Professional Documents

Culture Documents

Prefi TP Basic Accounting

Uploaded by

veri0 ratings0% found this document useful (0 votes)

4 views1 pagequestions on TP

Original Title

Prefi TP basic accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentquestions on TP

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pagePrefi TP Basic Accounting

Uploaded by

veriquestions on TP

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

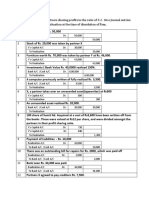

Case A Case B Case A Case B

Problem 1 (10pts) Problem 1 (10pts) Problem 1 (10pts) Problem 1 (10pts)

Aguilar and Angeles formed a Aguilar and Angeles formed a Aguilar and Angeles formed a Aguilar and Angeles formed a

partnership wherein Aguilar is to partnership wherein Aguilar is to partnership wherein Aguilar is to partnership wherein Aguilar is to

contribute cash while Angeles is to contribute cash while Angeles is to contribute cash while Angeles is to contribute cash while Angeles is to

transfer the assets and liabilities of transfer the assets and liabilities of transfer the assets and liabilities of transfer the assets and liabilities of

his business. Account balances of his business. Account balances of his business. Account balances of his business. Account balances of

Angeles are as follows: Angeles are as follows: Angeles are as follows: Angeles are as follows:

Debit Credit Debit Credit Debit Credit Debit Credit

Cash 300,000 Cash 300,000 Cash 300,000 Cash 300,000

Accounts Accounts Accounts Accounts

Receivable 450,000 Receivable 450,000 Receivable 450,000 Receivable 450,000

Inventories 240,000 Inventories 240,000 Inventories 240,000 Inventories 240,000

Accounts Accounts Accounts Accounts

Payable 90,000 Payable 90,000 Payable 90,000 Payable 90,000

Angeles, Angeles, Angeles, Angeles,

Capital 900,000 Capital 900,000 Capital 900,000 Capital 900,000

The partners agreed on the The partners agreed on the The partners agreed on the The partners agreed on the

following conditions: following conditions: following conditions: following conditions:

a. An allowance for a. An allowance for a. An allowance for a. An allowance for

uncollectible accounts of uncollectible accounts of uncollectible accounts of uncollectible accounts of

P22,000 is to be established P22,000 is to be established P22,000 is to be established P22,000 is to be established

b. The inventories are to be b. The inventories are to be b. The inventories are to be b. The inventories are to be

valued at their current valued at their current valued at their current valued at their current

replacement cost of P270,000 replacement cost of P270,000 replacement cost of P270,000 replacement cost of P270,000

c. Prepaid expenses of c. Prepaid expenses of c. Prepaid expenses of c. Prepaid expenses of

P12,000 and accrued P12,000 and accrued P12,000 and accrued P12,000 and accrued

expenses of P5,000 are to be expenses of P5,000 are to be expenses of P5,000 are to be expenses of P5,000 are to be

recognized recognized recognized recognized

d. Angeles is to be credited for d. Angeles is to be credited for d. Angeles is to be credited for d. Angeles is to be credited for

an amount equal to the net an amount equal to the net an amount equal to the net an amount equal to the net

assets transferred assets transferred assets transferred assets transferred

e. Aguilar is to contribute e. Aguilar is to contribute e. Aguilar is to contribute e. Aguilar is to contribute

sufficient cash to have an sufficient cash to have an sufficient cash to have an sufficient cash to have an

equal interest in the equal interest in the equal interest in the equal interest in the

partnership. partnership. partnership. partnership.

f. The partners shall use the f. The partners shall use the f. The partners shall use the f. The partners shall use the

books of Angeles. books of Angeles. books of Angeles. books of Angeles.

Required: Prepare journal entries Required: Prepare journal entries Required: Prepare journal entries Required: Prepare journal entries

to adjust the books and to record to adjust the books and to record to adjust the books and to record to adjust the books and to record

the receipt of Aguilar’s investment. the receipt of Aguilar’s investment. the receipt of Aguilar’s investment. the receipt of Aguilar’s investment.

Problem 2 (46pts) Problem 2 (46pts) Problem 2 (46pts) Problem 2 (46pts)

Encina, Endrada and Elina Encina, Endrada and Elina Encina, Endrada and Elina Encina, Endrada and Elina

Partnership has the following Partnership has the following Partnership has the following Partnership has the following

account balances as of 31 account balances as of 31 account balances as of 31 account balances as of 31

December 2023, when they December 2023, when they December 2023, when they December 2023, when they

decided to liquidate and wind up decided to liquidate and wind up decided to liquidate and wind up decided to liquidate and wind up

the affairs of the partnership: the affairs of the partnership: the affairs of the partnership: the affairs of the partnership:

Liabilities and Liabilities and Liabilities and Liabilities and

Assets Capital Assets Capital Assets Capital Assets Capital

Cash – Liabilities – Cash – Liabilities – Cash – Liabilities – Cash – Liabilities –

P8,000 P44,800 P8,000 P44,800 P8,000 P44,800 P8,000 P44,800

Other Assets Endrada, Loan Other Assets Endrada, Loan Other Assets Endrada, Loan Other Assets Endrada, Loan

– P136,000 – P2,000 – P136,000 – P2,000 – P136,000 – P2,000 – P136,000 – P2,000

Elina, Loan – Elina, Loan – Elina, Loan – Elina, Loan –

P3,200 P3,200 P3,200 P3,200

Encina, Capital Encina, Capital Encina, Capital Encina, Capital

– P38,000 – P38,000 – P38,000 – P38,000

Endrada, Endrada, Endrada, Endrada,

Capital – Capital – Capital – Capital –

P24,000 P24,000 P24,000 P24,000

Elina Capital – Elina Capital – Elina Capital – Elina Capital –

P32,000 P32,000 P32,000 P32,000

Total – Total – Total – Total – Total – Total – Total – Total –

P144,000 P144,000 P144,000 P144,000 P144,000 P144,000 P144,000 P144,000

Required: Prepare a statement of Required: Prepare a statement of Required: Prepare a statement of Required: Prepare a statement of

liquidation assuming that other liquidation assuming that other liquidation assuming that other liquidation assuming that other

assets were sold for P68,000 and assets were sold for P68,000 and assets were sold for P68,000 and assets were sold for P68,000 and

that any deficient partner was that any deficient partner was that any deficient partner was that any deficient partner was

insolvent. solvent. insolvent. solvent.

You might also like

- Group 1 Partnership Liquidation Activity FinalsDocument28 pagesGroup 1 Partnership Liquidation Activity FinalsRey Jr Alipis83% (6)

- Chapter 3 ParcorDocument6 pagesChapter 3 Parcornikki sy40% (5)

- The General's Favorite Fishing Hole Chart of Accounts Assets RevenuesDocument4 pagesThe General's Favorite Fishing Hole Chart of Accounts Assets RevenuesJessamae MacasojotNo ratings yet

- Partnership Liquidation LumpsumDocument1 pagePartnership Liquidation LumpsumNikki GarciaNo ratings yet

- Solving Problems On Debit and CreditDocument7 pagesSolving Problems On Debit and CreditMarlyn Lotivio100% (1)

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- AFAR - Corp LiqDocument1 pageAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Acc 422Document20 pagesAcc 422Charles WilleNo ratings yet

- Mvan Budget Sheet 2Document20 pagesMvan Budget Sheet 2karenmoller0No ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet

- Fish R Us PDFDocument7 pagesFish R Us PDFMCM EnterpriseNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceAnn Candole0% (1)

- Abm-301 Ils-In-funda Na Balance Pati Patot PanablaDocument120 pagesAbm-301 Ils-In-funda Na Balance Pati Patot PanablaBarney MabiniNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- In June of 20XXDocument3 pagesIn June of 20XXBonita VBNo ratings yet

- Dissolution With Journal Entries For Winter CampDocument10 pagesDissolution With Journal Entries For Winter CampDev RathiNo ratings yet

- Activity 1Document9 pagesActivity 1milkyode9No ratings yet

- Partnership & Business CombinationDocument32 pagesPartnership & Business CombinationJason Bautista100% (1)

- Fish R UsDocument3 pagesFish R UsJenny Pearl Dominguez CalizarNo ratings yet

- Assignment No. 1 (Financial Transactions) Answer KeyDocument9 pagesAssignment No. 1 (Financial Transactions) Answer KeyHeasylyn tadeoNo ratings yet

- A-Guide in Preparing and Presenting SFPDocument8 pagesA-Guide in Preparing and Presenting SFPalabmyselfNo ratings yet

- If Both Are IndividualsDocument6 pagesIf Both Are IndividualsRegineNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Prelim Examination - QuestionnairesDocument10 pagesPrelim Examination - QuestionnairesLuningning GarciaNo ratings yet

- Chapter 3 ParcorDocument6 pagesChapter 3 ParcorJwhll MaeNo ratings yet

- PTC3 General JournalDocument6 pagesPTC3 General JournalMicole LirioNo ratings yet

- Excel Accounting Software: The Complete Billing SolutionDocument13 pagesExcel Accounting Software: The Complete Billing SolutionUmairIsmailNo ratings yet

- Student Fee ChallanDocument1 pageStudent Fee ChallanMalik MarwanNo ratings yet

- 3 - Trial Balance To PL Account - ExamplesDocument49 pages3 - Trial Balance To PL Account - ExamplesDivyansh Pandey100% (2)

- Vdocuments - MX - Advanced Financial Accounting 1Document11 pagesVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNo ratings yet

- Accounting Process Practice ProblemDocument23 pagesAccounting Process Practice ProblemRenshey Cordova MacasNo ratings yet

- Partnership FormDocument5 pagesPartnership FormPatrick Jayson VillademosaNo ratings yet

- Coa 26 - 04 - 2021Document36 pagesCoa 26 - 04 - 2021Kirtan MankadNo ratings yet

- Partnership Formation Lecture NotesDocument3 pagesPartnership Formation Lecture Notesbum_24100% (5)

- Group ActivityDocument1 pageGroup ActivityMARL VINCENT L LABITADNo ratings yet

- Bajao-Activity 1-AccountingDocument21 pagesBajao-Activity 1-AccountingShen Calotes50% (2)

- Balance Sheet Practice WorkbookDocument7 pagesBalance Sheet Practice WorkbookBJNo ratings yet

- MerchandisingDocument13 pagesMerchandisingcoralvictoria929No ratings yet

- FABM 2 Closing-Entries 1Document3 pagesFABM 2 Closing-Entries 1ariannekaryllemercadoNo ratings yet

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Chapter 2Document16 pagesChapter 2Rynette FloresNo ratings yet

- Chapter 1 Practice ProblemsDocument5 pagesChapter 1 Practice ProblemsChristine Joyce SalvadorNo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- Project in Advanced Accntg. - LiquidationDocument10 pagesProject in Advanced Accntg. - LiquidationSnow TurnerNo ratings yet

- ChallanDocument1 pageChallanSohail Bin AshrafNo ratings yet

- Challan No. Challan No Challan No. Challan No.: Total: Total: Total: TotalDocument1 pageChallan No. Challan No Challan No. Challan No.: Total: Total: Total: TotalBATERA MOTUNo ratings yet

- Final Exam Advance Accounting WADocument5 pagesFinal Exam Advance Accounting WAShawn OrganoNo ratings yet

- Class On Periodic - PerpetualDocument2 pagesClass On Periodic - PerpetualmerakiNo ratings yet

- Merchandising QuizzerDocument1 pageMerchandising QuizzerjadeNo ratings yet

- Accounting 1Document88 pagesAccounting 1Rina Angeles EndozoNo ratings yet

- 5th Semester Fee Challan 1Document1 page5th Semester Fee Challan 1Ali HassanNo ratings yet

- Unit IV Corporate Liquidation PDFDocument20 pagesUnit IV Corporate Liquidation PDFLeslie Mae Vargas ZafeNo ratings yet

- Basic Accounting ProblemsDocument6 pagesBasic Accounting ProblemsDalia ElarabyNo ratings yet

- Requirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Document29 pagesRequirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Edrianne Dela RamaNo ratings yet

- Fish RUsDocument11 pagesFish RUseia aieNo ratings yet

- Exercise 2-1 Exercise 2-2 Exercise 2-3Document11 pagesExercise 2-1 Exercise 2-2 Exercise 2-3denise ngNo ratings yet

- Adv 1 - Dept 2010Document16 pagesAdv 1 - Dept 2010Aldrin100% (1)

- Britain's Day-flying Moths: A Field Guide to the Day-flying Moths of Great Britain and Ireland, Fully Revised and Updated Second EditionFrom EverandBritain's Day-flying Moths: A Field Guide to the Day-flying Moths of Great Britain and Ireland, Fully Revised and Updated Second EditionRating: 5 out of 5 stars5/5 (4)

- Group Buad 803Document7 pagesGroup Buad 803oluseyi osifuwaNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- Accounting Standard SummaryDocument17 pagesAccounting Standard Summarymegha.mm56No ratings yet

- Borras&ang&yepez Acccob2 Reflection1Document11 pagesBorras&ang&yepez Acccob2 Reflection1Josh Gabriel BorrasNo ratings yet

- ch09 PDFDocument55 pagesch09 PDFMohammed AljabriNo ratings yet

- Feasibility On Ice Candy ShopDocument31 pagesFeasibility On Ice Candy Shopm_turab100% (2)

- What Is Reconstruction?: Need For Internal ReconstructionDocument31 pagesWhat Is Reconstruction?: Need For Internal Reconstructionneeru79200079% (14)

- Adoption of IFRSDocument13 pagesAdoption of IFRSsuryamlacwNo ratings yet

- SCF PPT 1Document22 pagesSCF PPT 1Tanisha DoshiNo ratings yet

- Managerial Accounting CostingDocument244 pagesManagerial Accounting CostingHasan EvansNo ratings yet

- Group 2 PPT Man EconDocument93 pagesGroup 2 PPT Man Econerin santosNo ratings yet

- Audit Report ELPI TBK Konsolidasian 2022Document118 pagesAudit Report ELPI TBK Konsolidasian 2022argo indNo ratings yet

- Lady MDocument2 pagesLady MRishikesh NairNo ratings yet

- Eicher Motors: PrintDocument3 pagesEicher Motors: PrintAryan BagdekarNo ratings yet

- Chapter 7 Aa 1 SolDocument18 pagesChapter 7 Aa 1 SolStephanie SundiangNo ratings yet

- Payout Policy: Test Bank, Chapter 16 168Document11 pagesPayout Policy: Test Bank, Chapter 16 168AniKelbakianiNo ratings yet

- MBSS Annual Report 2013Document206 pagesMBSS Annual Report 2013Andri ChandraNo ratings yet

- Icpa - Far: Multiple ChoiceDocument25 pagesIcpa - Far: Multiple ChoiceCheska LeeNo ratings yet

- Revenue - Fundamental Principle - Standards - SourcesDocument6 pagesRevenue - Fundamental Principle - Standards - SourcesAlelie Joy dela CruzNo ratings yet

- Dell's Working Capital Financial Ratio: DSI DSO DPO CCCDocument17 pagesDell's Working Capital Financial Ratio: DSI DSO DPO CCCddNo ratings yet

- Microsoft Word - TASK 9706 - T 11 - 9706 - 41 2013Document1 pageMicrosoft Word - TASK 9706 - T 11 - 9706 - 41 2013Ayesha sheikhNo ratings yet

- Rizal Technological University-Accountancy Department (Cost Accounting)Document9 pagesRizal Technological University-Accountancy Department (Cost Accounting)Quartz KrystalNo ratings yet

- Assignment 1-6 WorksheetDocument5 pagesAssignment 1-6 WorksheetMonali PatelNo ratings yet

- Questions - Investment AppraisalDocument2 pagesQuestions - Investment Appraisalpercy mapetere100% (1)

- Part FormDocument6 pagesPart FormKing MacunatNo ratings yet

- Sample Reports Guide For The Financial EdgeDocument404 pagesSample Reports Guide For The Financial EdgeAdi PermanaNo ratings yet

- FM Mid Term Notes SajinJDocument25 pagesFM Mid Term Notes SajinJVishnu RC VijayanNo ratings yet

- Khalaf Taani PDFDocument9 pagesKhalaf Taani PDFDuana ZulqaNo ratings yet

- Mini CaseDocument15 pagesMini CaseSammir Malhotra0% (1)

- Financial Management PGDM Study MaterialDocument152 pagesFinancial Management PGDM Study MaterialSimranNo ratings yet