for the

deferment of spectrum auction instalment dues and AGR and related dues for 4 years. It also opted for the conversion of interest

related to these deferred obligations into equity and the same has been implemented during February 2023.

Other structural and procedural reforms announced by the GoI have also improved the liquidity position of VIL. As on March 31,

2023, around ₹17,200 crore bank guarantees (including ₹14,700 crore spectrum instalment guarantees) have been released by

the DoT.

3 CARE Ratings Ltd.

Press Release

Liquidity: Poor

VIL had free cash & bank balances of ₹250 crore as on June 30, 2023, and the obligations for the balance period of FY24 stands

at ₹8,605 crore. Despite the company resorting to minimal capex, deferring O&M creditor payments and utilization of short-term

loans, the current level of cash generation is insufficient to meet debt servicing obligations, thereby liquidity remains poor.

However, the articulation of the promoter entity’s support to the extent of ₹2,000 crore is expected to address any impending

obligations of the company arising out of any cash flow mismatches.

Assumptions/Covenants: Not applicable

Environment, social, and governance (ESG) risks:

VIL has been adopting various solutions/approaches to ensure that its networks are run in an energy efficient manner. The

company’s primary focus remains on reducing energy costs and minimizing environmental impact of its operations. The company’s

sustainability journey is complimented with its corporate responsibility agenda which is directed towards addressing some of

India’s critical social and developmental challenges in both rural and urban communities using the inherent potential and reach

of the mobile technology and platform and reducing the environmental impact with increasing preference and usage of digital.

Applicable criteria

Policy on default recognition

Consolidation

Financial Ratios – Non-financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Mobile Service Provider

Policy on Withdrawal of Ratings

About the company and industry

Industry classification

Macro-economic Indicator Sector Industry Basic Industry

Telecommunication Telecommunication Telecom - Services Telecom - Cellular & Fixed line services

VIL is an ABG and VGP partnership. VGP owns 32.29% stake and ABG owns 18.07% stake as on June 30, 2023, in VIL. Department

of Investment and Public Asset Management, Government of India holds about 33.14% as on June 30, 2023. With pan-India

operations, the company is one of the largest telecom operators providing voice, data, enterprise and other value-added services

across 22 service areas.

ABG is one of India’s largest conglomerates having its presence across 40 countries. VGP is one of the world’s largest

telecommunications companies having mobile and fixed network operations in 17 countries and, partners with mobile networks

in 46 more and fixed broadband operations in various market.

Brief Financials (Consolidated) (₹ crore) March 31, 2022 (A) March 31, 2023 (A) Q1FY24 (UA)

Total operating income 38,509 42,160 10,656

PBILDT 15,962 16,735 4,157

PAT -28,245 -29,301 -7,840

Overall gearing (times) NM NM NM

Interest coverage (times) NM NM NM

A: Audited UA: Unaudited; NM: Not meaningful

Note: The financials have been reclassified as per CARE Ratings’ standards

Note: ‘the above results are latest financial results available’

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating history for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

4 CARE Ratings Ltd.

Press Release

Complexity level of various instruments rated: Annexure-4

Lender details: Annexure-5

Annexure-1: Details of instruments/facilities

Size of the Rating Assigned

Name of the Date of Coupon Maturity

ISIN Issue along with Rating

Instrument Issuance Rate (%) Date

(₹ crore) Outlook

Fund-based – ST –

- - - 31-08-2023 4,000.00 CARE A4

Term loan

Debentures – Non-

INE669E08318 03-09-2018 10.90% 02-09-2023 0.00 Withdrawn

Convertible Debentures

Non-fund-based – LT –

- - - - 5,995.00 CARE B+; Stable

BG/LC

Term Loan – Long

- - - 30-06-2026 6,208.00 CARE B+; Stable

Term

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s)

Name of the Date(s) and

Amount and and and

SN Instrument/Bank Rating(s)

Type Outstanding Rating Rating(s) Rating(s) Rating(s)

Facilities assigned in

(₹ crore) assigned in assigned in assigned in

2020-2021

2023-2024 2022-2023 2021-2022

1)CARE B+

(CWN)

1)CARE B+; 1)CARE B+; (07-Jan-21)

Positive Stable

CARE 1)CARE B+; (16-Mar-23) (01-Feb-22) 2)CARE B+

Non-fund-based -

1 LT 5995.00 B+; Stable (CWN)

LT-BG/LC

Stable (24-Aug-23) 2)CARE B+; 2)CARE B- (24-Aug-20)

Stable (CWN)

(31-Jan-23) (13-Aug-21) 3)CARE BB-

(CWN)

(28-May-20)

1)CARE B+

(CWN)

1)CARE B+; 1)CARE B+; (07-Jan-21)

Positive Stable

CARE 1)CARE B+; (16-Mar-23) (01-Feb-22) 2)CARE B+

Term Loan-Long

2 LT 6208.00 B+; Stable (CWN)

Term

Stable (24-Aug-23) 2)CARE B+; 2)CARE B- (24-Aug-20)

Stable (CWN)

(31-Jan-23) (13-Aug-21) 3)CARE BB-

(CWN)

(28-May-20)

Fund-based - LT- 1)Withdrawn

3 LT - - - - -

Bank Overdraft (28-May-20)

1)CARE B+

(CWN)

1)CARE B+; 1)CARE B+; (07-Jan-21)

Positive Stable

Debentures-Non 1)CARE B+; (16-Mar-23) (01-Feb-22) 2)CARE B+

4 Convertible LT - - Stable (CWN)

Debentures (24-Aug-23) 2)CARE B+; 2)CARE B- (24-Aug-20)

Stable (CWN)

(31-Jan-23) (13-Aug-21) 3)CARE BB-

(CWN)

(28-May-20)

Debentures-Non 1)Withdrawn 1)CARE B+

5 LT - - - -

Convertible (01-Feb-22) (CWN)

5 CARE Ratings Ltd.

Press Release

Current Ratings Rating History

Date(s) Date(s) Date(s)

Name of the Date(s) and

Amount and and and

SN Instrument/Bank Rating(s)

Type Outstanding Rating Rating(s) Rating(s) Rating(s)

Facilities assigned in

(₹ crore) assigned in assigned in assigned in

2020-2021

2023-2024 2022-2023 2021-2022

Debentures (07-Jan-21)

2)CARE B-

(CWN) 2)CARE B+

(13-Aug-21) (CWN)

(24-Aug-20)

3)CARE BB-

(CWN)

(28-May-20)

1)CARE A4

(16-Mar-23)

Fund-based - ST- CARE 1)CARE A4 1)CARE A4

6 ST 4000.00 -

Term loan A4 (24-Aug-23) (01-Feb-22)

2)CARE A4

(31-Jan-23)

*LT/ST: Long term/Short term; CWN: Credit watch with negative implications

Annexure-3: Detailed explanation of covenants of the rated instruments/facilities: Not applicable

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Debentures-Non-Convertible Debentures Simple

2 Fund-based - ST-Term loan Simple

3 Non-fund-based - LT-BG/LC Simple

4 Term Loan-Long Term Simple

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

6 CARE Ratings Ltd.

Press Release

Contact us

Media Contact Analytical Contacts

Maulesh Desai

Mradul Mishra Director

Director CARE Ratings Limited

CARE Ratings Limited Phone: +91-79-40265605

Phone: +91-22-6754 3596 E-mail: maulesh.desai@careedge.in

E-mail: mradul.mishra@careedge.in

Prasanna Krishnan Lakshmi Kumar

Relationship Contact Associate Director

CARE Ratings Limited

Saikat Roy Phone: +91-11-45333236

Senior Director E-mail: prasanna.krishnan@careedge.in

CARE Ratings Limited

Phone: +91-22-67543404 Monika

E-mail: saikat.roy@careedge.in Analyst

CARE Ratings Limited

E-mail: monika@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise capital

and enable investors to make informed decisions. With an established track record of rating companies over almost three decades,

CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise, backed by the

methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in developing bank debt

and capital market instruments, including commercial papers, corporate bonds and debentures, and structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions with

the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has

no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the

terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and

triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

7 CARE Ratings Ltd.

You might also like

- A National Bank Cannot Lend Its CreditDocument2 pagesA National Bank Cannot Lend Its CreditvaltecNo ratings yet

- MONEY AND BANKING Notes PDFDocument20 pagesMONEY AND BANKING Notes PDFJames LusibaNo ratings yet

- Merger and Acquisition. CIA 1.2docxDocument13 pagesMerger and Acquisition. CIA 1.2docxSaloni Jain 1820343No ratings yet

- Business Strategy of SbiDocument23 pagesBusiness Strategy of Sbichitra_sweetgirl100% (1)

- Philippines Philippines: T Telec Elecommunica Ommunications R Tions Report EportDocument53 pagesPhilippines Philippines: T Telec Elecommunica Ommunications R Tions Report EportN SNo ratings yet

- Vivaan VasudevaDocument3 pagesVivaan Vasudevavasudeva.vivaanNo ratings yet

- Rating Rationale CRISILDocument10 pagesRating Rationale CRISILjagadeeshNo ratings yet

- Vijay Sales (India) Private LimitedDocument5 pagesVijay Sales (India) Private LimitedAakanksha RaiNo ratings yet

- FM Cia-3Document13 pagesFM Cia-3kowsheka.baskarNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- Investment PRESENTATION grp-3Document15 pagesInvestment PRESENTATION grp-3sidsaheb98No ratings yet

- Zinka Logistics Solutions - R-25092020Document8 pagesZinka Logistics Solutions - R-25092020Atiqur Rahman BarbhuiyaNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Parasakti - IndRa - Dec 2022 - BBB+Document5 pagesParasakti - IndRa - Dec 2022 - BBB+SaranNo ratings yet

- Raju Project For P2 NEW2Document20 pagesRaju Project For P2 NEW2Bhumika MittapelliNo ratings yet

- New AssignDocument11 pagesNew AssignRavitej ReddyNo ratings yet

- Padget Electronics Pvt. LTDDocument9 pagesPadget Electronics Pvt. LTDvenkyniyerNo ratings yet

- 3i Infotech LimitedDocument5 pages3i Infotech LimitedPratik SuranaNo ratings yet

- Kitex Garments LimitedDocument8 pagesKitex Garments LimitedSamsuzzoha ZohaNo ratings yet

- India Ratings and Research - Most Respected Credit Rating and Research Agency IndiaDocument6 pagesIndia Ratings and Research - Most Respected Credit Rating and Research Agency IndiainfotodollyraniNo ratings yet

- Dixon Technologies (India) LimitedDocument6 pagesDixon Technologies (India) Limitedsattyak.sharma.2022No ratings yet

- 247 Customer Private LimitedDocument7 pages247 Customer Private Limitednayabrasul208No ratings yet

- VE Commercial Vehicles LimitedDocument8 pagesVE Commercial Vehicles LimitedRajNo ratings yet

- GTPL Hathway LTD.: A) About The CompanyDocument10 pagesGTPL Hathway LTD.: A) About The CompanyPayal SinghNo ratings yet

- Idea VodafoneDocument7 pagesIdea VodafonePraveen AntonyNo ratings yet

- Ans 1. The Type Merger and Acquisition Used in Vodafone India Company Is HorizontalDocument3 pagesAns 1. The Type Merger and Acquisition Used in Vodafone India Company Is Horizontalkanchan lataNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- CTR Manufacturing Industries Private LimitedDocument7 pagesCTR Manufacturing Industries Private Limitedkrushna.maneNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- 1merger of Vodafone India and Idea CellularDocument4 pages1merger of Vodafone India and Idea Cellularagarwalsneha1909No ratings yet

- IDEA 03082022181130 SEIntimationResultsQ1FY23Document17 pagesIDEA 03082022181130 SEIntimationResultsQ1FY23vijaya babuNo ratings yet

- ICRA Press Release - Telecom Tower - 2nd May 2023 PDFDocument2 pagesICRA Press Release - Telecom Tower - 2nd May 2023 PDFV KeshavdevNo ratings yet

- Vodafone Idea LimitedDocument9 pagesVodafone Idea LimitedYash RaoNo ratings yet

- Attra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionDocument7 pagesAttra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionCharan gowdaNo ratings yet

- PSK Engineering Construction & Co-08-06-2020Document5 pagesPSK Engineering Construction & Co-08-06-2020The JdNo ratings yet

- Vodafone Idea ReportDocument19 pagesVodafone Idea ReportninadgacNo ratings yet

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Bajaj Finance Limited Ar 2022 23Document415 pagesBajaj Finance Limited Ar 2022 23nowdu purnimaNo ratings yet

- Rating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21Document5 pagesRating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21vulture212No ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- Group 12Document16 pagesGroup 12Keerthi NarinaNo ratings yet

- Future Corporate Resources - R - 05052020Document7 pagesFuture Corporate Resources - R - 05052020ChristianStefanNo ratings yet

- IRB Invit FundDocument6 pagesIRB Invit FundPavanNo ratings yet

- Bharti AXA Life Insurance Company LimitedDocument8 pagesBharti AXA Life Insurance Company LimitedJinal SanghviNo ratings yet

- IPO Note of Bharti Hexacom LimitedDocument8 pagesIPO Note of Bharti Hexacom LimitedSamim Al RashidNo ratings yet

- Girnar Software Pvt. LTDDocument7 pagesGirnar Software Pvt. LTDnabh.21bms0336No ratings yet

- Future Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Document9 pagesFuture Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Nostalgic MediatorNo ratings yet

- Cia - Financial ManagementDocument9 pagesCia - Financial Managementsattwikd77No ratings yet

- Idea Cellular Telecommunication: Recent DevelopmentsDocument10 pagesIdea Cellular Telecommunication: Recent DevelopmentsAbhijeet PatilNo ratings yet

- Olectra Greentech Limited - R - 27082020Document8 pagesOlectra Greentech Limited - R - 27082020eichermguptaNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- WCA 1st Jan 7th Jan 2024 - 240222 - 123936Document17 pagesWCA 1st Jan 7th Jan 2024 - 240222 - 123936priyankasadashiv21No ratings yet

- Downfall of Videocon: About CompanyDocument4 pagesDownfall of Videocon: About CompanyPRK21MS1099 GOPIKRISHNAN JNo ratings yet

- AIRTEL1PPTDocument19 pagesAIRTEL1PPTpoojagkhandelwalNo ratings yet

- Onshore Construction Company Private LimitedDocument7 pagesOnshore Construction Company Private Limitedhesham zakiNo ratings yet

- Track Components - ICRADocument8 pagesTrack Components - ICRAPuneet367No ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- New Vistas In: Fetal MedicineDocument2 pagesNew Vistas In: Fetal MedicineRaviraj TirukeNo ratings yet

- FOGSI PG Training Program 14th JulyDocument1 pageFOGSI PG Training Program 14th JulyRaviraj TirukeNo ratings yet

- डासांमार्फत पसरणा-या रोगराईDocument2 pagesडासांमार्फत पसरणा-या रोगराईRaviraj TirukeNo ratings yet

- Do's and Dont's For Ultrasound Clinic (Final)Document4 pagesDo's and Dont's For Ultrasound Clinic (Final)Raviraj TirukeNo ratings yet

- More Thought Square Foot: Enlivening WorkspacesDocument173 pagesMore Thought Square Foot: Enlivening WorkspacesRaviraj Tiruke100% (1)

- Fogsi Position Statement On The Use of ProgestogensDocument9 pagesFogsi Position Statement On The Use of ProgestogensRaviraj TirukeNo ratings yet

- Report On Lending Co.Document36 pagesReport On Lending Co.AbhishekNo ratings yet

- Rbi Irac Norms Circular PDFDocument138 pagesRbi Irac Norms Circular PDFCA Nikhil BazariNo ratings yet

- "Customer Attitude Towards COMMERCIAL LOANDocument58 pages"Customer Attitude Towards COMMERCIAL LOANPulkit SachdevaNo ratings yet

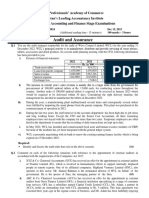

- Accounting 14 - Applied Auditing OkDocument12 pagesAccounting 14 - Applied Auditing OkNico evansNo ratings yet

- Loan and Lease StatementDocument13 pagesLoan and Lease StatementPrashant JhaNo ratings yet

- Investing ActivitiesDocument7 pagesInvesting ActivitiesMs. ArianaNo ratings yet

- Agri Gr8 PresentationDocument45 pagesAgri Gr8 PresentationJames WilliamNo ratings yet

- BankScope Stata Version 2015Document43 pagesBankScope Stata Version 2015AliNo ratings yet

- 03 - Review of LiteratureDocument9 pages03 - Review of LiteratureKalyani Thakur100% (1)

- Review of Chapter 8/9Document36 pagesReview of Chapter 8/9BookAddict721100% (1)

- Case Study 1Document9 pagesCase Study 1ShankarNo ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - Nosv netNo ratings yet

- Schedule K (Secured)Document5 pagesSchedule K (Secured)Jie Han100% (1)

- Rental Property Tax LawsDocument31 pagesRental Property Tax LawsArnold GalvanNo ratings yet

- Monetary Policy Transmission in India - Recent Trends and ImpedimentsDocument16 pagesMonetary Policy Transmission in India - Recent Trends and ImpedimentsGOURAV MISHRANo ratings yet

- Reverse Mortgages For SeniorsDocument1 pageReverse Mortgages For SeniorsChicago TribuneNo ratings yet

- Myanmar Finance ReportDocument20 pagesMyanmar Finance Reportmarcmyomyint1663No ratings yet

- Engineering Economy Module 2Document19 pagesEngineering Economy Module 2Nico Urieta De Ade0% (2)

- Internship Report On General Banking of Janata Bank LimitedDocument35 pagesInternship Report On General Banking of Janata Bank LimitedMd. Tareq AzizNo ratings yet

- FINS5530 Lecture 1 IntroductionDocument42 pagesFINS5530 Lecture 1 IntroductionMaiNguyenNo ratings yet

- Evolution and Role of Financial Services Companies inDocument11 pagesEvolution and Role of Financial Services Companies inRicha Sonali0% (2)

- 2 Project Financing in IndiaDocument20 pages2 Project Financing in IndiaashimathakurNo ratings yet

- Mithila Sultana Full ReportDocument67 pagesMithila Sultana Full ReportMithila SultanaNo ratings yet

- VOCABULARY Money Book 3Document1 pageVOCABULARY Money Book 3Edison Estalla CutipaNo ratings yet

- Credit Management of Agrani Bank LimitedDocument52 pagesCredit Management of Agrani Bank Limitedorda55555100% (7)

- Hinduja Leyland Finance LTDDocument28 pagesHinduja Leyland Finance LTDShekhar Landage100% (1)

- Banking and FinanceDocument2 pagesBanking and FinanceFaith VidallonNo ratings yet