Professional Documents

Culture Documents

ECO 6201E Individual Project - Lim Yi Sern (I23025781)

Uploaded by

i23025781Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECO 6201E Individual Project - Lim Yi Sern (I23025781)

Uploaded by

i23025781Copyright:

Available Formats

ECO 6201E

BUSINESS ECONOMICS

INDIVIDUAL PROJECT

LIM YI SERN

(i23025781)

OCTOBER 2023 SESSION

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

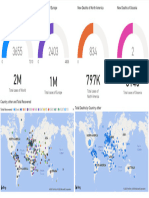

Chosen Country : Malaysia Period of Analysis : Year 2003 – Year 2022

Expansion Recession Expansion Recession Expansion

2020 – COVID-19 Pandemic

2008 – Global Financial Crisis

Peak

Peak

/ Sheraton Move

2000 – Dotcom Bubble

2014 to 2016 – Oil Price Plunge

2005 – High Global Oil Prices

2016 – US Presidential Election

2011 – European Debt Crisis

2013 – General Election

2018 – General Election

2022 – Endemic Phase (Covid-19)

2008 – General Election

Trough

Trough

Data Source: Worldometers.info [Accessed on: 18 November, 2023] Place of publication: Dover, Delaware, U.S.A. and World Bank national accounts data, and OECD

National Accounts data.

INTI International University Page 1 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Question 1:

Analyze and explain the shape of the business cycle of your chosen country. At each inflection

point, explain the factors that contribute to changes in the economic landscape.

Answer to Question 1:

The economic trajectory of Malaysia serves as a testament to the intricate dance between

various economic forces, illustrating the dynamic business cycles it has traversed over the past

two decades. In the early 2000s, following the recovery from the Asian Financial Crisis,

Malaysia embarked on a transformative era fueled by a technological boom. The Dot-com

Bubble of the late 1990s facilitated increased investment in the burgeoning tech sector,

ushering in a period of unprecedented growth and innovation. This expansion phase, spanning

from 2000 to 2008, witnessed Malaysia's increasing integration into the global economy,

fostering greater financial connectivity and heightened international trade (National Economic

Advisory Model, 2009).

However, the zenith of this economic optimism in 2008 was met with a stark reality—the burst

of the housing bubble triggering the Global Financial Crisis (GFC). Banks and financial

institutions in the United States and the West redirected their focus to home markets, resulting

in a significant drop in funds flowing into Malaysia (Goh and Lim, 2010). This led to the

crumbling of financial institutions, frozen credit markets, and a global recession. The

subsequent contraction phase in 2009 witnessed a negative GDP growth rate and a sharp spike

in unemployment. Governments responded with unprecedented interventions, including

massive stimulus packages and bank bailouts, aiming to stabilize the teetering economic

landscape.

The years 2009-2010 marked a crucial juncture for Malaysia's recovery. Central banks

implemented unconventional monetary policies, such as low-interest rates and quantitative

easing, to spur economic activity. Simultaneously, the Malaysian government and the Bank

Negara Malaysia (BNM) enacted fiscal measures, injecting liquidity and confidence into

markets (Harun, 2012). The financial sector, at the epicenter of the crisis, underwent

restructuring and reform to prevent future systemic failures. Monetary policy supported

domestic demand for economic recovery, and fiscal measures provided countercyclical support

for growth and incentives to stimulate private sector consumption and investment (Muhammad,

2010).

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 2 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Answer to Question 1: … cont’d

The post-recession expansion from 2010 to 2019 was characterized by resilience and

adaptation in Malaysia. In response to the economic threat, the Malaysian government

implemented a RM7 billion stimulus package in November 2008, a second RM60 billion

package in March 2009, and interest rate cuts by the central bank (Shankaran, 2009). Economic

reforms included stricter regulations on financial institutions to mitigate risks, while

technology and innovation emerged as key drivers of growth. However, challenges persisted

as the global economy grappled with geopolitical tensions, trade disputes, and shifting

dynamics. Notable incidents throughout the decade, such as the European debt crisis in 2011

and the Malaysian general elections in 2013 and 2018, marked periods of ups and downs. The

change of government and political instability in 2018 introduced uncertainties, and the year

2016 recorded the lowest world GDP growth since the Global Financial Crisis (Bank Negara

Malaysia, 2016).

The year 2020 brought an unexpected disruptor to Malaysia and global—the COVID-19

pandemic. Economists predicted it would cause the worst global economic recession, with

Malaysia's GDP drastically falling due to the indirect impacts of the pandemic, including the

Movement Control Order (MCO) or lockdown. The resulting global economic standstill

presented an unparalleled challenge, causing mass unemployment in sectors like travel and

hospitality. Governments worldwide responded with unprecedented fiscal stimulus measures

to mitigate the economic fallout.

The post-pandemic recovery from 2021 to 2022 showcased Malaysia's resilience and

adaptability. Successful vaccination campaigns contributed to a gradual reopening of

economies, with fiscal stimulus playing a pivotal role in supporting affected businesses and

individuals. The economic landscape entered a phase of transition as industries adapted to new

norms, and the Malaysian government recalibrated policies to foster sustained growth.

Meanwhile, a World Bank senior economist noted that Malaysia's economy demonstrated

stability and consistent growth, boasting a 5% annual growth rate and ranking as the wealthiest

among six countries (Cambodia, Indonesia, Mongolia, Vietnam, and the Philippines) before

the pandemic (FMT News, 2023).

(632 words)

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 3 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Question 2:

An economic cycle is something that is unavoidable by any country by any means. Explain the

importance of knowing the economic cycle and the related impact. Also explain measures that

are generally employed to overcome unintentional expansion or recession phase of economic

cycle.

Answer to Question 2:

Economic cycles, the inevitable rise and fall of economic activity, play a pivotal role in shaping

a nation's economic trajectory. The period from 2003 to 2022 in Malaysia offers a

comprehensive backdrop to explore the significance of understanding economic cycles and the

nuanced measures employed to navigate through phases of expansion and recession, including

the unprecedented challenges posed by the COVID-19 pandemic.

Importance of Knowing Economic Cycles:

A profound understanding of economic cycles is important for an effective policy responses.

In Malaysia, the aftermath of the 2008 global financial crisis serves as a compelling example.

Faced with the ripple effects of the U.S. subprime mortgage crisis, Malaysia swiftly

implemented expansionary fiscal policies, emphasizing infrastructure development and

monetary stimulus (Ariff & Abubakar, 2009). This tailored response not only shielded

Malaysia from the worst of the global downturn but also set the stage for a robust recovery.

Knowledge of economic cycles allows policymakers to calibrate responses, ensuring that

interventions align with the specific challenges posed by each phase.

Moreover, understanding economic cycles equips a nation to fortify its economic stability

against global shocks. Malaysia, being part of the interconnected global economy, had to

navigate external challenges such as the U.S. subprime mortgage crisis. Proactive measures,

including fortifying the financial sector, were employed to ensure stability in the face of these

shocks (Malaysian Institute of Economic Research, 2010). The ability to foresee and prepare

for such external shocks is a testament to the importance of comprehending economic cycles.

The most recent and unparalleled challenge, the COVID-19 pandemic, further underscores the

significance of understanding economic cycles. The pandemic disrupted global supply chains,

dampened consumer demand, and posed severe health and economic threats. In response,

Malaysia implemented a range of measures, including fiscal stimulus packages, to mitigate the

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 4 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Answer to Question 2: … cont’d

impact on businesses and households (Bank Negara Malaysia, 2020). The agility in adapting

strategies to the unique challenges posed by the pandemic demonstrates the ongoing

importance of understanding economic cycles.

Measures to Overcome Economic Expansion (2003 - 2007):

During phases of economic expansion from 2003 to 2007, Malaysia strategically employed

measures to leverage the growth momentum. Infrastructure-led growth emerged as a

cornerstone, with projects like Iskandar Malaysia aiming to stimulate investment and job

creation (Malaysian Institute of Economic Research, 2006). By prioritizing such projects,

Malaysia sought to create an environment conducive to increased economic activities.

Furthermore, diversification efforts played a crucial role in mitigating the risks associated with

over-reliance on traditional sectors. Malaysia actively diversified into high-value industries

such as technology and services, aiming to reduce vulnerability to sector-specific downturns

(Malaysian Institute of Economic Research, 2006). This strategic approach contributed to

sustained economic expansion and showcased the adaptability of Malaysia's economic policies.

Measures to Overcome Economic Recession (2008 - 2009):

The global financial crisis of 2008 necessitated a shift in policy measures to counter the

economic downturn. Malaysia, recognizing the severity of the crisis, implemented counter-

cyclical fiscal policies to stimulate demand and cushion the impact of the recession (Ariff &

Abubakar, 2009). This included a substantial increase in public spending, demonstrating a

commitment to using fiscal tools as a buffer during recessionary phases.

Simultaneously, monetary easing measures and support to the financial sector were pivotal in

maintaining confidence and stability. Bank Negara Malaysia, the central bank, played a crucial

role in introducing measures to ensure liquidity and stabilize the financial system (Ariff &

Abubakar, 2009). These measures not only prevented a more severe economic contraction but

also laid the foundation for a swifter recovery.

Measures During the COVID-19 Pandemic (2020 - 2022):

The COVID-19 pandemic presented unprecedented challenges, requiring a new set of measures

to safeguard both public health and the economy. Malaysia swiftly implemented movement

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 5 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Answer to Question 2: … cont’d

restrictions, providing financial aid to affected individuals and businesses (Bank Negara

Malaysia, 2020). Additionally, fiscal stimulus packages were introduced to bolster economic

resilience and ensure a robust recovery once the pandemic was under control.

In conclusion, the Malaysian experience from 2003 to 2022 underscores the intricate dance

with economic cycles. Knowledge of economic cycles facilitated informed policy responses,

enabling Malaysia to weather global storms and emerge stronger. The strategic focus on

infrastructure-led growth, economic diversification, and counter-cyclical policies exemplifies

Malaysia's resilience in navigating through the complexities of economic cycles. As Malaysia

looks towards the future, the lessons learned from this period, including the adaptive measures

during the COVID-19 pandemic, will undoubtedly shape its approach to the next inevitable

phase of economic evolution.

(731 words)

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 6 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Question 3:

While GDP is a widely used indicator for measuring the overall economic activity of a nation,

it is not a perfect measure for economic well-being. Using illustrations and samples, explain

why GDP is not the perfect measure for economic well-being.

Answer to Question 3:

Gross Domestic Product (GDP) has long been considered a key indicator of a nation's economic

health, measuring both the total income and expenditure on goods and services (Mankiw, 2014).

However, despite its widespread use, GDP falls short as the perfect measure for economic well-

being. This imperfection becomes apparent when examining specific aspects that GDP fails to

encapsulate, ranging from the value of leisure to the impact on the environment and the

overlooking of non-market activities.

One notable limitation of GDP is its exclusion of leisure, a crucial component of a well-rounded

and fulfilling life. Suppose a nation witnesses a sudden surge in productivity, with citizens

working every day of the week. This increased labor would contribute to a rise in GDP as more

goods and services are produced and consumed. However, such a scenario doesn't necessarily

translate into an improvement in overall well-being. The loss of leisure time, vital for relaxation

and personal satisfaction, would offset the gains reflected in the increased GDP (Stiglitz, Sen,

& Fitoussi, 2010).

GDP's focus on market transactions also results in the exclusion of the value of goods and

services produced within households, diminishing its accuracy as a comprehensive measure of

well-being. For instance, when a chef sells a meal at a restaurant, its value is included in GDP.

However, if the same chef prepares an equally delicious meal for her family, the value created

is not considered. Similarly, volunteer work, a significant contributor to societal well-being,

goes unnoticed in GDP calculations. This exclusion overlooks the substantial non-market

contributions individuals make to their communities, providing an incomplete picture of

economic well-being (Fisher, 1897).

Furthermore, GDP fails to account for the environmental consequences of economic activities.

Imagine a scenario where environmental regulations are lifted to boost production,

subsequently leading to a surge in GDP. While this might seem positive from an economic

standpoint, the deteriorating quality of air and water would likely offset any gains (Costanza et

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 7 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Answer to Question 3: … cont’d

al., 2009). By not factoring in environmental sustainability, GDP falls short in reflecting the

holistic well-being of a society.

Income distribution is another critical aspect neglected by GDP. It merely provides an average

measure of income per person, disregarding the significant disparities that may exist within a

society. For instance, two societies with the same GDP per person may have vastly different

distributions of wealth. One society could have a balanced income distribution, ensuring a

decent quality of life for all, while the other might exhibit extreme inequality, with a few

individuals enjoying immense wealth while others struggle in poverty. GDP fails to capture

these disparities, blurring the true economic well-being experienced by individuals (Milanovic,

2016).

Additionally, GDP does not consider the quality of healthcare and education, two fundamental

components of societal well-being. A nation may boast a high GDP, but if its healthcare system

is inefficient or education is subpar, the overall well-being of its citizens is compromised. This

oversight highlights the narrow focus of GDP on economic output without addressing the

crucial social factors that contribute to a nation's prosperity.

Senator Robert Kennedy aptly criticized GDP in 1968, stating that "It [Gross Domestic Product]

measures neither our wit nor our courage, neither our wisdom nor our learning, neither our

compassion nor our devotion to our country. It measures everything, in short, except that which

makes life worthwhile" (Kennedy, 1968). While GDP is instrumental in gauging a nation's

economic capacity to provide material necessities, it neglects the intangible factors that

contribute to a truly meaningful life.

In conclusion, GDP, despite its widespread use, is far from the perfect measure for economic

well-being. Its exclusion of leisure, non-market activities, environmental considerations,

income distribution nuances, and neglect of healthcare and education make it an incomplete

metric.

(616 words)

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 8 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Question 4:

If the GDP isn’t the perfect measure, suggest one indicator or index in your view that can

measure economic well-being. Do explain the rational of you choosing the said indicator to

replace GDP as a measure of economic well-being.

Answer to Question 4:

The Gross Domestic Product (GDP), while widely used as a measure of economic well-being,

has faced substantial criticism for its limitations. As a response to these critiques, the Genuine

Progress Indicator (GPI) emerges as a compelling alternative that provides a more holistic and

nuanced assessment of a nation's welfare (Lawn, 2013; Pillarisetti and van den Bergh, 2013;

Beça and Santos, 2010). The GPI addresses key issues inherent in GDP calculations, offering

a more accurate reflection of economic well-being.

Rationale for Choosing GPI:

Comprehensive Assessment:

The GPI goes beyond the monetary transactions considered in GDP and incorporates

environmental and social factors, providing a more comprehensive evaluation of a nation's

progress (Lawn, 2013). This approach considers income distribution, household and volunteer

work, and environmental factors, offering a broader picture of well-being.

Environmental Sustainability:

GPI accounts for the costs associated with pollution and depletion of natural resources,

addressing the oversight in GDP calculations (Pillarisetti and van den Bergh, 2013). This

emphasis on sustainability aligns with contemporary concerns about the environmental impact

of economic activities.

Social Indicators:

GPI includes factors such as income distribution and the value of unpaid work, recognizing

their impact on social well-being (Lawn, 2013). This addresses a significant limitation of GDP,

which fails to account for inequalities and non-market activities.

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 9 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Answer to Question 4: … cont’d

Health and Well-being:

GPI incorporates factors related to health and well-being, offering a more direct link to the

actual quality of life experienced by citizens (Lawn, 2013). This is a crucial departure from

GDP, which primarily focuses on economic output without considering its distribution or the

overall impact on individuals' lives.

Formula for GPI:

While the exact formula may vary, a general representation of GPI includes positive

contributions such as personal consumption, investments in human capital, and volunteer work,

while deducting negative elements like income inequality, environmental degradation, and the

depletion of non-renewable resources (Pillarisetti and van den Bergh, 2013).

𝐺𝑃𝐼 = 𝑃𝑒𝑟𝑠𝑜𝑛𝑎𝑙 𝐶𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 + 𝑃𝑟𝑖𝑣𝑎𝑡𝑒 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 + 𝑃𝑢𝑏𝑙𝑖𝑐 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡

+ 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐹𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛 − 𝐶𝑜𝑠𝑡𝑠 𝑜𝑓 𝐸𝑛𝑣𝑖𝑟𝑜𝑛𝑚𝑒𝑛𝑡𝑎𝑙 𝐷𝑒𝑔𝑟𝑎𝑑𝑎𝑡𝑖𝑜𝑛

− 𝐼𝑛𝑐𝑜𝑚𝑒 𝐼𝑛𝑒𝑞𝑢𝑎𝑙𝑖𝑡𝑦

Supporting Points:

Sustainability Focus:

GPI's emphasis on genuine progress aligns with the global shift toward sustainability goals

(Pillarisetti and van den Bergh, 2013). This focus positions GPI as a forward-looking indicator

that accounts for the consequences of present actions on future well-being.

Reflecting True Welfare:

By incorporating social and environmental factors, GPI moves beyond the narrow economic

lens of GDP to offer a more accurate representation of a nation's welfare (Lawn, 2013). It

addresses the fundamental issue of whether economic growth genuinely contributes to the well-

being of a society.

Community and Volunteer Work:

Acknowledging the value of unpaid work and community contributions, GPI recognizes the

importance of activities that contribute to societal well-being but are often overlooked by GDP

(Lawn, 2013). This inclusion reflects a more people-centric approach to economic assessment.

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 10 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

Answer to Question 4: … cont’d

Adjustments for Depletion:

GPI accounts for the depletion of natural resources and the costs associated with environmental

damage (Beça and Santos, 2010). This adjustment ensures that economic activities do not come

at the expense of long-term ecological sustainability.

In conclusion, the Genuine Progress Indicator (GPI) emerges as a robust alternative to GDP,

addressing its limitations by providing a more inclusive and sustainable measure of economic

well-being. Grounded in comprehensive factors such as environmental sustainability, social

indicators, and adjustments for depletion, the GPI offers a nuanced perspective aligning with

contemporary values (Lawn, 2013; Pillarisetti and van den Bergh, 2013; Beça and Santos,

2010). However, the adoption of the GPI is not without challenges. From an economic

standpoint, transitioning from GDP to the GPI entails overcoming entrenched practices and

potential resistance from those accustomed to traditional metrics (Stiglitz, Fitoussi, & Durand,

2018). Moreover, refining the GPI's formula and achieving consensus on variable weights pose

methodological hurdles (Kubiszewski et al., 2013). Despite these challenges, the GPI's

emphasis on genuine progress positions it as a forward-looking indicator, contributing to a

more accurate representation of a nation's welfare, reflecting the ever-evolving landscape of

economic thought (Daly & Cobb, 1989; Lawn, 2003). As nations grapple with the imperative

of sustainable development, the GPI stands as a promising tool, urging a shift toward holistic

and meaningful assessments of progress.

(673 words)

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 11 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

References:

National Economic Advisory Model. (2009). Economic Outlook: Malaysia. [Online]

Available at: https://www.pmo.gov.my/dokumenattached/NEM_Report_I.pdf (Accessed:

18-Nov-2023)

Goh, S. K., & Lim, K. P. (2010). The Impact of the Global Financial Crisis on Malaysia. In

The Global Financial Crisis: Impact on Asia and Policy Challenges Ahead (pp. 159-180).

Asian Development Bank.

Harun, M. H. M. (2012). Monetary Policy and Macroeconomic Stability in Malaysia: A

Structural Vector Error Correction Model Analysis. Procedia - Social and Behavioral

Sciences, 65, 956-963.

Muhammad, M. J. (2010). Fiscal Policy and Economic Growth in Malaysia: The Problem of

Implementability. Journal of Economic Cooperation and Development, 31(2), 27-58.

Shankaran, K. (2009). Malaysia's Response to the Global Economic Crisis. In Responding to

the Global Economic Crisis: Challenges for Sustainable Development (pp. 245-260).

United Nations Development Programme.

Bank Negara Malaysia. (2016). Annual Report 2016. Kuala Lumpur: Bank Negara Malaysia.

FMT News. (2023). Malaysia Ranks as the Wealthiest Among Six Nations. [Online] Available

at: https://www.freemalaysiatoday.com/category/business/2023/08/03/malaysia-emerged-

stronger-after-covid-19-says-world-bank/ (Accessed: 18-Nov-2023)

Ariff, M., & Abubakar, S. Y. (2009). "Post-crisis Reforms and International Cooperation:

The Case of Malaysia." Conference on Southeast Asian Trade and Economics. Honolulu.

Bank Negara Malaysia. (2020). Annual Report 2020. Kuala Lumpur: Bank Negara Malaysia.

Malaysian Institute of Economic Research (MIER). (2006). Malaysian Economic Outlook

2006. Kuala Lumpur: Malaysian Institute of Economic Research.

Malaysian Institute of Economic Research (MIER). (2010). Malaysian Economic Outlook

2010. Kuala Lumpur: Malaysian Institute of Economic Research.

Mankiw, N. G. (2014). Principles of Economics. Cengage Learning.

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 12 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

References: … cont’d

Stiglitz, J. E., Sen, A., & Fitoussi, J. P. (2010). Mismeasuring Our Lives: Why GDP Doesn't

Add Up. The New Press.

Fisher, I. (1897). Appreciation and Interest. Political Science Quarterly, 12(2), 340–345. [DOI:

10.2307/2140136]

Costanza, R., Hart, M., Posner, S., & Talberth, J. (2009). "Beyond GDP: The need for new

measures of progress." The Pardee Papers, No. 4.

Milanovic, B. (2016). Global Inequality: A New Approach for the Age of Globalization.

Harvard University Press, USA.

Kennedy, R. F. (1968). Remarks at the University of Kansas, March 18, 1968. Available at:

https://www.jfklibrary.org/learn/about-jfk/the-kennedy-family/robert-f-kennedy/robert-f-

kennedy-speeches/remarks-at-the-university-of-kansas-march-18-1968 [Source: MR 89-

34. Miscellaneous Recordings, John F. Kennedy Presidential Library.] (Accessed: 18-Nov-

2023)

Lawn, P. A. (2013). "A theoretical foundation to support the Index of Sustainable Economic

Welfare (ISEW), Genuine Progress Indicator (GPI), and other related indexes." Ecological

Economics, 44(1), 105–118. [DOI: 10.1016/S0921-8009(02)00258-6]

Pillarisetti, J., & van den Bergh, J. (2010). "Sustainable nations: What do aggregate indexes

tell us?" Environment, Development and Sustainability: A Multidisciplinary Approach to

the Theory and Practice of Sustainable Development, 12(1), 49-62. [DOI: 10.1007/s10668-

008-9179-7]

Beça, P., & Santos, R. (2010). "Measuring sustainable welfare: A new approach to the ISEW."

Ecological Economics, 69(4), 810-819. [DOI: 10.1016/j.ecolecon.2009.10.018]

Stiglitz, J., J. Fitoussi, and M. Durand. (2018). Beyond GDP: Measuring What Counts for

Economic and Social Performance. OECD Publishing, Paris. [DOI:

10.1787/9789264307292-en] (Accessed: 18-Nov-2023)

Daly, H., & Cobb, J. B., Jr. (1990). For the Common Good: Redirecting the Economy toward

Community, the Environment, and a Sustainable Future. Beacon Press, Boston, MA. ISBN:

0-8070-3702-3.

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 13 of 14

ECO 6201E – BUSINESS ECONOMICS INDIVIDUAL LIM YI SERN

MBALS – OCT 2023 SESSION PROJECT i23025781

References: … cont’d

Kubiszewski, I., Costanza, R., Franco, C., Lawn, P., Talberth, J., Jackson, T., & Aymler,

C. (2013). "Beyond GDP: Measuring and achieving global genuine progress." Ecological

Economics, 93, 57–68. [DOI: 10.1016/j.ecolecon.2013.04.019]

Question 1 Question 2 Question 3 Question 4 References

INTI International University Page 14 of 14

Turnitin Result:

Similarity: 9%

You might also like

- PWC Future of PaymentsDocument30 pagesPWC Future of PaymentsFarhaan MutturNo ratings yet

- Labor Canonical DoctrinesDocument17 pagesLabor Canonical DoctrinesJake MendozaNo ratings yet

- DPR - Ksa-19-03 # 09 - 04 - 2020Document61 pagesDPR - Ksa-19-03 # 09 - 04 - 2020Faiz AhmadNo ratings yet

- Inter 56632 Oil Soft Offer FobDocument8 pagesInter 56632 Oil Soft Offer Fobisam mansouriNo ratings yet

- Southwest Airlines Possible Solution-HBR CaseDocument17 pagesSouthwest Airlines Possible Solution-HBR Casekowshik yakkala100% (19)

- PWC Future of PaymentsDocument30 pagesPWC Future of PaymentsPramod Mulani100% (1)

- 1 Motion in Opposition To Substitute Party PlaintiffDocument5 pages1 Motion in Opposition To Substitute Party Plaintiff1SantaFeanNo ratings yet

- Inner Circle Trader Ict Forex Ict NotesDocument110 pagesInner Circle Trader Ict Forex Ict NotesEdvinas Jakas92% (12)

- Group Members: Literature Review On Extention of in Construction ProjectDocument29 pagesGroup Members: Literature Review On Extention of in Construction ProjectJoseph Rana SangpangNo ratings yet

- Ul AppletonDocument2 pagesUl AppletonDIEGO SANCHEZ100% (1)

- Kick Off Meeting Cum Awareness Session DMW PatialaDocument97 pagesKick Off Meeting Cum Awareness Session DMW PatialaAnkurNo ratings yet

- Libby Financial Accounting Chapter3Document10 pagesLibby Financial Accounting Chapter3Jie Bo Ti67% (3)

- GDP Growth RateDocument14 pagesGDP Growth Ratei23025781No ratings yet

- WHO GPW 13 Impact Framework Targets and Indicators AlignmentDocument11 pagesWHO GPW 13 Impact Framework Targets and Indicators AlignmentAquila Azizah100% (1)

- India Real Estate Office and Residential Market Jul Sep 2022 9383Document4 pagesIndia Real Estate Office and Residential Market Jul Sep 2022 9383sunilNo ratings yet

- Dubai BIM RoadmapDocument1 pageDubai BIM RoadmapZÄkãrîãêÊlJêmLîNo ratings yet

- Osint Trend Forecasts For 2023 and BeyondDocument1 pageOsint Trend Forecasts For 2023 and BeyondpagnupalmeNo ratings yet

- COVID-19: Mitigation Strategy For Indian Textile and Apparel SectorDocument11 pagesCOVID-19: Mitigation Strategy For Indian Textile and Apparel SectorRavi BabuNo ratings yet

- Bangladesh S Intended Nationally Determined Contributions 'Document2 pagesBangladesh S Intended Nationally Determined Contributions 'Tahmina SultanaNo ratings yet

- 2020 Magalang Mps Tactical DashboardDocument4 pages2020 Magalang Mps Tactical DashboardLeander VelasquezNo ratings yet

- 5business Environment and Environmental AnalysisDocument1 page5business Environment and Environmental Analysis3399354264No ratings yet

- MCR2030 CityScorecard - UNDRR PDFDocument55 pagesMCR2030 CityScorecard - UNDRR PDFNezzar Fahima Unsi AliNo ratings yet

- Macro Fall2015 SOLUTIONDocument4 pagesMacro Fall2015 SOLUTIONAhmed KharratNo ratings yet

- TN FICCI ReportDocument24 pagesTN FICCI ReportRavi S RathodNo ratings yet

- Between Globalization and Regionalization: What Is The Future of The Automobile Industry?Document17 pagesBetween Globalization and Regionalization: What Is The Future of The Automobile Industry?Việt HùngNo ratings yet

- Guder Quarterly Report 2022Document7 pagesGuder Quarterly Report 2022mohammedamin oumerNo ratings yet

- Materi Webinar OJK - Hermawan Kartajaya 22 July 2021Document24 pagesMateri Webinar OJK - Hermawan Kartajaya 22 July 2021Ratih PrimatiaNo ratings yet

- Trans-Santiago (IESE 2021)Document9 pagesTrans-Santiago (IESE 2021)Alex ChristlNo ratings yet

- 11-12 DPI Nov-DecDocument52 pages11-12 DPI Nov-DecRatnin PanityingNo ratings yet

- Oecd Stri Country Note MysDocument4 pagesOecd Stri Country Note MysMohammad Azree YahayaNo ratings yet

- Buget RectificareDocument21 pagesBuget RectificarePimaria FruntiseniNo ratings yet

- Energie Potentielle-2021-LepDocument2 pagesEnergie Potentielle-2021-LepUlrich ZoungranaNo ratings yet

- Poster ILC2016 v2Document1 pagePoster ILC2016 v2Rahen RanganNo ratings yet

- Chapter 19Document11 pagesChapter 19Jihad H. SalehNo ratings yet

- TransantiagoDocument9 pagesTransantiagoDuc PhamNo ratings yet

- DC04 - DMRC - Daily Progress Report 25-07-2021Document31 pagesDC04 - DMRC - Daily Progress Report 25-07-2021Saksham SehgalNo ratings yet

- Q2 2018 Slide PresentationDocument14 pagesQ2 2018 Slide PresentationZerohedgeNo ratings yet

- LDIP Sta. Ana, LDIP Alignment Form, With InstructionsDocument241 pagesLDIP Sta. Ana, LDIP Alignment Form, With Instructionsflorence obianoNo ratings yet

- Relationship Between GDP Growth and In:lation in The UK (1989 - 2013)Document1 pageRelationship Between GDP Growth and In:lation in The UK (1989 - 2013)fusionNo ratings yet

- Houston Industrial Market Quicktake: April 2020Document2 pagesHouston Industrial Market Quicktake: April 2020Kevin ParkerNo ratings yet

- Transportation Cost and Benefit Analysis II - Literature ReviewDocument26 pagesTransportation Cost and Benefit Analysis II - Literature ReviewJeyamony ANo ratings yet

- AM Integrated Report 2020Document72 pagesAM Integrated Report 2020Lê Tố NhưNo ratings yet

- October 2022 eDocument20 pagesOctober 2022 eEng Clive KabelengaNo ratings yet

- Portuguese Market Outlook Up To 2040: A Report To APRENDocument48 pagesPortuguese Market Outlook Up To 2040: A Report To APRENMiguel Chã AlmeidaNo ratings yet

- Transportation Cost and Benefit Analysis II - Literature ReviewDocument26 pagesTransportation Cost and Benefit Analysis II - Literature ReviewjarameliNo ratings yet

- Peer Banks' O&G Targets ResearchDocument1 pagePeer Banks' O&G Targets Researchscaus729No ratings yet

- Introduction To Hyve December 2021Document36 pagesIntroduction To Hyve December 2021Jose María MateuNo ratings yet

- Boletim Mensal Do Iva: ABRIL 2020Document8 pagesBoletim Mensal Do Iva: ABRIL 2020Francisco CaculoNo ratings yet

- Roland Berger Trend Compendium 2030: Megatrend 3Document45 pagesRoland Berger Trend Compendium 2030: Megatrend 3Luqman HakimNo ratings yet

- Wesp2020 Summary enDocument21 pagesWesp2020 Summary enClaudium Claudius0% (1)

- Duty Free Philippines Corporation Accomplishment Report: (Individual)Document2 pagesDuty Free Philippines Corporation Accomplishment Report: (Individual)Aprl BaduyaNo ratings yet

- Country Profile PE - IMD Business School 2021Document10 pagesCountry Profile PE - IMD Business School 2021Lucero RuizNo ratings yet

- Social and Economic Impact COVIDDocument46 pagesSocial and Economic Impact COVIDArmaghan ShahNo ratings yet

- MarketsandMarkets - Future of Hydrogen - TeaserDocument38 pagesMarketsandMarkets - Future of Hydrogen - TeaserKaranvir singhNo ratings yet

- Post Covid Forecasts Scenarios TablesDocument5 pagesPost Covid Forecasts Scenarios Tablesanver2679No ratings yet

- Escalation of 'Sunshine' Project - 24th March'21Document22 pagesEscalation of 'Sunshine' Project - 24th March'21abir senguptaNo ratings yet

- 21MB0001 ModelDocument1 page21MB0001 ModelPhreetzi ÜnseenNo ratings yet

- Impact of COVID-19 On Pakistan's EconomyDocument47 pagesImpact of COVID-19 On Pakistan's EconomyMAMANo ratings yet

- Salesforce Inc. - Analyst - Investor Day 2022Document37 pagesSalesforce Inc. - Analyst - Investor Day 2022Shi ParkNo ratings yet

- Eurobarómetro de Febrero de 2023.Document176 pagesEurobarómetro de Febrero de 2023.Irene CastroNo ratings yet

- Asian Paints 22-23 - Sustainable JourneyDocument1 pageAsian Paints 22-23 - Sustainable Journeyrawatdaksh77No ratings yet

- Vodafone Group PLC: DisclaimerDocument17 pagesVodafone Group PLC: DisclaimerTawfiq4444No ratings yet

- Covid 19Document1 pageCovid 19oyuka oyukaNo ratings yet

- Country Profile: BahrainDocument10 pagesCountry Profile: BahrainOMERNo ratings yet

- TEVTA Online Web Portal: Trade Wise Traceability Update SummaryDocument5 pagesTEVTA Online Web Portal: Trade Wise Traceability Update SummaryAbdul MateenNo ratings yet

- Global Market Outlook 2017 2021 1Document60 pagesGlobal Market Outlook 2017 2021 1Flynn SophieNo ratings yet

- 04 Alvin Poi - iRAP Implementation Progress in MalaysiaDocument27 pages04 Alvin Poi - iRAP Implementation Progress in MalaysiaShafiq SyazwanNo ratings yet

- CAF PRESENTACION CORPORATIVA FRDocument29 pagesCAF PRESENTACION CORPORATIVA FRjoseba.adobeNo ratings yet

- Sustainable Energy for All 2015: Progress Toward Sustainable EnergyFrom EverandSustainable Energy for All 2015: Progress Toward Sustainable EnergyNo ratings yet

- Company Case: Qualtrics: Managing The Complete Customer ExperienceDocument2 pagesCompany Case: Qualtrics: Managing The Complete Customer ExperienceHà ChinhNo ratings yet

- Đề cương Tín Dụng: Domestic marketing. This involves the company manipulating a series ofDocument19 pagesĐề cương Tín Dụng: Domestic marketing. This involves the company manipulating a series ofNgọc MinhNo ratings yet

- Job Description Import/Export Manager Century Arms, IncDocument2 pagesJob Description Import/Export Manager Century Arms, IncAspire SuccessNo ratings yet

- Managerial Level: May 2007 ExaminationsDocument35 pagesManagerial Level: May 2007 ExaminationsIsavic AlsinaNo ratings yet

- Affidavit of No Interest DR ArzagaDocument2 pagesAffidavit of No Interest DR ArzagaKazper Vic V. BermejoNo ratings yet

- Class 4 Exercise ProblemsDocument23 pagesClass 4 Exercise ProblemsVinodshankar Bhat100% (1)

- Marketing Plan of Nestle Pure LifeDocument109 pagesMarketing Plan of Nestle Pure LifeRida RamzanNo ratings yet

- Tax SOLVINGDocument3 pagesTax SOLVINGjr centenoNo ratings yet

- 13.product and Process Innovation NewDocument20 pages13.product and Process Innovation Newsetiyawanmuktiwijaya160902No ratings yet

- Booklet ProjectDocument50 pagesBooklet ProjectRaihan BeckhamNo ratings yet

- Atty Pat Tab C Drug Free Workplace Program LectureDocument20 pagesAtty Pat Tab C Drug Free Workplace Program LectureLPS CMNo ratings yet

- Delight Info Paper v2 1Document24 pagesDelight Info Paper v2 1AshokNo ratings yet

- YB Tripartite Engagement AgreementDocument6 pagesYB Tripartite Engagement AgreementYesBroker InNo ratings yet

- Mil Quarter 1 Module 3Document5 pagesMil Quarter 1 Module 3Catherine SarrosaNo ratings yet

- MalaysiaDocument43 pagesMalaysiaMary Christine Formiloza MacalinaoNo ratings yet

- Uber Case StudyDocument15 pagesUber Case StudyRaman SrinivasanNo ratings yet

- MPT History Part 1Document3 pagesMPT History Part 1orbisrobeNo ratings yet

- L1f18bbam0320 Assignment 3Document3 pagesL1f18bbam0320 Assignment 3Abaidullah TanveerNo ratings yet

- Curriculum EjemploDocument3 pagesCurriculum EjemploBaudel Alfonso ParraNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementArun ReddyNo ratings yet

- Inventory Assignment - Maruti Suzuki LimitedDocument5 pagesInventory Assignment - Maruti Suzuki LimitedRaghu MongaNo ratings yet